European System of Central Banks

| European Union |

This article is part of a series on the |

Policies and issues

|

Elections

|

Not to be confused with the Eurosystem.

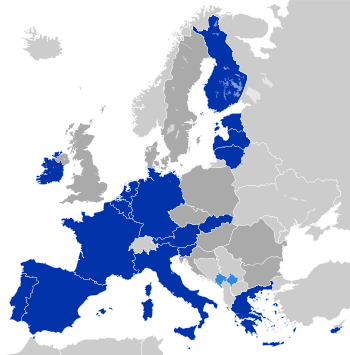

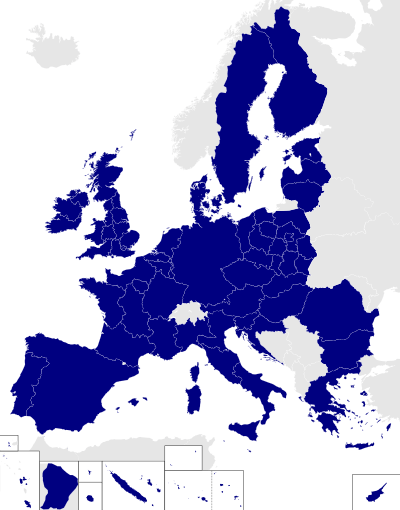

The European System of Central Banks (ESCB) is composed of the European Central Bank (ECB) and the national central banks (NCBs) of all 28 European Union (EU) Member States.

Functions

Since not all the EU states have joined the euro, the ESCB could not be used as the monetary authority of the eurozone. For this reason the Eurosystem (which excludes all the NCBs which have not adopted the euro) became the institution in charge of those tasks which in principle had to be managed by the ESCB. In accordance with the treaty establishing the European Community and the Statute of the European System of Central Banks and of the European Central Bank, the primary objective of the Eurosystem is to maintain price stability. Without prejudice to this objective, the Eurosystem shall support the general economic policies in the Community and act in accordance with the principles of an open market economy.

The basic tasks to be carried out by the Eurosystem are (art. 127 TFEU):

- to define and implement the monetary policy of the eurozone;

- to conduct foreign exchange operations;

- to hold and manage the official foreign reserves of the Member States; and

- to promote the smooth operation of payment systems.

In addition, the Eurosystem contributes to the smooth conduct of policies pursued by the competent authorities relating to the prudential supervision of credit institutions and the stability of the financial system. The ECB has an advisory role vis-à-vis the Community and national authorities on matters which fall within its field of competence, particularly where Community or national legislation is concerned. Finally, in order to undertake the tasks of the ESCB, the ECB, assisted by the NCBs, has the task of collecting the necessary statistical information either from the competent national authorities or directly from economic agents.

Organization

The process of decision-making in the Eurosystem is centralized through the decision-making bodies of the ECB, namely the Governing Council and the Executive Board. As long as there are Member States which have not adopted the euro, a third decision-making body, the General Council, shall also exist. The NCBs of the Member States that do not participate in the euro area are members of the ESCB with a special status – while they are allowed to conduct their respective national monetary policies, they do not take part in the decision-making with regard to the single monetary policy for the euro area and the implementation of such decisions.

The Governing Council comprises all the members of the Executive Board and the governors of the NCBs of the Member States without a derogation, i.e. those countries which have adopted the euro. The main responsibilities of the Governing Council are:

- to adopt the guidelines and take the decisions necessary to ensure the performance of the tasks entrusted to the Eurosystem;

- to formulate the monetary policy of the euro area, including, as appropriate, decisions relating to intermediate monetary objectives, key interest rates and the supply of reserves in the Eurosystem, and

- to establish the necessary guidelines for their implementation.

The Executive Board comprises the President, the Vice-President and four other members, all chosen from among persons of recognized standing and professional experience in monetary or banking matters. They are appointed by common accord of the governments of the Member States at the level of the Heads of State or Government, on a recommendation from the Council of Ministers after it has consulted the European Parliament and the Governing Council of the ECB (i.e. the Council of the European Monetary Institute (EMI) for the first appointments). The main responsibilities of the Executive Board are:

- to implement monetary policy in accordance with the guidelines and decisions laid down by the Governing Council of the ECB and, in doing so, to give the necessary instructions to the NCBs; and

- to execute those powers which have been delegated to it by the Governing Council of the ECB.

The General Council comprises the President and the Vice-President and the governors of the NCBs of all 28 Member States. The General Council performs the tasks which the ECB took over from the EMI and which, owing to the derogation of one or more Member States, still have to be performed in Stage Three of Economic and Monetary Union (EMU). The General Council also contributes to:

- the ECB's advisory functions;

- the collection of statistical information;

- the preparation of the ECB's annual reports;

- the establishment of the necessary rules for standardising the accounting and reporting of operations undertaken by the NCBs;

- the taking of measures relating to the establishment of the key for the ECB's capital subscription other than those already laid down in the Treaty;

- the laying-down of the conditions of employment of the members of staff of the ECB; and

- the necessary preparations for irrevocably fixing the exchange rates of the currencies of the Member States with a derogation against the euro.

The Eurosystem is independent. When performing Eurosystem-related tasks, neither the ECB, nor an NCB, nor any member of their decision-making bodies may seek or take instructions from any external body. The Community institutions and bodies and the governments of the Member States may not seek to influence the members of the decision-making bodies of the ECB or of the NCBs in the performance of their tasks. The Statute of the ESCB makes provision for the following measures to ensure security of tenure for NCB governors and members of the Executive Board:

- a minimum renewable term of office for national central bank governors of five years;

- a minimum non-renewable term of office for members of the Executive Board of eight years (a system of staggered appointments was used for the first Executive Board for members other than the President in order to ensure continuity); and

- removal from office is only possible in the event of incapacity or serious misconduct; in this respect the Court of Justice of the European Communities is competent to settle any disputes.

The ECB's capital amounts to €5 billion. The NCBs are the sole subscribers to and holders of the capital of the ECB. The subscription of capital is based on a key established on the basis of the EU Member States' respective shares in the GDP and population of the Community. It has, thus far, been paid up to an amount just over €4 billion. The euro area NCBs have paid up their respective subscriptions to the ECB's capital in full. The NCBs of the non-participating countries have to pay up 7% of their respective subscriptions to the ECB's capital as a contribution to the operational costs of the ECB. As a result, the ECB was endowed with an initial capital of just under €4 billion.

In addition, the NCBs of the Member States participating in the euro area have provided the ECB with foreign reserve assets of up to an amount equivalent to around €40 billion. The contributions of each NCB were fixed in proportion to its share in the ECB's subscribed capital, while in return each NCB was credited by the ECB with a claim in euro equivalent to its contribution. 15% of the contributions were made in gold, and the remaining 85% in US dollars and Japanese yen.

Member banks

The ESCB is composed of the following 28 NCBs and the ECB. The first section of this list comprises those ESCB banks that form the Eurosystem (those states that have adopted the euro, plus the ECB) which sets eurozone monetary policy. The second section contains those banks which maintain separate currencies.

Notes

| Wikisource has original text related to this article: |

- ↑ Most common name for post, also used: President, Chairman or General Secretary

External links

- European Central Bank

- ECB – The General Council

- Central Bank Rates: ECB Key Rate, chart and data

- Organisation and operation of the ECB CVCE (Centre for European Studies)

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||