Academic perspectives on capitalism

Capitalism is an economic system in which trade, industries, and the means of production are largely or entirely privately owned and operated for profit.[1][2] As an economic system, it has been the subject of contention and debate between economic schools of thought.

Background

Different economic perspectives emphasise specific elements of capitalism in their preferred definition. Laissez-faire and economic liberal economists emphasise the degree to which government does not have control over markets and the importance of property rights.[3][4] Neoclassical and Keynesian macro-economists emphasise the need for government regulation to prevent monopolies and to soften the effects of the boom and bust cycle.[5] Marxian economists emphasise the role of capital accumulation, exploitation and wage labour. Most political economists emphasise private property as well, in addition to power relations, wage labour, class, and the uniqueness of capitalism as a historical formation.[6]

In Marxian theoretics, capitalism is considered the fourth stage of history before the inevitable rise of socialism.

Classical political economy

The classical school of economic thought emerged in Britain in the late 18th century. The classical political economists Adam Smith, David Ricardo, Jean-Baptiste Say, and John Stuart Mill published analyses of the production, distribution and exchange of goods in a market that have since formed the basis of study for most contemporary economists.

In France, 'Physiocrats' like François Quesnay promoted free trade based on a conception that wealth originated from land. Quesnay's Tableau Économique (1759), described the economy analytically and laid the foundation of the Physiocrats' economic theory, followed by Anne Robert Jacques Turgot who opposed tariffs and customs duties and advocated free trade. Richard Cantillon defined long-run equilibrium as the balance of flows of income, and argued that the supply and demand mechanism around land influenced short-term prices.

Smith's attack on mercantilism and his reasoning for "the system of natural liberty" in The Wealth of Nations (1776) are usually taken as the beginning of classical political economy. Smith devised a set of concepts that remain strongly associated with capitalism today. His theories regarding the "invisible hand" are commonly interpreted to mean individual pursuit of self-interest unintentionally producing collective good for society. It was necessary for Smith to be so forceful in his argument in favour of free markets because he had to overcome the popular mercantilist sentiment of the time period.[7]

He criticised monopolies, tariffs, duties, and other state enforced restrictions of his time and believed that the market is the most fair and efficient arbitrator of resources. This view was shared by David Ricardo, second most important of the classical political economists and one of the most influential economists of modern times.[8]

In On the Principles of Political Economy and Taxation (1817), he developed the law of comparative advantage, which explains why it is profitable for two parties to trade, even if one of the trading partners is more efficient in every type of economic production. This principle supports the economic case for free trade. Ricardo was a supporter of Say's Law and held the view that full employment is the normal equilibrium for a competitive economy.[9] He also argued that inflation is closely related to changes in quantity of money and credit and was a proponent of the law of diminishing returns, which states that each additional unit of input yields less and less additional output.[10]

The values of classical political economy are strongly associated with the classical liberal doctrine of minimal government intervention in the economy, though it does not necessarily oppose the state's provision of a few basic public goods.[11] Classical liberal thought has generally assumed a clear division between the economy and other realms of social activity, such as the state.[12]

While economic liberalism favours markets unfettered by the government, it maintains that the state has a legitimate role in providing public goods.[13] For instance, Adam Smith argued that the state has a role in providing roads, canals, schools and bridges that cannot be efficiently implemented by private entities. However, he preferred that these goods should be paid proportionally to their consumption (e.g. putting a toll). In addition, he advocated retaliatory tariffs to bring about free trade, and copyrights and patents to encourage innovation.[13]

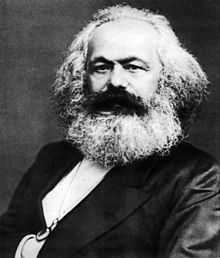

Marxian analysis

The Marxian theory of historical materialism states the history of the world is fundamentally determined by the material conditions at any given time – in other words, the relationships which people have with each other in order to fulfil basic needs such as feeding, clothing and housing themselves and their families.[14] Overall, Marx and Engels claimed to have identified five successive stages of the development of these material conditions in Western Europe.[15]

Marxian theory pays special attention to the development of capitalism in human development. The bulk of his work is devoted to exploring the mechanisms of capitalism, which in western society classically arose "red in tooth and claw" from feudal society in a revolutionary movement.

