Ian Bremmer

| Ian Bremmer | |

|---|---|

Ian Bremmer | |

| Born |

November 12, 1969 United States |

| Occupation | Political scientist, author, entrepreneur |

| Education |

BA, Tulane University MA, PhD, Stanford University |

| Website | |

| ianbremmer.com | |

Ian Bremmer (born November 12, 1969) is an American political scientist specializing in US foreign policy, states in transition, and global political risk. He is the president and founder of Eurasia Group, a political risk research and consulting firm. As of December 2014, he is foreign affairs columnist and editor-at-large at TIME.[1] In 2013, he was named Global Research Professor at New York University.[2] Eurasia Group provides analysis and expertise about how political developments and national security dynamics move markets and shape investment environments across the globe.

Life and career

Bremmer is of Armenian and German descent.[3]

Bremmer is most widely known for advances in political risk; referred to as the "guru" in the field by the Economist[4] and The Wall Street Journal[5] and, more directly, bringing political science as a discipline to the financial markets.[6] In 2001, Bremmer created Wall Street's first global political risk index, now the GPRI (Global Political Risk Index). Bremmer's definition of an emerging market as "a country where politics matters at least as much as economics to the market"[7] is a standard reference in the political risk field.

Bremmer has published nine books, including the national bestsellers Every Nation for Itself: Winners and Losers in a G-Zero World (Portfolio, May 2012), which details risks and opportunities in a world without global leadership, and The End of the Free Market: Who Wins the War Between States and Corporations (Portfolio, May 2010), which describes the global phenomenon of state capitalism and its implications for economics and politics. He also wrote The J Curve: A New Way to Understand Why Nations Rise and Fall (Simon & Schuster, 2006), selected by The Economist as one of the best books of 2006.[8]

Bremmer is a frequent writer and commentator in the media. He is a contributor for the Financial Times A-List,[9] and writes a regular column for Reuters. He has also published articles in the Washington Post, the New York Times, The Wall Street Journal, Harvard Business Review, Foreign Affairs and many other publications. He appears regularly on CNBC, CNN, Fox News Channel, Bloomberg Television, National Public Radio, the BBC, and other networks.

Among his professional appointments, Bremmer serves on the Presidents Council of the Near East Foundation, the Leadership Council for the Concordia Summit, and the Board of Trustees of Intelligence Squared. In 2007, he was named as a 'Young Global Leader' of the World Economic Forum, and in 2010 founded and was appointed Chair of the Forum's Global Agenda Council for Geopolitical Risk.

Bremmer received his B.A. at Tulane University, and his M.A. and PhD in political science from Stanford University in 1994. He then served on the faculty of the Hoover Institution where, at 25, he became the Institution's youngest ever National Fellow. He has held research and faculty positions at New York University (where he presently teaches), Columbia University, the EastWest Institute, Lawrence Livermore National Laboratory, and the World Policy Institute, where he has served as Senior Fellow since 1997.

Key concepts

The J-Curve

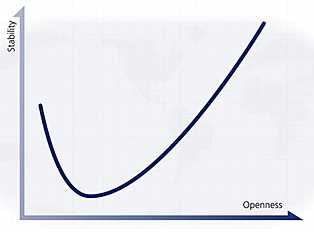

Bremmer's J curve[10] outlines the link between a country's openness and its stability. While many countries are stable because they are open (the United States, France, Japan), others are stable because they are closed (North Korea, Cuba, Iraq under Saddam Hussein). States can travel both forward (right) and backwards (left) along this J curve, so stability and openness are never secure. The J is steeper on the left hand side, as it is easier for a leader in a failed state to create stability by closing the country than to build a civil society and establish accountable institutions; the curve is higher on the far right than left because states that prevail in opening their societies (Eastern Europe, for example) ultimately become more stable than authoritarian regimes.

State capitalism

Ian Bremmer describes state capitalism as a system in which the state dominates markets primarily for political gain. In his book, The End of the Free Market: Who Wins the War Between States and Corporations (New York: Portfolio, 2010), Bremmer describes China as the primary driver for the rise of state capitalism as a challenge to the free market economies of the developed world, particularly in the aftermath of the financial crisis.[11]

G-Zero

The term G-Zero world refers to a breakdown in global leadership brought about by a decline of Western influence and the inability of other nations to fill the void.[12][13] It is a reference to a perceived shift away from the pre-eminence of the Group of Seven industrialized countries and the expanded Group of Twenty, which includes major emerging powers like China, India, Brazil, Turkey, and others. In his book, Every Nation for Itself: Winners and Losers in a G-Zero World (New York: Portfolio, 2012), Bremmer explains that, in the G-Zero, no country or group of countries has the political and economic leverage to drive an international agenda or provide global public goods.[14][15]

