Holcim

| |

| Public | |

| Traded as | SIX: HOLN, LSE: 0HK9, |

| Industry | Building materials |

| Founded | 1912 |

| Headquarters | Jona, Switzerland |

Key people | Bernard Fontana (CEO), Thomas Aebischer (CFO), Rolf Soiron (Chairman) |

| Products | Cement, construction aggregate, concrete |

| Revenue | CHF 21.65 billion (2010)[1] |

| CHF 2.619 billion (2010)[1] | |

| Profit | CHF 1.182 billion (2010)[1] |

| Total assets | CHF 44.26 billion (end 2010)[1] |

| Total equity | CHF 21.12 billion (end 2010)[1] |

Number of employees | 71,000 (2014)[2] |

| Website | Holcim.com |

Holcim is a Swiss-based global building materials and aggregates company. Founded in 1912, the company expanded into France and then throughout Europe and Middle East during the 1920s. They expanded in the Americas during the 1950s and went public in 1958. The company continued to expand in Latin America and added Asian divisions during the 1970s and 1980s. A series of mergers and buyouts made Holcim one of the two largest cement manufacturers worldwide by 2014, roughly tied with rival Lafarge. In April 2014, the two companies agreed to a US$60 billion "merger of equals". The deal will face regulatory scrutiny and likely will take more than one year to complete.

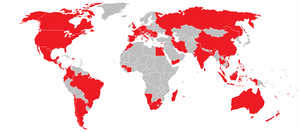

As of 2014, Holcim does business in more than 70 different countries and employs 71,000 people. The company is the market leader in cement production in Australia, Azerbaijan, India, Slovakia, Switzerland, and Latin America.

Overview

Holcim is headquartered in Jona, Switzerland and holds interests in more than 70 countries worldwide. They employ 71,000 people.[2] Subsidiaries include St. Lawrence Cement (Canada), Aggregate Industries (the UK), and Holcim Apasco (Mexico). The company's products include cement, clinker, concrete, lime, and aggregates.[3] They also offer consulting services, third party research and development, and land waste management services.[3][4] Their largest business segment is the manufacture and distribution of cement and aggregates.[4] As of 2014, Holcim's annual production capacity was 215 million tons.[3] It has a BBB credit rating according to Fitch Ratings, with a 3.5 funds from operations to debt ratio.[5]

Holcim is the cement market leader in Australia, Azerbaijan, India, Slovakia, Switzerland, and Latin America. It is among the top few producers throughout Europe, North America, and Asia.[6] Globally, Holcim and Lafarge are the two largest producers in terms of sales, as of 2014.[7]

History

Holcim was founded by Adolf Gygi in 1912 as "Aargauische Portlandcementfabrik Holderbank-Wildegg".[8][9] The original headquarters were in Holderbank, (Lenzburg district, Canton of Aargau, ca. 40 km from Zürich).[8] In 1914, the company merged with "Rheintalischen Cementfabrik Rüthi" owned by Ernst Schmidheiny. Schmidheiny took over leadership duties and began the company on a course of expansion.[9]

In 1922, Holderbank, as the company was then known, expanded beyond the Swiss borders into France. Schmidheiny continued to expand, primarily by buying stakes in existing companies. By the end of the decade Holderbank held stakes in Belgium, Germany, the Netherlands, and Egypt.[9] Positions in Lebanon and South Africa soon followed.[8] Schmidheiny died in the 1930s and his sons, Ernst Jr. and Max, took over the business, splitting it into two divisions. Ernst took over the Holderbank building materials business, while Max oversaw the other lines. This organization scheme remained in place until the 1970s.[9]

After World War II, Hans Gygi, son of Adolf Gygi, took over leadership. He oversaw the company during the Swiss housing boom of the 1950s, and as Holderbank expanded into Canada, then throughout North and South America. The company went public in 1958 in order to raise more capital to fuel further expansion. Hydroelectric projects in Switzerland generated large concrete contracts, offsetting losses in Egypt when the country's government nationalized Holderbank's factories.[9]

During the early 1970s, growth in Brazil and Mexico improved the company's bottom line. The Schmidheiny brothers convinced shareholders that the company should consolidate holdings and merge with Schweizerischen Cement-Industrie-Gesellschaft. The combined company had annual revenue of 800 million Swiss francs and established Holderbank as one of the industries largest companies worldwide. The oil crisis of 1973 hit the industry hard as construction demand dried up in much of the world. Strong markets in Lebanon and South Africa allowed Holderbank to weather the storm. By 1976, revenue and profits had returned to pre-crisis levels.[9]

