Economic growth

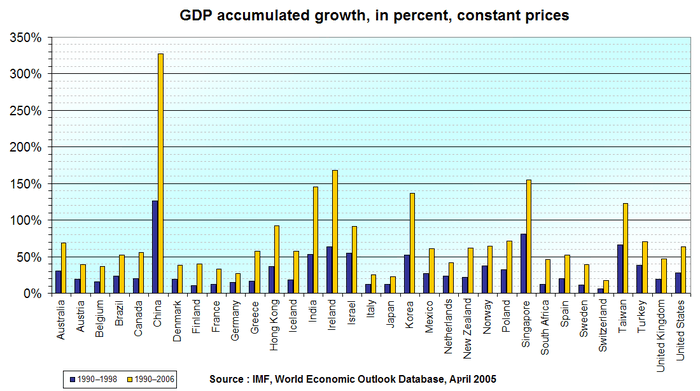

Economic growth is the increase in the market value of the goods and services produced by an economy over time. It is conventionally measured as the percent rate of increase in real gross domestic product, or real GDP.[1] Of more importance is the growth of the ratio of GDP to population (GDP per capita, which is also called per capita income). An increase in growth caused by more efficient use of inputs is referred to as intensive growth. GDP growth caused only by increases in inputs such as capital, population or territory is called extensive growth.[2]

In economics, "economic growth" or "economic growth theory" typically refers to growth of potential output, i.e., production at "full employment". As an area of study, economic growth is generally distinguished from development economics. The former is primarily the study of how countries can advance their economies. The latter is the study of the economic development process particularly in low-income countries.

Growth is usually calculated in real terms – i.e., inflation-adjusted terms – to eliminate the distorting effect of inflation on the price of goods produced. Measurement of economic growth uses national income accounting.[3] Since economic growth is measured as the annual percent change of gross domestic product (GDP), it has all the advantages and drawbacks of that measure.

Measuring economic growth

Economic growth is generally calculated from data on GDP and population provided by countries' statistical agencies, although independent scholarly estimates are also available.

Importance of long-run growth

Over long periods of time, even small rates of growth, such as a 2% annual increase, have large effects. For example, the United Kingdom experienced a 1.97% average annual increase in its inflation-adjusted GDP between 1830 and 2008.[4] In 1830, the GDP was 41,373 million pounds. It grew to 1,330,088 million pounds by 2008. A growth rate that averaged 1.97% over 178 years resulted in a 32-fold increase in GDP by 2008.

The large impact of a relatively small growth rate over a long period of time is due to the power of exponential growth. The rule of 72, a mathematical result, states that if something grows at the rate of x% per year, then its level will double every 72/x years. For example, a growth rate of 2.5% per annum leads to a doubling of the GDP within 28.8 years, whilst a growth rate of 8% per year leads to a doubling of GDP within 9 years. Thus, a small difference in economic growth rates between countries can result in very different standards of living for their populations if this small difference continues for many years.

Quality of life

Happiness has been shown to increase with a higher GDP per capita, at least up to a level of $15,000 per person.[5] Economic growth has the indirect potential to alleviate poverty, as a result of a simultaneous increase in employment opportunities and increased labour productivity.[6] A study by researchers at the Overseas Development Institute (ODI) of 24 countries that experienced growth found that in 18 cases, poverty was alleviated.[6] However, employment is no guarantee of escaping poverty; the International Labour Organization (ILO) estimates that as many as 40% of workers are poor, not earning enough to keep their families above the $2 a day poverty line.[6] For instance, in India most of the chronically poor are wage earners in formal employment, because their jobs are insecure and low paid and offer no chance to accumulate wealth to avoid risks; other countries found bigger benefits from focusing more on productivity improvement than on low-skilled work.[6]

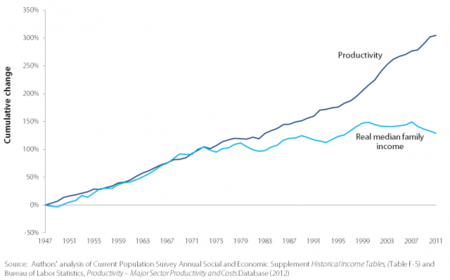

Increases in employment without increases in productivity lead to a rise in the number of working poor, which is why some experts are now promoting the creation of "quality" and not "quantity" in labour market policies.[6] This approach does highlight how higher productivity has helped reduce poverty in East Asia, but the negative impact is beginning to show.[6] In Vietnam, for example, employment growth has slowed while productivity growth has continued.[6] Furthermore, productivity increases do not always lead to increased wages, as can be seen in the United States, where the gap between productivity and wages has been rising since the 1980s.[6] The ODI study showed that other sectors were just as important in reducing unemployment, as manufacturing.[6] The services sector is most effective at translating productivity growth into employment growth. Agriculture provides a safety net for jobs and an economic buffer when other sectors are struggling.[6] This study suggests a more nuanced understanding of economic growth and quality of life and poverty alleviation.

Factors affecting economic growth

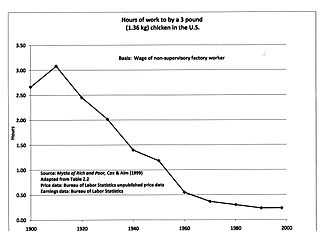

Productivity

Increases in productivity have historically been the most important source of real per capita economic growth.[7][8][9][10] Increases in productivity lower the real cost of goods. Over the 20th century the real price of many goods fell by over 90%.[11]

Historical sources of productivity growth

Economic growth has traditionally been attributed to the accumulation of human and physical capital, and increased productivity arising from technological innovation.[12]

Before industrialization, technological progress resulted in an increase in population, which was kept in check by food supply and other resources, which acted to limit per capita income, a condition known as the Malthusian trap.[13][14] The rapid economic growth that occurred during the Industrial Revolution was remarkable because it was in excess of population growth, providing an escape from the Malthusian trap.[15] Countries that industrialized eventually saw their population growth slow, a condition called demographic transition.

Increases in productivity are the major factor responsible for per capita economic growth – this has been especially evident since the mid-19th century. Most of the economic growth in the 20th century was due to reduced inputs of labor, materials, energy, and land per unit of economic output (less input per widget). The balance of growth has come from using more inputs overall because of the growth in output (more widgets or alternately more value added), including new kinds of goods and services (innovations).[16]

During the Industrial Revolution, mechanization began to replace hand methods in manufacturing, and new processes streamlined production of chemicals, iron, steel, and other products.[17] Machine tools made the economical production of metal parts possible, so that parts could be interchangeable.[18] See: Interchangeable parts.

