Human resource accounting

Human resource accounting is the process of identifying and reporting investments made in the human resources of an organization that are presently unaccounted for in the conventional accounting practices. It is an extension of standard accounting principles. Measuring the value of human resources can assist organizations in accurately documenting their assets.

Objectives

- To furnish cost value information for making proper and effective management decisions about acquiring, allocating, developing, and maintaining human resources in order to achieve cost effective organizational objectives.

- To monitor effectively the use of human resources by the management.

- To have an analysis of the Human Asset, i.e. whether such assets are conserved, depleted, or appreciated.

- To aid in the development of management principles and proper decision making for the future, by classifying financial consequences of various practices.

Methods

Approaches to human resource accounting (HRA) were first developed in 1691. The next approach was developed from 1691-1960, and the third phase was post-1960. There are two approaches to HRA. Under the cost approach, also called the "human resource cost accounting method" or model, there is an acquisition cost model and a replacement cost model. Under the value approach, there is a present value of future earnings method, a discounted future wage model, and a competitive bidding model.

Cost approach

This approach is also called an acquisition cost model. This approach was developed by Brummet, Flamholtz,[1] and Pyle but the first attempt towards employee valuation was made by a footwear manufacturing company, R. G. Barry Corporation of Columbus, Ohio with the help of Michigan University in 1967. This method measures the organization’s investment in employees using the five parameters: recruiting, acquisition, formal training and familiarization, informal training and informal familiarization, and experience and development. This model suggests that instead of charging the costs to profit and loss statement (p&l) accounting, it should be capitalized in the balance sheet. The process of giving a status of asset to the expenditure item is called capitalization. In human resource management, it is necessary to amortize the capitalized amount over a period of time. So, here one will take the age of the employee at the time of recruitment and at the time of retirement. Out of these, a few employees may leave the organization before attaining the superannuation. This is similar to a physical asset. e.g.: If a company spends one lakh on an employee recruited at 25 years, and he leaves the organization at the age 50, he serves the company for 25 years (his actual retirement age was 55 years). The company has recovered rupees 83333.33 so the unamortized amount of rupees 16666.66 should be charged to p&l account.

100000\30=3333.33

3333.33*25=83333.33

100000-83333.33=16666.67

This method is the only method of Human Resource Accounting that is based on sound accounting principals and policies.

Limitations

- The valuation method is based on the false assumption that the dollar is stable.

- Since the assets cannot be sold there are no independent checks of valuation.

- This method measures only the costs to the organization, but ignores completely any measure of the value of the employee to the organization (Cascio 3).

- It is too tedious to gather the related information regarding the human values.

Replacement cost approach

This approach measures the cost of replacing an employee. According to Likert (1985) replacement cost includes recruitment, selection, compensation, and training cost (including the income foregone during the training period). The data derived from this method could be useful in deciding whether to dismiss or replace the staff.

Limitations

- Substitution of replacement cost method for historical cost method does little more than update the valuation, at the expense of importing considerably more subjectivity into the measure. This method may also lead to an upwardly biased estimate because an inefficient firm may incur a greater cost to replace an employee (Cascio 3-4).

Present value of future earnings

Lev and Schwartz (1971) proposed an economic valuation of employees based on the present value of future earnings, adjusted for the probability of employees’ death/separation/retirement. This method helps in determining what an employee’s future contribution is worth today.

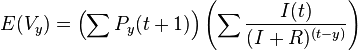

According to this model, the value of human capital embodied in a person who is ‘y’ years old, is the present value of his/her future earnings from employment and can be calculated by using the following formula:

where E (Vy) = expected value of a ‘y’ year old person’s human capital, T = the person’s retirement age, Py (t) = probability of the person leaving the organization, I(t) = expected earnings of the person in period I, and R = discount rate.

Limitations

- The measure is an objective one because it uses widely based statistics such as census income return and mortality tables.

- The measure assigns more weight to averages than to the value of any specific group or individual (Cascio 4-5).