In the late 1970s and early 1980s, Holderbank continued its expansion in Latin America and expanded into Asia and Spain for the first time. Thomas Schmidheiny took over leadership, overseeing the company as in expanded into Eastern Europe and experienced a boom in Spanish construction preceding the 1992 Summer Olympics. By 1986, Holderbank was the world's largest cement manufacturer. In the 1990s, the company consolidated its European holdings as the American market drove growth. Expansion into Eastern Europe and Russia continued.[9]

In 2001, the company changed its name from "Holderbank Financière Glaris" to Holcim (short for Holderbank ciment).[8] Asia drove growth in the 2000s, as the company saw more than 50% of its business come from emerging markets.[9] In 2005, Holcim purchased Aggregate Industries for US$4.1 billion, entering the United Kingdom for the first time.[2] That year, the company also expanded into India by acquiring a stakes in The Associated Cement Companies (ACC) and Ambuja Cement Eastern. In 2008, Holcim became the largest shareholder of China's Huaxin Cement with a 40% stake. In 2009, they acquired Cemex Australia.[9]

In February 2012, Bernard Fontana became the first CEO of Holcim that was not part of the founding families.[2]

Proposed merger

On April 7, 2014, Holcim and Lafarge announced they had agreed to terms on a "merger of equals" valued at nearly $60 billion. The merger would entail Lafarge stock being converted into Holcim stock on a 1:1 basis.[10] Former Holcim shareholders would own 53% of LafargeHolcim.[10] The new company would be based in Switzerland and have a manufacturing capacity of 427 million tons a year, which would vastly exceed the 227 million ton capacity of current industry leader Anhui Conch.[7] Lafarge Chief Executive Officer Bruno Lafont will lead the new company, while Holcim's Wolfgang Reitzle will be chairman.[2] Executives from both companies said the deal will save the new company 1.4 billion euros (US$1.9 billion) annually and create "the most advanced group in the building materials industry."[7]

The deal will face significant regulatory obstacles, as 15 different jurisdictions could potentially raise objections. The cement market in Europe is already tightly consolidated and antitrust scrutiny of deals has been commonplace since the 1970s.[7] To meet regulatory concerns, Holcim and Lafarge plan to sell or spinoff assets that generated about 5 billion euros (US$6.9 billion) of revenue in 2013 in regions of large overlap between the two companies.[2] Lafont said the merger was aimed at rebalancing operations, not cutting costs. He said overlapping businesses would be sold, not closed, so industry job losses would be minimal.[7]

Industry analysts said the deal would combine Holcim's marketing strength with Lafarge's edge in innovation, while providing significant cost savings, but cautioned "the road to merger clearance will be a long, complex and uncertain one."[10] Other analysts said the deal could lead to further mergers within the industry and give competitors a chance to pick up assets at a bargain price.[2] Most analysts surveyed by Reuters felt the merger would be approved in the end.[10]

See also

Holcim competitors include:

Notes and references

- ↑ 1.0 1.1 1.2 1.3 1.4 "Annual Report 2010" (PDF). Holcim. Retrieved 31 March 2011.

- ↑ 2.0 2.1 2.2 2.3 2.4 2.5 2.6 Patrick Winters; Francois de Beaupuy (April 7, 2014). "Holcim to Merge With Lafarge to Form Biggest Cement Maker". Bloomberg. Retrieved April 9, 2014.

- ↑ 3.0 3.1 3.2 "Holcim Ltd. Company Profile". Yahoo. Retrieved March 10, 2014.

- ↑ 4.0 4.1 "Holcim Ltd-reg (HOLN:SIX Swiss Ex)". Business Week. Retrieved April 10, 2014.

- ↑ Fitch Ratings (April 9, 2014). "Fitch Affirms Holcim Ltd at 'BBB'; Outlook Stable". Reuters. Retrieved April 10, 2014.

- ↑ ICR Research (October 24, 2011). "Corporate profile – Holcim". Cemnet. Retrieved April 10, 2014.

- ↑ 7.0 7.1 7.2 7.3 7.4 David Jolly (April 7, 2014). "Antitrust Hurdles Loom Large for Giant Cement Merger". New York Times. Retrieved April 9, 2014.

- ↑ 8.0 8.1 8.2 8.3 "About us: History". Holcim. Retrieved April 10, 2014.

- ↑ 9.0 9.1 9.2 9.3 9.4 9.5 9.6 9.7 9.8 "Holcim history 1912-2012". Holcim. Retrieved April 10, 2014.

- ↑ 10.0 10.1 10.2 10.3 Natalie Huet; Caroline Copley (April 7, 2014). "Holcim, Lafarge agree to merger to create cement giant". Reuters. Retrieved April 9, 2014.

External links

| Wikimedia Commons has media related to Holcim. |