Deviation risk measure

In financial mathematics, a deviation risk measure is a function to quantify financial risk (and not necessarily downside risk) in a different method than a general risk measure. Deviation risk measures generalize the concept of standard deviation.

Mathematical definition

A function ![D: \mathcal{L}^2 \to [0,+\infty]](../I/m/3ae19b9a709002442c53e8a19aa3e05e.png) , where

, where  is the L2 space of random portfolio returns, is a deviation risk measure if

is the L2 space of random portfolio returns, is a deviation risk measure if

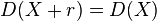

- Shift-invariant:

for any

for any

- Normalization:

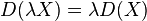

- Positively homogeneous:

for any

for any  and

and

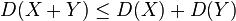

- Sublinearity:

for any

for any

- Positivity:

for all nonconstant X, and

for all nonconstant X, and  for any constant X.[1][2]

for any constant X.[1][2]

Relation to risk measure

There is a one-to-one relationship between a deviation risk measure D and an expectation-bounded risk measure R where for any

-

![D(X) = R(X - \mathbb{E}[X])](../I/m/716e9df41706e2e2a69df0ed075dfb68.png)

-

![R(X) = D(X) - \mathbb{E}[X]](../I/m/0a44992754e402029e3e0372c7b9658a.png) .

.

R is expectation bounded if ![R(X) > \mathbb{E}[-X]](../I/m/68b84cfb4796ef5974914b06959500a3.png) for any nonconstant X and

for any nonconstant X and ![R(X) = \mathbb{E}[-X]](../I/m/aff240d6061c0fa00519a9a2fffe0aea.png) for any constant X.

for any constant X.

If ![D(X) < \mathbb{E}[X] - \operatorname{ess\inf} X](../I/m/0d448f2ef3350a5df1a890f24856fa33.png) for every X (where

for every X (where  is the essential infimum), then there is a relationship between D and a coherent risk measure.[1]

is the essential infimum), then there is a relationship between D and a coherent risk measure.[1]

Examples

The standard deviation is clearly a deviation risk measure.

References

- ↑ 1.0 1.1 Rockafellar, Tyrrell; Uryasev, Stanislav; Zabarankin, Michael (2002). "Deviation Measures in Risk Analysis and Optimization". Retrieved January 15, 2012.

- ↑ Cheng, Siwei; Liu, Yanhui; Wang, Shouyang (2004). "Progress in Risk Measurement". Advanced Modelling and Optimization 6 (1).