Value-form

| Part of a series on |

| Marxian economics |

|---|

|

|

Concepts

|

|

Topics |

|

Variants

|

|

Works

|

|

|

Journals

|

|

Related topics |

|

| Part of a series on |

| Marxism |

|---|

|

|

Theoretical works

|

|

|

|

People |

|

The value-form or form of value (Wertform in German) is a concept in Karl Marx's critique of political economy.[1] It refers to the social form (a socially attributed status) of a commodity (any product traded in markets), which contrasts with the tangible use-value or utility (its "useful form" or "natural form") which it has, as a product which satisfies some human need. The use-value of a product is normally observable when we see the product being used. The economic value of a product, however, refers to a symbolized relationship which is not directly observable, except as a number signalling a potential money-price. If we consider products purely as "values" of a certain magnitude, we disregard and abstract away from all the different use-values they can have in their tangible shapes and forms.

Marx borrowed, criticized and developed the idea of the form of value from the Greek philosopher Aristotle, who pondered the nature of exchange value in chapter 5 of Book 5 in his Nicomachean Ethics.[2] In so doing, Marx was also influenced by, and responding to, the classical political economy discourse about the economic laws governing commodity values and money,[3] beginning with William Petty's Quantulumcunque Concerning Money (1682)[4] and culminating with David Ricardo's Principles of Political Economy and Taxation (1817).

Marx's concept is introduced in the first chapter of Das Kapital[5] where Marx argues economic value becomes manifest in an objectified way only through the form of value established by the exchange of products. People know very well that any product represents a value, i.e. there is an economic cost of supply for the product. But how much value? What something is economically "worth" can be expressed only relatively, by relating, weighing, comparing and equating it to amounts of other tradeable objects (or to the labour effort or sum of money those objects represent).[6] The value of products is expressed by their exchange-value, by what they can trade for. Because value is expressed as exchange-value, it seems to the ordinary observer that value and exchange-value are simply the same thing. In that case, value simply expresses a relationship between products with a trading ratio. Since exchange-value is most often expressed by a money-price, it seems that "value", "price" and "money" are really the same thing. But Marx argues they are not the same things.

Issues of interpretation

The "problem" of a form-analysis of value

Essentially, Marx's value-form analysis intends to answer the question, how are the value-relationships of products expressed in ways that acquire an objective existence in their own right (ultimately as relationships between quantities of money, or money-prices),[7] and how these product-values can change, independently of the valuers who trade in them.[8] Marx argued that neither the classical political economists nor the vulgar economists who succeeded them were able to explain satisfactorily how that worked, resulting in serious theoretical errors. The reason behind the errors was—according to Marx—that, as market trade developed, the economic relationship between commodity-values and money increasingly appeared in an inverted, reified way. In reality, economic value is a social relationship between people that is reflected by a thing or expressed by the relationship between things. Yet it often seems more like value is a thing which creates the social relationship.

Marx's idea can be traced back to his 1857 Grundrisse manuscript where he contrasted communal production with production for exchange.[9] Marx notes in Das Kapital that:

It is one of the chief failings of classical political economy that it has never succeeded, by means of its analysis of commodities, and in particular of their value, in discovering the form of value which in fact turns value into exchange-value... The value-form of the product of labour is the most abstract, but also the most universal form of the bourgeois mode of production; by that fact it stamps the bourgeois mode of production as a particular kind of social production of a historical and transitory character. If then we make the mistake of treating it as the eternal natural form of social production, we necessarily overlook the specificity of the value-form, and consequently of the commodity form together with its further developments, the money form, the capital form, etc. We therefore find that economists who are entirely agreed that labour-time is the measure of the magnitude of value, have the strangest and most contradictory ideas about money, that is, about the universal equivalent in its finished form.[10]

Similarly, in vulgar (or vulgar Marxist) economics, the commodity is simply a combination of use-value and exchange-value. That is not Marx's own argument.[11] As he explains in Capital, Volume III, business competition among producers centres precisely on the discrepancies between the socially established values of commodities and their particular exchange-values.[12] Marx believed that correctly distinguishing between the form and content of value was essential for the logical coherence of the labour theory of value,[13] and he criticized Adam Smith specifically because Smith:

confuses the measure of value as the immanent measure which at the same time forms the substance of value [i.e., labour-time], with the measure of value in the sense that money is called a measure of value.[14]