Capitalism is considered the Fourth Stage in the Marxian stages of history, appearing after the bourgeois revolution when the capitalists (or their merchant predecessors) overthrow the feudal system. Capitalism is characterised by the following:[16][17][18][19]

- Market economy: In capitalism, the entire economy is guided by market forces. Supporters of laissez faire economics argue that there should be little or no intervention from the government under capitalism. Marxists, however, such as Lenin in his Imperialism, the Highest Stage of Capitalism, argue that the capitalist government is a powerful instrument for the furtherance of capitalism and the capitalist nation-state, particularly in the conquest of markets abroad.

- Private property: The means of production are no longer in the hands of the monarchy and its nobles, but rather they are controlled by the capitalists. The capitalists control the means of production through commercial enterprises (such as corporations) which aim to maximise profit.

- Parliamentary democracy: The capitalists tend to govern through an elected centralised parliament or congress, rather than under an autocracy. Capitalist (bourgeois) democracy, although it may be extended to the whole population, does not necessarily lead to universal suffrage. Historically it has excluded (by force, segregation, legislation or other means) sections of the population such as women, slaves, ex-slaves, people of colour or those on low income. The government acts on behalf of, and is controlled by, the capitalists through various methods.

- Wages: In capitalism, workers are rewarded according to their contract with their employer. Power elites propagate the illusion that market forces mean wages converge to an equilibrium at which workers are paid for precisely the value of their services. In reality workers are paid less than the value of their productivity — the difference forming profit for the employer. In this sense all paid employment is exploitation and the worker is "alienated" from their work. Insofar as the profit-motive drives the market, it is impossible for workers to be paid for the full value of their labour, as all employers will act in the same manner.

- Imperialism: Wealthy countries seek to dominate poorer countries in order to gain access to raw materials and to provide captive markets for finished products. This is done directly through war, the threat of war, or the export of capital. The capitalist's control over the state can play an essential part in the development of capitalism, to the extent the state directs warfare and other foreign intervention.

- Financial institutions: Banks and capital markets such as stock exchanges direct unused capital to where it is needed. They reduce barriers to entry in all markets, especially to the poor; it is in this way that banks dramatically improve class mobility.

- Monopolistic tendencies: The natural, unrestrained market forces will create monopolies from the most successful commercial entities.

In capitalism, the profit motive rules and people, freed from serfdom, work for the capitalists for wages. The capitalist class are free to spread their laissez faire practices around the world. In the capitalist-controlled parliament, laws are made to protect wealth.

But according to Marx, capitalism, like slave society and feudalism, also has critical failings — inner contradictions which will lead to its downfall. The working class, to which the capitalist class gave birth in order to produce commodities and profits, is the "grave digger" of capitalism. The worker is not paid the full value of what he or she produces. The rest is surplus value — the capitalist's profit, which Marx calls the "unpaid labour of the working class." The capitalists are forced by competition to attempt to drive down the wages of the working class to increase their profits, and this creates conflict between the classes, and gives rise to the development of class consciousness in the working class. The working class, through trade union and other struggles, becomes conscious of itself as an exploited class.

In the view of classical Marxism, the struggles of the working class against the attacks of the capitalist class lead the working class to establish its own collective control over production — the basis of socialist society. Marx believed that capitalism always leads to monopolies and leads the people to poverty; yet the fewer the restrictions on the free market, (e.g. from the state and trade unions) the sooner it finds itself in crisis. Marx is rather vague in his explanation of how the working class will come to consciousness.

The capitalist stage of development or "bourgeois society," for Marx, represented the most advanced form of social organisation to date, but Marxian ideology postulates that the working classes will come to power in a worldwide socialist transformation of human society as the end of the series of first aristocratic, then capitalist, and finally working class rule was reached.[20][21]

Following Adam Smith, Marx distinguished the use value of commodities from their exchange value in the market. Capital, according to Marx, is created with the purchase of commodities for the purpose of creating new commodities with an exchange value higher than the sum of the original purchases. For Marx, the use of labor power had itself become a commodity under capitalism; the exchange value of labor power, as reflected in the wage, is less than the value it produces for the capitalist.

In conjunction with his criticism of capitalism was Marx's belief that the working class, due to its relationship to the means of production and numerical superiority under capitalism, would be the driving force behind the socialist revolution.[22] This argument is intertwined with Marx's version of the labor theory of value arguing that labor is the source of all value, and thus of profit.

