Heteroscedasticity-consistent standard errors

The topic of heteroscedasticity-consistent (HC) standard errors arises in statistics and econometrics in the context of linear regression as well as time series analysis. The alternative names of Huber–White standard errors, Eicker–White or Eicker–Huber–White[1] are also frequently used in relation to the same ideas.

In regression and time-series modelling, basic forms of models make use of the

assumption that the errors or disturbances ui have the same variance across all observation points. When this is not the case, the errors are said to be heteroscedastic, or to have heteroscedasticity, and this behaviour will be reflected in the residuals  estimated from a fitted model. Heteroscedasticity-consistent standard errors are used to allow the fitting of a model that does contain heteroscedastic residuals. The first such approach was proposed by Huber (1967), and further improved procedures have been produced since for cross-sectional data, time-series data and GARCH estimation.

estimated from a fitted model. Heteroscedasticity-consistent standard errors are used to allow the fitting of a model that does contain heteroscedastic residuals. The first such approach was proposed by Huber (1967), and further improved procedures have been produced since for cross-sectional data, time-series data and GARCH estimation.

Definition

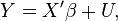

Assume that we are studying the linear regression model

where X is the vector of explanatory variables and β is a k × 1 column vector of parameters to be estimated.

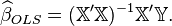

The ordinary least squares (OLS) estimator is

where  denotes the matrix of stacked

denotes the matrix of stacked  values observed in the data.

values observed in the data.

If the sample errors have equal variance σ2 and are uncorrelated, then the least-squares estimate of β is BLUE (best linear unbiased estimator), and its variance is easily estimated with

where  are regression residuals.

are regression residuals.

When the assumptions of ![E[uu'] = \sigma^2 I_n](../I/m/55039d6dcc26abdec72b8ccc8f3d06df.png) are violated, the OLS estimator loses its desirable properties. Indeed,

are violated, the OLS estimator loses its desirable properties. Indeed,

where ![\Sigma = V[u]](../I/m/d09eb1e30b96d76a7b4d90fb2bcf0901.png) .

.

While the OLS point estimator remains unbiased, it is not "best" in the sense of having minimum mean square error, and the OLS variance estimator ![v_{OLS}[\hat\beta_{OLS}]](../I/m/1e7bc681e3ae746308f3a798927f33e5.png) does not provide a consistent estimate of the variance of the OLS estimates.

does not provide a consistent estimate of the variance of the OLS estimates.

White's heteroscedasticity-consistent estimator

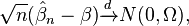

If the regression errors  are independent, but have distinct variances σi2, then

are independent, but have distinct variances σi2, then  which can be estimated with

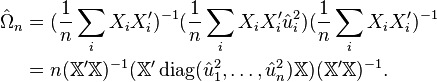

which can be estimated with  . This provides White's (1980) estimator, often referred to as HCE (heteroscedasticity-consistent estimator):

. This provides White's (1980) estimator, often referred to as HCE (heteroscedasticity-consistent estimator):

where as above  denotes the matrix of stacked

denotes the matrix of stacked  values from the data. The estimator can be derived in terms of the generalized method of moments (GMM).

values from the data. The estimator can be derived in terms of the generalized method of moments (GMM).

Note that also often discussed in the literature (including in White's paper itself) is the covariance matrix  of the

of the  -consistent limiting distribution:

-consistent limiting distribution:

where,

and

Thus,

and

![\widehat{Var}[X u] = \frac{1}{n} \sum_i X_i X_i' \hat u_i^2 = \frac{1}{n} \mathbb{X}' \operatorname{diag}(\hat u_1^2, \ldots, \hat u_n^2) \mathbb{X}](../I/m/fc0e44e624a31bf2a69e8aae2b42cb7f.png) .

.

Precisely which covariance matrix is of concern should be a matter of context.

Alternative estimators have been proposed in MacKinnon & White (1985) that correct for unequal variances of regression residuals due to different leverage. Unlike the asymptotic White's estimator, their estimators are unbiased when the data are homoscedastic.

See also

- Generalized least squares

- Generalized estimating equations

- White test — a test for whether heteroscedasticity is present.

Software

- Stata: robust option applicable in many pseudo-likelihood based procedures. See online help for _robust option and regress command.

- RATS: robusterrors option is available in many of the regression and optimization commands (linreg, nlls, etc.).

- Eviews: EViews version 8 offers three different methods for robust least squares: M-estimation (Huber, 1973), S-estimation (Rousseeuw and Yohai, 1984), and MM-estimation (Yohai 1987).

References

- ↑ Kleiber, C., Zeileis, A (2006) Applied Econometrics with R, UseR-2006 conference

- Hayes, Andrew F.; Cai, Li (2007), "Using heteroscedasticity-consistent standard error estimators in OLS regression: An introduction and software implementation", Behavior Research Methods 37: 709–722

- Eicker, Friedhelm (1967), "Limit Theorems for Regression with Unequal and Dependent Errors", Proceedings of the Fifth Berkeley Symposium on Mathematical Statistics and Probability, pp. 59–82, MR 0214223, Zbl 0217.51201

- MacKinnon, James G.; White, Halbert (1985), "Some Heteroskedastic-Consistent Covariance Matrix Estimators with Improved Finite Sample Properties", Journal of Econometrics 29 (29): 305–325, doi:10.1016/0304-4076(85)90158-7

- Huber, Peter J. (1967), "The behavior of maximum likelihood estimates under nonstandard conditions", Proceedings of the Fifth Berkeley Symposium on Mathematical Statistics and Probability, pp. 221–233, MR 0216620, Zbl 0212.21504

- White, Halbert (1980), "A Heteroskedasticity-Consistent Covariance Matrix Estimator and a Direct Test for Heteroskedasticity", Econometrica 48 (4): 817–838, doi:10.2307/1912934, JSTOR 1912934, MR 575027

- Greene, William. (1998), Econometric Analysis, Prentice Hall

![v_{OLS}[\hat\beta_{OLS}] = s^2 (\mathbb{X}'\mathbb{X})^{-1}, s^2 = \frac{\sum_i \hat u_i^2}{n-k}](../I/m/7ce4298a063858bc188cadb0422d340d.png)

![V[\hat\beta_{OLS}] = V[ (\mathbb{X}'\mathbb{X})^{-1} \mathbb{X}'\mathbb{Y}] = (\mathbb{X}'\mathbb{X})^{-1} \mathbb{X}' \Sigma \mathbb{X} (\mathbb{X}'\mathbb{X})^{-1}](../I/m/e57546e602204916a9844dd6159a5209.png)

![\begin{align}

v_{HCE}[\hat\beta_{OLS}] &= \frac{1}{n} (\frac{1}{n} \sum_i X_i X_i' )^{-1} (\frac{1}{n} \sum_i X_i X_i' \hat{u}_i^2 ) (\frac{1}{n} \sum_i X_i X_i' )^{-1} \\

&= ( \mathbb{X}' \mathbb{X} )^{-1} ( \mathbb{X}' \operatorname{diag}(\hat u_1^2, \ldots, \hat u_n^2) \mathbb{X} ) ( \mathbb{X}' \mathbb{X})^{-1},

\end{align}](../I/m/a5e37fbd68395c990c257764363d6b0a.png)

![\Omega = E[X X']^{-1}Var[X u]E[X X']^{-1},](../I/m/9547fe26d276c558a7eb6e1d1e9045e9.png)

![\hat\Omega_n = n \cdot v_{HCE}[\hat\beta_{OLS}]](../I/m/0285a4b1c03269824b2d511d98a32a35.png)