Althusserian interpretation

The value-form is often regarded as a difficult, obscure or even esoteric idea by scholars, and there has been considerable debate about its real theoretical significance. Marx himself started off the controversy when he emphasized that Capital, Volume I was not difficult to understand, "with the exception of the section on the form of value."[15] In his "Preface to Capital Vol. 1," the French philosopher Louis Althusser famously asserted:

The greatest difficulties, theoretical or otherwise, which are obstacles to an easy reading of Capital Volume One are unfortunately (or fortunately) concentrated at the very beginning of Volume One, to be precise, in its first Part, which deals with 'Commodities and Money'. I therefore give the following advice: put the whole of Part One aside for the time being and begin your reading with Part Two...[16]

Althusser's suggestions were taken up by many New Left Marxists, which meant that Marx's theory of the value-form and its significance were rarely taught.[17] However, Marx very deliberately and explicitly made an effort to state his interpretation of commodity trade with absolute clarity in his first chapters. Marx aims to demonstrate that the "labour theory of value" that guided the classical political economists in interpreting the economy cannot be correct, because the concept of economic value itself is misconstrued.

Academic difficulties

Probably the difficulty Marxist academics have had with Marx's own text is because, abstractly, economic value refers at the same time to quantitative and qualitative dimensions,[18] which can be stated according to both absolute and relative criteria, and expressed as:

- a relationship

- a subjective orientation

- an attribute

- an object in its own right

From the use of the expression "value" it may therefore not be immediately obvious what kind of valuation or expression is being referred to, it depends on the theoretical context.[19] Ladislaus von Bortkiewicz, the originator of the famous "transformation problem" controversy, claimed confidently that in Marx's text, "the context always reveals clearly which value is meant".[20] Nevertheless, there have been very lengthy academic debates about what Marx really did mean in particular passages. Rigorously investigated, the concept of "value" turns out not to be a "neat-and-tidy accounting concept" that can be manipulated with mathematical precision; it can be manipulated with mathematical precision only if a series of definitions are already fixed and assumed (it is a fuzzy concept). At the end of his life, David Ricardo had to "conclude, rather sadly, that 'there is no such thing in nature as a perfect measure of value' (1823, p. 404) – there is no such thing as an invariable standard of value".[21]

In addition, official economics typically takes it for granted that the exchange processes on which markets are based already exist and will occur, and that prices already exist, or can be imputed. This is often called the "gross substitution axiom" by economists: all products are, in principle, supposed to be mutually interchangeable, and therefore the "price mechanism" can allocate resources in such a way, that market equilibria are assured by the laws of supply and demand.[22] This assumption is overturned only in special cases, where markets still must be brought into being and a process of "price discovery" takes place. In modern economics, the "value" of something is defined either as a money-price, or as a personal (subjective) valuation, and the exchangeability of products as such presents no special problem; it normally does not merit any special inquiry since exchangeability as such is taken for granted.

According to orthodox economics, money serves as a medium of exchange to minimize the transaction costs of barter among utility-maximizing individuals. Such an approach is very different from Marx's historical interpretation of the formation of value. In Marx's theory, the "value" of a product is something separate and distinct from the "price" it happens to fetch (goods can sell for more than they are worth, or less, i.e., they are not necessarily worth what they happen to sell for).[23]

Value-form and commodity fetishism

The theory of the forms of value is the basis for Marx's concept of commodity fetishism, which concerns how the independent power acquired by the value of tradeable objects is reflected back into human thought, and more specifically into the theories of the political economists about the market economy. In Althusserian theory, however, this meaning is unknown, because Althusserian theory detaches the concept of "commodity fetishism" from the concept of the "value-form". Almost none of the New Left discussions of commodity fetishism refer to Marx's value-form analysis in any depth.[24]

In the reified perception of the political economists and the vulgar Marxists, products have value because they are expressible in money-prices, but Marx argues that in reality it is just the other way round: because commodities have value, i.e. because they are all products of social labour, their values can be expressed by generally accepted money-prices, accurately or not. The true relationship can, however, be traced out only when the historical evolution of economic exchange is considered from its most simple beginnings to its most developed forms. The end-result of market development is a fully monetized economy (a "cash economy"), but how its workings appear to the individual at the micro-level, is often the exact inverse of its causal dynamic at the macro-level. According to Marx, this creates a lot of confusions in economic theorizing.

