Effective interest rate

| Finance |

|---|

|

The effective interest rate, effective annual interest rate, annual equivalent rate (AER) or simply effective rate is the interest rate on a loan or financial product restated from the nominal interest rate as an interest rate with annual compound interest payable in arrears.

It is used to compare the annual interest between loans with different compounding terms (daily, monthly, annually, or other). The effective interest rate differs in two important respects from the annual percentage rate (APR):[1]

- the effective interest rate generally does not incorporate one-time charges such as front-end fees;

- the effective interest rate is (generally) not defined by legal or regulatory authorities (as APR is in many jurisdictions).[2]

By contrast, the effective APR is used as a legal term, where front-fees and other costs can be included, as defined by local law.[1][2]

Annual percentage yield or effective annual yield is the analogous concept used for savings or investment products, such as a certificate of deposit. Since any loan is an investment product for the lender, the terms may be used to apply to the same transaction, depending on the point of view.

Effective annual interest or yield may be calculated or applied differently depending on the circumstances, and the definition should be studied carefully. For example, a bank may refer to the yield on a loan portfolio after expected losses as its effective yield and include income from other fees, meaning that the interest paid by each borrower may differ substantially from the bank's effective yield.

Calculation

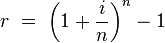

The effective interest rate is calculated as if compounded annually. The effective rate is calculated in the following way, where r is the effective annual rate, i the nominal rate, and n the number of compounding periods per year (for example, 12 for monthly compounding):

For example, a nominal interest rate of 6% compounded monthly is equivalent to an effective interest rate of 6.17%. 6% compounded monthly is credited as 6%/12 = 0.005 every month. After one year, the initial capital is increased by the factor (1 + 0.005)12 ≈ 1.0617.

When the frequency of compounding is increased up to infinity the calculation will be:

The yield depends on the frequency of compounding:

| Nominal Rate | Semi-Annual | Quarterly | Monthly | Daily | Continuous |

|---|---|---|---|---|---|

| 1% | 1.003% | 1.004% | 1.005% | 1.005% | 1.005% |

| 5% | 5.063% | 5.095% | 5.116% | 5.127% | 5.127% |

| 10% | 10.250% | 10.381% | 10.471% | 10.516% | 10.517% |

| 15% | 15.563% | 15.865% | 16.075% | 16.180% | 16.183% |

| 20% | 21.000% | 21.551% | 21.939% | 22.134% | 22.140% |

| 30% | 32.250% | 33.547% | 34.489% | 34.969% | 34.986% |

| 40% | 44.000% | 46.410% | 48.213% | 49.150% | 49.182% |

| 50% | 56.250% | 60.181% | 63.209% | 64.816% | 64.872% |

The effective interest rate is a special case of the internal rate of return.

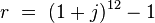

If the monthly interest rate j is known and remains constant throughout the year, the effective annual rate can be calculated as follows:

See also

- Real interest rate

- Real versus nominal value (economics)

- For a zero-coupon bond such as a US treasury bill, an annual effective discount rate may be specified instead of an effective interest rate, because zero coupon bonds trade at a discount from their face value.

Notes

- ↑ 1.0 1.1 The term "nominal APR" is the annual rate without compounding, while the term "effective APR" includes compound interest and, depending on the particular legal definition, can include fees or other charges.

- ↑ 2.0 2.1 "FRB Speech: Creating More Effective Consumer Disclosures" Governor Randall S. Kroszner, May 2007, webpage: [www.federalreserve.gov/newsevents/speech/Kroszner20070523a.htm FedR-Kroszner-23a].

References

- "Interest Rates: An Introduction", webpage: NYFed.

External links

- http://www.miniwebtool.com/effective-interest-rate-calculator/ Online Effective Interest Rate Calculator