During the Second Industrial Revolution, a major factor of productivity growth was the substitution of inanimate power for human and animal labor. Also there was a great increase power as steam powered electricity generation and internal combustion supplanted limited wind and water power.[17] Since that replacement, the great expansion of total power was driven by continuous improvements in energy conversion efficiency.[19] Other major historical sources of productivity were automation, transportation infrastructures (canals, railroads, and highways),[20][21] new materials (steel) and power, which includes steam and internal combustion engines and electricity. Other productivity improvements included mechanized agriculture and scientific agriculture including chemical fertilizers and livestock and poultry management, and the Green Revolution. Interchangeable parts made with machine tools powered by electric motors evolved into mass production, which is universally used today.[18]

Great sources of productivity improvement in the late 19th century were railroads, steam ships, horse-pulled reapers and combine harvesters, and steam-powered factories.[22][23] The invention of processes for making cheap steel were important for many forms of mechanization and transportation. By the late 19th century both prices and weekly work hours fell because less labor, materials, and energy were required to produce and transport goods. However, real wages rose, allowing workers to improve their diet, buy consumer goods and afford better housing.[22]

Mass production of the 1920s created overproduction, which was arguably one of several causes of the Great Depression of the 1930s.[24] Following the Great Depression, economic growth resumed, aided in part by demand for entirely new goods and services, such as telephones, radio, television, automobiles, and household appliances, air conditioning, and commercial aviation (after 1950), creating enough new demand to stabilize the work week.[25] The building of highway infrastructures also contributed to post World War II growth, as did capital investments in manufacturing and chemical industries.[26] The post World War II economy also benefited from the discovery of vast amounts of oil around the world, particularly in the Middle East. By John W. Kendrick’s estimate, three-quarters of increase in U.S. per capita GDP from 1889 to 1957 was due to increased productivity.[27]

Economic growth in in the United States slowed down after 1973.[28] In contrast growth in Asia has been strong since then, starting with Japan and spreading to Korea, China, the Indian subcontinent and other parts of Asia. In 1957 South Korea had a lower per capita GDP than Ghana,[29] and by 2008 it was 17 times as high as Ghana's.[30] The Japanese economic growth has slackened considerably since the late 1980s.

Productivity in the United States grew at an increasing rate throughout the 19th century and was most rapid in the early to middle decades of the 20th century.[31][32][33][34][35] US productivity growth spiked towards the end of the century in 1996–2004, due to an acceleration in the rate of technological innovation known as Moore's law.[36][37][38][39] After 2004 U.S. productivity growth returned to the low levels of 1972-96.[36]

New product and services

Another major cause of economic growth is the introduction of new products and services and the improvement of existing products. New products create demand, which is necessary to offset the decline in employment that occurs through labor saving technology.[40]

Growth phases and sector shares

Economic growth in the U.S. and other developed countries went through phases that affected growth through changes in the labor force participation rate and the relative sizes of economic sectors. The transition from an agricultural economy to manufacturing increased the size of the high output per hour, high productivity growth manufacturing sector while reducing the size of the lower output per hour, lower productivity growth agricultural sector. Eventually high productivity growth in manufacturing reduced the sector size as prices fell and employment shrank relative to other sectors.[41][42] The service and government sectors, where output per hour and productivity growth is very low, saw increases in share of the economy and employment.[7]

Business cycle

Economists distinguish between short-run economic changes in production and long-run economic growth. Short-run variation in economic growth is termed the business cycle. The business cycle is made up of booms and drops in production that occur over a period of months or years. Generally, economists attribute the ups and downs in the business cycle to fluctuations in aggregate demand. In contrast, economic growth is concerned with the long-run trend in production due to structural causes such as technological growth and factor accumulation. The business cycle moves up and down, creating fluctuations around the long-run trend in economic growth.

Income equality

According to International Monetary Fund economists, inequality in wealth and income is negatively correlated with subsequent economic growth.[43] A strong demand for redistribution will occur in societies where much of the population does not have access to productive resources. Rational voters have to internalize this dynamic problem of social choice.[45] 2013 Economics Nobel prize winner Robert J. Shiller said that rising inequality in the United States and elsewhere is the most important problem faced in the U.S. and elsewhere.[46] High levels of inequality prevent not just economic prosperity, but also the quality of a country's institutions and high levels of education.[47]

According to economists David Castells-Quintana and Vicente Royuela, increasing inequality harms economic growth.[48] High and persistent unemployment, in which inequality increases, has a negative effect on subsequent long-run economic growth.[48] Unemployment can harm growth not only because it is a waste of resources, but also because it generates redistributive pressures and subsequent distortions, drives people to poverty, constrains liquidity limiting labor mobility, and erodes self-esteem promoting social dislocation, unrest and conflict.[48] Policies aiming at controlling unemployment and in particular at reducing its inequality-associated effects support economic growth.[48]

Some theories popular from the 1950s to 2011 incorrectly stated that inequality had a positive effect on economic development.[43][44] Analyses based on comparing yearly equality figures to yearly growth rates were misleading because it takes several years for effects to manifest as changes to economic growth.[49] IMF economists found a strong association between lower levels of inequality in developing countries and sustained periods of economic growth. Developing countries with high inequality have "succeeded in initiating growth at high rates for a few years" but "longer growth spells are robustly associated with more equality in the income distribution."[44]

Economist Joseph Stiglitz presented evidence in 2009 that both global inequality and inequality within countries prevent growth by limiting aggregate demand.[50] Economist Branko Milanovic, wrote in 2001 that, "The view that income inequality harms growth – or that improved equality can help sustain growth – has become more widely held in recent years. ... The main reason for this shift is the increasing importance of human capital in development. When physical capital mattered most, savings and investments were key. Then it was important to have a large contingent of rich people who could save a greater proportion of their income than the poor and invest it in physical capital. But now that human capital is scarcer than machines, widespread education has become the secret to growth."[51]

