Consumption smoothing

Consumption smoothing is the economic concept used to express the desire of people to have a stable path of consumption. Since Milton Friedman's permanent income theory (1956) and Modigliani and Brumberg (1954) life-cycle model, the idea that agents prefer a stable path of consumption has been widely accepted.[1][2] This idea came to replace the perception that people had a marginal propensity to consume and therefore current consumption was tied to current income.

Friedman's theory argues that consumption is linked to the permanent income of agents. Thus, when income is affected by transitory shocks, for example, agents' consumption should not change, since they can use savings or borrowing to adjust. This theory assumes that agents are able to finance consumption with earnings that are not yet generated, and thus assumes perfect capital markets. Empirical evidence shows that liquidity constraint is one of the main reasons why it is difficult to observe consumption smoothing in the data.

Model

Robert Hall (1978) formalized Friedman's idea.[3] By taking into account the diminishing returns to consumption, and therefore, assuming a concave utility function, he showed that agents optimally would choose to keep a stable path of consumption.

With (cf. Hall's paper)

being the mathematical expectation conditional on all information available in

being the mathematical expectation conditional on all information available in

being the agent's rate of time preference

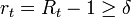

being the agent's rate of time preference being the real rate of interest in

being the real rate of interest in

being the strictly concave one-period utility function

being the strictly concave one-period utility function being the consumption in

being the consumption in

being the earnings in

being the earnings in

being the assets, apart from human capital, in

being the assets, apart from human capital, in  .

.

agents choose the consumption path that maximizes:

Subject to a sequence of budget constraints:

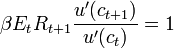

The first order necessary condition in this case will be:

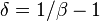

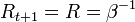

By assuming that  we obtain, for the previous

equation:

we obtain, for the previous

equation:

Which, due to the concavity of the utility function, implies:

Thus, rational agents would expect to achieve the same consumption in every period.

Hall also showed that for a quadratic utility function, the optimal consumption is equal to:

This expression shows that agents choose to consume a fraction of their present discounted value of their human and financial wealth.

Criticism

Although Hall's proof,  , is extremely short, just nine lines, Hall's corollary 4,

, is extremely short, just nine lines, Hall's corollary 4,  , can be found in Flavin.[4] Wu [5] has shown that changes in consumption being zero is the result of an error. Wu's proof is shown below applying the same definitions and techniques found in Sargent.[6]

, can be found in Flavin.[4] Wu [5] has shown that changes in consumption being zero is the result of an error. Wu's proof is shown below applying the same definitions and techniques found in Sargent.[6]

A consumer maximizes

![\sum_{i=0}^{\infty} b^t \left[u_0+u_1c_1-\frac{u_2} {2} c_t ^2 \right],](../I/m/013c73cc4d1a7ca625dd593914141ce0.png) subject to

subject to

![A_t = R [A_t + y_t - c_t]](../I/m/ae01993122b456e37d826f1190af6df2.png) , where

, where  , under a stochastic process, is

, under a stochastic process, is

- where

is consumption,

is consumption,  is non-human assets,

is non-human assets,  is labor income,

is labor income,  is gross rate of return (all at the beginning of period).

is gross rate of return (all at the beginning of period).  is expectation,

is expectation,  is time.

is time.

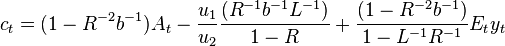

Under the "Euler equation approach," optimal consumption for period t is given by

-

, where,

, where, is the lag operator

is the lag operator

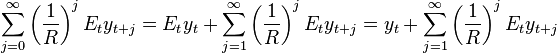

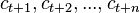

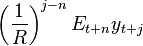

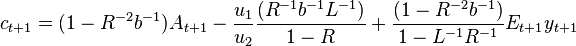

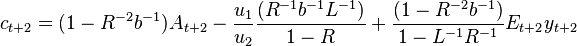

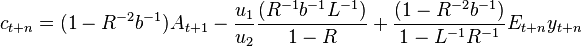

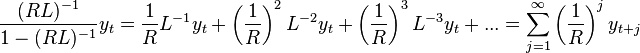

Repeating Euler optimization, one should find that consumption,  , should be given by

, should be given by

- . . .

