Economy of the Czech Republic

| Economy of Czech Republic | |

|---|---|

Pankrác financial district in Prague | |

| Currency | Czech koruna (Kč or CZK) |

| calendar year | |

Trade organisations | EU, WTO (via EU membership) and OECD |

| Statistics | |

| GDP |

|

| GDP rank | 36th (PPP) |

GDP growth |

|

GDP per capita |

|

GDP by sector | agriculture: 1.8%, industry: 39.6%, services: 58.6% (2012 est.) |

|

| |

Population below poverty line | 9% (2010 est.) |

| 24.9 (2012) | |

Labour force | 5.304 million (2013 est.) |

Labour force by occupation | agriculture: 2.6%, industry: 37.4%, services: 60% (2012) |

| Unemployment |

|

Average gross salary | CZK 24,061 / €972 / $1,299 per month (Q1 2013)[3] |

Main industries | motor vehicles, metallurgy, machinery and equipment, glass, armaments |

| 44th[4] | |

| External | |

| Exports |

|

Export goods | machinery and transport equipment, raw materials and fuel, chemicals |

Main export partners |

(2012 est.)[5] |

| Imports |

|

Import goods | machinery and transport equipment, raw materials and fuels, chemicals |

Main import partners |

|

Gross external debt |

|

| Public finances | |

|

| |

| Revenues |

|

| Expenses |

|

| Economic aid | $2.4bn from EU funds (2004–06) |

|

AA (Domestic) AA- (Foreign) AA+ (T&C Assessment) (Standard & Poor's)[7] | |

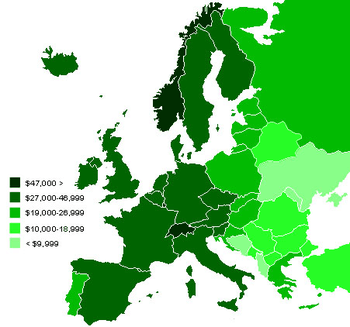

Of the countries in central and eastern Europe, the Czech Republic has one of the most developed industrialized economies. It is one of the most stable and prosperous of the post-Communist states of Central and Eastern Europe. GDP per capita at purchasing power parity was $27,100 in 2011, which is 85% of the EU average.

The principal industries are heavy and general machine-building, iron and steel production, metalworking, chemical production, electronics, transportation equipment, textiles, glass, brewing, china, ceramics, and pharmaceuticals. Its main agricultural products are sugar beets, fodder roots, potatoes, wheat, and hops.

History

The country's strong industrial tradition dates back to the 19th century, when Bohemia and Moravia were the economic heartland of the Austro-Hungarian Empire. The Czech lands produced a majority (about 70%) of all industrial goods in the Austro-Hungarian Empire, some of which were almost monopolistic. The Czechoslovak crown was introduced in April 1919. Introduced at a 1:1 ratio to the Austro-Hungarian currency, it became one of the most stable currencies in Europe. The First Republic became one of the 10 most developed countries of the world (behind the U.S., Canada, Australia, Switzerland, Argentina, Britain, France, Sweden and Belgium).[8]

The consequences of the Munich Agreement were disastrous for the economy. After the occupation and forced subordination of the economy to German economic interests, the crown was officially pegged to the mark at a ratio of 1:10, even though the unofficial exchange rate was 1 to 6-7 and Germans immediately started buying Czech goods in large quantities.[9]

In accordance with Stalin's development policy of planned interdependence, all the economies of the socialist countries were tightly linked to that of the Soviet Union. Czechoslovakia was the most prosperous country in the Eastern Bloc, however it continued to lag further behind the rest of the developed world. With the disintegration of the communist economic alliance in 1991, Czech manufacturers lost their traditional markets among former communist countries in the east.

Today, this heritage is both an asset and a liability. The Czech Republic has a well-educated population and a well-developed infrastructure.

