Income elasticity of demand

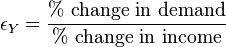

In economics, income elasticity of demand measures the responsiveness of the demand for a good to a change in the income of the people demanding the good, ceteris paribus. It is calculated as the ratio of the percentage change in demand to the percentage change in income. For example, if, in response to a 10% increase in income, the demand for a good increased by 20%, the income elasticity of demand would be 20%/10% = 2.

Interpretation

- A negative income elasticity of demand is associated with inferior goods; an increase in income will lead to a fall in the demand and may lead to changes to more luxurious substitutes

- A positive income elasticity of demand is associated with normal goods; an increase in income will lead to a rise in demand. If income elasticity of demand of a commodity is less than 1, it is a necessity good. If the elasticity of demand is greater than 1, it is a luxury good or a superior good.

- A zero income elasticity of demand occurs when an increase in income is not associated with a change in the demand of a good. These would be sticky goods.

Income elasticity of demand can be used as an indicator of industry health, future consumption patterns and as a guide to firms investment decisions. For example, the "selected income elasticities" below suggest that an increasing portion of consumer's budgets will be devoted to purchasing automobiles and restaurant meals and a smaller share to tobacco and margarine.[1]

Income elasticities are closely related to the population income distribution and the fraction of the product's sales attributable to buyers from different income brackets. Specifically when a buyer in a certain income bracket experiences an income increase, their purchase of a product changes to match that of individuals in their new income bracket. If the income share elasticity is defined as the negative percentage change in individuals given a percentage increase in income bracken the income-elasticity, after some computation, becomes the expected value of the income-share elasticity with respect to the income distribution of purchasers of the product. When the income distribution is described by a gamma distribution, the income elasticity is proportional to the percentage difference between the average income of the product's buyers and the average income of the population.[2]

Mathematical definition

More formally, the income elasticity of demand,  , for a given Marshallian demand function

, for a given Marshallian demand function  for a good is

for a good is

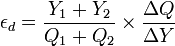

or alternatively:

This can be rewritten in the form:

With income  , and vector of prices

, and vector of prices  .

.

Many necessities have an income elasticity of demand between zero and one: expenditure on these goods may increase with income, but not as fast as income does, so the proportion of expenditure on these goods falls as income rises. This observation for food is known as Engel's law.

Types of income elasticity of demand

There are five possible income demand curves:

1. High income elasticity of demand:

In this case increase in income is accompanied by relatively larger increase in quantity demanded. Here the value of coefficient Ey is greater than unity (Ey>1). E.g.: 20% increase in quantity demanded due to 10% increase in income.

2. Unitary income elasticity of demand:

In this case increase in income is accompanied by same proportionate increase in quantity demanded. Here the value of coefficient Ey is equal to unity (Ey=1). E.g.: 10% increase in quantity demanded due to 10% increase in income.

3. Low income elasticity of demand:

In this case proportionate increase in income is accompanied by less than increase in quantity demanded. Here the value of coefficient Ey is less than unity (Ey<1). E.g.: 5% increase in quantity demanded due to 10% increase in income.

4. Zero income elasticity of demand:

This shows that quantity bought is constant regardless of changes in income. Here the value of coefficient Ey is equal to zero (Ey=0). E.g.: No change in quantity demanded even 10% increase in income.

5. Negative income elasticity of demand:

In this case increase in income is accompanied by decrease in quantity demanded. Here the value of coefficient Ey is less than zero/negative (Ey<0). E.g.: 5% decrease in quantity demanded due to 10% increase in income.

Selected income elasticities

- Automobiles 2.98[3]

- Books 1.44

- A persons own life (also called Value of Statistical Life) 0.50 to 0.60 [4]

- Restaurant Meals 1.40

- Tobacco 0.64

- Margarine −0.20

- Public Transportation −0.36[5]

Income elasticities are notably stable over time and across countries due to the law of one price.[6]

See also

Notes

References

- Bordley; McDonald. "Estimating Income Elasticities from the Average Income of a Product's Buyers and the Population Income Distribution". Journal of Business and Economic Statistics.

- Perloff, J. (2008). Microeconomics Theory & Applications with Calculus. Pearson. ISBN 978-0-321-27794-7.

- Samuelson; Nordhaus (2001). Microeconomics (17th ed.). McGraw-Hill.

- Frank, Robert (2008). Microeconomics and Behavior (7th ed.). McGraw-Hill. ISBN 978-0-07-126349-8.