Acceptance set

In financial mathematics, acceptance set is a set of acceptable future net worth which is acceptable to the regulator. It is related to risk measures.

Mathematical Definition

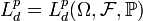

Given a probability space  , and letting

, and letting  be the Lp space in the scalar case and

be the Lp space in the scalar case and  in d-dimensions, then we can define acceptance sets as below.

in d-dimensions, then we can define acceptance sets as below.

Scalar Case

An acceptance set is a set  satisfying:

satisfying:

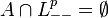

-

-

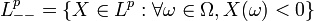

such that

such that

-

- Additionally if

is convex then it is a convex acceptance set

is convex then it is a convex acceptance set

- And if

is a positively homogeneous cone then it is a coherent acceptance set[1]

is a positively homogeneous cone then it is a coherent acceptance set[1]

- And if

Set-valued Case

An acceptance set (in a space with  assets) is a set

assets) is a set  satisfying:

satisfying:

-

with

with  denoting the random variable that is constantly 1

denoting the random variable that is constantly 1  -a.s.

-a.s. -

-

is directionally closed in

is directionally closed in  with

with

-

Additionally, if  is convex (a convex cone) then it is called a convex (coherent) acceptance set. [2]

is convex (a convex cone) then it is called a convex (coherent) acceptance set. [2]

Note that  where

where  is a constant solvency cone and

is a constant solvency cone and  is the set of portfolios of the

is the set of portfolios of the  reference assets.

reference assets.

Relation to Risk Measures

An acceptance set is convex (coherent) if and only if the corresponding risk measure is convex (coherent). As defined below it can be shown that  and

and  .

.

Risk Measure to Acceptance Set

- If

is a (scalar) risk measure then

is a (scalar) risk measure then  is an acceptance set.

is an acceptance set. - If

is a set-valued risk measure then

is a set-valued risk measure then  is an acceptance set.

is an acceptance set.

Acceptance Set to Risk Measure

- If

is an acceptance set (in 1-d) then

is an acceptance set (in 1-d) then  defines a (scalar) risk measure.

defines a (scalar) risk measure. - If

is an acceptance set then

is an acceptance set then  is a set-valued risk measure.

is a set-valued risk measure.

Examples

Superhedging price

The acceptance set associated with the superhedging price is the negative of the set of values of a self-financing portfolio at the terminal time. That is

-

.

.

Entropic risk measure

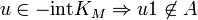

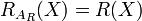

The acceptance set associated with the entropic risk measure is the set of payoffs with positive expected utility. That is

where  is the exponential utility function.[3]

is the exponential utility function.[3]

References

- ↑ Artzner, Philippe; Delbaen, Freddy; Eber, Jean-Marc; Heath, David (1999). "Coherent Measures of Risk". Mathematical Finance 9 (3): 203–228. doi:10.1111/1467-9965.00068.

- ↑ Hamel, A. H.; Heyde, F. (2010). "Duality for Set-Valued Measures of Risk" (pdf). SIAM Journal on Financial Mathematics 1 (1): 66–95. doi:10.1137/080743494. Retrieved August 17, 2012.

- ↑ Follmer, Hans; Schied, Alexander (October 8, 2008). "Convex and Coherent Risk Measures" (pdf). Retrieved July 22, 2010.

![A = \{X \in L^p(\mathcal{F}): E[u(X)] \geq 0\} = \{X \in L^p(\mathcal{F}): E\left[e^{-\theta X}\right] \leq 1\}](../I/m/dc44d3e2dfc0b2c5b9f95b3b74b2c929.png)