Weberian political sociology

In social science, the understanding of the defining characteristics of capitalism has been strongly influenced by the German sociologist, Max Weber. Weber considered market exchange, a voluntary supply of labour and a planned division of labour within the enterprises as defining features of capitalism. Capitalist enterprises, in contrast to their counterparts in prior modes of economic activity, were directed toward the rationalisation of production, maximising efficiency and productivity – a tendency embedded in a sociological process of enveloping rationalisation that formed modern legal bureaucracies in both public and private spheres.[23] According to Weber, workers in pre-capitalist economies understood work in terms of a personal relationship between master and journeyman in a guild, or between lord and peasant in a manor.[24]

For these developments of capitalism to emerge, Weber argued, it was necessary the development of a "capitalist spirit"; that is, ideas and habits that favour a rational pursuit of economic gain. These ideas, in order to propagate a certain manner of life and come to dominate others, "had to originate somewhere ... as a way of life common to whole groups of men".[23] In his book The Protestant Ethic and the Spirit of Capitalism (1904–1905), Weber sought to trace how a particular form of religious spirit, infused into traditional modes of economic activity, was a condition of possibility of modern western capitalism. For Weber, the 'spirit of capitalism' was, in general, that of ascetic Protestantism; this ideology was able to motivate extreme rationalisation of daily life, a propensity to accumulate capital by a religious ethic to advance economically through hard and diligent work, and thus also the propensity to reinvest capital. This was sufficient, then, to create "self-mediating capital" as conceived by Marx.

This is pictured in the Protestant understanding of beruf [25] – whose meaning encompass at the same time profession, vocation, and calling – as exemplified in Proverbs 22:29, "Seest thou a man diligent in his calling? He shall stand before kings". In the Protestant Ethic, Weber describes the developments of this idea of calling from its religious roots, through the understanding of someone's economic success as a sign of his salvation, until the conception that moneymaking is, within the modern economic order, the result and the expression of diligence in one's calling.

Finally, as the social mores critical for its development became no longer necessary for its maintenance, modern western capitalism came to represent the order "now bound to the technical and economic conditions of machine production which today determine the lives of all the individuals who are born into this mechanism, not only those directly concerned with economic acquisition, with irresistible force. Perhaps it will so determine them until the last ton of fossilised coal is burnt" (p. 123).[26] This is further seen in his criticism of "specialists without spirit, hedonists without a heart" that were developing, in his opinion, with the fading of the original Puritan "spirit" associated with capitalism.

Institutional economics

Institutional economics, once the main school of economic thought in the United States, holds that capitalism cannot be separated from the political and social system within which it is embedded. It stresses the legal foundations of capitalism (see John R. Commons) and the evolutionary, habituated, and volitional processes by which institutions are erected and then changed.

One key figure in institutional economics was Thorstein Veblen who in his book, The Theory of the Leisure Class (1899), analysed the motivations of wealthy people in capitalism who conspicuously consumed their riches as a way of demonstrating success. The concept of conspicuous consumption was in direct contradiction to the neoclassical view that capitalism was efficient.

In The Theory of Business Enterprise (1904) Veblen distinguished the motivations of industrial production for people to use things from business motivations that used, or misused, industrial infrastructure for profit, arguing that the former often is hindered because businesses pursue the latter. Output and technological advance are restricted by business practices and the creation of monopolies. Businesses protect their existing capital investments and employ excessive credit, leading to depressions and increasing military expenditure and war through business control of political power.

New institutional economics

New institutional economics, a field pioneered by Douglass North, stresses the need of a legal framework in order for capitalism to function optimally, and focuses on the relationship between the historical development of capitalism and the creation and maintenance of political and economic institutions.[27] In new institutional economics and other fields focusing on public policy, economists seek to judge when and whether governmental intervention (such as taxes, welfare, and government regulation) can result in potential gains in efficiency. According to Gregory Mankiw, a New Keynesian economist, governmental intervention can improve on market outcomes under conditions of "market failure", or situations in which the market on its own does not allocate resources efficiently.[28]

German Historical School and Austrian School

From the perspective of the German Historical School, capitalism is primarily identified in terms of the organisation of production for markets. Although this perspective shares similar theoretical roots with that of Weber, its emphasis on markets and money lends it different focus.[29] For followers of the German Historical School, the key shift from traditional modes of economic activity to capitalism involved the shift from medieval restrictions on credit and money to the modern monetary economy combined with an emphasis on the profit motive.

In the late 19th century, the German Historical School of economics diverged, with the emerging Austrian School of economics, led at the time by Carl Menger. Later generations of followers of the Austrian School continued to be influential in Western economic thought in the early part of the 20th century.