Weaponization of finance

The term weaponization of finance refers to the foreign policy strategy of using incentives (access to capital markets) and penalties (varied types of sanctions) as tools of coercive diplomacy. In his Eurasia Group Top Risks 2015 report,[16] Bremmer coins the weaponization of finance to describe the ways in which the United States is using its influence to affect global outcomes. Rather than rely on traditional elements of America’s security advantage – including US-led alliances such as NATO and multi-lateral institutions such as the World Bank and the International Monetary Fund – Bremmer argues that the US is now ‘weaponizing finance’ by limiting access to the American marketplace and to US banks as an instrument of its foreign and security policy.

Pivot state

Bremmer uses 'pivot state' to describe a nation that is able to build profitable relationships with multiple other major powers without becoming overly reliant on any one of them.[17] This ability to hedge allows a pivot state to avoid capture—in terms of security or economy—at the hands of a single country. In his book, Every Nation for Itself: Winners and Losers in a G-Zero World (New York: Portfolio, 2012),[18] Bremmer explains how, in a volatile G-Zero world, the ability to pivot will take on increased importance. At the opposite end of the spectrum are shadow states that are frozen within the influence of a single power. The United States' neighbors illustrate the terms very well. With significant trade ties with both the United States and Asia and formal security ties with NATO, Canada is a good example of a pivot state that is hedged against a slowdown in or conflict with any single major power. Mexico, on the other hand, is a shadow state due to its overwhelming reliance on the US economy.

Selected bibliography

Books

- Superpower: Three Choices for the Next America. (New York: Portfolio, May 2015). ISBN 978-1591847472

- Every Nation for Itself: Winners and Losers in a G-Zero World. (New York: Portfolio, May 2012). ISBN 978-1-59184-468-6

- The End of the Free Market: Who Wins the War Between States and Corporations. (New York: Portfolio, 2010). ISBN 978-1-59184-301-6

- The Fat Tail: The Power of Political Knowledge for Strategic Investing. (with Preston Keat), (New York: Oxford University Press, 2009; revised paperback, 2010). ISBN 0-19-532855-8

- Managing Strategic Surprise: Lessons from Risk Management & Risk Assessment. (edited with Paul Bracken and David Gordon), (Cambridge: Cambridge University Press, 2008). ISBN 0-521-88315-6

- The J Curve: A New Way to Understand Why Nations Rise and Fall. (Simon & Schuster, 2006; revised paperback, 2007). ISBN 0-7432-7471-7

- New States, New Politics: Building the Post-Soviet Nations. (edited with Raymond Taras), (Cambridge: Cambridge University Press, 1997). ISBN 0-521-57799-3

- Nations and Politics in the Soviet Successor States. (edited with Raymond Taras), (Cambridge: Cambridge University Press, 1993). ISBN 0-521-43860-8

- Soviet Nationalities Problems. (edited with Norman Naimark), (Stanford: Stanford Center for Russian and East European Studies: 1990). ISBN 0-87725-195-9

- Bremmer's books at Google Books

- "The J Curve" official website

- "The Fat Tail" official website

- "The End of the Free Market" official website

- "Every Nation For Itself" official website

E-Books

- What's Next: Essays on Geopolitics that Matter. (edited with Douglas Rediker), (New York: Portfolio, November 2012). ISBN 978-1-10162-196-7

- What's Next: Essays on Geopolitics that Matter, vol. 2. (edited with Wu Xinbo), (Geneva: World Economic Forum, January 2014).

Selected Essays

- Pivoting Back, The Economist, The World in 2015, January 2015

- The Four Major Geopolitical Challenges Investors Must Face, Institutional Investor, November 3, 2014

- The New Cold War on Business, Fortune, October 8, 2014

- A Tortured Policy Toward Russia, The New York Times, March 26, 2014

- The New Rules of Globalization, Harvard Business Review, January–February 2014

- China's Limited Influence, New York Times, November 27, 2013

- Lost Legitimacy: Why Governing is Harder than Ever, Foreign Affairs, November 18, 2013

- Last One Standing, Politico, November 2013

- China: Superpower or Superbust?, The National Interest, November–December 2013

- Stop the Politics on Syria, with Jon Huntsman, Jr, Financial Times, August 31, 2013

- Abe's Electoral Win is Great News for Japan, with David Petraeus, Financial Times, July 22, 2013