1989–1995

The "Velvet Revolution" in 1989, offered a chance for profound and sustained political and economic reform. Signs of economic resurgence began to appear in the wake of the shock therapy that the International Monetary Fund (IMF) labelled the "big bang" of January 1991. Since then, consistent liberalization and astute economic management has led to the removal of 95% of all price controls, low unemployment, a positive balance of payments position, a stable exchange rate, a shift of exports from former communist economic bloc markets to Western Europe, and relatively low foreign debt. Inflation has been higher than in some other countries – mostly in the 10% range – and the government has run consistent modest budget deficits.

Two government priorities have been strict fiscal policies and creating a good climate for incoming investment in the republic. Following a series of currency devaluations, the crown has remained stable in relation to the US$. The Czech crown became fully convertible for most business purposes in late 1995.

In order to stimulate the economy and attract foreign partners, the government has revamped the legal and administrative structure governing investment. With the breakup of the Soviet Union, the country, till that point highly dependent on exports to the USSR, had to make a radical shift in economic outlook: away from the East, and towards the West. This necessitated the restructuring of existing banking and telecommunications facilities, as well as adjusting commercial laws and practices to fit Western standards. Further minimizing reliance on a single major partner, successive Czech governments have welcomed U.S. investment (amongst others) as a counterbalance to the strong economic influence of Western European partners, especially of their powerful neighbour, Germany. Although foreign direct investment (FDI) runs in uneven cycles, with a 12.9% share of total FDI between 1990 and March 1998, the U.S. was the third-largest foreign investor in the Czech economy, behind Germany and the Netherlands.

Progress toward creating a stable investment climate was recognized when the Czech Republic became the first post-communist country to receive an investment-grade credit rating by international credit institutions.

The republic boasts a flourishing consumer production sector and has privatized most state-owned heavy industries through the voucher privatization system. Under the system, every citizen was given the opportunity to buy, for a moderate price, a book of vouchers that represents potential shares in any state-owned company. The voucher holders could then invest their vouchers, increasing the capital base of the chosen company, and creating a nation of citizen share-holders. This is in contrast to Russian privatization, which consisted of sales of communal assets to private companies rather than share-transfer to citizens. The effect of this policy has been dramatic. Under communism, state ownership of businesses was estimated to be 97%. Privatization through restitution of real estate to the former owners was largely completed in 1992. By 1998, more than 80% of enterprises were in private hands. Now completed, the program has made Czechs, who own shares of each of the Czech companies, one of the highest per-capita share owners in the world.

1995–2000

The republic's economic transformation was far from complete. Political and financial crises in 1997, shattered the Czech Republic's image as one of the most stable and prosperous of post-Communist states. Delays in enterprise restructuring and failure to develop a well-functioning capital market played major roles in Czech economic troubles, which culminated in a currency crisis in May. The formerly pegged currency was forced into a floating system as investors sold their Korunas faster than the government could buy them. This followed a worldwide trend to divest from developing countries that year. Investors also worried the republic's economic transformation was far from complete. Another complicating factor was the current account deficit, which reached nearly 8% of GDP.

In response to the crisis, two austerity packages were introduced later in the spring (called vernacularly "The Packages"), which cut government spending by 2.5% of GDP. Growth dropped to 0.3% in 1997, −2.3% in 1998, and −0.5% in 1999. The government established a restructuring agency in 1999 and launched a revitalization program – to spur the sale of firms to foreign companies. Key priorities included accelerating legislative convergence with EU norms, restructuring enterprises, and privatising banks and utilities. The economy, fueled by increased export growth and investment, was expected to recover by 2000.

2000–2005

Growth in 2000–05 was supported by exports to the EU, primarily to Germany, and a strong recovery of foreign and domestic investment. Domestic demand is playing an ever more important role in underpinning growth as interest rates drop and the availability of credit cards and mortgages increases. Current account deficits of around 5% of GDP are beginning to decline as demand for Czech products in the European Union increases. Inflation is under control. Recent accession to the EU gives further impetus and direction to structural reform. In early 2004 the government passed increases in the Value Added Tax (VAT) and tightened eligibility for social benefits with the intention to bring the public finance gap down to 4% of GDP by 2006, but more difficult pension and healthcare reforms will have to wait until after the next elections. Privatization of the state-owned telecommunications firm Český Telecom took place in 2005. Intensified restructuring among large enterprises, improvements in the financial sector, and effective use of available EU funds should strengthen output growth.

