Banking in India

Banking in India in the modern sense originated in the last decades of the 18th century. The among the first banks were Bank of Hindustan, which established in 1770 and liquidated in 1829-32; and General Bank of India, established 1786 but failed in 1791.[1][2][3][4]

The largest bank, and the oldest still in existence, is the State Bank of India. It originated as the Bank of Calcutta in June 1806. In 1809, it was renamed as the Bank of Bengal. This was one of the three banks funded by a presidency government, the other two were the Bank of Bombay and the Bank of Madras. The three banks were merged in 1921 to form the Imperial Bank of India, which upon India's independence, became the State Bank of India in 1955. For many years the presidency banks had acted as quasi-central banks, as did their successors, until the Reserve Bank of India was established in 1935, under the Reserve Bank of India Act, 1934.[5][6]

In 1960, the State Banks of India was given control of eight state-associated banks under the State Bank of India (Subsidiary Banks) Act, 1959. These are now called its associate banks.[5] In 1969 the Indian government nationalised 14 major private banks. In 1980, 6 more private banks were nationalised.[7] These nationalised banks are the majority of lenders in the Indian economy. They dominate the banking sector because of their large size and widespread networks.[8]

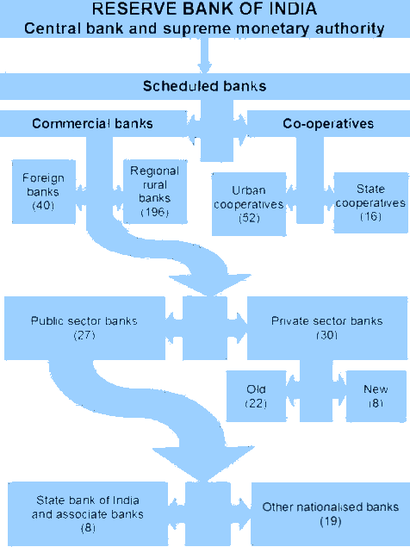

The Indian banking sector is broadly classified into scheduled banks and non-scheduled banks. The scheduled banks are those which are included under the 2nd Schedule of the Reserve Bank of India Act, 1934. The scheduled banks are further classified into: nationalised banks; State Bank of India and its associates; Regional Rural Banks (RRBs); foreign banks; and other Indian private sector banks.[6] The term commercial banks refers to both scheduled and non-scheduled commercial banks which are regulated under the Banking Regulation Act, 1949.[9]

Generally banking in India was fairly mature in terms of supply, product range and reach-even though reach in rural India and to the poor still remains a challenge. The government has developed initiatives to address this through the State Bank of India expanding its branch network and through the National Bank for Agriculture and Rural Development with things like microfinance.

History

Ancient India

The Vedas (2000-1400 BCE) are earliest Indian texts to mention the concept of usury. The word kusidin is translated as usurer. The Sutras (700-100 BCE) and the Jatakas (600-400 BCE) also mention usury. Also, during this period, texts began to condemn usury. Vasishtha forbade Brahmin and Kshatriya varnas from participating in usury. By 2nd century CE, usury seems to have become more acceptable.[10] The Manusmriti considers usury an acceptable means of acquiring wealth or leading a livelihood.[11] It also considers money lending above a certain rate, different ceiling rates for different caste, a grave sin.[12]

The Jatakas also mention the existence of loan deeds. These were called rnapatra or rnapanna. The Dharmashastras also supported the use of loan deeds. Kautilya has also mentioned the usage of loan deeds.[13] Loans deeds were also called rnalekhaya.[14]

Later during the Mauryan period (321-185 BCE), an instrument called adesha was in use, which was an order on a banker directing him to pay the sum on the note to a third person, which corresponds to the definition of a modern bill of exchange. The considerable use of these instruments have been recorded. In large towns, merchants also gave letters of credit to one another.[14]

Medieval era

The use of loan deeds continued into the Mughal era and were called dastawez. Two types of loans deeds have been recorded. The dastawez-e-indultalab was payable on demand and dastawez-e-miadi was payable after a stipulated time. The use of payment orders by royal treasuries, called barattes, have been also recorded. There are also records of Indian bankers using issuing bills of exchange on foreign countries. The evolution of hundis, a type of credit instrument, also occurred during this period and they continue to be in use today.[14]