A 1999 review in the Journal of Economic Literature states high inequality lowers growth, perhaps because it increases social and political instability.[52] A 1992 World Bank report published in the Journal of Development Economics said that inequality "is negatively, and robustly, correlated with growth. This result is not highly dependent upon assumptions about either the form of the growth regression or the measure of inequality."[53]

In 1993, Galor and Zeira showed that inequality in the presence of credit market imperfections has a long lasting detrimental effect on human capital formation and economic development.[54] A 1996 study by Perotti examines the channels through which inequality may affect economic growth. He shows that in accordance with the credit market imperfection approach, inequality is associated with lower level of human capital formation (education, experience, and apprenticeship) and higher level of fertility, while lower level of human capital is associated with lower growth and lower levels of economic growth. He demonstrated that inequality is associated with lower levels of taxation, while lower levels of taxation, contrary to the theories, are associated with lower level of economic growth[55]

Some theories developed in the 1970s established possible avenues through which inequality may have a positive effect on economic development.[43][44] According to a 1955 review, savings by the wealthy, if these increase with inequality, were thought to offset reduced consumer demand.[56] A 2013 report on Nigeria suggests that growth has risen with increased income inequality.[57]

Research by Harvard economist Robert Barro, found that there is "little overall relation between income inequality and rates of growth and investment". According to work by Barro in 1999 and 2000, high levels of inequality reduce growth in relatively poor countries but encourage growth in richer countries.[58][59] Princeton economist Roland Benabou's research shows that inequality does not matter per se to growth, but "inequality in the relative distribution of earnings and political power" does matter. A study of Swedish counties between 1960 and 2000 found a positive impact of inequality on growth with lead times of five years or less, but no correlation after ten years.[60] Studies of larger data sets have found no correlations for any fixed lead time,[49] and a negative impact on the duration of growth.[43]

Equitable growth

While acknowledging the central role economic growth can potentially play in human development, poverty reduction and the achievement of the Millennium Development Goals, it is becoming widely understood amongst the development community that special efforts must be made to ensure poorer sections of society are able to participate in economic growth.[61][62][63] The effect of economic growth on poverty reduction - the growth elasticity of poverty - can depend on the existing level of inequality.[64][65] For instance, with low inequality a country with a growth rate of 2% per head and 40% of its population living in poverty, can halve poverty in ten years, but a country with high inequality would take nearly 60 years to achieve the same reduction.[66][67] In the words of the Secretary General of the United Nations Ban Ki-Moon: "While economic growth is necessary, it is not sufficient for progress on reducing poverty."[61]

Demographic changes

Demographic factors may influence growth by changing the employment to population ratio and the labor force participation rate.[7] Industrialization creates a demographic transition in which birth rates decline and the average age of the population increases.

Women with fewer children and better access market employment tend to join the labor force in higher percentages. There is a reduced demand for child labor and children spend more years in school. The increase in the percentage of women in the labor force in the U.S. contributed to economic growth, as did the entrance of the baby boomers into the work force.[7] See: Spending wave

Negative effects

A number of arguments have been raised against economic growth.[68]

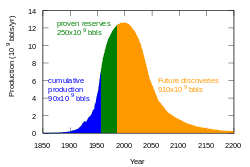

Resource depletion

Many earlier predictions of resource depletion, such as Thomas Malthus' 1798 predictions about approaching famines in Europe, The Population Bomb (1968),[69][70][71] and the Simon–Ehrlich wager (1980) [72] have not materialized. Diminished production of most resources has not occurred so far, one reason being that advancements in technology and science have allowed some previously unavailable resources to be produced.[72] In some cases, substitution of more abundant materials, such as plastics for cast metals, lowered growth of usage for some metals. In the case of the limited resource of land, famine was relieved firstly by the revolution in transportation caused by railroads and steam ships, and later by the Green Revolution and chemical fertilizers, especially the Haber process for ammonia synthesis.[73][74]

In the case of minerals, lower grades of mineral resources are being extracted, requiring higher inputs of capital and energy for both extraction and processing.[75] An example is natural gas from shale and other low permeability rock, which can be developed with much higher inputs of energy, capital, and materials than conventional gas in previous decades. Another example is offshore oil and gas, which has exponentially increasing cost as water depth increases.

Environmental impact

Critics such as the Club of Rome argue that a narrow view of economic growth, combined with globalization, is creating a scenario where we could see a systemic collapse of our planet's natural resources.[76][77]

Concerns about possible negative effects of growth on the environment and society led some to advocate lower levels of growth. This led to the ideas of uneconomic growth and de-growth – and Green parties that argue that economies are part of a global society and global ecology, and cannot outstrip their natural growth without damaging those.

Those more optimistic about the environmental impacts of growth believe that, though localized environmental effects may occur, large-scale ecological effects are minor. The argument, as stated by commentator Julian Lincoln Simon, states that if these global-scale ecological effects exist, human ingenuity will find ways to adapt to them.[78]

Implications of global warming

Up to the present there are close correlations of economic growth with carbon dioxide emissions across nations, although there is also a considerable divergence in carbon intensity (carbon emissions per GDP).[79] Globally, Tim Garrett observes that the emissions rate is directly related to the historical accumulation of economic wealth.[80] The Stern Review notes that the prediction that, "Under business as usual, global emissions will be sufficient to propel greenhouse gas concentrations to over 550ppm CO2 by 2050 and over 650–700ppm by the end of this century is robust to a wide range of changes in model assumptions." The scientific consensus is that planetary ecosystem functioning without incurring dangerous risks requires stabilization at 450–550 ppm.[81]

As a consequence, growth-oriented environmental economists propose massive government intervention into switching sources of energy production, favouring wind, solar, hydroelectric, and nuclear. This would largely confine use of fossil fuels to either domestic cooking needs (such as for kerosene burners) or where carbon capture and storage technology can be cost-effective and reliable.[82] The Stern Review, published by the United Kingdom Government in 2006, concluded that an investment of 1% of GDP (later changed to 2%) would be sufficient to avoid the worst effects of climate change, and that failure to do so could risk climate-related costs equal to 20% of GDP. Because carbon capture and storage is as yet widely unproven, and its long term effectiveness (such as in containing carbon dioxide 'leaks') unknown, and because of current costs of alternative fuels, these policy responses largely rest on faith of technological change.