Assuming  ,

,

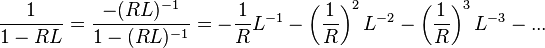

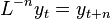

Since  can be expanded as

can be expanded as

and by definition of lag operator

implies

thus for any n

then

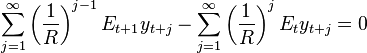

and for n = 1

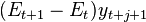

Flavin's Mispecification

Flavin stated that

Flavin assumed that at period t+1, one still has the same number of incomes than at period t, i.e., sum of incomes from zero to infinity, instead of 1 to infinity. In fact, from one period to another, the number of income has to decline from n (where n tends to infinite) to n-1.

and found out that

and reached the Hall's conclusion that if the "expectations of future income are rational, the expectation of next period's revision in expectation,  , is zero. Thus

, is zero. Thus  ."

."

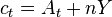

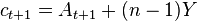

To see Flavin's mispecification, lets assume the case that  and that the

and that the  is

is  then

then

, where n tends to infinite and if one were to specify for

, where n tends to infinite and if one were to specify for  that the sum varies from 1 to infinite, instead of 0 to infinite,

that the sum varies from 1 to infinite, instead of 0 to infinite,

,

,

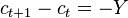

then the difference of consumption from one period to another is not zero but,

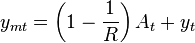

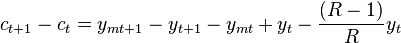

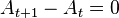

Restatement and Wu's Result

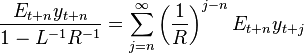

Applying the corrected  , the change in consumption is,

, the change in consumption is,

and since,

If we assume that,

and applying the definition of total income or "measured" income,

the change in consumption can be written as

thus

- change in savings =

Implications

- Change in savings is a function of growth of labor income:

- - any factor or policy affecting labor income growth will affect change in savings.

- - income growth is dynamic leading to the disequilibrium model in Keynes [7] saving and disaving

- - Clower's [8] dual decision hypothesis may help explain why unexpected changes in income makes consumers revise consumption and affect their change in savings

- In practice, the relationship between change in savings and growth helps explain why:

- - countries with rapid growth, e.g. those with trade surplus, have usually higher change in savings and countries with lower growth, e.g. trade deficit, lower change in saving. Net trade surplus countries such as Germany, China, Korea enjoy the highest gains in savings while countries such as U.S. loss in savings. Change in savings in Japan were high when trade was in surplus; now it is lower due to appreciation of Japanese Yen.

- - depending on the intercept of savings vs growth, savings can turn negative even though growth is positive. Most economists, including Modigliani,[9] have only considered growth vs savings, instead of change in savings. Case in point is the U.S. with positive growth and with saving rate bordering on negative.

- - targeting a level of saving rate is meaningless, what matters is growth and change of savings.

Empirical Evidence

Robert Hall (1978) estimated the Euler equation in order to find evidence of a random walk in consumption. The data used are US National Income and Product Accounts (NIPA) quarterly from 1948 to 1977. For the analysis the author does not consider the consumption of durable goods. Although Hall argues that he finds some evidence of consumption smoothing, he does so using a modified version. There are also some econometric concerns about his findings.

Wilcox (1989) argue that liquidity constraint is the reason why consumption smoothing does not show up in the data.[10] Zeldes (1989) follows the same argument and finds that a poor household's consumption is correlated with contemporaneous income, while a rich household's consumption is not.[11]

References

- ↑ Friedman, Milton (1956). "A Theory of the Consumption Function." Princeton N. J.: Princeton University Press.

- ↑ Modigliani, F. & Brumberg, R. (1954): 'Utility analysis and the consumption function: An interpretation of cross-section data'. In: Kurihara, K.K (ed.): Post-Keynesian Economics

- ↑ Hall, Robert (1978). "Stochastic Implications of the Life Cycle-Permanent Income Hypothesis: Theory and Evidence." Journal of Political Economy, vol. 86, pp. 971-988.

- ↑ Flavin, M.A. (1977, published 1981), "The Adjustment of Consumption to Changing expectations about Future Income," Journal of Political Economy, vol. 89n, no. 5.