- The New Abnormal, with Nouriel Roubini, Institutional Investor, June 17, 2013

- From G8 to G20 to G-Zero: Why No One Wants to Take Charge in the New Global Order, New Statesman, June 11, 2013

- How to Play Well with China, with Jon Huntsman, Jr, The New York Times, June 2, 2013

- When America Stops Importing Energy, with Kenneth A. Hersh, International Herald Tribune, May 22, 2013

- Three Troubled Allies, One Superpower, Wall Street Journal, January 11, 2013

- United by a Catchy Acronym, International Herald Tribune, November 30, 2012

- US-German Relationship on the Rocks, with Mark Leonard, Washington Post, October 18, 2012

- Where Politics and Commerce Collide, with David F. Gordon, International Herald Tribune, October 7, 2012

- Georgia's Rose Revolution Will Not Wilt, Financial Times, October 2, 2012

- Not the Old Middle East, International Herald Tribune, September 18, 2012

- Rise of the Different, with David F. Gordon, International Herald Tribune, June 18, 2012

- Five Myths About America's Decline, Washington Post, May 4, 2012

- The Future Belongs to the Flexible, Wall Street Journal, April 27, 2012

- France's What-If Campaign, International Herald Tribune, February 16, 2012

- Far Too Soon to Write Off America, Financial Times, December 28, 2011

- An Upbeat View of America's 'Bad' Year, with David F. Gordon, International Herald Tribune, December 28, 2011

- Searching the World for Good Governance, International Herald Tribune, November 27, 2011

- Whose Economy Has It Worst?, with Nouriel Roubini, Wall Street Journal, November 12, 2011

- The G-Zero Order, with David F. Gordon, International Herald Tribune, October 26, 2011

- Hungary's New Path is the Hidden Danger to Europe, Financial Times, October 9, 2011

- China's Bumpy Road Ahead, Wall Street Journal, July 9, 2011

- On the Economy, Be Careful What You Wish For, Foreign Policy, July/August 2011

- The Collateral Damage in Pakistan, International Herald Tribune, May 5, 2011

- Washington's Stark Choice: Democracy or Riyadh, Financial Times, March 17, 2011

- Get Ready for a Growth Supercycle, Wall Street Journal, March 2, 2011

- The J Curve Hits the Middle East, Financial Times, February 16, 2011

- A G-Zero World, with Nouriel Roubini, Foreign Affairs, March/April 2011

- Cyberteeth Bared, with Parag Khanna, International Herald Tribune, December 22, 2010

- The Fourth Wave, Foreign Policy, December 2010

- Democracy in Cyberspace, Foreign Affairs, November/December 2010

- Japan's Overblown Anxiety, International Herald Tribune, November 16, 2010

- Paradise Lost: Why Fallen Markets Will Never Be the Same, with Nouriel Roubini, Institutional Investor, September 2010

- BP's Lucky it Spilled in US, not Chinese Waters, USA Today, July 14, 2010

- Sagging Global Growth Requires Us To Act, with Nouriel Roubini, The Financial Times, July 12, 2010

- When the State Battles the Corporation, The International Herald Tribune, June 23, 2010

- Dangerous Insecurity, The International Herald Tribune, May 25, 2010

- As Free Market Democracies Flail, Watch Out for China, USA Today, May 25, 2010

- The Long Shadow of the Invisible Hand, The Wall Street Journal, May 22, 2010

- Fight of the Century, Prospect, April 2010

- At Davos, All the Globalizers are Gone, Washington Post, January 29, 2010

- A Year of US-China Discord, with David Gordon, Project Syndicate, January 2010

- State Capitalism Comes of Age, Foreign Affairs, May/June 2009

- AIG and 'Political Risk', with Sean West, The Wall Street Journal, March 20, 2009

- Outrage is an Unaffordable Luxury, The Washington Post, March 18, 2009

- Expect the World Economy to Suffer through 2009, with Nouriel Roubini, The Wall Street Journal, January 23, 2009

- Reasons to be Gloomy, Slate, September 18, 2008

- Threat or Opportunity? What Sovereign Wealth Funds Mean for US Companies, with Juan Pujadas, The View, Summer 2008

- A Political Scientist in China, Slate, October 5, 2007

- The Dawn of the Next Cold War, Newsweek International, February 26, 2007

- In the Right Direction, The National Interest, Jan/Feb 2007

- Hedging Political Risk in China, with Fareed Zakaria, Harvard Business Review, November 2006