On the other hand, British conservative politician and journalist Nigel Lawson claimed that people in a hundred years' time would be "seven times as well off as we are today", therefore it is not reasonable to impose sacrifices on the "much poorer present generation".[83]

Physical constraints on growth

Some physical scientists like Al Bartlett regard continuous economic growth as unsustainable.[84][85] Several factors may constrain economic growth - for example: finite, peaked, or depleted resources. Many basic industrial metals (copper, iron, bauxite, etc.), as well as rare-earth minerals, face output limitations.[86]

In 1972, the The Limits to Growth study modeled limitations to infinite growth; originally ridiculed,[69][70][71] these models have been validated and updated.[87][88][89]

Some Malthusians, such as William R. Catton, Jr., author of the 1980 book Overshoot, express skepticism of the idea that various technological advancements will make previously inaccessible or lower-grade resources more available. Such advances and increases in efficiency, they suggest, merely accelerate the drawing down of finite resources. Catton refers to the contemporary increases in rates of resource extraction as, "...stealing ravenously from the future".[90] The apparent and temporary "increase" of resource extraction with the use of new technology leads to the popular perception that resources are infinite or can be substituted without limit, but this perception fails to consider that ultimately, even lower-quality resources are finite and become uneconomic to extract when the ore quality is too low.

Lack of credit may constrain growth.[91]

Theories and models

Classical growth theory

In classical (Ricardian) economics, the theory of production and the theory of growth are based on the theory or law of variable proportions, whereby increasing either of the factors of production (labor or capital), while holding the other constant and assuming no technological change, will increase output, but at a diminishing rate that eventually will approach zero. These concepts have their origins in Thomas Malthus’s theorizing about agriculture. Malthus’s examples included the number of seeds harvested relative to the number of seeds planted (capital) on a plot of land and the size of the harvest from a plot of land versus the number of workers employed.[92] See: Diminishing returns

Criticisms of classical growth theory are that technology, the most important factor in economic growth, is held constant and that economies of scale are ignored.[93]

The neoclassical model

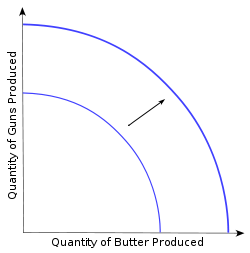

The notion of growth as increased stocks of capital goods was codified as the Solow-Swan Growth Model, which involved a series of equations that showed the relationship between labor-time, capital goods, output, and investment. According to this view, the role of technological change became crucial, even more important than capital accumulation. This model, developed by Robert Solow[94] and Trevor Swan[95] in the 1950s, was the first attempt to model long-run growth analytically. This model assumes that countries use their resources efficiently and that there are diminishing returns to capital and labor increases. From these two premises, the neoclassical model makes three important predictions. First, increasing capital relative to labor creates economic growth, since people can be more productive given more capital. Second, poor countries with less capital per person grow faster because each investment in capital produces a higher return than rich countries with ample capital. Third, because of diminishing returns to capital, economies eventually reach a point where any increase in capital no longer creates economic growth. This point is called a steady state.

The model also notes that countries can overcome this steady state and continue growing by inventing new technology. In the long run, output per capita depends on the rate of saving, but the rate of output growth should be equal for any saving rate. In this model, the process by which countries continue growing despite the diminishing returns is "exogenous" and represents the creation of new technology that allows production with fewer resources. Technology improves, the steady state level of capital increases, and the country invests and grows. The data do not support some of this model's predictions, in particular, that all countries grow at the same rate in the long run, or that poorer countries should grow faster until they reach their steady state. Also, the data suggest the world has slowly increased its rate of growth.

Criticisms of the neo-classical growth model are that it does not account for differing rates of return for different capital investments and that the economic life of capital assets has been declining.[7]

Endogenous growth theory

Growth theory advanced again with theories of economist Paul Romer and Robert Lucas, Jr. in the late 1980s and early 1990s.

Unsatisfied with Solow's explanation, economists worked to "endogenize" technology in the 1980s. They developed the endogenous growth theory that includes a mathematical explanation of technological advancement.[96][97] This model also incorporated a new concept of human capital, the skills and knowledge that make workers productive. Unlike physical capital, human capital has increasing rates of return. Therefore, overall there are constant returns to capital, and economies never reach a steady state. Growth does not slow as capital accumulates, but the rate of growth depends on the types of capital a country invests in. Research done in this area has focused on what increases human capital (e.g. education) or technological change (e.g. innovation).[98]

Unified growth theory

Unified growth theory was developed by Oded Galor and his co-authors to address the inability of endogenous growth theory to explain key empirical regularities in the growth processes of individual economies and the world economy as a whole. Endogenous growth theory was satisfied with accounting for empirical regularities in the growth process of developed economies over the last hundred years. As a consequence, it was not able to explain the qualitatively different empirical regularities that characterized the growth process over longer time horizons in both developed and less developed economies. Unified growth theories are endogenous growth theories that are consistent with the entire process of development, and in particular the transition from the epoch of Malthusian stagnation that had characterized most of the process of development to the contemporary era of sustained economic growth.[99]

The big push

One popular theory in the 1940s was the Big Push, which suggested that countries needed to jump from one stage of development to another through a virtuous cycle, in which large investments in infrastructure and education coupled with private investments would move the economy to a more productive stage, breaking free from economic paradigms appropriate to a lower productivity stage.[100]

Schumpeterian growth

Schumpeterian growth is an economic theory named after the 20th-century Austrian economist Joseph Schumpeter. The approach explains growth as a consequence of innovation and a process of creative destruction that captures the dual nature of technological progress: in terms of creation, entrepreneurs introduce new products or processes in the hope that they will enjoy temporary monopoly-like profits as they capture markets. In doing so, they make old technologies or products obsolete. This can be seen as an annulment of previous technologies, which makes them obsolete, and "...destroys the rents generated by previous innovations." (Aghion 855)[101] A major model that illustrates Schumpeterian growth is the Aghion-Howitt model.[102]

