Brent Crude

Brent Crude is a major trading classification of sweet light crude oil that serves as a major benchmark price for purchases of oil worldwide. This grade is described as light because of its relatively low density, and sweet because of its low sulfur content. Brent Crude is extracted from the North Sea and comprises Brent Blend, Forties Blend, Oseberg and Ekofisk crudes (also known as the BFOE Quotation). The Brent Crude oil marker is also known as Brent Blend, London Brent and Brent petroleum.

The other well-known classifications (also called references or benchmarks) are the OPEC Reference Basket, Dubai Crude, Oman Crude, Urals oil and West Texas Intermediate (WTI). Brent is the leading global price benchmark for Atlantic basin crude oils. It is used to price two thirds of the world's internationally traded crude oil supplies.

Background

Originally Brent Crude was produced from the Brent oilfield. The name "Brent" comes from the naming policy of Shell UK Exploration and Production, operating on behalf of ExxonMobil and Royal Dutch Shell, which originally named all of its fields after birds (in this case the Brent Goose).[1][2][3][4] But it is also an acronym for the formation layers of the oil field: Broom(oseBerg), Rannoch, Etive, Ness and Tarbert.[5]

Petroleum production from Europe, Africa and the Middle East flowing West tends to be priced relative to this oil, i.e. it forms a benchmark. However, large parts of Europe now receive their oil from Russia.

Characteristics

Brent blend is a light crude oil (LCO), though not as light as West Texas Intermediate (WTI). It contains approximately 0.37% of sulphur, classifying it as sweet crude, yet not as sweet as WTI. Brent is suitable for production of petrol and middle distillates. It is typically refined in Northwest Europe.

Brent Crude has an API gravity of around 38.06 and a specific gravity of around 0.835.

Paper Market Trading

The ICE Futures Europe symbol for Brent crude futures is B.[6] It was originally traded on the open outcry International Petroleum Exchange in London, but since 2005 has been traded on the electronic IntercontinentalExchange, known as ICE. One contract equals 1,000 barrels (159 m3). Contracts are quoted in U.S. dollars. Each tick lost or gained equals $10.

Pricing

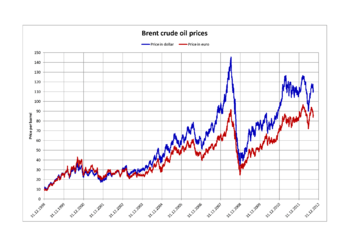

Historically price differences between Brent and other index crudes have been based on physical differences in crude oil specifications and short-term variations in supply and demand. Prior to September 2010, there existed a typical price difference per barrel of between ±3 USD/bbl compared to WTI and OPEC Basket; however, since the autumn of 2010 Brent has been priced much higher than WTI, reaching a difference of more than $11 a barrel by the end of February 2011 (WTI: 104 USD/bbl, LCO: 116 USD/bbl). In February 2011 the divergence reached $16 during a supply glut, record stockpiles, at Cushing, Oklahoma before peaking at above $23 in August 2012. It has since (September 2012) decreased significantly to around $18 after refinery maintenance settled down and supply issues eased slightly.

Many reasons have been given for this widening divergence ranging from a speculative change away from WTI trading (although not supported by trading volumes), Dollar currency movements, regional demand variations, and even politics. The depletion of the North Sea oil fields is one explanation for the divergence in forward prices.

The US Energy Information Administration attributes the price spread between WTI and Brent to an oversupply of crude oil in the interior of North America (WTI price is set at Cushing, Oklahoma) caused by rapidly increasing oil production from Canadian oil sands and tight oil formations such as the Bakken Formation, Niobrara Formation, and Eagle Ford Formation. Oil production in the interior of North America has exceeded the capacity of pipelines to carry it to markets on the Gulf Coast and east coast of North America; as a result, the oil price on the US and Canadian east coast and parts of the US Gulf Coast since 2011 has been set by the price of Brent Crude, while markets in the interior still follow the WTI price. Much US and Canadian crude oil from the interior is now shipped to the coast by railroad, which is much more expensive than pipeline.[7]

Delivery dates

In addition to the IntercontinentalExchange, Brent crude financial futures are also traded on the NYMEX, with the symbol BZ, and have expiry dates in all 12 months of the year.[8]

Brent Index

The Brent Index[9] is the cash settlement price for the IntercontinentalExchange (ICE) Brent Future based on ICE Futures Brent index at expiry.

The index represents the average price of trading in the 25 day Brent Blend, Forties, Oseberg, Ekofisk (BFOE) market in the relevant delivery month as reported and confirmed by the industry media. Only published cargo size (600,000 barrels (95,000 m3)) trades and assessments are taken into consideration.

The index is calculated as an average of the following elements:

1. A weighted average of first month cargo trades in the 25-day BFOE market.

2. A weighted average of second month cargo trades in the 25 day BFOE market plus or minus a straight average of the spread trades between the first and second months.

3. A straight average of designated assessments published in media reports.

First month weighted average

This is an average of the cargo trade prices reported, weighted to include multiple trades at any one price level. If media sources should conflict as to how many trades took place at a given price, then ICE Futures will endeavour to clarify the actual amount of trades through contact with the media sources and market users, whilst reserving the right to omit trades that cannot be substantiated to the satisfaction of the Exchange.

