Dynamic currency conversion

Dynamic currency conversion (DCC) or cardholder preferred currency (CPC) is a financial service in which credit card holders, when making a payment in a foreign country, have the cost of a transaction converted to their home currency at the point of sale. Though it allows customers to see the exact amount their card will be charged, expressed in their home currency, the exchange rate is generally less favorable than that offered through their credit card company.[1] The DCC exchange rate would incorporate the foreign exchange rate charged by the credit card company, in addition to a fee paid to the merchant and that retained by the DCC operator. However, the credit card company may charge an additional fee for charges made outside the card holder's home country, though the charge appears to have been made in the home currency under DCC.

The currency conversion is done by the merchant or his representative card processor at the point of sale instead of by the credit card company when the account is charged. The financial benefit to the merchant or their provider may be an incentive for the merchant to use DCC even when it would be disadvantageous to the customer. The merchant is now obliged to ask the customer if they want to use DCC but sometimes false information is given by the merchant to persuade clients to use DCC, such as that "DCC bypasses foreign transaction fees" or that "their machines automatically convert purchases to the home currency at the point of sale", which are both not true. Most credit card companies and advisers recommend that consumers not use DCC when it is offered to them. Credit card companies claim that they are required by law to permit DCC operators access to their platforms.

Anecdotal evidence suggests many customers do not understand DCC, are not properly informed of the terms, and are not able to make an informed decision whether to elect to pay in the local currency or in their home currency. Proponents of this service suggest that the benefits to travelers is that it allows them to view and therefore understand prices in foreign countries in their home currency and for business travelers making it easier to enter expenses.

How DCC works

When a customer wants to pay for a transaction using a credit card, the payment terminal will detect whether the card is payable in another country. If so, the terminal will display to the salesperson a notification that the card is a foreign card and the salesperson will offer the cardholder the option of paying in their own currency.

If the cardholder accepts the option, the transaction will be directed through the DCC operator which will determine the exchange rate to the cardholder's currency using their own or a third party source, such as Reuters, to which is added the merchant's margin and the DCC operator's margin. The source of the exchange rate and the margins are not normally disclosed. The benefit to the merchant may be merely the avoidance of the credit card company fees. The credit card company would charge a fee to the DCC operator in place of the fee it would obtain from the merchant.

The terminal will display the exchange rate that will be used and the amount in the cardholder's currency. The cardholder may then confirm the transaction by pressing OK on the terminal keypad in the normal manner, and the cardholder would normally need to sign the receipt. Alternatively, if the cardholder rejects the transaction, for example because of the exchange rate offered, they can press Cancel to abort the transaction. The salesperson would need to re-enter the transaction for it to be processed without the DCC option.

The DCC operator guarantees that the amount in the cardholder's currency will be debited to the cardholder's account, and that the merchant's account will be credited with the amount in the local currency. The exchange rate risk, though small, is borne by the DCC operator. The DCC transaction may be a part of the DCC operator's wider foreign exchange operation, or it may simultaneously buy one currency from and onsell the other currency to a specialised foreign exchange dealer. (The DCC operator may be based in a third country and use a third base currency.) The cardholder's credit card company may impose an additional foreign transaction fee on the transaction, which appears on the statement.

DCC operates similarly with Internet transactions. When credit card information is entered to finalise payment, the system can detect the home country of the cardholder and offer the cardholder the option of paying in their currency. DCC is presently available for cash withdrawals at ATMs.

History

Dynamic currency conversion was created in 1996 and commercialised by a number of companies including Monex Financial Services[2] and FEXCO[3]

Prior to the card schemes (Visa and MasterCard) imposing rules relating to DCC, cardholder transactions were converted without the need to disclose that the transaction was being converted into a customer's home currency, in a process known as "back office DCC". Visa and MasterCard now prohibit this practice and require the customer's consent for DCC, although many travelers have reported that this is not universally followed.[4][5]

Even with Visa and MasterCard's rules, it can be argued that the customer is not given enough information to make a truly informed choice.

Impact

DCC has proved popular with merchants. DCC enables merchants to profit from the foreign exchange conversion that occurs during the payment process for a foreign denominated Visa or MasterCard.

Credit card acquirers and payment gateways will also take a profit on the foreign exchange conversion that occurs during the payment process for foreign denominated Visa and Master cards when DCC is used. DCC revenue has been important for them because it offsets increasing international interchange fees.

Advantages

The main advantage of DCC is that for a non-DCC transaction the customer does not know exactly the exchange rate that the credit card company will apply (and the final cost) until the transaction is cleared, so the actual rate is not known to the customer until it appears on a monthly statement.