Institutions and growth

According to Acemoğlu, Simon Johnson and James Robinson, the positive correlation between high income and cold climate is a by-product of history. Europeans adopted very different colonization policies in different colonies, with different associated institutions. In places where these colonizers faced high mortality rates (e.g., due to the presence of tropical diseases), they could not settle permanently, and they were thus more likely to establish extractive institutions, which persisted after independence; in places where they could settle permanently (e.g. those with temperate climates), they established institutions with this objective in mind and modeled them after those in their European homelands. In these 'neo-Europes' better institutions in turn produced better development outcomes. Thus, although other economists focus on the identity or type of legal system of the colonizers to explain institutions, these authors look at the environmental conditions in the colonies to explain institutions. For instance, former colonies have inherited corrupt governments and geo-political boundaries (set by the colonizers) that are not properly placed regarding the geographical locations of different ethnic groups, creating internal disputes and conflicts that hinder development. In another example, societies that emerged in colonies without solid native populations established better property rights and incentives for long-term investment than those where native populations were large.[103]

Human capital and growth

One ubiquitous element of both theoretical and empirical analyses of economic growth is the role of human capital. The skills of the population enter into both neoclassical and endogenous growth models.[104] The most commonly used measure of human capital is the level of school attainment in a country, building upon the data development of Robert Barro and Jong-Wha Lee.[105] This measure of human capital, however, requires the strong assumption that what is learned in a year of schooling is the same across all countries. It also presumes that human capital is only developed in formal schooling, contrary to the extensive evidence that families, neighborhoods, peers, and health also contribute to the development of human capital. To measure human capital more accurately, Eric Hanushek and Dennis Kimko introduced measures of mathematics and science skills from international assessments into growth analysis.[106] They found that quality of human capital was very significantly related to economic growth. This approach has been extended by a variety of authors, and the evidence indicates that economic growth is very closely related to the cognitive skills of the population.[107]

Energy consumption and efficiency theories

Energy economic theories emphasize the role of energy consumption and energy efficiency as important historical causes of economic growth. Increases in energy efficiency were a portion of the increase in Total factor productivity.[108] Some of the most technologically important innovations in history involved increases in energy efficiency. These include the great improvements in efficiency of conversion of heat to work, the reuse of heat, the reduction in friction and the transmission of power, especially through electrification.[109][110]

See also

- Degrowth

- Export-oriented industrialization

- Growth accounting

- List of countries by real GDP growth rate

References

- ↑ Statistics on the Growth of the Global Gross Domestic Product (GDP) from 2003 to 2013, IMF, October 2012.

- ↑ Bjork, Gordon J. (1999). The Way It Worked and Why It Won’t: Structural Change and the Slowdown of U.S. Economic Growth. Westport, CT; London: Praeger. pp. 2, 67. ISBN 0-275-96532-5.

- ↑ Bjork 1999, pp. 251

- ↑ Lawrence H. Officer, "What Was the U.K. GDP Then?" MeasuringWorth, 2011. URL:http://www.measuringworth.com/ukgdp/

- ↑ In Pursuit of Happiness Research. Is It Reliable? What Does It Imply for Policy? The Cato institute. April 11, 2007

- ↑ 6.0 6.1 6.2 6.3 6.4 6.5 6.6 6.7 6.8 6.9 Claire Melamed, Renate Hartwig and Ursula Grant 2011. Jobs, growth and poverty: what do we know, what don't we know, what should we know? London: Overseas Development Institute

- ↑ 7.0 7.1 7.2 7.3 7.4 Bjork 1999

- ↑ Roubini, Nouriel; Backus, David. "Lectures in Macroeconomics"<Chapter 4. Productivity and Growth>

- ↑ Wang, Ping (2014). "Growth Accounting" (PDF). p. 2.

- ↑ Corry, Dan; Valero, Anna; Van Reenen, John (Nov 2011). "UK Economic Performance Since 1997" (PDF)<” The UK‟s high GDP per capita growth was driven by strong growth in productivity (GDP per hour), which was second only to the US .”>

- ↑ Rosenberg, Nathan (1982). Inside the Black Box: Technology and Economics. Cambridge, New York: Cambridge University Press. p. 258. ISBN 0-521-27367-6<Attributed to Simon Kuznets>

- ↑ Lucas, R. E. 1988. "On the mechanics of economic development," Journal of monetary economics, 22(1), 3–42.

- ↑ Galor, Oded (2005). "From Stagnation to Growth: Unified Growth Theory". Handbook of Economic Growth 1. Elsevier. pp. 171–293.

- ↑ Clark, Gregory (2007). A Farewell to Alms: A Brief Economic History of the World. Princeton University Press. ISBN 978-0-691-12135-2Part I: The Malthusian Trap

- ↑ Clark 2007, pp. Part 2: The Industrial Revolution

- ↑ Kendrick, J. W. 1961 "Productivity trends in the United States," Princeton University Press

- ↑ 17.0 17.1 Landes, David. S. (1969). The Unbound Prometheus: Technological Change and Industrial Development in Western Europe from 1750 to the Present. Cambridge, New York: Press Syndicate of the University of Cambridge. ISBN 0-521-09418-6.

- ↑ 18.0 18.1 Hounshell, David A. (1984), From the American System to Mass Production, 1800-1932: The Development of Manufacturing Technology in the United States, Baltimore, Maryland: Johns Hopkins University Press, ISBN 978-0-8018-2975-8, LCCN 83016269

- ↑ Ayres, Robert U.; Warr, Benjamin (2004). "Accounting for Growth: The Role of Physical Work" (PDF).

- ↑ Grubler, Arnulf (1990). The Rise and Fall of Infrastructures (PDF).

- ↑ Taylor, George Rogers. The Transportation Revolution, 1815–1860. ISBN 978-0873321013.

- ↑ 22.0 22.1 Wells, David A. (1890). Recent Economic Changes and Their Effect on Production and Distribution of Wealth and Well-Being of Society. New York: D. Appleton and Co. ISBN 0543724743.

- ↑ Atack, Jeremy; Passell, Peter (1994). A New Economic View of American History. New York: W.W. Norton and Co. ISBN 0-393-96315-2.

- ↑ Beaudreau, Bernard C. (1996). Mass Production, the Stock Market Crash and the Great Depression. New York, Lincoln, Shanghi: Authors Choice Press.

- ↑ Moore, Stephen; Simon, Julian (December 15, 1999). "The Greatest Century That Ever Was: 25 Miraculous Trends of the last 100 Years, The Cato Institute: Policy Analysis, No. 364" (PDF).Diffusion curves for various innovations start at Fig. 14

- ↑ Field, Alexander J. (2011). A Great Leap Forward: 1930s Depression and U.S. Economic Growth. New Haven, London: Yale University Press. ISBN 978-0-300-15109-1.