Example: Should media sources report the following 25-day trades for the first month:

| Media Source (1) | Media Source (2) | Media Source (3) | Media Source (4) | Media Source (5) | ICE Summary |

|---|---|---|---|---|---|

| 88.46 | 88.64 | 88.64 | 88.64 | 88.64 | 88.46 |

| 88.65 | 88.65 | 88.65 | 88.64 | 88.64 | |

| 88.66 | 88.66 | 88.65 | 88.64 | ||

| 88.66 | 88.65 | ||||

| 88.66 |

First month weighted average = 88.610

Second month deals plus/minus spread trades

This second element in the calculation produces an implied average price for the first month of the 25-day market, by averaging the second month traded cargo prices plus or minus an average of the spread trades between the first and second months. Trades in the second month of the 25-day market are also taken into consideration in this second element of the calculation, after having been adjusted by the size of the differential between the first and second 25-day months. Trade prices for the second month are averaged in the same way as above, and the average 1st-2nd month spread value is determined by the straight average price of spread trades documented by media sources.

Example: Should media sources report the following 25 day cargo trades for the second month:

| Media Source (1) | Media Source (2) | Media Source (3) | Media Source (4) | Media Source (5) | ICE Summary |

|---|---|---|---|---|---|

| 88.51 | 88.70 | 88.53 | 88.51 | 88.53 | 88.51 |

| 88.53 | 88.68 | 88.53 | 88.68 | 88.53 | |

| 88.53 | 88.68 | 88.58 | 88.53 | ||

| 88.70 | 88.58 | ||||

| 88.68 | |||||

| 88.70 |

Second month weighted average = 88.588

Average spread trade prices

Example: Should media sources report the following 25-day trades for the first-second month spread:

| Media Source (1) | Media Source (2) | Media Source (3) | Media Source (4) | Media Source (5) |

|---|---|---|---|---|

| 0.04 | 0.04 | 0.03 | 0.03 | 0.03 |

| 0.04 | 0.04 | 0.03 | ||

| 0.04 | 0.04 |

(6*0.04) + (4*0.03)/10

Average spread trade price = 0.036

In a backwardated market, the average spread trade price will be added to the weighted average trade price for the second month, in order to construct the implied first month price level. The spread price would be subtracted from the average second month price in the event of a contango market. Thus, the second month weighted average of $88.588 plus the average differential of $0.0362 would give an implied first month price of $88.624.

Intra-day price assessments

The industry media publish 25-day BFOE price assessments throughout the trading day. The midpoint of each quote is used to calculate an average for the whole trading day. The trading day is taken from 09:30 GMT (10.30 BST)–19.30 inclusive. Example: Should media sources publish the following quotes throughout the day for the first 25-day BFOE month, these would be averaged to give the following results:

| Time GMT/BST | Media Source (1) | Media Source (1) | Media Source (2) | Media Source (2) | Media Source (3) | Media Source (3) |

|---|---|---|---|---|---|---|

| 09.30/10.30 | 88.560 | 88.610 | 88.550 | 88.620 | 88.570 | 88.610 |

| 12.30 | 88.570 | 88.630 | 88.570 | 88.620 | 88.560 | 88.600 |

| 14:30 | 88.580 | 88.630 | 88.600 | 88.650 | 88.610 | 88.650 |

| 17:30 | 88.600 | 88.650 | 88.620 | 88.670 | 88.620 | 88.650 |

| 19.30 | 88.700 | 88.750 | 88.710 | 88.760 | 88.700 | 88.750 |

| AVERAGE | 88.628 | 88.637 | 88.632 |

|---|

Average market assessment = 88.632

See also

- List of crude oil products

- ETF Securities

- Iranian oil bourse

- Petrobourse

- Petrodollar warfare

- Petroeuro

- Petroleum classification

References

- ↑ "UK brent, crude oil, brent crude,". One Financial Markets/CB Financial Services Ltd. 2012. Retrieved 25 March 2012.

- ↑ http://www.investing-for-beginner.org/brent-Crude.html

- ↑ as this page states give a name of an animal to an oil field is not only in the case of Brent

- ↑ Andrew Inkpen, Michael H. Moffet. The Global Oil &Gas Industry. PennWell Corporation, Oklahoma, 2011. p. 372. ISBN 978-1-59370-239-7.

- ↑ John W. Fleenor, Sylvester Taylor, Craig Chappelow. Leveraging the Impact of 360-Degree Feddback. Center for Creative Leadership. John Wiley &Sons, Inc., New Jersey. p. 50. ISBN 978-0-470-22310-9.

- ↑ ICE Product Guide: Brent Crude Futures. Theice.com. Retrieved on 2013-11-26.

- ↑ US Energy Information Administration, Short-Term Energy Outlook Supplement: Brent Crude Oil Spot Price Forecast, 10 July 2010.

- ↑ List of Commodity Delivery Dates on Wikinvest

- ↑ IntercontinentalExchange, Inc (2008-01-21), The Brent Index, retrieved 2010-04-28

External links

| Wikinews has related news: Portal:Economy and business |

- Definition

- Crude oil types, US Energy Information Administration, US Department of Energy

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||