Affine term structure model

An affine term structure model is a financial model that relates zero-coupon bond prices (i.e. the discount curve) to a spot rate model. It is particularly useful for inverting the yield curve – the process of determining spot rate model inputs from observable bond market data.

Background

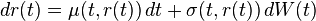

Start with a stochastic short rate model  with dynamics

with dynamics

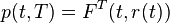

and a risk-free zero-coupon bond maturing at time  with price

with price  at time

at time  . If

. If

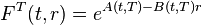

and  has the form

has the form

where  and

and  are deterministic functions, then the short rate model is said to have an affine term structure.

are deterministic functions, then the short rate model is said to have an affine term structure.

Existence

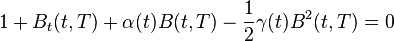

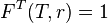

Using Ito's formula we can determine the constraints on  and

and  which will result in an affine term structure. Assuming the bond has an affine term structure and

which will result in an affine term structure. Assuming the bond has an affine term structure and  satisfies the term structure equation, we get

satisfies the term structure equation, we get

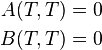

The boundary value

implies

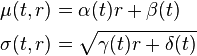

Next, assume that  and

and  are affine in

are affine in  :

:

The differential equation then becomes

Because this formula must hold for all  ,

,  ,

,  , the coefficient of

, the coefficient of  must equal zero.

must equal zero.

Then the other term must vanish as well.

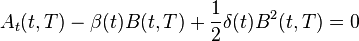

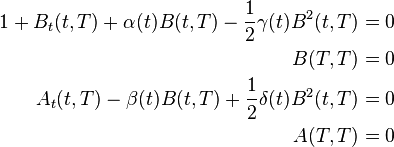

Then, assuming  and

and  are affine in

are affine in  , the model has an affine term structure where

, the model has an affine term structure where  and

and  satisfy the system of equations:

satisfy the system of equations:

Models with ATS

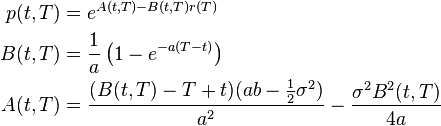

Vasicek

The Vasicek model  has an affine term structure where

has an affine term structure where

References

- Bjork, Tomas (2009). Arbitrage Theory in Continuous Time, third edition. New York, NY: Oxford University Press. ISBN 978-0-19-957474-2.

![A_t(t,T)-\beta(t)B(t,T)+\frac{1}{2}\delta(t)B^2(t,T)-\left[1+B_t(t,T)+\alpha(t)B(t,T)-\frac{1}{2}\gamma(t)B^2(t,T)\right]r=0](../I/m/ae495daf50ad4fa70030168ed2d79ae6.png)