- ↑ Kendrick, John W. (1961). Productivity Trends in the United States. Princeton University Press for NBER. p. 3.

- ↑ St. Louis Federal Reserve Real GDP per capita in the U.S. rose from $17,747 in 1960 to $26,281 in 1973 for a growth rate of 3.07%/yr. Calculation: (26,281/17,747)^(1/13). From 1973 to 2007 the growth rate was 1.089%. Calculation: (49,571/26,281)^(1/34) From 2000 to 2011 average annual growth was 0.64%.

- ↑ Leading article: Africa has to spend carefully. The Independent. July 13, 2006.

- ↑ Data refer to the year 2008. $26,341 GDP for Korea, $1513 for Ghana. World Economic Outlook Database – October 2008. International Monetary Fund.

- ↑ Kendrick, John (1991). "U.S. Productivity Performance in Perspective, Business Economics, October 1, 1991". doi:10.2307/23485828.

- ↑ Field, Alezander J. (2007). "U.S. Economic Growth in the Gilded Age, Journal of Macroeconomics 31" (PDF). pp. 173–190.

- ↑ Field, Alexander (2004). "Technological Change and Economic Growth the Interwar Years and the 1990s".

- ↑ Gordon, Robert J. (2000). "Interpreting the "One Big Wave" in U.S. Long Term Productivity Growth, National Bureau of Economic Research Working paper 7752".

- ↑ Abramovitz, Moses; David, Paul A. (2000). Two Centuries of American Macroeconomic Growth From Exploitation of Resource Abundance to Knowledge-Driven Development (PDF). Stanford University. pp. 24–5 (pdf p=28–9).

- ↑ 36.0 36.1 Gordon, Robert J. (Spring 2013). "U.S. Productivity Growth: The Slowdown Has Returned After a Temporary Revival" (PDF). International Productivity Monitor, Centre for the Study of Living Standards 25: 13–19. Retrieved 2014-07-19.

The U.S. economy achieved a growth rate of labour productivity of 2.48 per cent per year for 81 years, followed by 24 years of 1.32 per cent, then a temporary recovery back to 2.48 per cent per cent, and a final slowdown to 1.35 per cent. The similarity of the growth rates in 1891-1972 with 1996-2004, and of 1972-96 with 1996-2011 is quite remarkable.

- ↑ Dale W. Jorgenson, Mun S. Ho and Jon D. Samuels (2014). "Long-term Estimates of U.S. Productivity and Growth" (PDF). World KLEMS Conference. Retrieved 2014-05-27.

- ↑ Dale W. Jorgenson, Mun S. Ho, and Kevin J. Stiroh (2008). "A Retrospective Look at the U.S. Productivity Growth Resurgence". Journal of Economic Perspectives. Retrieved 2014-05-15.

- ↑ Bruce T. Grimm, Brent R. Moulton, and David B. Wasshausen (2002). "Information Processing Equipment and Software in the National Accounts" (PDF). U.S. Department of Commerce Bureau of Economic Analysis. Retrieved 2014-05-15.

- ↑ Ayres, Robert (1989). "Technological Transformations and Long Waves" (PDF). p. 9<Attributed to Mensch who described new products as "demand creating".>

- ↑ "Manufacturing’s Declining Share of GDP is a Global Phenomenon, and It’s Something to Celebrate". U.S. Chamber of Commerce Foundation.

- ↑ "All Employees: Manufacturing".

- ↑ 43.0 43.1 43.2 43.3 43.4 Berg, Andrew G.; Ostry, Jonathan D. (2011). "Equality and Efficiency". Finance and Development (International Monetary Fund) 48 (3). Retrieved July 13, 2014.

- ↑ 44.0 44.1 44.2 44.3 Andrew Berg and Jonathan Ostry. (2011) "Inequality and Unsustainable Growth: Two Sides of the Same Coin" IMF Staff Discussion Note No. SDN/11/08 (International Monetary Fund)

- ↑ Alesina, Alberto; Rodrick, Dani (May 1994). "Distributive Politics and Economic Growth" (PDF). Quarterly Journal of Economics 109 (2): 465–90. doi:10.2307/2118470. Retrieved 17 October 2013.

- ↑ Christoffersen, John (October 14, 2013). "Rising inequality 'most important problem,' says Nobel-winning economist". St. Louis Post-Dispatch. Retrieved 19 October 2013.

- ↑ Easterly, W (2007). "Inequality does cause underdevelopment: Insights from a new instrument" (PDF). Journal of Development Economics 84 (2): 755–776. doi:10.1016/j.jdeveco.2006.11.002.

- ↑ 48.0 48.1 48.2 48.3 Castells-Quintana, David; Royuela, Vicente (2012). "Unemployment and long-run economic growth: The role of income inequality and urbanisation" (PDF). Investigaciones Regionales 12 (24): 153–173. Retrieved 17 October 2013.

- ↑ 49.0 49.1 Banerjee, Abhijit V.; Duflo, Esther (2003). "Inequality And Growth: What Can The Data Say?". Journal of Economic Growth 8 (3): 267–99. doi:10.1023/A:1026205114860. Retrieved September 25, 2012.

- ↑ Stiglitz, J (2009). "The global crisis, social protection and jobs" (PDF). International Labour Review 148 (1–2).

- ↑ More or Less| Branko Milanovic| Finance & Development| September 2011| Vol. 48, No. 3

- ↑ Temple, J (1999). "The New Growth Evidence" (PDF). Journal of Economic Literature 37 (1): 112–156. doi:10.1257/jel.37.1.112.

- ↑ Clarke, G (1995). "More evidence on income distribution and growth" (PDF). Journal of Development Economics 47: 403–427. doi:10.1016/0304-3878(94)00069-o.

- ↑ Galor, Oded and Joseph Zeira, 1993, "Income Distribution and Macroeconomics," Review of Economic Studies, 60(1), 35–52.

- ↑ Perotti, R (1996). "Growth, income distribution and democracy: what do the data say?" (PDF). Journal of Economic Growth 1 (2): 149–187. doi:10.1007/bf00138861.

- ↑ Kaldor, Nicoals, 1955, Alternative Theories of Distribution," Review of Economic Studies, 23(2), 83–100.

- ↑ Muhammad Dandume Yusuf (2 February 2013). "Corruption, Inequality of Income and economic Growth in Nigeria".