- Lowering the Temperature, Comment is Free, October 20, 2006

- The World is J-Curved, Washington Post, October 1, 2006

- Prices Transform Oil into a Weapon, International Herald Tribune, August 27, 2005

- Managing Risk in an Unstable World, Harvard Business Review, June 2005

- George Kennan's Lessons for the War on Terror, International Herald Tribune, March 24, 2005

- Diary of a Political Scientist, Slate, February 2–6, 2004

- Ian Bremmer’s articles at Project Syndicate

Blogs

Interviews

- Bremmer guest hosts on Charlie Rose

- Bremmer interviews on The Daily Show

- PWC interview with Bremmer, CEOs

- PWC interview with Bremmer on political risk

- Mckinsey Quarterly interview with Bremmer

- Bremmer at the Council on Foreign Relations

- Bremmer interviews in The Big Think

- Bremmer interview in Newsweek

- Bremmer's J Curve in the Daily Telegraph

- Bremmer's End of the Free Market in the Daily Telegraph

- The J Curve on BBC Newsnight

- SFO interview with Bremmer

- Foreign Policy Association interview with Bremmer

- Barrons interview with Bremmer

- Financial Times interview with Bremmer

- Reuters interview with Bremmer

- Foreign Policy interview with Bremmer and Nouriel Roubini

- Spears interview with Bremmer

- Strategy & Business interview with Bremmer

- The Big Interview with Bremmer on The Wall Street Journal

- Bremmer interview in the Washington Post

- Bremmer guest hosts CNBC Squawk Box

Testimony

Research

Ian Bremmer's research interests include:

- International political economy;

- Geoeconomics and geopolitics;

- States in transition and global emerging markets;

- US foreign policy

Current appointments

- Editor-at-Large and Foreign Affairs Columnist, TIME Magazine

- Global Research Professor, New York University

- Senior Fellow, World Policy Institute

- Presidents Council, Near East Foundation

- Leadership Council, Concordia

- Board of Directors, Intelligence Squared

- Member, Global Agenda Council on Geoeconomics, World Economic Forum

- Member, Council on Foreign Relations

- Member, International Institute for Strategic Studies

References

- ↑ http://www.mediabistro.com/fishbowlny/ian-bremmer-joins-time_b236550

- ↑ https://www.nyu.edu/about/news-publications/news/2013/12/02/ian-bremmer-president-of-eurasia-group-named-nyu-global-research-professor.html

- ↑ Thompson, Damian (September 30, 2006). "Here's how the world works". The Daily Telegraph (London). Retrieved 2008-08-01.

- ↑ "Beyond Economics". The Economist. February 10, 2011.

- ↑ Warnock, Eleanor. , "The Wall Street Journal," April 9, 2015.

- ↑ Quinn, James (July 10, 2010). "The West Should Fear the Growth of State Capitalism". The Daily Telegraph (London). Retrieved 2010-07-10.

- ↑ Managing Risk in an Unstable World

- ↑ "Fighting to be tops". The Economist. December 7, 2006.

- ↑ "The A-List". The Financial Times. June 2011.

- ↑ Bremmer, Ian. 2006. The J Curve: A New Way to Understand Why Nations Rise and Fall. Simon and Schuster.

- ↑

- ↑ Eurasia Group Top 10 Risks of 2011

- ↑ Gregory Scoblete. Will Free Markets Give Way to State Capitalism?, RealClearPolitics, May 28, 2010.

- ↑ Ian Bremmer and David Gordon.G-Zero, Foreign Policy, January 7, 2011.

- ↑ Ian Bremmer and Nouriel Roubini. A G-Zero World, Foreign Affairs, March/April 2011.

- ↑ Bremmer, Ian and Kupchan Cliff. , January 2015.

- ↑ Bremmer, Ian. , "Wall Street Journal", April 27, 2012.

- ↑ Bremmer, Ian. [Every Nation for Itself], New York: Portfolio, 2012.

External links

| Wikiquote has quotations related to: Ian Bremmer |

| Wikimedia Commons has media related to Ian Bremmer. |

Ian Bremmer

- Bremmer webpage

- Bremmer bio at Eurasia Group

- Ian Bremmer on Facebook

- Ian Bremmer on Twitter

- RSA Vision webcasts – Ian Bremmer on "The Fat Tail"

- Archived op-ed commentaries at Project Syndicate

- Archived commentaries at TIME Magazine

- Appearances on C-SPAN

- Ian Bremmer at the Internet Movie Database

- Works by or about Ian Bremmer in libraries (WorldCat catalog)

Eurasia Group

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|