2005–2010

Growth continued in the first years of the EU membership. The credit portion of the Financial crisis of 2007–2010 did not affect the Czech Republic much, mostly due to its stable banking sector which has learned its lessons during a smaller crisis in the late 1990s and became much more cautious. As a fraction of the GDP, the Czech public debt is among the smallest ones in Central and Eastern Europe. Moreover, unlike many other post-communist countries, an overwhelming majority of the household debt – over 99% – is denominated in the local Czech currency. That's why the country wasn't affected by the shrunken money supply in the U.S. dollars.

However, as a large exporter, the economy was sensitive to the decrease of the demand in Germany and other trading partners. In the middle of 2009, the annual drop of the GDP for 2009 was estimated around 3% or 4.3%,[10] a relatively modest decrease. The impact of the economic crisis may have been limited by the existence of the national currency that temporarily weakened in H1 of 2009, simplifying the life of the exporters.

2010-present

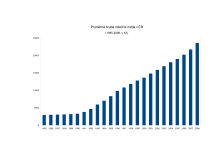

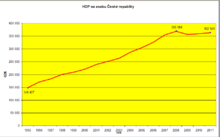

From the financial crisis of 2007–2010, Czech Republic is in stagnation or decreasing of GDP. Some commenters and economs criticising fiscal conservative policy of Petr Nečas right-wing government, especially criticising ex-minister of finance, Miroslav Kalousek. Miroslav Kalousek in 2008 interview, as minister of finance in center-right government of Mirek Topolánek, said "Czech Republic will not suffer by financial crisis".[11] In September 2008, Miroslav Kalousek formed state budget with projection of 5% GDP increase in 2009. In 2009 and 2010, Czech Republic suffered strong economical crisis and GDP decreased by 4,5%. From 2009 to 2012, Czech Republic suffered highest state budget deficits in history of independent Czech Republic. From 2008 to 2012, the public debt of Czech Republic increased by 18,9%. Most decrease of industrial output was in construction industry (-25% in 2009, -15,5% in 2013). From 4Q 2009 to 1Q 2013, GDP decreased by 7,8%.

In 2012, Czech government increased VAT. Basic VAT was increased from 20% in 2012 to 21% in 2013 and reduced VAT increased from 14% to 15% in 2013. Small enterprises sales decreased by 21% from 2012 to 2013 as result of increasing VAT.[12] Patria.cz predicting sales stagnation and mild increase in 2013. Another problem is foreign trade. Czech Republic is consider as export economy (Czech Republic have strong machinery and automobile industry), however in 2013, foreign trade rapidly decreased which led to many other problems and increase of state budget deficit.

In 2013, Czech National Bank, central bank, implemented controversial monetary step. To increase export and employment, CNB wilfully deflated Czech Crown (CZK), which inflation increased from 0.2% in November 2013, to 1.3% in 1Q 2014.

In 2014, GDP in the Czech Republic increased by 2% and is predicted to increase by 2.7% in 2015.

Energy

The Czech Republic is reducing its dependence on highly polluting low-grade brown coal as a source of energy. Nuclear power currently provides about 30% of total power needs, and its share is projected to increase to 40%. Natural gas is procured from Russian Gazprom (roughly three-fourths of domestic consumption) and from Norwegian companies (most of the remaining one-fourth). Russian gas is imported via Ukraine (Friendship pipeline), Norwegian gas is transported through Germany. The gas consumption (approx. 100 TWh in 2003-5) is almost two times higher than the electricity consumption. South Moravia has a small amount of oil and gas deposits.

Statistical indicators

From the CIA World Factbook 2008

Background

GDP (pp.): $273.1 billion (2011)

GDP Growth: 1.7% (2011)

GDP per capita (pp.): $25,934 (2011)[13]

GDP by sector: Agriculture: 2.9% Industry: 38.7% Services: 58.7% (2008)

Inflation: 1.9% (2011)

Labour Force: 5,370,000 (2008)

Unemployment: 6.5% (Jun 2011)[14]

Industrial production growth rate: 5.4% (2011)

Household income or consumption by percentage share: (1996)

- lowest 10%: 4.3%

- highest 10%: 22.4%

Public Debt: 41.5% GDP (2011)

Trade and finance

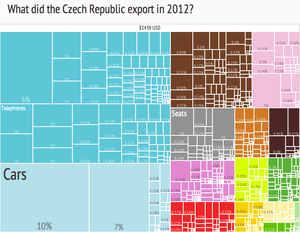

Exports: $122 billion (2007) Export goods: machinery and transport goods 52%, raw materials 9%, chemicals 5%, other 34% (2003).