- ↑ Barro (1999)

- ↑ "Inequality and Growth in a Panel of Countries".

- ↑ Ruth-Aida Nahum (2 February 2005). "Income Inequality and Growth: a Panel Study of Swedish Counties 1960-2000".

- ↑ 61.0 61.1 Claire Melamed, Kate Higgins and Andy Sumner (2010) Economic growth and the MDGs Overseas Development Institute

- ↑ Anand, Rahul et al. (17 August 2013). "Inclusive growth revisited: Measurement and evolution". VoxEU.org (Centre for Economic Policy Research). Retrieved 13 January 2015.

- ↑ Anand, Rahul et al. (May 2013). "Inclusive Growth: Measurement and Determinants" (PDF). IMF Working Paper (WP/13/135). Asia Pacific Department: International Monetary Fund. Retrieved 13 January 2015.

- ↑ Ranieri, Rafael; Ramos, Raquel Almeida (March 2013). "Inclusive Growth: Building up a Concept" (PDF). Working Paper 104. Brazil: International Policy Centre for Inclusive Growth. ISSN 1812-108X. Retrieved 13 January 2015.

- ↑ Bourguignon, Francois, "Growth Elasticity of Poverty Reduction: Explaining Heterogeneity across Countries and Time Periods" in Inequality and Growth, Ch. 1.

- ↑ Ravallion, M. (2007) Inequality is bad for the poor in S. Jenkins and J. Micklewright, (eds.) Inequality and Poverty Re-examined, Oxford University Press, Oxford.

- ↑ Elena Ianchovichina and Susanna Lundstrom, 2009. "Inclusive growth analytics: Framework and application", Policy Research Working Paper Series 4851, The World Bank.

- ↑ Case, K.E., and Fair, R.C. 2006. Principles of Macroeconomics. Prentice Hall. ISBN 0-13-222645-6, ISBN 978-0-13-222645-5.

- ↑ 69.0 69.1 "Chapter 17: Growth and Productivity-The Long-Run Possibilities". Oswego.edu. 1999-06-10. Retrieved 2010-12-22.

- ↑ 70.0 70.1 Bailey, Ronald (2004-02-04). "Science and Public Policy - Reason Magazine". Reason.com. Retrieved 2010-12-22.

- ↑ 71.0 71.1 Hayward, Steven F. "That Old Time Religion". AEI. Retrieved 2010-12-22.

- ↑ 72.0 72.1 Regis, Ed. "The Doomslayer". Wired.

- ↑ Wells, David A. (1891). Recent Economic Changes and Their Effect on Production and Distribution of Wealth and Well-Being of Society. New York: D. Appleton and Co. ISBN 0-543-72474-3.Opening line of the Preface.

- ↑ Smil, Vaclav (2004). Enriching the Earth: Fritz Haber, Carl Bosch, and the Transformation of World Food Production. MIT Press. ISBN 0-262-69313-5.

- ↑ Hall, Charles A.S.; Cleveland, Cutler J.; Kaufmann, Robert (1992). Energy and Resource Quality: The ecology of the Economic Process. Niwot, Colorado: University Press of Colorado.

- ↑ Donella H. Meadows, Jorgen Randers, Dennis L. Meadows. Limits to Growth: The 30-Year Update. White River Junction, Vermont : Chelsea Green, 2004.

- ↑ Allan Schnaiberg. The Environment: From Surpus to Scarcity. New York: Oxford University Press.

- ↑ The Ultimate Resource, Julian Simon, 1981

- ↑ Stern Review, Part III Stabilization. Table 7.1 p. 168

- ↑ Garrett, T. J. (2009). "Are there basic physical constraints on future anthropogenic emissions of carbon dioxide?". Climatic Change 104 (3–4): 437. doi:10.1007/s10584-009-9717-9.

- ↑ Stern Review Economics of Climate Change. Part III Stabilization p.183

- ↑ Jaccard, M. 2005 Sustainable Fossil Fuels. Cambridge University Press.

- ↑ "Examination of Witnesses (Questions 32–39)". 16 May 2007. Retrieved 2007-11-29.

- ↑ Bartlett, Albert Allen (2013). "Arithmetic, Population and Energy - a talk by Al Bartlett". albartlett.org. Retrieved 2014-07-22.

You cannot sustain population growth and / or growth in the rates of consumption of resources.

- ↑ Murphy, Tom (2011-07-12). "Galactic-Scale Energy". Do the Math. Retrieved 2014-07-22.

continued growth in energy use becomes physically impossible within conceivable timeframes ... all economic growth must similarly end.

- ↑ Klare, M. T. (2012). The Race for What’s Left. Metropolitan Books. ISBN 9781250023971.

- ↑ Turner, Graham. A Comparison of the Limits of Growth with Thirty Years of Reality. CSIRO Working Paper Series, (2010). Available at: http://www.csiro.au/files/files/plje.pdf

- ↑ Hall, C. & Day, J. "Revisiting the Limits to Growth After Peak Oil" American Scientist 2009; 97: 230-238.

- ↑ Meadows, D H; Randers (2004). Limits to Growth: The 30-Year Update. Chelsea Green Publishing. ISBN 978-1-931498-58-6.

- ↑ "Overshoot" by William Catton, p. 3 [1980]

- ↑ Makerere University. Economic Policy Research Centre (1996). "Credit accessibility to the rural poor in Uganda". Economic policy research bulletin (Economic Policy Research Centre, Makerere University Campus) 2 (1): 1. Retrieved 2014-07-20.

The design of traditional credit markets reflects the concern to policy makers that a shortage of affordable credit constrains growth [...]

- ↑ Bjork 1999, pp. 297,8

- ↑ Bjork 1999, pp. 298

- ↑ Robert M. Solow (1956), "A Contribution to the Theory of Economic Growth," Quarterly Journal of Economics, 70(1), p p. 65-94.

- ↑ Swan, Trevor W. (1956). "Economic Growth and Capital Accumulation'". Economic Record 32: 334–61. doi:10.1111/j.1475-4932.1956.tb00434.x.

- ↑ D. Romer, 1986

- ↑ Lucas, 1988

- ↑ Elhanah Helpman, The Mystery of Economic Growth, Harvard University Press, 2004.