Austrian-born economist Joseph Schumpeter, sometimes associated with the School,[30] emphasised the "creative destruction" of capitalism—the fact that market economies undergo constant change. Schumpeter argued that at any moment in time there are rising industries and declining industries. Schumpeter, and many contemporary economists influenced by his work, argue that resources should flow from the declining to the expanding industries for an economy to grow, but they recognised that sometimes resources are slow to withdraw from the declining industries because of various forms of institutional resistance to change.

The Austrian economists Ludwig von Mises and Friedrich Hayek were among the leading defenders of market economy against 20th century proponents of socialist planned economies. Mises and Hayek argued that only market capitalism could manage a complex, modern economy.

Since a modern economy produces such a large array of distinct goods and services, and consists of such a large array of consumers and enterprises, argued Mises and Hayek, the information problems facing any other form of economic organisation other than market capitalism would exceed its capacity to handle information. Thinkers within Supply-side economics built on the work of the Austrian School, and particularly emphasise Say's Law: "supply creates its own demand." Capitalism, to this school, is defined by lack of state restraint on the decisions of producers.

Keynesian economics

In his 1936 The General Theory of Employment, Interest and Money, the British economist John Maynard Keynes argued that capitalism suffered a basic problem in its ability to recover from periods of slowdowns in investment. Keynes argued that a capitalist economy could remain in an indefinite equilibrium despite high unemployment.

Essentially rejecting Say's law, he argued that some people may have a liquidity preference that would see them rather hold money than buy new goods or services, which therefore raised the prospect that the Great Depression would not end without what he termed in the General Theory "a somewhat comprehensive socialisation of investment."

Keynesian economics challenged the notion that laissez-faire capitalist economics could operate well on their own, without state intervention used to promote aggregate demand, fighting high unemployment and deflation of the sort seen during the 1930s. He and his followers recommended "pump-priming" the economy to avoid recession: cutting taxes, increasing government borrowing, and spending during an economic down-turn. This was to be accompanied by trying to control wages nationally partly through the use of inflation to cut real wages and to deter people from holding money.[31]

John Maynard Keynes tried to provide solutions to many of Marx's problems without completely abandoning the classical understanding of capitalism. His work attempted to show that regulation can be effective, and that economic stabilisers can rein in the aggressive expansions and recessions that Marx disliked. These changes sought to create more stability in the business cycle, and reduce the abuses of labourers. Keynesian economists argue that Keynesian policies were one of the primary reasons capitalism was able to recover following the Great Depression.[32] The premises of Keynes's work have, however, since been challenged by neoclassical and supply-side economics and the Austrian School.

In The General Theory and later, Keynes also responded to the socialists and left-wing liberals who argued, especially during the Depression of the 1930s, that capitalism caused war. He argued that if capitalism were managed, domestically and internationally (with coordinated international Keynesian policies, an international monetary system that didn't pit the interests of countries against each other, and a high degree of freedom of trade), then this system of managed capitalism would promote peace rather than conflict between countries. His plans during World War II for post-war international economic institutions and policies (which contributed to the creation at Bretton Woods of the International Monetary Fund and the World Bank, and later to the creation of the General Agreement on Tariffs and Trade and eventually the World Trade Organisation) were aimed to give effect to this vision.[33]

Another challenge to Keynesian thinking came from his colleague Piero Sraffa, and subsequently from the Neo-Ricardian school that followed Sraffa. In Sraffa's highly technical analysis, capitalism is defined by an entire system of social relations among both producers and consumers, but with a primary emphasis on the demands of production. According to Sraffa, the tendency of capital to seek its highest rate of profit causes a dynamic instability in social and economic relations.

Neoclassical economics and the Chicago School

Neoclassical economics explain capitalism as made up of individuals, enterprises, markets and government. According to their theories, individuals engage in a capitalist economy as consumers, labourers, and investors. As labourers, individuals may decide which jobs to prepare for, and in which markets to look for work. As investors they decide how much of their income to save and how to invest their savings. These savings, which become investments, provide much of the money that businesses need to grow.

Business firms decide what to produce and where this production should occur. They also purchase inputs (materials, labour, and capital). Businesses try to influence consumer purchase decisions through marketing and advertisement, as well as the creation of new and improved products. Driving the capitalist economy is the search for profits (revenues minus expenses). This is known as the profit motive, and it helps ensure that companies produce the goods and services that consumers desire and are able to buy. To be profitable, firms must sell a quantity of their product at a certain price to yield a profit. A business may lose money if sales fall too low or if its costs become too high. The profit motive encourages firms to operate more efficiently. By using less materials, labour or capital, a firm can cut its production costs, which can lead to increased profits.

