Basic affine jump diffusion

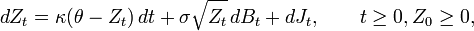

In probability theory, a basic affine jump diffusion (basic AJD) is a stochastic process Z of the form

where  is a standard Brownian motion, and

is a standard Brownian motion, and  is an independent compound Poisson process with constant jump intensity

is an independent compound Poisson process with constant jump intensity  and independent exponentially distributed jumps with mean

and independent exponentially distributed jumps with mean  . For the process to be well defined, it is necessary that

. For the process to be well defined, it is necessary that  and

and  . A basic AJD is a special case of an affine process and of a jump diffusion. On the other hand, the Cox–Ingersoll–Ross (CIR) process is a special case of a basic AJD.

. A basic AJD is a special case of an affine process and of a jump diffusion. On the other hand, the Cox–Ingersoll–Ross (CIR) process is a special case of a basic AJD.

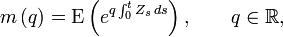

Basic AJDs are attractive for modeling default times in credit risk applications,[1][2][3][4] since both the moment generating function

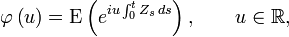

and the characteristic function

are known in closed form.[3]

The characteristic function allows one to calculate the density of an integrated basic AJD

by Fourier inversion, which can be done efficiently using the FFT.

References

- ↑ Darrell Duffie, Nicolae Gârleanu (2001). "Risk and Valuation of Collateralized Debt Obligations". Financial Analysts Journal 57: 41–59. doi:10.2469/faj.v57.n1.2418. Preprint

- ↑ Allan Mortensen (2006). "Semi-Analytical Valuation of Basket Credit Derivatives in Intensity-Based Models". Journal of Derivatives 13: 8–26. doi:10.3905/jod.2006.635417. Preprint

- ↑ 3.0 3.1 Andreas Ecker (2009). "Computational Techniques for basic Affine Models of Portfolio Credit Risk". Journal of Computational Finance 13: 63–97.

- ↑ Peter Feldhütter, Mads Stenbo Nielsen (2010). "Systematic and idiosyncratic default risk in synthetic credit markets". Preprint