- ↑ Galor O., 2005, From Stagnation to Growth: Unified Growth Theory. Handbook of Economic Growth, Elsevier

- ↑ Paul Rosenstein-Rodan

- ↑ Quote from Philippe Aghion, 2002, Schumpeterian Growth Theory and the Dynamics of Income Inequality, Econometrica, 70(3), 855–882.

• Also see Wendy Carlin and David Soskice, 2006, Macroeconomics: Imperfections, Institutions & Policies, specifically chapter 14. - ↑ • Philippe Aghion and Peter Howitt, 1992, A Model of Growth Through Creative Destruction, Econometrica, 60(2), 323–351.

• Philippe Aghion, 2002, Schumpeterian Growth Theory and the Dynamics of Income Inequality, Econometrica, 70(3), 855–882. - ↑ Daron Acemoğlu, Simon Johnson and James A. Robinson.The Colonial Origins of Comparative Development: An Empirical Investigation. American Economic Review 91(5): 1369–401. 2001.

- ↑ • Mankiw, N. Gregory, David Romer, and David Weil. 1992. "A contribution to the empirics of economic growth." Quarterly Journal of Economics 107, no. 2 (May): 407–437

• Sala-i-Martin, Xavier, Gernot Doppelhofer, and Ronald I. Miller. 2004. "Determinants of long-term growth: A Bayesian Averaging of Classical Estimates (BACE) approach." American Economic Review 94, no. 4 (September): 813–835.

• LudRomer, Paul. 1990. "Human capital and growth: Theory and evidence." Carnegie-Rochester Conference Series on Public Policy 32: 251–286. - ↑ Barro, Robert J., and Jong-Wha Lee. 2001. "International data on educational attainment: Updates and implications." Oxford Economic Papers 53, no. 3 (July): 541–563.

- ↑ Hanushek, Eric A., and Dennis D. Kimko. 2000. "Schooling, labor force quality, and the growth of nations." American Economic Review 90, no. 5 (December): 1184–1208

- ↑ • Hanushek, Eric A., and Ludger Woessmann. 2008. "The role of cognitive skills in economic development." Journal of Economic Literature 46, no. 3 (September): 607–668 .

• Hanushek, Eric A., and Ludger Woessmann. 2011. "How much do educational outcomes matter in OECD countries?" Economic Policy, 26, no. 67: 427–491. - ↑ Kendrick, John W. (1961). Productivity Trends in the United States (PDF). Princeton University Press for NBER. pp. 96–99.

- ↑ Landes, David. S. (1969). The Unbound Prometheus: Technological Change and Industrial Development in Western Europe from 1750 to the Present. Cambridge, New York: Press Syndicate of the University of Cambridge. pp. 289, 293. ISBN 0-521-09418-6.

- ↑ Devine, Jr., Warren D. (1983). "From Shafts to Wires: Historical Perspective on Electrification, Journal of Economic History, Vol. 43, Issue 2" (PDF). p. 355.

Further reading

- Argyrous, G., Forstater, M and Mongiovi, G. (eds.) (2004) Growth, Distribution, And Effective Demand: Essays in Honor of Edward J. Nell. New York: M.E. Sharpe.

- Barro, Robert J. (1997) Determinants of Economic Growth: A Cross-Country Empirical Study. MIT Press: Cambridge, MA.

- Galor, O. (2005) From Stagnation to Growth: Unified Growth Theory. Handbook of Economic Growth, Elsevier.

- Grier, Kevin (2008). Empirics of Economic Growth. The Concise Encyclopedia of Economics (2nd ed.). Library of Economics and Liberty. ISBN 978-0865976658. OCLC 237794267.

- Halevi, Joseph; Laibman, David and Nell, Edward J. (eds.) (1992) Beyond the Steady State: Essays in the Revival of Growth Theory, edited with, London, UK:

- Hueting, Roefi (2011) The future of the Environmentally sustainable national income. Ökologisches Wirtschaften, 4/2011, 30-35

- Jones, Charles I. (2002) Introduction to Economic Growth 2nd ed. W. W. Norton & Company: New York, N.Y.

- Kirzner, Israel. (1973) Competition and Entrepreneurship

- Lucas, Robert E., Jr. (2003) The Industrial Revolution: Past and Future, Federal Reserve Bank of Minneapolis, Annual Report online edition

- Mises, Ludwig E. (1949) Human Action 1998 reprint by the Mises Institute

- Paepke, C. Owen. The Evolution of Progress: The End of Economic Growth and the Beginning of Human Transformation. New York, Toronto: Random House. ISBN 0-679-41582-3.

- Puthenkalam, John Joseph, "Integrating Freedom, Democracy and Human Rights into Theories of Economic Growth", Manila, 1998.

- Romer, Paul M. (2008). Economic Growth. The Concise Encyclopedia of Economics (2nd ed.). Library of Economics and Liberty. ISBN 978-0865976658. OCLC 237794267.

- Schumpeter, Jospeph A. (1912) The Theory of Economic Development 1982 reprint, Transaction Publishers

- Vladimir N. Pokrovskii (2011) Econodynamics. The Theory of Social Production, Springer, Berlin.

- Weil, David N. (2008) Economic Growth 2nd ed. Addison Wesley.

External links

Articles and lectures

- "Economic growth." Encyclopædia Britannic. 2007. Encyclopædia Britannica Online. 17 November 2007.

- Beyond Classical and Keynesian Macroeconomic Policy. Paul Romer's plain-English explanation of endogenous growth theory.

- Does Economic Growth increase Living Standards?

- CEPR Economics Seminar Series Two seminars on the importance of growth with economists Dean Baker and Mark Weisbrot

- On global economic history by Jan Luiten van Zanden. Explores the idea of the inevitability of the Industrial Revolution.

- The Economist Has No Clothes – essay by Robert Nadeau in Scientific American on the basic assumptions behind current economic theory

- World Growth Institute. An organization dedicated to helping the developing world realize its full potential via economic growth.

- Economics for Everyone- Evaluating Economic Growth

- Understanding the world today Multiple reports on economic growth

- Research and Degrowth network Academic association dedicated to research, awareness raising, and events organization around the topic of degrowth.

Data

- Angus Maddison's Historical Dataseries – Series for almost all countries on GDP, Population and GDP per capita from the year 0 up to 2003

- OECD Economic growth statistics

- multinational data sets easy to use data set showing gdp, per capita and population, by country and region, 1970 to 2008. Updated regularly.