Colonial era

During the period of British rule merchants established the Union Bank of Calcutta in 1869, first as a private joint stock association, then partnership. Its proprietors were the owners of the earlier Commercial Bank and the Calcutta Bank, who by mutual consent created Union Bank to replace these two banks. In 1840 it established an agency at Singapore, and closed the one at Mirzapore that it had opened in the previous year. Also in 1840 the Bank revealed that it had been the subject of a fraud by the bank's accountant. Union Bank was incorporated in 1845 but failed in 1848, having been insolvent for some time and having used new money from depositors to pay its dividends.[15]

The Allahabad Bank, established in 1865 and still functioning today, is the oldest Joint Stock bank in India, it was not the first though. That honour belongs to the Bank of Upper India, which was established in 1863, and which survived until 1913, when it failed, with some of its assets and liabilities being transferred to the Alliance Bank of Simla.

Foreign banks too started to appear, particularly in Calcutta, in the 1860s. The Comptoir d'Escompte de Paris opened a branch in Calcutta in 1860, and another in Bombay in 1862; branches in Madras and Pondicherry, then a French possession, followed. HSBC established itself in Bengal in 1869. Calcutta was the most active trading port in India, mainly due to the trade of the British Empire, and so became a banking centre.

The first entirely Indian joint stock bank was the Oudh Commercial Bank, established in 1881 in Faizabad. It failed in 1958. The next was the Punjab National Bank, established in Lahore in 1894, which has survived to the present and is now one of the largest banks in India.

Around the turn of the 20th Century, the Indian economy was passing through a relative period of stability. Around five decades had elapsed since the Indian rebellion, and the social, industrial and other infrastructure had improved. Indians had established small banks, most of which served particular ethnic and religious communities.

The presidency banks dominated banking in India but there were also some exchange banks and a number of Indian joint stock banks. All these banks operated in different segments of the economy. The exchange banks, mostly owned by Europeans, concentrated on financing foreign trade. Indian joint stock banks were generally under capitalised and lacked the experience and maturity to compete with the presidency and exchange banks. This segmentation let Lord Curzon to observe, "In respect of banking it seems we are behind the times. We are like some old fashioned sailing ship, divided by solid wooden bulkheads into separate and cumbersome compartments."

The period between 1906 and 1911, saw the establishment of banks inspired by the Swadeshi movement. The Swadeshi movement inspired local businessmen and political figures to found banks of and for the Indian community. A number of banks established then have survived to the present such as Bank of India, Corporation Bank, Indian Bank, Bank of Baroda, Canara Bank and Central Bank of India.

The fervour of Swadeshi movement lead to establishing of many private banks in Dakshina Kannada and Udupi district which were unified earlier and known by the name South Canara ( South Kanara ) district. Four nationalised banks started in this district and also a leading private sector bank. Hence undivided Dakshina Kannada district is known as "Cradle of Indian Banking".

During the First World War (1914–1918) through the end of the Second World War (1939–1945), and two years thereafter until the independence of India were challenging for Indian banking. The years of the First World War were turbulent, and it took its toll with banks simply collapsing despite the Indian economy gaining indirect boost due to war-related economic activities. At least 94 banks in India failed between 1913 and 1918 as indicated in the following table:

| Years | Number of banks that failed | Authorised Capital ( | Paid-up Capital ( |

|---|---|---|---|

| 1913 | 12 | 274 | 35 |

| 1914 | 42 | 710 | 109 |

| 1915 | 11 | 56 | 5 |

| 1916 | 13 | 231 | 4 |

| 1917 | 9 | 76 | 25 |

| 1918 | 7 | 209 | 1 |

Post-Independence

The partition of India in 1947 adversely impacted the economies of Punjab and West Bengal, paralysing banking activities for months. India's independence marked the end of a regime of the Laissez-faire for the Indian banking. The Government of India initiated measures to play an active role in the economic life of the nation, and the Industrial Policy Resolution adopted by the government in 1948 envisaged a mixed economy. This resulted into greater involvement of the state in different segments of the economy including banking and finance. The major steps to regulate banking included:

- The Reserve Bank of India, India's central banking authority, was established in April 1935, but was nationalised on 1 January 1949 under the terms of the Reserve Bank of India (Transfer to Public Ownership) Act, 1948 (RBI, 2005b).[16]

- In 1949, the Banking Regulation Act was enacted which empowered the Reserve Bank of India (RBI) "to regulate, control, and inspect the banks in India".