Basic explanation

Marx initially defines a product of human labour that has become a commodity (in German: Kaufware, i.e., merchandise, ware for sale) as being simultaneously:

- A useful object that can satisfy a want or need (a use value); this is the value of object considered from the point of view of consuming or using it, referring to its observable material form, i.e., the tangible, observable characteristics it has that make it useful, and therefore valued by people, even if the use is only symbolic.

- An object of economic value generally; this is the value of the object considered from the point of view of its earnings potential, its sale value or its cost of production ("commercial value"). The reference here is to the social form of the product, which is not directly observable.

The "form of value" (also a reference to phenomenology in the classical philosophical sense used by Hegel) then refers to the specific ways of relating through which "what a commodity is worth" happens to be socially expressed in trading processes, when different products and assets are compared with each other. Practically speaking, Marx argues that the product values cannot be directly observed and can become observably manifest only as exchange-values, i.e., as relative expressions, by comparing their worth to other goods they can be traded for. This causes people to think value and exchange-value are the same thing, but Marx argues they are not; the content, magnitude and form of value must be distinguished, and according to the law of value, the exchange value of products being traded is determined and regulated by their value.

Historical change

Marx argues that the form of value is not "static" or "fixed once and for all", but rather, that it develops logically and historically in trading processes from very simple, primitive expressions to very complicated or sophisticated expressions. Subsequently he also examines the various forms taken by capital, the forms of wages, and so forth. In each case, the form denotes how a specific social or economic relationship among people is expressed or symbolized.

Initially, in primitive exchange, the form that economic value takes does not even involve any prices, since what something is "worth" is very simply expressed in (a quantity of) some other good (an occasional barter relationship).[25] Some scholars, such as Hans-Georg Backhaus, argue that for this reason value simply did not exist in societies where money was not used. Marx, though, argues that product-values did exist in primitive economies, but that establishing how much products were worth followed customary practices, rather than purely a comparison with other products, or reckoning with money; thus, value was merely expressed in a different way. All the time, that is, people knew quite well that their products had value because it cost work-effort to replace them, and consequently they also valued their products.

In the most primitive (simplest) situation, people acquire objects for which they have a use by borrowing, trading or bartering, in exchange for other goods that they don't particularly have a need for themselves. They value things directly because of their useful qualities. In the process, customary norms develop for what counts as a normal, balanced exchange.

But at the most abstract, developed level, the value form is only a purely monetary relationship between objects, or an abstract earnings potential or credit provision based on some assumptions, which may not even refer to any tangible object of trade anymore at all. At that point, it appears that the value of an asset is simply the amount of income that could be obtained if the asset were traded under certain conditions.

Social relations

By analyzing the value-form, Marx aims to show that when people bring their products into relation with each other in market trade, they are also socially related in specific ways (whether they like it or not, and whether they are aware of it or not), and that this fact very strongly influences the very way in which they think about how they are related.[26] It influences how they will view the whole human interactive process of giving and receiving, taking and procuring, sharing and relinquishing, accepting and rejecting—and how to balance all that.[27]

The value-form of products does not merely refer to a "trading valuation of objects"; it refers also to a certain way of relating or interacting, and a mentality, among human subjects who internalize the value-form, so that the manifestations of economic value become regarded as completely normal, natural and self-evident in human interactions (a "market culture," which is also reflected in language use). Marx's slightly surreal description of what goes on in commodity exchanges highlights not only that value relationships appear to exist between commodities quite independently of the valuers, but also that people accept that these relationships exist even although they do not understand exactly what they are, or why they exist at all. They often participate in markets without knowing much at all about how they work.

Objectification

Marx's argument is that in order to be able to trade, people must objectify (objectively express) the value of goods produced, but it turns out that, in doing so, they are actually also objectifying and comparing the value of their own labour-efforts. Most abstractly, the quantities of money for which products are traded express claims to quantities of society's labour in general, or "abstract labour". So by equating and comparing the value of their products in exchange, people at the same time equate and compare the value of their labour efforts, even if they are completely unaware of that; and what a product is worth becomes dependent on, and changes according to, what other products are worth, even regardless of subjective evaluations of what the product is worth. Marxists often call this a "real abstraction", i.e. the symbolic token representing a socio-economic relationship is practically treated as a tradeable thing in its own right.

