Distortion risk measure

In financial mathematics, a distortion risk measure is a type of risk measure which is related to the cumulative distribution function of the return of a financial portfolio.

Mathematical definition

The function  associated with the distortion function

associated with the distortion function ![g: [0,1] \to [0,1]](../I/m/97fd26d67e9595db275d4a69efc1fd5b.png) is a distortion risk measure if for any random variable of gains

is a distortion risk measure if for any random variable of gains  (where

(where  is the Lp space) then

is the Lp space) then

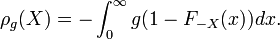

where  is the cumulative distribution function for

is the cumulative distribution function for  and

and  is the dual distortion function

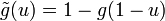

is the dual distortion function  .[1]

.[1]

If  almost surely then

almost surely then  is given by the Choquet integral, i.e.

is given by the Choquet integral, i.e.  [1][2] Equivalently,

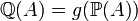

[1][2] Equivalently, ![\rho_g(X) = \mathbb{E}^{\mathbb{Q}}[-X]](../I/m/fed48379d0bf8034811a644153174ab5.png) [2] such that

[2] such that  is the probability measure generated by

is the probability measure generated by  , i.e. for any

, i.e. for any  the sigma-algebra then

the sigma-algebra then  .[3]

.[3]

Properties

In addition to the properties of general risk measures, distortion risk measures also have:

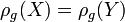

- Law invariant: If the distribution of

and

and  are the same then

are the same then  .

. - Monotone with respect to first order stochastic dominance.

- If

is a concave distortion function, then

is a concave distortion function, then  is monotone with respect to second order stochastic dominance.

is monotone with respect to second order stochastic dominance.

- If

-

is a concave distortion function if and only if

is a concave distortion function if and only if  is a coherent risk measure.[1][2]

is a coherent risk measure.[1][2]

Examples

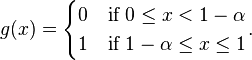

- Value at risk is a distortion risk measure with associated distortion function

[2][3]

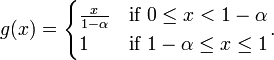

[2][3] - Conditional value at risk is a distortion risk measure with associated distortion function

[2][3]

[2][3] - The negative expectation is a distortion risk measure with associated distortion function

.[1]

.[1]

See also

References

- ↑ 1.0 1.1 1.2 1.3 Sereda, E. N.; Bronshtein, E. M.; Rachev, S. T.; Fabozzi, F. J.; Sun, W.; Stoyanov, S. V. (2010). "Distortion Risk Measures in Portfolio Optimization". Handbook of Portfolio Construction. p. 649. doi:10.1007/978-0-387-77439-8_25. ISBN 978-0-387-77438-1.

- ↑ 2.0 2.1 2.2 2.3 2.4 Julia L. Wirch; Mary R. Hardy. "Distortion Risk Measures: Coherence and Stochastic Dominance" (pdf). Retrieved March 10, 2012.

- ↑ 3.0 3.1 3.2 Balbás, A.; Garrido, J.; Mayoral, S. (2008). "Properties of Distortion Risk Measures". Methodology and Computing in Applied Probability 11 (3): 385. doi:10.1007/s11009-008-9089-z.

- Wu, Xianyi; Xian Zhou (April 7, 2006). "A new characterization of distortion premiums via countable additivity for comonotonic risks". Insurance: Mathematics and Economics 38 (2): 324–334. doi:10.1016/j.insmatheco.2005.09.002. Retrieved March 14, 2012.