Cochrane–Orcutt estimation

Cochrane–Orcutt estimation is a procedure in econometrics, which adjusts a linear model for serial correlation in the error term. It is named after statisticians Donald Cochrane and Guy Orcutt.[1]

Theory

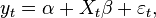

Consider the model

where  is the value of the dependent variable of interest at time t,

is the value of the dependent variable of interest at time t,  is a column vector of coefficients to be estimated,

is a column vector of coefficients to be estimated,  is a row vector of explanatory variables at time t, and

is a row vector of explanatory variables at time t, and  is the error term at time t.

is the error term at time t.

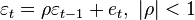

If it is found via the Durbin–Watson statistic that the error term is serially correlated over time, then standard statistical inference as normally applied to regressions is invalid because standard errors are estimated with bias. To avoid this problem, the residuals must be modeled. If the process generating the residuals is found to be a stationary first-order autoregressive structure,[2]  , with the errors {

, with the errors { } being white noise, then the Cochrane–Orcutt procedure can be used to transform the model by taking a quasi-difference:

} being white noise, then the Cochrane–Orcutt procedure can be used to transform the model by taking a quasi-difference:

In this specification the error terms are white noise, so statistical inference is valid. Then the sum of squared residuals (the sum of squared estimates of  ) is minimized with respect to

) is minimized with respect to  , conditional on

, conditional on  .

.

Estimating the autoregressive parameter

If  is not known, then it is estimated by first regressing the untransformed model and obtaining the residuals {

is not known, then it is estimated by first regressing the untransformed model and obtaining the residuals { }, and regressing

}, and regressing  on

on  , leading to an estimate of

, leading to an estimate of  and making the transformed regression sketched above feasible. (Note that one data point, the first, is lost in this regression.) This procedure of autoregressing estimated residuals can be done once and the resulting value of

and making the transformed regression sketched above feasible. (Note that one data point, the first, is lost in this regression.) This procedure of autoregressing estimated residuals can be done once and the resulting value of  can be used in the transformed y regression, or the residuals of the residuals autoregression can themselves be autoregressed in consecutive steps until no substantial change in the estimated value of

can be used in the transformed y regression, or the residuals of the residuals autoregression can themselves be autoregressed in consecutive steps until no substantial change in the estimated value of  is observed.

is observed.

It has to be noted, though, that the iterative Cochrane–Orcutt procedure might converge to a local but not global minimum of the residual sum of squares.[3][4]

See also

References

- ↑ Cochrane, D.; Orcutt, G. H. (1949). "Application of Least Squares Regression to Relationships Containing Auto-Correlated Error Terms". Journal of the American Statistical Association 44 (245): 32–61. doi:10.1080/01621459.1949.10483290.

- ↑ Wooldridge, Jeffrey M. (2013). Introductory Econometrics: A Modern Approach (Fifth international ed.). Mason, OH: South-Western. pp. 409–415. ISBN 978-1-111-53439-4.

- ↑ Dufour, J. M.; Gaudry, M. J. I.; Liem, T. C. (1980). "The Cochrane-Orcutt procedure numerical examples of multiple admissible minima". Economics Letters 6 (1): 43–48. doi:10.1016/0165-1765(80)90055-5.

- ↑ Dufour, J. -M.; Gaudry, M. J. I.; Hafer, R. W. (1983). "A warning on the use of the Cochrane-Orcutt procedure based on a money demand equation". Empirical Economics 8 (2): 111–117. doi:10.1007/BF01973194.

Further reading

- Davidson, Russell; MacKinnon, James G. (1993). Estimation and Inference in Econometrics. Oxford University Press. pp. 327–373. ISBN 0-19-506011-3.

- Hamilton, James D. (1994). Time Series Analysis. Princeton: Princeton University Press. pp. 220–225. ISBN 0-691-04289-6.

- Johnston, John (1972). Econometric Methods (Second ed.). New York: McGraw-Hill. pp. 259–265.

- Kmenta, Jan (1986). Elements of Econometrics (Second ed.). New York: Macmillan. pp. 302–317. ISBN 0-02-365070-2.