This objectification process has two main effects:

- Value relations gain an independent, objective existence that begins to regulate and dominate human life, and to which all people must adjust their behaviour, whether they like it or not. They internalize the value-form by adjusting to its effects (this is called "the forces and laws of the market"). Simply put, if human valuations originate in people's ability to prioritize and weigh up behavioural responses according to self-chosen options, the very meaning of their choices, and the language in which they are expressed, will be strongly influenced by the surrounding world ordered by the value-system.

- A consequent tendency towards a reifying inversion in human awareness (subjects become treated as things, and things become treated as active subjects, while means become ends, and ends become means). Even although the values attributed to products exist only as a social effect of how people are relating and related, it begins to look like value is actually an intrinsic property of products; the way average values change, begins to lead a "life of its own" that individuals and groups are unable to control and must adjust to, like it or not.

The combination of (1) and (2) mean that regardless of how one happens to think or choose, one must necessarily conform to the structure of value relations that exists in capitalist society, quite independently of one's will or awareness. It is not that value relations are "only objective" or "only subjective" (value relations obviously could not exist at all, without humans making and accepting valuations, whether explicitly or implicitly) but rather that the objectification of value becomes a tangible, practical reality that one simply cannot get away from. A relationship is established between things that, although it originates in human valuations, escapes from the control of individuals, groups and nations.

Textual sources

Marx's explanation of the value-form originated in his Grundrisse manuscripts, and in ideas expressed his 1859 book A Contribution to the Critique of Political Economy, which failed to sell many copies. It is already clearly evident in his manuscript of Theories of Surplus Value (1861–63). Marx first explicitly described the concept in an appendix to the first (1867) edition of Das Kapital,[28] but this appendix was dropped in a second edition, where the first chapter was rewritten to include a special section on the value-form at the end.

In a preface to the first edition of Das Kapital, Marx stated

"I have popularised the passages concerning the substance of value and the magnitude of value as much as possible. The value-form, whose fully developed shape is the money-form, is very simple and slight in content. Nevertheless, the human mind has sought in vain for more than 2,000 years to get to the bottom of it..."[29]

Marx gives various reasons for this, but the main obstacle seems to be that trading relations refer to societal relations that are not necessarily observably manifest, and therefore can only be inferred or analyzed with the aid of highly abstract ideas. The quote clarifies that Marx thought that the value-form of commodities is not simply a feature of capitalism, but is associated with the whole history of commodity trade.[30]

According to Marx, the Greek philosopher Aristotle (circa 360–370 BC) had already described the basics of the value-form when he argued[31]) that an expression such as "5 beds = 1 house" does not differ from "5 beds = such and such an amount of money", but according to Marx, Aristotle's analysis "suffered shipwreck" because he lacked a clear concept of value. By this Marx meant that Aristotle was unable to clarify the substance of value, i.e., what exactly was being equated in value-comparisons, or what was the common denominator commensurating different goods.[32] Aristotle thought the common factor must simply be the demand for goods, since without demand for goods that could satisfy some need or want, they would not be exchanged. According to Marx, the substance of product-value is human labour-time in general, labour-in-the-abstract or "abstract labour". This value exists quite independently of the particular forms that exchange may take, though obviously value is always expressed in some form or other.

Marx argues that only when market production is highly developed, that it becomes possible to understand what economic value actually means in a comprehensive and theoretically consistent way, separate from other sorts of value (like aesthetic value or moral value). He discusses the notion of the formal equality of market actors more in the Grundrisse.[33] Marx admitted that the value-form was a somewhat difficult notion but he assumed "a reader who is willing to learn something new and therefore to think for himself."[34] In a preface to the second edition of Das Kapital, Marx said that he had "completely revised" his treatment, because his friend Dr. Louis Kugelmann had convinced him that a "more didactic exposition of the form of value" was needed.[35]

The development of the form of value in the history of trading relations

Marx distinguishes between four successive steps in the process of trading products, i.e., in the circulation of commodities, through which fairly stable and objective value proportionalities (Wertverthaltnisse in German) form that express "what products are worth". These steps are:

- 1. The simple value-form, an expression that contains the duality of relative value and equivalent value.

- 2. The expanded or total value-form, a quantitative "chaining together" of the simple forms of expressing value.

