Guaranteed Annual Income

Guaranteed Annual Income in Canada, refers to various proposals discussed in Canada since the 1970s, to implement guaranteed minimum income or basic income; herein referred to as NIT (for negative income tax) and UD (for Universal Demogrant) respectively.

Models

The first model encompassed under the GAI is the Negative income tax (NIT). Negative Income Tax works on the assumption that families who earn below the low-income threshold should receive aid in the form of direct grants, rather than paying taxes. This allows a family unit to use resources as it best sees fit rather than being constrained by the traditional income assistance programs. Experiments utilizing the Negative Income Tax model have been completed in the United States in the late 1960s through the early 1970s.

The NIT model was also tested in Canada in the 1970s in Manitoba; it was called the Mincome experiment. It allowed every family unit to receive a minimum cash benefit, with every dollar over the benefit amount taxed at 60%. The results showed a modest impact on labor markets, with family working hours decreasing 5%. These potential economic costs can be offset by the opportunity cost of more time for family and education. Mothers spent more time rearing newborns, and the educational impacts are regarded as a success. Students in these families showed higher test scores and lower dropout rates. There was also an increase in adults continuing education.[1][2]

The second model that falls under the Guaranteed Annual Income concept is the Unconditional Basic Income also known as the universal demogrant (UD) model. This is a payment to all persons regardless of income. It is usually favored by those who see the GAI as a right of citizenship and whose purpose is to eliminate poverty through the basic income and lead to more equal sharing of the economic benefits of society.[3]

Implementation of similar proposals

In Namibia in 2008 a non-profit coalition implemented a monthly cash grant of approximately 13 U.S. dollars to every Namibian citizen until they were of pension age where they would then be eligible for the existing universal state old age pension. The results were outstanding in improving health outcomes due to child malnutrition and absolute poverty declined.[4] To help deal with inflation of prices and the low-income/poverty in Iran, the government is now providing a general subsidy to every citizen each month to guarantee a basic income; with results that are showing a great deal of promise.[5] Brazil has also implemented a Citizens Basic Income for all of its citizens, again with positive results in terms of health and economic stimulation.[6]

Criticism

There are some obvious impediments to the implementation of a Guaranteed Annual Income in Canada. First, at the heart of the issue is whether or not work incentives would decrease and by extension, the eventual cost of a nationwide GAI would balloon beyond feasibility. Eliminating poverty can be a costly endeavour depending on the support levels and taxation rates that are chosen by the government.[7] If individuals stop working economic growth and productivity may be jeopardized. Economic growth leads back to the cost issue, where substantial public revenue must be used to ensure basic economic security for all. Depending on the approach taken by the government there are ways to create a cost-neutral GAI.[8]

Another obstacle to the concept of Guaranteed Annual Income would be single employer subsidization and an incentive for employers to reduce workers’ wages, as the government will guarantee their employee’s a minimum living standard.[8]

A third obstruction to the GAI is the public argument of “why should the lazy be paid”? Those individuals that choose not to “work” insults the moral principle of reciprocity. The removal of a tie between income and contribution encourages parasitism.[8]

Financial model

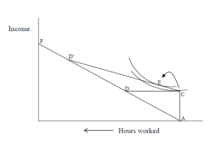

For any income earned up to a break point value, the government would provide a progressively small cash transfer. The concept is summarized by the formula B=G-TY where B is the net amount paid by the government to the citizen (if it is a negative value) or tax paid (if a positive value), G is minimum guaranteed payment, Y is the gross annual income, and T is the tax rate. As such, if a person has no income, they will receive a minimum guaranteed payment (G); all subsequent income is taxed at a rate T which is less than 100 percent. A classic diagram in economics illustrating this is shown in Figure 1. It is important to remember that while the y axis demonstrates increasing gross income, the x axis displays decreasing number of hours worked. With a negative income tax, individuals who have no income would earn a minimum amount (represented on Figure 1 as a value equal to ‘C’) instead of nothing (A). As part of a traditional welfare system, individuals receiving assistance would be taxed at a rate of 100% (demonstrated in the line connecting ‘C’ and ‘D’) and as such the net income level is unchanged. However, negative income tax provides an incentive for those receiving government assistance to work (as represented by the line C to D’), as they are taxed at a rate less than 100%. Last ‘F’ is the break-point value for annual income, above which an individual would not qualify for assistance.[9]

History

In 1970 the Department of National Health and Welfare issued a white paper which both emphasized the ability of NIT to decrease poverty but at the potential expense of decreased work incentive. Specifically, the white paper [10] stated:

| “ | An overall guaranteed income program...worthy of consideration must offer a substantial level of benefit to people who are normally in the labour market. Therefore a great deal of further study and investigation, is needed to find out what effects such a program would have on people’s motivation and on their incentives to work and save. Until these questions are answered, the fear of its impact on productivity will be the main deterrent to the introduction of a general overall guaranteed income plan. (p. 126) | ” |

Following this stance, the National Council of Welfare advocated in 1976 for the implementation of the guaranteed annual income in Canada.[11]

In order to determine real-life responses to NIT implementation, the US government undertook four income maintenance experiments; they transpired in New Jersey and Pennsylvania (1968-1972), rural areas of North Carolina and Iowa (1970–72), Seattle and Denver (1970–78), and Gary Indiana (1971-1974). These prospective large-scale field studies were truly remarkable due to their size and the fact that families were randomized to either an experimental arm (i.e., NIT) or control arm (usual tax practice). Three major objectives of these interventions were to measure the labour supply response of NIT recipients, understand the effect of varying the base guarantee level and tax rate, and to make a better estimate of the cost of implementing such a program.[12]