- The Banking Regulation Act also provided that no new bank or branch of an existing bank could be opened without a license from the RBI, and no two banks could have common directors.

Nationalization in the 1960s

Despite the provisions, control and regulations of the Reserve Bank of India, banks in India except the State Bank of India (SBI), continued to be owned and operated by private persons. By the 1960s, the Indian banking industry had become an important tool to facilitate the development of the Indian economy. At the same time, it had emerged as a large employer, and a debate had ensued about the nationalization of the banking industry. Indira Gandhi, the then Prime Minister of India, expressed the intention of the Government of India in the annual conference of the All India Congress Meeting in a paper entitled "Stray thoughts on Bank Nationalization."[17] The meeting received the paper with enthusiasm.

Thereafter, her move was swift and sudden. The Government of India issued an ordinance ('Banking Companies (Acquisition and Transfer of Undertakings) Ordinance, 1969') and nationalised the 14 largest commercial banks with effect from the midnight of 19 July 1969. These banks contained 85 percent of bank deposits in the country.[17] Jayaprakash Narayan, a national leader of India, described the step as a "masterstroke of political sagacity." Within two weeks of the issue of the ordinance, the Parliament passed the Banking Companies (Acquisition and Transfer of Undertaking) Bill, and it received the presidential approval on 9 August 1969.

A second dose of nationalisation of 6 more commercial banks followed in 1980. The stated reason for the nationalisation was to give the government more control of credit delivery. With the second dose of nationalisation, the Government of India controlled around 91% of the banking business of India. Later on, in the year 1993, the government merged New Bank of India with Punjab National Bank.[18] It was the only merger between nationalised banks and resulted in the reduction of the number of nationalised banks from 20 to 19. After this, until the 1990s, the nationalised banks grew at a pace of around 4%, closer to the average growth rate of the Indian economy.

Liberalization in the 1990s

In the early 1990s, the then government embarked on a policy of liberalization, licensing a small number of private banks. These came to be known as New Generation tech-savvy banks, and included Global Trust Bank (the first of such new generation banks to be set up), which later amalgamated with Oriental Bank of Commerce, UTI Bank (since renamed Axis Bank), ICICI Bank and HDFC Bank. This move, along with the rapid growth in the economy of India, revitalised the banking sector in India, which has seen rapid growth with strong contribution from all the three sectors of banks, namely, government banks, private banks and foreign banks.

The next stage for the Indian banking has been set up with the proposed relaxation in the norms for foreign direct investment, where all foreign investors in banks may be given voting rights which could exceed the present cap of 10% at present. It has gone up to 74% with some restrictions.

The new policy shook the Banking sector in India completely. Bankers, till this time, were used to the 4–6–4 method (borrow at 4%; lend at 6%; go home at 4) of functioning. The new wave ushered in a modern outlook and tech-savvy methods of working for traditional banks. All this led to the retail boom in India. People demanded more from their banks and received more.

Current period

All banks which are included in the Second Schedule to the Reserve Bank of India Act, 1934 are Scheduled Banks. These banks comprise Scheduled Commercial Banks and Scheduled Co-operative Banks. Scheduled Commercial Banks in India are categorised into five different groups according to their ownership and/or nature of operation. These bank groups are:

- State Bank of India and its Associates

- Nationalised Banks

- Private Sector Banks

- Foreign Banks

- Regional Rural Banks.

