Current account

In economics, a country's current account is one of the two components of its balance of payments, the other being the capital account. The current account consists of the balance of trade, net primary income or factor income (earnings on foreign investments minus payments made to foreign investors) and net cash transfers, that have taken place over a given period of time. The current account balance is one of two major measures of a country's foreign trade (the other being the net capital outflow). A current account surplus increases a country's net foreign assets by the corresponding amount, and a current account deficit does the reverse. Both government and private payments are included in the calculation. It is called the current account because goods and services are generally consumed in the current period.[1][2]

Overview

A country's balance of trade is the net or difference between the country's exports of goods and services and its imports of goods and services, ignoring all financial transfers, investments and other components, over a given period of time. A country is said to have a trade surplus if its exports exceed its imports, and a trade deficit if its imports exceed its exports.

Positive net sales abroad generally contributes to a current account surplus; negative net sales abroad generally contributes to a current account deficit. Because exports generate positive net sales, and because the trade balance is typically the largest component of the current account, a current account surplus is usually associated with positive net exports.

In the net factor income or income account, income payments are outflows, and income receipts are inflows. Income are receipts from investments made abroad (note: investments are recorded in the capital account but income from investments is recorded in the current account) and money sent by individuals working abroad, known as remittances, to their families back home. If the income account is negative, the country is paying more than it is taking in interest, dividends, etc.

The various subcategories in the income account are linked to specific respective subcategories in the capital account, as income is often composed of factor payments from the ownership of capital (assets) or the negative capital (debts) abroad. From the capital account, economists and central banks determine implied rates of return on the different types of capital. The United States, for example, gleans a substantially larger rate of return from foreign capital than foreigners do from owning United States capital.

In the traditional accounting of balance of payments, the current account equals the change in net foreign assets. A current account deficit implies a paralleled reduction of the net foreign assets.

- Current account = changes in net foreign assets.

If an economy is running a current account deficit, it is absorbing (absorption = domestic consumption + investment + government spending) more than that it is producing. This can only happen if some other economies are lending their savings to it (in the form of debt to or direct/ portfolio investment in the economy) or the economy is running down its foreign assets such as official foreign currency reserve.

On the other hand, if an economy is running a current account surplus it is absorbing less than that it is producing. This means it is saving. As the economy is open, this saving is being invested abroad and thus foreign assets are being created.

Calculation

Normally, the current account is calculated by adding up the 4 components of current account: goods, services, income and current transfers.[3]

- Goods

- Being movable and physical in nature, goods are often traded by countries all over the world. When a transaction of certain good's ownership from a local country to a foreign country takes place, this is called an "export." The other way around, when a good's owner changes to a local inhabitant from a foreigner, is defined to be an "import." In calculating current account, exports are marked as credit (the inflow of money) and imports as debit. (the outflow of money.)

- Services

- When an intangible service (e.g. tourism) is used by a foreigner in a local land and the local resident receives the money from a foreigner, this is also counted as an export, thus a credit.

- Income

- A credit of income happens when an individual or a company of domestic nationality receives money from a company or individual with foreign identity. A foreign company's investment upon a domestic company or a local government is considered as a credit.

- Current transfers

- Current transfers take place when a certain foreign country simply provides currency to another country with nothing received as a return. Typically, such transfers are done in the form of donations, aids, or official assistance.

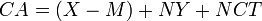

A country's current account can be calculated by the following formula:

When CA is the current account, X and M are respectively the export and import of goods and services, NY the net income from abroad, and NCT the net current transfers.

Reducing current account deficits

Action to reduce a substantial current account deficit usually involves increasing exports (goods going out of a country and entering abroad countries) or decreasing imports (goods coming from a foreign country into a country). Firstly, this is generally accomplished directly through import restrictions, quotas, or duties (though these may indirectly limit exports as well), or by promoting exports (through subsidies, custom duty exemptions etc.). Influencing the exchange rate to make exports cheaper for foreign buyers will indirectly increase the balance of payments. Also, Currency wars, a phenomenon evident in post recessionary markets is a protectionist policy, whereby countries devalue their currencies to ensure export competitiveness. Secondly, adjusting government spending to favor domestic suppliers is also effective.

Less obvious methods to reduce a current account deficit include measures that increase domestic savings (or reduced domestic borrowing), including a reduction in borrowing by the national government.

A current account deficit is not always a problem. The Pitchford thesis states that a current account deficit does not matter if it is driven by the private sector. It is also known as the "consenting adults" view of the current account, as it holds that deficits are not a problem if they result from private sector agents engaging in mutually beneficial trade. A current account deficit creates an obligation of repayments of foreign capital, and that capital consists of many individual transactions. Pitchford asserts that since each of these transactions were individually considered financially sound when they were made, their aggregate effect (the current account deficit) is also sound.

Interrelationships in the balance of payments

Absent changes in official reserves, the current account is the mirror image of the sum of the capital and financial accounts. One might then ask: Is the current account driven by the capital and financial accounts or is it vice versa? The traditional response is that the current account is the main causal factor, with capital and financial accounts simply reflecting financing of a deficit or investment of funds arising as a result of a surplus. However, more recently some observers have suggested that the opposite causal relationship may be important in some cases. In particular, it has controversially been suggested that the United States current account deficit is driven by the desire of international investors to acquire U.S. assets (See Ben Bernanke,[4] William Poole links below). However, the main viewpoint undoubtedly remains that the causative factor is the current account and that the positive financial account reflects the need to finance the country's current account deficit.