An economy grows when the total value of goods and services produced rises. This growth requires investment in infrastructure, capital and other resources necessary in production. In a capitalist system, businesses decide when and how much they want to invest.

Income in a capitalist economy depends primarily on what skills are in demand and what skills are being supplied. Skills that are in scarce supply are worth more in the market and can attract higher incomes. Competition among workers for jobs — and among employers for skilled workers — help determine wage rates. Firms need to pay high enough wages to attract the appropriate workers; when jobs are scarce, workers may accept lower wages than they would when jobs are plentiful. Trade union and governments influence wages in capitalist systems. Unions act to represent their members in negotiations with employers over such things as wage rates and acceptable working conditions.

Milton Friedman took many of the basic principles set forth by Adam Smith and the classical economists and gave them a new twist. One example of this is his article in the September 1970 issue of The New York Times Magazine, where he argues that the social responsibility of business is "to use its resources and engage in activities designed to increase its profits ... (through) open and free competition without deception or fraud." This is similar to Smith's argument that self-interest in turn benefits the whole of society.[34] Work like this helped lay the foundations for the coming marketisation (or privatisation) of state enterprises and the supply-side economics of Ronald Reagan and Margaret Thatcher.

The Chicago School of economics is best known for its free market advocacy and monetarist ideas. According to Friedman and other monetarists, market economies are inherently stable if left to themselves and depressions result only from government intervention.[35]

Friedman, for example, argued that the Great Depression was result of a contraction of the money supply, controlled by the Federal Reserve, and not by the lack of investment as John Maynard Keynes had argued. Ben Bernanke, former Chairman of the Federal Reserve, is among the economists today generally accepting Friedman's analysis of the causes of the Great Depression.[36]

Neoclassical economists[37] subscribe to a subjective theory of value, according to which the value derived from consumption of a good, rather than being objective and static, varies widely from person to person and for the same person at different times. Adherence to a subjective theory of value compels Neoclassical thinkers to reject the labour theory of value upheld by Adam Smith and other classical liberal thinkers, which was grounded upon a conception of objective value.

References

- ↑ "Capitalism" Oxford Dictionaries. "capitalism. an economic and political system in which a country's trade and industry are controlled by private owners for profit, rather than by the state." Retrieved 4 January 2013.

- ↑ Chris Jenks. Core Sociological Dichotomies. "Capitalism, as a mode of production, is an economic system of manufacture and exchange which is geared toward the production and sale of commodities within a market for profit, where the manufacture of commodities consists of the use of the formally free labour of workers in exchange for a wage to create commodities in which the manufacturer extracts surplus value from the labour of the workers in terms of the difference between the wages paid to the worker and the value of the commodity produced by him/her to generate that profit." London, England, UK; Thousand Oaks, California, USA; New Delhi, India: SAGE. p. 383.

- ↑ Tucker, Irvin B. (1997). Macroeconomics for Today. p. 553.

- ↑ Case, Karl E. (2004). Principles of Macroeconomics. Prentice Hall.

- ↑ Fulcher, James (2004). Capitalism A Very Short Introduction. Oxford University Press. p. 41.

- ↑ Stilwell, Frank. “Political Economy: the Contest of Economic Ideas.” First Edition. Oxford University Press. Melbourne, Australia. 2002.

- ↑ Degen, Robert. The Triumph of Capitalism. 1st ed. New Brunswick, NJ: Transaction Publishers, 2008.

- ↑ Hunt, E.K. (2002). History of Economic Thought: A Critical Perspective. M.E. Sharpe. p. 92.

- ↑ Blackwell Encyclopedia of Political Thought. Blackwell Publishing. 1991. p. 91.

- ↑ Skousen, Mark (2001). The Making of Modern Economics: The Lives and Ideas of the Great Thinkers. M.E. Sharpe. pp. 98–102, 134.

- ↑ Eric Aaron, What's Right? (Dural, Australia: Rosenberg Publishing, 2003), 75.

- ↑ Calhoun, Craig (2002). Capitalism: Dictionary of the Social Sciences. Oxford University Press.

- ↑ 13.0 13.1 "Adam Smith". econlib.org.

- ↑ See, in particular, Marx and Engels, The German Ideology

- ↑ Marx makes no claim to have produced a master key to history. Historical materialism is not "an historico-philosophic theory of the marche generale imposed by fate upon every people, whatever the historic circumstances in which it finds itself" (Marx, Karl: Letter to editor of the Russian paper Otetchestvennye Zapiskym, 1877). His ideas, he explains, are based on a concrete study of the actual conditions that pertained in Europe.