In Canada, an analogous experiment called Mincome took place in Winnipeg and Dauphin, Manitoba between 1974 - 1979. Importantly, the city of Dauphin served as a saturation site, since all 10,000 community members were eligible to participate (the elderly and disabled were exempt from the four American NIT experiments); four foci of Mincome were an economic arm (examining labour response), a sociologic research division (examining family formation and community cohesion), an administrative programme, and a statistical division.[13] Unfortunately, the ambitious project ran into significant budgetary problems early on and neither the newly elected Progressive Conservative government in Ottawa nor the Tory government in Manitoba felt strongly about providing further funding. As stated by Hum and Simpson:[14]

| “ | The original budget of $17 million was never more than a wild guess and, in the event, proved far inadequate. The inflationary price increases of the 1970s, coupled with a larger than anticipated unemployment rate, meant that the proportion of the total going to programme expenses exceeded estimates and was not under the control of the researchers. (p. 44) | ” |

Ultimately the Dauphin data which was collected at great expense to the taxpayers and time from participants (in the first social experiment ever conducted in Canada) remains largely unexamined. However, some of the participant interviews were released and provide support for the efficacy of NIT. For instance Amy Richardson, a mother of six whose husband was disabled said:[13]

| “ | It was enough to bring your income up to where it should be. It was enough to add some cream to the coffee. Everybody was the same so there was no shame. (p.25) | ” |

Doreen Henderson, a stay at home mother whose husband worked as a janitor also appreciated the benefits of NIT;[13] she said:

| “ | Give them enough money to raise their kids. People work hard, and it`s still not enough. This isn`t welfare. This is making sure kids have enough to eat...They should have kept it (NIT). It made a real difference. (p.26) | ” |

In general, the average reduction in work force in the US sites was about 13%, with most of the reduction in labour from secondary (typically the wives) and tertiary (typically older children) earners as opposed to the primary earner (usually the husbands). In Mincome the reduction in work effort was more modest: 1% for men and 3% for wives.[14] It is important to remember that when the experiments were conducted, it was less socially acceptable for women to work outside the home. According to Rossi and Lyall [12] only 40% of wives who participated in the experiment worked outside the home and their earning power was low due to limited and discontinuous work experience. As such, the authors contend that wives’ labour involvement was marginal and when faced with competing tasks of looking after the household and raising children, the additional income provided by NIT was sufficient to justify an exit from the labor market. However, this phenomenon was predominantly observed in Caucasian wives whereas African American and Hispanic women exhibited a small increase in labor force participation. Interestingly, the decrease in labor involvement of teenage children was correlated to higher rates of high school graduation. A potential explanation is that the additional income from government assistance meant that young adults could stay in school as opposed to join the workforce in order to support their family. This has the potential positive long-term effect of allowing youth to find higher wage employment. In summary, the work supply response to NIT was very complex; however, data from the American studies would argue against a dramatic decline in the labour force.

See also

- Mincome Program

- Basic income

- Negative income tax

References

- ↑ Salkind, N.J. & Haskins, R. (1982). Negative income tax: The impact on children from low-income families. Journal of Family Issues, 3, 165-180.

- ↑ http://public.econ.duke.edu/~erw/197/forget-cea%20%282%29.pdf

- ↑ http://www.canadiansocialresearch.net/ssrgai.htm#NIT

- ↑ Basic Income Grant Coalition. (2012). Namibia Tax Consortium [Data File]. Retrieved from http://www.bignam.org/BIG_pilot.html

- ↑ "Iran’s bold economic reform: Economic jihad". The Economist. 23 June 2011. Retrieved 30 November 2013.

- ↑ Senator Eduardo Suplicy. (2012). The Citizens Basic Income [Data File]. Retrieved from http://www.senado.gov.br/senadores/Senador/esuplicy/#

- ↑ Hum, D. & Simpson, W. (1993). Economic response to a guaranteed annual income: Experience from Canada and the United States. Journal of Labor Economics, 11(1), S263-S296.

- ↑ 8.0 8.1 8.2 Young, M & Mulvale, J.P. (2009). Possibilities and prospects: The debate over a guaranteed income. Ottawa, ON: Canadian Centre for Policy Alternatives.

- ↑ Friedman, M. (1982). Capitalism and Freedom. Chicago, IL: University of Chicago Press.

- ↑ National Health and Welfare. (1970). Income security for Canadians. National Health and Welfare white paper. Ottawa, ON: Queen’s Printer.

- ↑ Guide to the guaranteed income, National Council of Welfare, january 1976

- ↑ 12.0 12.1 Rossi, H. & Lyall, K. (1976). Reforming public welfare: A critique of the negative income tax experiment. New York, NY: Russell Sage Foundation.

- ↑ 13.0 13.1 13.2 Forget, E. (2008). The town with no poverty: A history of the North American Guaranteed Annual Income. Winnipeg, MB: University of Manitoba.

- ↑ 14.0 14.1 Hum, D. & Simpson, W. (2001). A guaranteed annual income? From Mincome to the millenium. Policy Options, 12, 78-82.