In the bank group-wise classification, IDBI Bank Ltd. is included in Nationalised Banks. Scheduled Co-operative Banks consist of Scheduled State Co-operative Banks and Scheduled Urban Cooperative Banks.

| Indicators | 31 March of | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | |

| Number of Commercial Banks | 284 | 218 | 178 | 169 | 166 | 163 | 163 | 169 | 151 |

| Number of Branches | 70,373 | 72,072 | 74,653 | 78,787 | 82,897 | 88,203 | 94,019 | 102,377 | 109,811 |

| Population per Banks (in thousands) | 16 | 16 | 15 | 15 | 15 | 14 | 13 | 13 | 12 |

| Aggregate Deposits | |||||||||

| Bank Credit | |||||||||

| Deposit as percentage to GNP (at factor cost) | 62% | 64% | 69% | 73% | 77% | 78% | 78% | 78% | 79% |

| Per Capita Deposit | |||||||||

| Per Capita Credit | |||||||||

| Credit Deposit Ratio | 63% | 70% | 74% | 75% | 74% | 74% | 76% | 79% | 79% |

By 2010, banking in India was generally fairly mature in terms of supply, product range and reach-even though reach in rural India still remains a challenge for the private sector and foreign banks. In terms of quality of assets and capital adequacy, Indian banks are considered to have clean, strong and transparent balance sheets relative to other banks in comparable economies in its region. The Reserve Bank of India is an autonomous body, with minimal pressure from the government.

With the growth in the Indian economy expected to be strong for quite some time-especially in its services sector-the demand for banking services, especially retail banking, mortgages and investment services are expected to be strong. One may also expect M&As, takeovers, and asset sales.

In March 2006, the Reserve Bank of India allowed Warburg Pincus to increase its stake in Kotak Mahindra Bank (a private sector bank) to 10%. This is the first time an investor has been allowed to hold more than 5% in a private sector bank since the RBI announced norms in 2005 that any stake exceeding 5% in the private sector banks would need to be vetted by them.

In recent years critics have charged that the non-government owned banks are too aggressive in their loan recovery efforts in connexion with housing, vehicle and personal loans. There are press reports that the banks' loan recovery efforts have driven defaulting borrowers to suicide.[20][21][22]

By 2013 the Indian Banking Industry employed 1,175,149 employees and had a total of 109,811 branches in India and 171 branches abroad and manages an aggregate deposit of ![]() 67504.54 billion (US$1.1 trillion or €1.0 trillion) and bank credit of

67504.54 billion (US$1.1 trillion or €1.0 trillion) and bank credit of ![]() 52604.59 billion (US$840 billion or €780 billion). The net profit of the banks operating in India was

52604.59 billion (US$840 billion or €780 billion). The net profit of the banks operating in India was ![]() 1027.51 billion (US$16 billion or €15 billion) against a turnover of

1027.51 billion (US$16 billion or €15 billion) against a turnover of ![]() 9148.59 billion (US$150 billion or €140 billion) for the financial year 2012-13.[19]

9148.59 billion (US$150 billion or €140 billion) for the financial year 2012-13.[19]

.png)

On 28 Aug, 2014,Pradhan Mantri Jan Dhan Yojana (Hindi: प्रधानमंत्री जन धन योजना, English: Prime Minister's People Money Scheme) is a scheme for comprehensive financial inclusion launched by the Prime Minister of India, Narendra Modi.[23] Run by Department of Financial Services, Ministry of Finance, on the inauguration day, 1.5 Crore (15 million) bank accounts were opened under this scheme.[24][25] By 10 January 2015, 11.5 crore accounts were opened, with around ![]() 8698 crore (US$1.4 billion) were deposited under the scheme,[26] which also has an option for opening new bank accounts with zero balance.

8698 crore (US$1.4 billion) were deposited under the scheme,[26] which also has an option for opening new bank accounts with zero balance.

Adoption of banking technology

The IT revolution has had a great impact on the Indian banking system. The use of computers has led to the introduction of online banking in India. The use of computers in the banking sector in India has increased many fold after the economic liberalisation of 1991 as the country's banking sector has been exposed to the world's market. Indian banks were finding it difficult to compete with the international banks in terms of customer service, without the use of information technology.