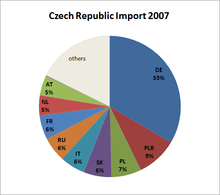

Imports: $116.6 billion Import goods: machinery and transport goods 46%, raw materials and fuels 16%, chemicals 10%, other 28% (2003)

Current Account balance: -$4,533,000 (2007)

Export partners: Germany 30.8%, Slovakia 8.7%, Poland 5.9%, France 5.4%, UK 5.1%, Italy 4.9%, Austria 4.9% (2007).

Import partners: Germany 31.4%, Netherlands 6.7%, Slovakia 6.4%, Poland 6.3%, Austria 5.1%, China 5.1%, Russia 4.5%, Italy 4.4%, France 4.1% (2007).

Reserves: $34.59 billion (2007)

Foreign Direct Investment: $86.75 billion (2007)

Czech Investment Abroad: $6.058 billion (2007)

External debt: $74.7 billion (2007)

Value of Publicly Traded Shares: $48.6 billion (2006)

Exchange rates:

- koruny (Kč) per US$1 – 18.75 (December 2010),[13] 18.277 (2007), 23.957 (2005), 25.7 (2004), 28.2 (2003), 32.7 (2002), 38.0 (2001), 38.6 (2001), 34.6 (1999), 32.3 (1998), 31.7 (1997), 27.1 (1996), 26.5 (1995)

- koruny (Kč) per EUR€1 – 25.06 (December 2010)[13]

Energy (production and consumption)

Electricity production: 77.38 GWh (2005) Electricity – production by source:

- fossil fuel: 75.54%

- hydro: 2.55%

- nuclear: 20.37%

- other: 1.54% (1998)

Electricity – consumption: 59.72 GWh (2005)

Electricity – exports: 24.99 GWh (2005)

Electricity – imports: 12.35 GWh (2005)

Oil – production: 18,030 bbl/d (2,867 m3/d) (2005)

Oil – consumption: 213,000 bbl/d (33,900 m3/d) (2005 est.)

Oil – exports: 20,930 bbl/d (3,328 m3/d) (2004)

Oil – imports: 203,700 bbl/d (32,390 m3/d) (2004)

Oil – proved reserves: 15,000,000 bbl (2,400,000 m3) (1 January 2006)

Natural gas – production: 165 million m³ (2005 est.)

Natural gas – consumption: 9.076 billion m³ (2005 est.)

Natural gas – exports: 81.52 million m³ (2005 est.)

Natural gas – imports: 8.976 billion m³ (2005 est.)

Natural gas – proved reserves: 3.802 billion m³ (1 January 2006)

Natural resources: coal, timber, lignite, uranium, magnesite.

Agriculture – products: wheat, rye, oats, corn, barley, potatoes, sugar beets, hops, fruit; pigs, cattle, poultry, horses; forest products

IT and Telecommunications

Households with access to fixed and mobile telephone access[15]

- landline telephone – 25% (2009)

- according to the Czech Statistical Office:[16] 55,2% (2005); 31,1% (2008); 27,6% (2009); 24,2% (2010); 23,4% (2011); 21,8% (2012)

- mobile telephone – 94% (2009)

- according to the Czech Statistical Office:[16] 81,2% (2005); 92,4% (2008); 94,6% (2009); 95,6% (2010); 96,2% (2011); 97,0% (2012)

Individuals with mobile telephone access

- according to the Czech Statistical Office:[17] 75,8% (2005); 90,6% (2009); 93,9% (2011); 96,0% (2012); 96,0% (2013)

Broadband penetration rate[15]

- fixed broadband – 19.1% (2010)