- ↑ Marx, Early writings, Penguin, 1975, p. 426.

- ↑ Charles Taylor, “Critical Notice”, Canadian Journal of Philosophy 10 (1980), p. 330.

- ↑ Marx and Engels, The Critique of the Gotha Programme

- ↑ Marx and Engels, The Civil War in France

- ↑ The Communist Manifesto

- ↑ "To Marx, the problem of reconstituting society did not arise from some prescription, motivated by his personal predilections; it followed, as an iron-clad historical necessity – on the one hand, from the productive forces grown to powerful maturity; on the other, from the impossibility further to organise these forces according to the will of the law of value." – Leon Trotsky, "Marxism in our Time", 1939 (Inevitability of Socialism), WSWS.org

- ↑ Wheen, Francis Books That Shook the World: Marx's Das Kapital1st ed. London: Atlantic Books, 2006

- ↑ 23.0 23.1 Bendix, Reinhard: Max Weber: An Intellectual Portrait. Love & Brydone; London, 1959

- ↑ Kilcullen, John (1996). "Max Weber: On Capitalism". Macquarie University. Retrieved 26 February 2008.

- ↑ Max Weber; Peter R. Baehr; Gordon C. Wells (2002). The Protestant ethic and the "spirit" of capitalism and other writings. Penguin.

- ↑ "Conference Agenda" (PDF). Economy and Society. Retrieved 26 February 2008.

- ↑ North, Douglass C. (1990). Institutions, Institutional Change and Economic Performance. Cambridge University Press.

- ↑ Mankiw, Gregory (1997). Principles of Economics. Harvard University. p. 10. ISBN 0-03-024719-5.

- ↑ Burnham, Peter (2003). Capitalism: The Concise Oxford Dictionary of Politics. Oxford University Press.

- ↑ David Simpson, (1983) "Joseph Schumpeter and the Austrian School of Economics", Journal of Economic Studies, Vol. 10 Iss: 4, pp. 18–28

- ↑ Paul Mattick. "Marx and Keynes: the limits of the mixed economy". Marxists. Retrieved 26 February 2008.

- ↑ Erhardt III, Erwin. "History of Economic Development." University of Cincinnati. Lindner Center Auditorium, Cincinnati. 7 November 2008.

- ↑ See Donald Markwell, John Maynard Keynes and International Relations: Economic Paths to War and Peace, Oxford University Press, 2006.

- ↑ Friedman, Milton. "The Social Responsibility of Business is to Increase its Profits." The New York Times Magazine 13 September 1970.

- ↑ Felderer, Bernhard. Macroeconomics and New Macroeconomics.

- ↑ Ben Bernanke (8 November 2002). "Remarks by Governor Ben S. Bernanke". The Federal Reserve Board. Retrieved 26 February 2008.

- ↑ Yonary, Yuval P. (1998). The Struggle Over the Soul of Economics. Princeton University Press. p. 29. ISBN 0-691-03419-2.

External links

| Wikimedia Commons has media related to Capitalism. |

| Wikisource has the text of the 1922 Encyclopædia Britannica article Academic perspectives on capitalism. |

| Wikiquote has quotations related to: Academic perspectives on capitalism |

| Look up academic perspectives on capitalism in Wiktionary, the free dictionary. |

- Capitalism on In Our Time at the BBC. (listen now)

- Hessen, Robert (2008). Capitalism. The Concise Encyclopedia of Economics (2nd ed.). Library of Economics and Liberty. ISBN 978-0865976658. OCLC 237794267.

- Center on Capitalism and Society at Columbia University

- Center for the Study of Capitalism at Wake Forest University

- Commonwealth Club of California-Dr. Yaron Brook and Dr. David Callahan: Is Capitalism Moral? A Debate – October 22, 2012

- Basic Characteristics of Capitalism from textbooksfree.org

- Selected Titles on Capitalism and Its Discontents. Harvard University Press

- Growth, Accumulation, Crisis: With New Macroeconomic Data for Sweden 1800-2000 by Rodney Edvinsson

- David Harvey, Reading Marx's Capital, Reading Marx’s Capital - Class 11, Chapter 25, The General Law of Capitalist Accumulation (video lecture)

| Library resources about Capitalism |

| ||||||||||||||||||||||||||