The RBI set up a number of committees to define and co-ordinate banking technology. These have included:

- In 1984 was formed the Committee on Mechanisation in the Banking Industry (1984)[27] whose chairman was Dr. C Rangarajan, Deputy Governor, Reserve Bank of India. The major recommendations of this committee were introducing MICR technology in all the banks in the metropolises in India.[28] This provided for the use of standardized cheque forms and encoders.

- In 1988, the RBI set up the Committee on Computerisation in Banks (1988)[29] headed by Dr. C Rangarajan. It emphasized that settlement operation must be computerized in the clearing houses of RBI in Bhubaneshwar, Guwahati, Jaipur, Patna and Thiruvananthapuram. It further stated that there should be National Clearing of inter-city cheques at Kolkata, Mumbai, Delhi, Chennai and MICR should be made operational. It also focused on computerisation of branches and increasing connectivity among branches through computers. It also suggested modalities for implementing on-line banking. The committee submitted its reports in 1989 and computerisation began from 1993 with the settlement between IBA and bank employees' associations.[30]

- In 1994, the Committee on Technology Issues relating to Payment systems, Cheque Clearing and Securities Settlement in the Banking Industry (1994)[31] was set up under Chairman W S Saraf. It emphasized Electronic Funds Transfer (EFT) system, with the BANKNET communications network as its carrier. It also said that MICR clearing should be set up in all branches of all those banks with more than 100 branches.

- In 1995, the Committee for proposing Legislation on Electronic Funds Transfer and other Electronic Payments (1995)[32] again emphasized EFT system.[30]

Automated teller machine growth

The total number of automated teller machines (ATMs) installed in India by various banks as of end June 2012 was 99,218.[33] The new private sector banks in India have the most ATMs, followed by off-site ATMs belonging to SBI and its subsidiaries and then by nationalised banks and foreign banks, while on-site is highest for the nationalised banks of India.[30]

| Bank type | Number of branches | On-site ATMs | Off-site ATMs | Total ATMs |

|---|---|---|---|---|

| Nationalised banks | 33,627 | 38,606 | 22,265 | 60,871 |

| State Bank of India | 13,661 | 28,926 | 22,827 | 51,753 |

| Old private sector banks | 4,511 | 4,761 | 4,624 | 9,385 |

| New private sector banks | 1,685 | 12,546 | 26,839 | 39,385 |

| Foreign banks | 242 | 295 | 854 | 1,149 |

| TOTAL | 53,726 | 85,134 | 77,409 | 1,62,543 |

Cheque truncation initiative

In 2008 the Reserve Bank of India introduced a system to allow cheque truncation in India, the cheque truncation system as it was known was first rolled out in the National Capital Region and then rolled out nationally.

Expansion of banking infrastructure

Physical as well as virtual expansion of banking through mobile banking, internet banking, tele banking, bio-metric and mobile ATMs is taking place [34] since last decade and has gained momentum in last few years.

See also

- History of banking

- Institute of Banking Personnel Selection

- Banking Frontiers – a monthly magazine, published in Mumbai

References

- ↑ Radhe Shyam Rungta (1970). The Rise of Business Corporations in India, 1851-1900. CUP Archive. p. 221. GGKEY:NC1SA25Y2CB. Retrieved 12 January 2015.

- ↑ H. K. Mishra (1991). Famines and Poverty in India. APH Publishing. p. 197. ISBN 978-81-7024-374-8. Retrieved 12 January 2015.

- ↑ Muthiah S (2011). Madras Miscellany. Westland. p. 933. ISBN 978-93-80032-84-9. Retrieved 12 January 2015.

- ↑ "The Advent of Modern Banking in India: 1720 to 1850s". Reserve Bank of India. Retrieved 12 January 2015.

- ↑ 5.0 5.1 "Evolution of SBI". State Bank of India. Retrieved 12 January 2015.

- ↑ 6.0 6.1 "Business Financing: Banks". Government of India. Retrieved 12 January 2015.

- ↑ "Social Controls, the Nationalisation of Banks and the era of bank expansion - 1968 to 1985". Reserve Bank of India. Retrieved 12 January 2015.