- mobile broadband – 3.5% (2010)

Individuals using computer and internet[15]

- computer – 67% (2009)

- according to the Czech Statistical Office:[18] 42,0% (2005); 59,2% (2009); 64,1% (2010); 67,1% (2011); 69,5% (2012); 70,2% (2013)

- internet – 64% (2009)

- according to the Czech Statistical Office:[19] 32,1% (2005); 55,9% (2009); 61,8% (2010); 65,5% (2011); 69,5% (2012); 70,4% (2013)

See also

- Healthcare in the Czech Republic

- Škoda Works

- Czech National Bank

- Prague Stock Exchange

- Economy of Europe

Resources

- Statistická ročenka České republiky (Statistical Yearbook of the Czech Republic) by the Czech Statistical Office. The current line is published annually since 1957. Recent yearbooks can be read online (in Czech and English).

- Czechoslovakia published its first statistical yearbook in 1920. Historically used names: Statistická příručka Republiky československé, Statistická ročenka Protektorátu Čechy a Morava (during the occupation) and Statistická ročenka Československé socialistické republiky.

- Statistics about the Czech lands in Austria-Hungary were collected by Zemský statistický úřad Království českého (Provincial Statistical Office of the Czech Kingdom) founded in 1897. Two detailed books (in Czech and German) were published in 1909 and 1913.

References

- ↑ "Veřejný dluh České Republiky". Veřejný dluh České Republiky. Retrieved 3 March 2015.

- ↑ 2.0 2.1 "Nejnovější ekonomické údaje". Retrieved 3 March 2015.

- ↑ "Prùmìrné mzdy - ÈSÚ". Retrieved 3 March 2015.

- ↑ "Doing Business in Czech Republic 2015". World Bank. Retrieved 2015-03-20.

- ↑ "Export Partners of Czech Republic". CIA World Factbook. 2012. Retrieved 2013-07-24.

- ↑ "Import Partners of Czech Republic". CIA World Factbook. 2012. Retrieved 2013-07-24.

- ↑ "Sovereigns rating list". Standard & Poor's. Retrieved 15 January 2012.

- ↑ "Náš účet za komunismus". 18 October 2012. Retrieved 3 March 2015.

- ↑ "History of Czechoslovak currency". zlate-mince.cz (in Czech). Retrieved 17 July 2014.

- ↑ "Earth Times: show/278536,czech-economy-to-shrink-by-43-per-cent-in-2009.html". Retrieved 3 March 2015.

- ↑ "Miroslav Kalousek: Moná vás zklamu: krize nám nehrozí". Hospodáøské noviny. Retrieved 3 March 2015.

- ↑ "Sluby - vývoj treb ve slubách v ÈR, 2015". Retrieved 3 March 2015.

- ↑ 13.0 13.1 13.2 "CEE Basic Data - Key economic indicators and forecasts". Retrieved 3 March 2015.

- ↑ New Eurostat website - Eurostat

- ↑ 15.0 15.1 15.2 IT and telecommunications in Central and Eastern Europe

- ↑ 16.0 16.1 http://www.czso.cz/csu/2013edicniplan.nsf/t/0E002419AC/$File/0001132115.xls

- ↑ http://www.czso.cz/csu/2013edicniplan.nsf/t/0E0024189E/$File/0001132118.xls

- ↑ http://www.czso.cz/csu/2013edicniplan.nsf/t/0E0024193D/$File/0001132119.xls

- ↑ http://www.czso.cz/csu/2013edicniplan.nsf/t/0E002418A7/$File/0001132120.xls

External links

- OECD Economic Survey of the Czech Republic

- Czech economic indicators Latest indicators collected by Czech national bank

- OECD's Czech Republic country Web site

- Doing business in Czech Republic at the Wayback Machine (archived May 30, 2008)

- Current economic data

- Economy: Development and potential at the Wayback Machine (archived June 11, 2008)

- Economy of the Czech Republic – Annual Trends

- World Bank Summary Trade Statistics Czech Republic

| ||||||||||||||||||||||||||||||||||||||

| ||||||||

| ||||||||||

| ||||||||||||||||||