- ↑ Wu, C. K. (1996), "New Result in Theory of Consumption: Changes in Savings and Income Growth," https://ideas.repec.org/p/wpa/wuwpma/9706007.html

- ↑ Sargent, T. J. (1987), "Macroeconomic Theory," 2nd Edition, Academic Press.

- ↑ Keynes, J.M. (1936), "The General Theory of Employment, Interest, and Money," Hartcourt Brace Jovanovich.

- ↑ Clower, R.W. (1965), "The Keynesian Counterrevolution: A Theoretical Appraisal,", The Theory of Interest Rates, ed. F.H. Hahn and F.P.R. Brechling, Macmillan, p. 103-25.

- ↑ Modigliani, F. and Brumbert, R. (unpublished manuscript 1952, published 1979), "Utility Analysis and Aggregate Consumption Functions: An Attempt at Integration," Collected Papers of Franco Modigliani, ed. A. Abel, Vol. 2, MIT Press.

- ↑ Wilcox, James A. (1989). "Liquidity Constraints on Consumption: The Real Effects of Real Lending Policies." Federal Reserve Bank of San Francisco Economic Review, pp. 39-52.

- ↑ Zeldes, Stephen P. (1989). "Consumption and Liquidity Constraints: An Empirical Investigation." Journal of Political Economy, University of Chicago Press, vol. 97(2), pp. 305-46

![E_{0}\sum_{t=0}^{\infty }\beta^{t}\left[u(c_{t})\right]](../I/m/1c72249b77877adaaece557e0dc8ebb2.png)

![E_{t}[c_{t+1}]=c_{t}](../I/m/30bba4cda3b3fc0348988b670786ae0c.png)

![c_{t}=\left[ \frac{r}{1+r}\right] \left[ E_{t}\sum_{i=0}^{\infty

}\left( \frac{1}{1+r}\right) ^{i}y_{t+i}+A_{t}\right]](../I/m/4a792c13f7c40464834ef87d825d1101.png)

![c_{t+n} = (1 - R^{-1}) \left[A_{t+n} + \frac{E_{t+n}y_{t+n}} {1-L^{-1}R^{-1}} \right]](../I/m/3b9e8a45bb98c81ce06d0f9f806f369d.png)

![c_{t+n} = (1-R^{-1}) \left[A_{t+n} + \sum_{j=n}^{\infty}\left( \frac{1}{R}\right) ^{j-n} E_{t+n} y_{t+j} \right]](../I/m/e91ac3ae29d0fe020c8a540d5ebc4bf3.png)

![c_{t+1} = (1-R^{-1}) \left[A_{t+1} + \sum_{j=1}^{\infty}\left( \frac{1}{R}\right) ^{j-1} E_{t+1} y_{t+j} \right]](../I/m/9b87f940ec21adcf9c8c6096b7716b65.png)

![c_{t+1} = (1-R^{-1}) \left[A_{t+1} + \sum_{j=0}^{\infty}\left( \frac{1}{R}\right) ^{j} E_{t+1} y_{t+j+1} \right]](../I/m/baca203ba5db04b6e64745d801003d1c.png)

![c_{t+1} - c_t = (1-R^{-1}) \left[A_{t+1} -A_t + \sum_{j=0}^{\infty}\left( \frac{1}{R}\right) ^{j} E_{t+1} y_{t+j+1} - \sum_{j=0}^{\infty}\left( \frac{1}{R}\right) ^{j} E_{t} y_{t+j} \right] = (1-R^{-1}) \sum_{j=0}^{\infty}\left( \frac{1}{R}\right) ^{j} (E_{t+1} - E_{t}) y_{t+j+1}](../I/m/9848b34fa5ba7143afe0de65020ed225.png)

![c_{t+1} - c_t = (1-R^{-1}) \left[A_{t+1} -A_t + \sum_{j=1}^{\infty}\left( \frac{1}{R}\right) ^{j-1} E_{t+1} y_{t+j} - \sum_{j=0}^{\infty}\left( \frac{1}{R}\right) ^{j} E_{t} y_{t+j} \right]](../I/m/7ed634875570a804f97ab8cdfafe7d4f.png)