- ↑ D. Muraleedharan (2009). Modern Banking: Theory And Practice. PHI Learning Pvt. Ltd. p. 2. ISBN 978-81-203-3655-1. Retrieved 12 January 2015.

- ↑ "Directory of Bank Offices: Certain Concepts". Reserve Bank of India. Retrieved 12 January 2015.

- ↑ Fred Gottheil (1 January 2013). Principles of Economics. Cengage Learning. p. 417. ISBN 1-133-96206-8. Retrieved 11 January 2015.

- ↑ Santosh Kumar Das (1980). The economic history of ancient India. Cosmo Publications. pp. 229–. ISBN 978-81-307-0423-4.

- ↑ Chris A. Gregory (1997). Savage Money: The Anthropology and Politics of Commodity Exchange. Taylor & Francis. p. 212. ISBN 978-90-5702-091-9. Retrieved 11 January 2015.

- ↑ Md. Aquique (1974). Economic History of Mithila. Abhinav Publications. p. 157. ISBN 978-81-7017-004-4. Retrieved 12 January 2015.

- ↑ 14.0 14.1 14.2 "Evolution of Payment Systems in India". Reserve Bank of India. 12 December 1998. Retrieved 12 January 2015.

- ↑ Cooke, Charles Northcote (1863) The rise, progress, and present condition of banking in India. (Printed by P.M. Cranenburgh, Bengal Print. Co.), pp.177-200.

- ↑ Reference www.rbi.org.in

- ↑ 17.0 17.1 Austin, Granville (1999). Working a Democratic Constitution – A History of the Indian Experience. New Delhi: Oxford University Press. p. 215. ISBN 0-19-565610-5.

- ↑ Parmatam Parkash Arya; B. B. Tandon (2003). Economic Reforms in India: From First to Second Generation and Beyond. Deep & Deep Publications. pp. 369–. ISBN 978-81-7629-435-5.

- ↑ 19.0 19.1 "Statistical Tables Related to Banks in India - Reserve Bank of India" (PDF).

- ↑ "ICICI personal loan customer commits suicide after alleged harassment by recovery agents". Parinda.com. Retrieved 28 July 2010.

- ↑ "Karnataka / Mysore News: ICICI Bank returns tractor to farmer’s mother". The Hindu (Chennai, India). 30 June 2008. Retrieved 28 July 2010.

- ↑ "ICICI’s third eye: It’s Indiatime". Indiatime.com. Retrieved 28 July 2010.

- ↑ "Prime Minister to Launch Pradhan Mantri Jan Dhan Yojana Tomorrow". Press Information Bureau, Govt. of India. 27 August 2014. Retrieved 28 August 2014.

- ↑ ET Bureau (28 August 2014). "PM 'Jan Dhan' Yojana launched; aims to open 1.5 crore bank accounts on first day". The Economic Times. Retrieved 28 August 2014.

- ↑ "Modi: Banking for all to end "financial untouchability"". Reuters. 28 August 2014. Retrieved 29 August 2014.

- ↑ http://www.pmjdy.gov.in/account-statistics-country.aspx

- ↑ "Computerisation of banking sector".

- ↑ "MICR technology".

- ↑ "Committee on Computerisation in Banks (1988)".

- ↑ 30.0 30.1 30.2 INDIAN BANKING SYSTEM. I.K INTERNATIONAL PUBLISHING HOUSE PVT. LTD. 2006. ISBN 81-88237-88-4.

- ↑ "Reforms in banking system".

- ↑ "Reforms of banking sector".

- ↑ Indian banking system. I.K. International. 2006. ISBN 81-88237-88-4.

- ↑ Srivastava, Samir K, "Expansion of banking in India", The Economic Times, 7 June 2008, pp. 8 (Available at: http://m.economictimes.com/PDAET/articleshow/3107960.cms)

Further reading

- The Evolution of the State Bank of India (The Era of the Imperial Bank of India, 1921–1955) (Volume III)

External links

| ||||||||||||||||||||||||||||||||||||||

| ||||||||||||||