Balanced budget

| Public finance |

|---|

|

|

|

|

Reform |

A balanced budget (particularly that of a government) refers to a budget in which revenues are equal to expenditures. Thus, neither a budget deficit nor a budget surplus exists ("the accounts balance"). More generally, it refers to a budget that has no budget deficit, but could possibly have a budget surplus.[1] A cyclically balanced budget is a budget that is not necessarily balanced year-to-year, but is balanced over the economic cycle, running a surplus in boom years and running a deficit in lean years, with these offsetting over time.

Balanced budgets and the associated topic of budget deficits are a contentious point within academic economics and within politics. The mainstream economic view is that having a balanced budget in every year is not desirable, with budget deficits in lean times being desirable. Most economists have also agreed that a balanced budget would decrease interest rates,[2] increase savings and investment,[2] shrink trade deficits and help the economy grow faster over a longer period of time.[2]

Economic views

Mainstream economics—mainly advocates a cyclic balanced budget, arguing from the perspective of Keynesian economics—budget deficits provide fiscal stimulus in lean times, while budget surpluses provide restraint in boom times. However, it should be noted that Keynesian economics does not advocate for fiscal stimulus when the existing government debt is already significant.

Alternative currents in the mainstream and branches of heterodox economics argue differently, with some arguing that budget deficits are always harmful, and others arguing that budget deficits are not only beneficial, but also necessary.

Schools which often argue against the effectiveness of budget deficits as cyclical tools include the freshwater school of mainstream economics and neoclassical economics more generally, and the Austrian school of economics. Budget deficits are argued to be necessary by some within Post-Keynesian economics, notably the Chartalist school.

- Larger deficits, sufficient to recycle savings out of a growing gross domestic product (GDP) in excess of what can be recycled by profit-seeking private investment, are not an economic sin but an economic necessity.[3]

Budget deficits can usually be calculated by subtractng the total planned expenditure from the total available budget. This will then show either a budget deficit (a negative total) or a budget surplus (a positive total).

Political views

United States

In the United States, the fiscal conservatism movement believes that balanced budgets are an important goal. Every state other than Vermont has a balanced budget amendment, providing some form of ban on deficits, while the Oregon kicker bans surpluses of greater than 2% of revenue. The Colorado Taxpayer Bill of Rights (the TABOR amendment) also bans surpluses, and requires the state to refund taxpayers in event of a budget surplus.

Sweden

Following the over-borrowing in both the public and private sector that led to the Swedish banking crisis of the early 1990s and under influence from a series of reports on the future demographic challenges, a wide political consensus developed on fiscal prudence. In the year 2000 this was enshrined in a law that stated a goal of a surplus of 2% over the business cycle, to be used to pay off the public debt and to secure the long-term future for the cherished welfare state. Today the goal is 1% over the business cycle, as the retirement pension is no longer considered a government expenditure.

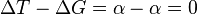

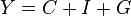

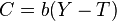

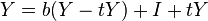

Balanced budget multiplier

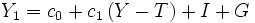

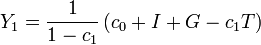

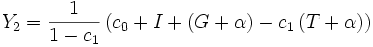

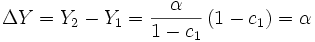

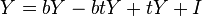

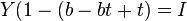

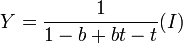

Because of the multiplier effect, it is possible to change aggregate demand (Y) keeping a balanced budget. The government increases its expenditures (G), balancing it by an increase in taxes (T). Since only part of the money taken away from households would have actually been used in the economy, the change in consumption expenditure will be smaller than the change in taxes. Therefore the money which would have been saved by households is instead injected into the economy, itself becoming part of the multiplier process. In general, a change in the balanced budget will change aggregate demand by an amount equal to the change in spending.

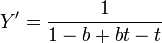

Balanced budget multiplier as taxes depend on income

See also

- Balanced Budget Amendment (United States government)

References

- ↑ Sullivan, Arthur; Steven M. Sheffrin (2003). Economics: Principles in action. Upper Saddle River, New Jersey 07458: Pearson Prentice Hall. pp. 376, 403. ISBN 0-13-063085-3.

- ↑ 2.0 2.1 2.2 "Winners and Losers In a Balanced Budget". The Washington Post. 4 May 1997.

- ↑ (Vickrey 1996, Fallacy 1)

- Vickrey, William (October 5, 1996), Fifteen Fatal Fallacies of Financial Fundamentalism: A Disquisition on Demand Side Economics. Paper was written one week before the author's death, three days before he received the Nobel Memorial Prize in Economics.