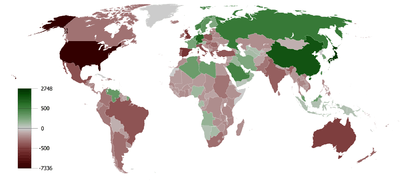

Current account surpluses are facing current account deficits of other countries, the indebtedness of which towards abroad therefore increases. According to Balances Mechanics by Wolfgang Stützel this is described as surplus of expenses over the revenues. Increasing imbalances in foreign trade are critically discussed as a possible cause of the financial crisis since 2007.[5] Many keynesian economists consider the existing differences between the current accounts in the eurozone to be the root cause of the Euro crisis, for instance Heiner Flassbeck,[6] Paul Krugman[7] or Joseph Stiglitz.[8]

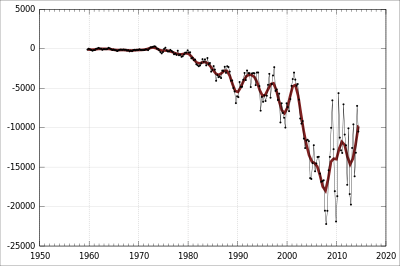

U.S. account deficits

Since 1989, the current account deficit of the US has been increasingly large, reaching close to 7% of the GDP in 2006. In 2011, it was the highest deficit in the world.[9] New evidence, however, suggests that the U.S. current account deficits are being mitigated by positive valuation effects.[10] That is, the U.S. assets overseas are gaining in value relative to the domestic assets held by foreign investors. The net foreign assets of the U.S. are therefore not deteriorating one to one with the current account deficits. The most recent experience has reversed this positive valuation effect, however, with the US net foreign asset position deteriorating by more than two trillion dollars in 2008.[11] This was due primarily to the relative under-performance of domestic ownership of foreign assets (largely foreign equities) compared to foreign ownership of domestic assets (largely US treasuries and bonds).

See also

- Balance of payments

- Balance of trade

- List of countries by current account balance

- Global saving glut

- FRED (Federal Reserve Economic Data)

- U.S. public debt

References

- ↑ Ecological Economics: Principles And Applications; Herman E. Daly, Joshua Farley; Island Press, 2003

- ↑ Current Account Deficits: Is There a Problem?, Atish Ghosh, Uma Ramakrishnan, IMF, 2012-03-28.

- ↑ Investopedia (18 August 2009). "Understanding The Current Account In The Balance Of Payments".

- ↑ The Global Saving Glut and the U.S. Current Account Deficit http://www.federalreserve.gov/boarddocs/speeches/2005/200503102/

- ↑ Wolfgang Münchau, „Kernschmelze im Finanzsystem", Carl Hanser Verlag, München, 2008, S. 155ff.; vgl. Benedikt Fehr: „'Bretton Woods II ist tot. Es lebe Bretton Woods III'" in FAZ 12. Mai 2009, S. 32. FAZ.Net, Stephanie Schoenwald:„Globale Ungleichgewichte. Sind sie für die Finanzmarktkrise (mit-) verantwortlich?" KfW (Kreditanstalt für Wiederaufbau) Research. MakroScope. No. 29, Februar 2009. S. 1.

Zu den außenwirtschaftlichen Ungleichgewichten als „makroökonomischer Nährboden" der Krise siehe auch Deutsche Bundesbank: Finanzstabilitätsbericht 2009, Frankfurt am Main, November 2009 (PDF)., Gustav Horn, Heike Joebges, Rudolf Zwiener: „Von der Finanzkrise zur Weltwirtschaftskrise (II), Globale Ungleichgewichte: Ursache der Krise und Auswegstrategien für Deutschland" IMK-Report Nr. 40, August 2009, S. 6 f. (PDF; 260 kB) - ↑ Heiner Flassbeck: Wege aus der Eurokrise. YouTube http://www.youtube.com/watch?v=mfKuosvO6Ac

- ↑ Paul Krugman Blog: Germans and Aliens, available on line at: http://krugman.blogs.nytimes.com/2012/01/09/germans-and-aliens/

- ↑ Joseph Stiglitz: Is Mercantilism Doomed to Fail?, Online verfügbar unter http://www.youtube.com/watch?v=D207fSLnxHk

- ↑ https://www.cia.gov/library/publications/the-world-factbook/rankorder/2187rank.html

- ↑ Current Account Sustainability and Relative Reliability https://www.cia.gov/library/publications/the-world-factbook/rankorder/2187rank.html

- ↑ US net foreign assets

External links

- Are Trade Deficits a Drag on U.S. Economic Growth?

- Ellen Frank, Where Do U.S.A Dollars Go When the United States Runs a Trade Deficit? from Dollars & Sense magazine, March/April 2004.

- CIA Fact Book of Account Rankings Worldwide

- Current Account Surplus Watch from New America Foundation

- The Global Saving Glut and the U.S. Current Account Deficit from Global saving glut

| |||||||||||||||||||||||||||||||||||||