Consumption function

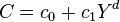

In economics, the consumption function, or better, the consumption expenditure function, is a one mathematical function used to express consumer spending. According to economic science historians' books, it was first mentioned by John Maynard Keynes who introduced it in his most famous book The General Theory of Employment, Interest, and Money. The function is used to calculate the amount of total consumption in an economy. Due to the lack of mathematical tools when it was first drafted, Keynes presented a simplistic formulation, today fairly overcomed (see last paragraph). It was made up of autonomous consumption that is not influenced by current income and induced consumption that is influenced by the economy's income level. This function could be written in a variety of ways, the most simplistic being  .

.

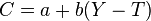

A refined version of the initial consumption function is shown as the affine function:

where

- C = total consumption,

- c0 = autonomous consumption (c0 > 0),

- c1 is the marginal propensity to consume (ie the induced consumption) (0 < c1 < 1), and

- Yd = disposable income (income after government intervention – benefits, taxes and transfer payments – or Y + (G – T)).

Autonomous consumption represents consumption when income is zero. In estimation, this is usually assumed to be positive. The marginal propensity to consume (MPC), on the other hand measures the rate at which consumption is changing when income is changing. In a geometric fashion, the MPC is actually the slope of the consumption function.

The MPC is assumed to be positive. Thus, as income increases, consumption increases. However, Keynes mentioned that the increases (for income and consumption) are not equal. According to him, "as income increases, consumption increases but not by as much as the increase in income".

The Keynesian consumption function is also known as the absolute income hypothesis, as it only bases consumption on current income and ignores potential future income (or lack of).

Criticism of the simplicity and irreality of this assumption lead to the development of Milton Friedman's permanent income hypothesis and Richard Brumberg & Franco Modigliani's life cycle hypothesis. But none of them developed a definitive Consumption Expenditure Function. Friedman, although he got the Nobel prize for his book A Theory of the Consumption Function (1957), presented several different definitions of the permanent income in his approach, making it impossible to develop a more sophisticated function. Modigliani and Brumberg tried to develop a better consumption expenditure function using the income got in the whole life of consumers, but them and their followers ended in a formulation lacking economic theory and therefore full of proxies that do not account for the complex changes of today's economic systems.

Until recently, the three main existing theories, based on the income dependent Consumption Expenditure Function pointed by Keynes in 1936, were Duesenberry's (1949)[1] Relative Consumption Expenditure, Modigliani and Brumberg's (1954) Life-Cycle Income and Friedman's (1957)[2] Permanent Income.

Some new theoretical works[3] are based, following Duesenberry's one, on behavioral economics and suggest that a number of behavioural principles can be taken as microeconomic foundations for a behaviourally-based aggregate consumption function.

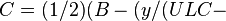

The most recent theoretical approach by Rafael J. Hernández Núñez[4] uses mathematics to redefine the utility indifference curves concept and formulation, clearly states what the permanent income is, and thus makes it possible to finally create a complete theoretical and mathematical development of the Consumption Expenditure Function that brings the economic community a full function with, as Keynes anticipated more than half a century ago, a subjective and an objective part when referring to consumption expenditure decisions.

Formulation is as follows:

α

α α

α

where

- C = total consumption,

- B = Budget Constraint -> Disposable Income,

- α = Marginal propensity to spend in consumption,

- β = Marginal propensity to save,

- ULC stands for the Upper Limit Chosen = α + β,

- y = value calculated to get the maximum possible consumption expenditure out of the total allocation of the current Budget Constraint plus the maximum possible borrowing, or negative saving, in consumption expenditure for a given period and a given set of subjacent factors, and

- x = value calculated for the minimum possible consumption out of the total consumption expenditure allocation of the Budget Constraint plus the maximum possible saving for a given period and a given set of subjacent factors.

See also

- Aggregate demand

- Consumption (economics)

- Life cycle hypothesis

- Measures of national income and output

- Permanent income hypothesis

Notes

- ↑ Duesenberry, J. S. (1949): Income, Saving and the Theory of Consumer Behavior

- ↑ Friedman, M. (1957) A Theory of the Consumption Function.

- ↑ d’Orlando, F.; Sanfilippo, E. (2010). "Behavioral foundations for the Keynesian consumption function". Journal of Economic Psychology 31 (6): 1035. doi:10.1016/j.joep.2010.09.004.

- ↑ Hernández Núñez, R. J. (2014): The Consumption Expenditure Function. Paperback. www.amazon.com

External links

- The Consumption Expenditure function by Rafael J. Hernández Núñez

- An essay examining the strengths and weaknesses of Keynes's theory of consumption

| ||||||||||||||

| ||||||||||||||||||