Other advantages to customers, according to proponents, are:

- the ability to view and therefore understand prices in foreign countries in their home currency

- the ability to enter expenses more easily and promptly, especially for business travellers

- EU regulation 2560/2001 could make non-eurozone cash withdrawals within the European Economic Area cheaper for eurozone customers, because euro cash withdrawals are regulated. A Swedish law (SFS 2002:598) combined with the EU resolution does the same thing for Swedish cards if the transaction is in SEK or EUR. Generally, Eurozone banks charge a fixed fee for foreign cash withdrawals while domestic withdrawals are free of charge. Because of the EU regulation, this makes EEA withdrawals in euros free of charge. For example, let's say that a eurozone card is used for a withdrawal in the UK. With DCC there are two options: processing the transaction in pounds (good exchange rate but a fixed cash withdrawal fee) or processing the transaction in euros (bad exchange rate but no fixed cash withdrawal fee). For small amounts, the latter option may turn out cheaper.

For the merchant which normally accepts credit cards, DCC offers an opportunity to earn a margin on the transaction with no exchange rate risk, which is borne by the DCC operator.

Disadvantages

The main objection to DCC is the unfavorable exchange rates being applied on the transaction,[6] resulting in a higher charge on their credit card, and that in many cases the customer is not aware of the additional and often unnecessary cost of the DCC transaction.

The size of the foreign exchange margin added using DCC varies depending on the DCC operator, card acquirer or payment gateway and merchant. This margin is in addition to any charges levied by the customer's bank or credit card company for a foreign purchase. In most cases, customers are charged more using DCC than they would have been if they had simply paid in the foreign currency.[7][8][9]

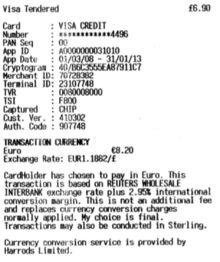

An example can be seen in the following image, where the same GBP purchase is made twice just after each other: one with DCC and one without DCC. In both cases, the original amount is GBP 6.90 and is paid with a Visa card denominated in EUR. When applying DCC (left part of the image), the amount becomes EUR 8.20. This will also be the amount on the credit card statement. Without DCC, the amount is GBP 6.90 and the resulting EUR charge can be found only at the credit card statement, and can vary with any fluctuations between the GBP and EUR currencies.

On the card statement, the difference in charges can be seen: the DCC transaction is correctly charged at EUR 8.20 while the non-DCC is charged at EUR 8.04 - a difference of almost 2%. While this may seem a small amount for the customer, it can mean a big income stream for the DCC operator and merchant.

In summary:

- Rate can be less favourable than the actual exchange rate as the merchant sets the rate in its favor

- Customers may not be advised of the choice open to them to select the local currency or may not notice that DCC is being used

- Customers may find DCC to be forced upon them, without a clear choice, as merchants falsely claim their machines automatically convert purchases to home currency at the point of sale

- Credit card disputes can be lengthy or impossible if a customer signs the receipt with / without a clear choice.

DCC providers

The main DCC providers are:

- FEXCO Merchant Services[10] based in Ireland

- Premier Tax Free, part of the Fintrax Group[11] based in Ireland

- Global Blue[12] based in Switzerland

- MONEX Financial Services[13]

- Planet Payment[14]

- Euronet Worldwide[15] based in the United States

- Elavon Inc.[16] based in the United States

- Six Payment Services[17]

- ConCardis[18]

References

- ↑ The Age, 30 March 2015: Dynamic currency conversion - robbery by choice

- ↑ "About us". Monex Financial Services. Retrieved 9 June 2014.

- ↑ "Dynamic Currency Conversion (DCC)". FEXCO. Retrieved 9 June 2014.

- ↑ Collinson, Patrick (12 July 2008). "Going to Spain? Just say no". The Guardian (London). Retrieved 1 May 2010.

- ↑ "Dynamic currency exchange". FlyerTalk. Retrieved 31 December 2011.

- ↑ Keck, Gayle (31 July 2005). "Charge It . . . but Check the Math". Washington Post. Retrieved 31 December 2011.

- ↑ Steele, Jason. "The Foreign Conversion Scam". Retrieved 31 December 2011.

- ↑ Keck, Gayle (31 July 2005). "Charge It . . . but Check the Math". Washington Post. Retrieved 31 December 2011.

- ↑ "Dynamic Currency Conversion: Still A Scam". 9 March 2008. courant.com. Retrieved 31 December 2011.

- ↑ FEXCO Merchant Services

- ↑ Fintrax Group

- ↑ Global Blue

- ↑ Monex Financial Services

- ↑ Planet Payment

- ↑ Pure Commerce

- ↑ Merchant Services

- ↑ Six Payment Services

- ↑ ConCardis