Elasticity of a function

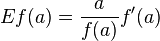

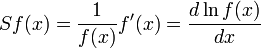

In mathematics, the elasticity or point elasticity of a positive differentiable function f of a positive variable (positive input, positive output)[1] at point a is defined as[2]

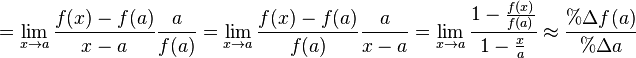

or equivalently

It is thus the ratio of the relative (percentage) change in the function's output  with respect to the relative change in its input

with respect to the relative change in its input  , for infinitesimal changes from a point

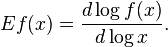

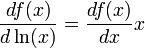

, for infinitesimal changes from a point  . Equivalently, it is the ratio of the infinitesimal change of the logarithm of a function with respect to the infinitesimal change of the logarithm of the argument.

. Equivalently, it is the ratio of the infinitesimal change of the logarithm of a function with respect to the infinitesimal change of the logarithm of the argument.

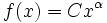

The elasticity of a function is a constant  if and only if the function has the form

if and only if the function has the form  for a constant

for a constant  .

.

The elasticity at a point is the limit of the arc elasticity between two points as the separation between those two points approaches zero.

The concept of elasticity is widely used in economics; see elasticity (economics) for details. [3] [4][5]

Rules

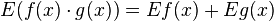

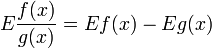

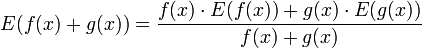

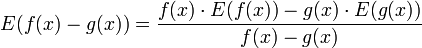

Rules for finding the elasticity of products and quotients are simpler than those for derivatives. Let f, g be differentiable. Then[2]

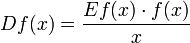

The derivative can be expressed in terms of elasticity as

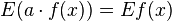

Let a and b be constants. Then

,

, .

.

Estimating point elasticities

In economics, the price elasticity of demand refers to the elasticity of a demand function Q(P), and can be expressed as (dQ/dP)/(Q(P)/P) or the ratio of the value of the marginal function (dQ/dP) to the value of the average function (Q(P)/P). This relationship provides an easy way of determining whether a demand curve is elastic or inelastic at a particular point. First, suppose one follows the usual convention in mathematics of plotting the independent variable (P) horizontally and the dependent variable (Q) vertically. Then the slope of a line tangent to the curve at that point is the value of the marginal function at that point. The slope of a ray drawn from the origin through the point is the value of the average function. If the absolute value of the slope of the tangent is greater than the slope of the ray then the function is elastic at the point; if the slope of the secant is greater than the absolute value of the slope of the tangent then the curve is inelastic at the point.[6] If the tangent line is extended to the horizontal axis the problem is simply a matter of comparing angles formed by the lines and the horizontal axis. If the marginal angle is greater than the average angle then the function is elastic at the point; if the marginal angle is less than the average angle then the function is inelastic at that point. If, however, one follows the convention adopted by economists and plots the independent variable P on the vertical axis and the dependent variable Q on the horizontal axis, then the opposite rules would apply.

The same graphical procedure can also be applied to a supply function or other functions.

Semi-elasticity

A semi-elasticity (or semielasticity) gives the percentage change in f(x) in terms of a change (not percentage-wise) of x. Algebraically, the semi-elasticity S of a function f at point x is [7][8]

An example of semi-elasticity is modified duration in bond trading.

The term "semi-elasticity" is also sometimes used for the change if f(x) in terms of a percentage change in x[9] which would be

See also

References

- ↑ The elasticity can also be defined if the input and/or output is consistently negative, or simply away from any points where the input or output is zero, but in practice the elasticity is used for positive quantities.

- ↑ 2.0 2.1 Sydsaeter, Knut; Hammond, Peter (1995). Mathematics for Economic Analysis. Englewood Cliffs, NJ: Prentice Hall. pp. 173–175. ISBN 013583600X.

- ↑ • Hanoch, G. (1975) “The elasticity of scale and the shape of average costs,” American Economic Review 65, pp. 492-497.

- ↑ • Panzar, J.C. and R.D. Willig (1977) “Economies of scale in multi-output production, Quarterly Journal of Economics 91, 481-493.

- ↑ • Zelenyuk, V. (2013) “A scale elasticity measure for directional distance function and its dual: Theory and DEA estimation.” European Journal of Operational Research 228:3, pp 592–600

- ↑ Chiang; Wainwright (2005). Fundamental Methods of Mathematical Economics (4th ed.). Boston: McGraw-Hill. pp. 192–193. ISBN 0070109109.

- ↑ Wooldridge, Jeffrey (2003). Introductory Econometrics: A Modern Approach (2nd ed.). South-Western. p. 656. ISBN 0-324-11364-1.

- ↑ White, Lawrence Henry (1999). The theory of monetary institutions. Malden: Blackwell. p. 148. ISBN 0-631-21214-0.

- ↑ http://www.stata.com/help.cgi?margins

- Nievergelt, Yves (1983). "The Concept of Elasticity in Economics". SIAM Review 25 (2): 261–265. doi:10.1137/1025049.

- Färe, R., S. Grosskopf and C.A.K. Lovell (1986), “Scale economies and duality” Zeitschrift für Nationalökonomie 46:2, pp. 175-182.

- Hanoch, G. (1975) “The elasticity of scale and the shape of average costs,” American Economic Review 65, pp. 492-497.

- Panzar, J.C. and R.D. Willig (1977) “Economies of scale in multi-output production, Quarterly Journal of Economics 91, 481-493.

- Zelenyuk V. (2014) “Scale efficiency and homotheticity: equivalence of primal and dual measures” Journal of Productivity Analysis 42:1, pp 15-24.

- Zelenyuk, V. (2015) "Aggregation of scale efficiency," European Journal of Operational Research, 240:1, pp 269-277.