Value to the organization

Hekimian and Jones (1967) proposed that when an organization had several divisions seeking the same employee, the employee should be allocated to the highest bidder and the bid price incorporated into that division’s investment base. For example, a value of a professional athlete’s service is often determined by how much money a particular team, acting in an open competitive market, is willing to pay him or her.

Limitations

- The soundness of the valuation depends wholly on the information, judgment, and impartiality of the bidder (Cascio 5).

Expense model

According to Mirvis and Mac (1976), this model focuses on attaching dollar estimates to the behavioral outcomes produced by working in an organization. Criteria such as absenteeism, turnover, and job performance are measured using traditional organizational tools, and then costs are estimated for each criterion. For example, in costing labor turnover, dollar figures are attached to separation costs, replacement costs, and training costs.

Model on human resource accounting

This model prescribes the human resource accounting approach for two categories of employees:[2]

- Employees, who are at strategic, key decision-making positions such as MD, CEO (Top Executives)

- Employees, who execute the decision taken by Top Executives

Model arrives value of human resources as sum of below-mentioned three parts:

- Real capital cost part

- Present value of future salary/wages payments

- Performance evaluation part

Limitations

1. Calculation process is lengthy and cumbersome.

2. Lev and Schwartz valuation principles have been used at one point of time, so this model contains a weakness from the Lev and Schwartz model.

Ravindra Tiwari has prescribed another approach to value human resources at the time of annual appraisal exercise, which suggests valuation of human resources on different appraisal parameters.

₵==Limitations == Human Resource Accounting is the accounting methods, systems, and techniques, which coupled with special knowledge and ability, assist personnel management in the valuation of personnel in their knowledge, ability and motivation in the same organization as well as from organization to organization. It means that some employees become a liability instead of becoming a human resource. HRA facilitates decision making about the personnel i.e. either to keep or to dispense with their services or to provide mega-training. There are many limitations that make the management reluctant to introduce HRA. Some of the attributes are:

- There is no proper clear cut and specific procedure or guidelines for finding costs and value of human resources of an organization. The systems that are being adopted have certain drawbacks.

- The period of existence of human resources is uncertain and hence valuing them under uncertainty in the future seems to be unrealistic.

- The much needed empirical evidence is yet to be found to support the hypothesis that HRA as a tool of management facilitates better and effective management of human resources.

- As human resources are incapable of being owned, retained, and utilized, unlike the physical assets, there is a problem for the management to treat them as assets in the strict sense.

- There is a constant fear of opposition from the trade unions as placing a value on employees would make them claim rewards and compensations based on such valuations.

- In spite of all its significance and necessity, the Tax Laws don’t recognize human beings as assets.

- There is no universally accepted method of the valuation of human resources.

References

Notes

Further reading

- Blau, Gary E. Human Resource Accounting, 1st ed. Scarsdale, N.Y.: Work in America Institute, 1978.

- Caplan, Edwin H. and Landekich, Stephen. Human Resource Accounting: Past, Present and Future. New York: National Association of Accountants, 1974.

- Cascio, Wayne F. Costing Human Resources: The Financial Impact of Behavior in Organizations, 3rd ed. Boston: PWS-Kent Pub. Co., 1991.

- Monti–Belkaoui Janice and Riahi–Belkaoui Ahmed. Human Resource Valuation: A Guide to Strategies and Techniques. Quorum Books: Westport, Connecticut–London, 1995.

- Ulf Johanson, Gunilla Eklöv, Mikael Holmgren, Maria Mårtensson School of Business Stockholm University, Human Resource Costing and Accounting versus The Balanced Scorecard: A literature survey of experience with the concepts 1998 (PDF)

- Tiwari Ravindra, Kodwani Amitabh Deo, "Human Resource Accounting-A New Dimension"

- Tiwari Ravindra, Kodwani Amitabh Deo, "How to Value Human Resources" (Approach for Valuation of Human Resource at the time annual appraisal exercise)

- Management accounting: Ravi.M.Kishore- taxmann allied publications