- 3. The general value-form, i.e., the expression of the worth of all products reckoned in a general equivalent.

- 4. The money-form of value, which is a general equivalent used in trading (a medium of exchange) that is universally exchangeable.

These forms are different ways of symbolizing and representing what goods are worth, to facilitate trade and cost/benefit calculations. The simple value-form does not (or not necessarily) involve a money-referent at all, and the expanded and general forms are intermediary expressions between a non-monetary and a monetary expression of economic value. The four steps are an abstract summary of what essentially happens to the trading relationship when the trade in products grows and develops. The four steps are not necessarily an adequate literal description of what historically happens.

Simple form of value

The value relationship in Marx's economic sense begins to emerge, when we are able to state that one bundle of use-values is worth the same as another bundle of (different) use-values. That happens when the bundles are regularly traded for each other, and thus are regarded as instruments of trade. It is a quantitative relationship between quantities. The simplest value-form expression can be stated as the following equation:

X quantity of commodity A is worth Y quantity of commodity B

where the value of X(A) is expressed relatively, as being equal to a certain quantity of B, meaning that A is the relative form of value and B the equivalent form of value, so that B is effectively the value-form of (expresses the value of) A. If we ask "how much is X quantity of commodity A worth?" the answer is "Y quantity of commodity B". This simple equation, expressing a simple value proportion between products, however permits several possibilities of differences in valuation emerging within the circulation of products:

- the absolute value of A changes, but the absolute value of B stays constant; in this case, the change in the relative value of A depends only on a change in the absolute value of A (The absolute value, Marx argues, is the total labour cost on average implicated in making a commodity).

- the absolute value of A stays constant, but the absolute value of B changes; in this case, the relative value of A fluctuates in inverse relation to changes in the absolute value of B, meaning that if B goes down then A goes up, while if B goes up then A goes down.

- the values of A and B both change in the same direction and in the same proportion. In this case, the equation still holds, but the change in absolute value is noticeable only if A and B are compared with a commodity C, where C's value stays constant. If all commodities increase or decrease in value by the same amount, then their relative values all remain exactly the same.

- the values of A and B change in the same direction, but not by the same amount, or vary in opposite directions.

These possible changes in valuation enable us to understand already that what any particular product will trade for is delimited by what other products will trade for, quite independently of how much the buyer would like to pay, or how much the seller would like to get in return. Value should not be confused with price here, however, because products can be traded at prices above or below what they are worth (implying value-price deviations; this complicates the picture and is elaborated only in the third volume of Das Kapital). For simplicity's sake, Marx assumes initially that the money-price of a commodity will be equal to its value (ordinarily, price-value deviations would not be very great); but in Capital Vol 3 it becomes clear that the sale of goods above or below their value has a crucial effect on profits.

The main implications of the simple relative form of value are that:

- The value of an individual commodity can change relative to other commodities, although the real cost in labour of that particular commodity stays constant, and vice versa, the real labour cost of that particular commodity can vary, although its relative value remains the same; this means that goods can be devalued or revalued depending on what happens elsewhere in the trading system and on changes in the conditions of producing them elsewhere. It would therefore be wrong to claim, as some Marxists[36] argue, that for Marx "economic value is labour"; rather, economic value really refers to the current social valuation of labour effort implicated in products.

- That the absolute and relative values of commodities can change constantly, in proportions which do not exactly compensate each other, or cancel each other out, via haphazard adjustments to new production and demand conditions.[37]

Marx also argues that, at the same time, such an economic equation accomplishes two other things:

- the value of specific labour activities is implicitly related in proportion to the value of labour in general, and

- private labour activities, carried out independently of each other, are socially recognized as being a fraction of society's total labour.

Effectively, a social nexus (a societal connection or bond) is established and affirmed via the value-comparisons in the marketplace, which makes relative labour costs (the expenditures of human work energy) the real substance of value. Obviously, some assets are not produced by human labour at all, but how they are valued commercially will nevertheless refer, explicitly or implicitly, directly or indirectly, to the comparative cost structure of related assets that are labour-products. A tree in the middle of the Amazon Rain Forest has no commercial value where it stands. We can estimate its value only by estimating what it would cost to cut it down, what it would sell for in markets, or what income we could currently get from it—or how much we could charge people to look at it. Imputing an "acceptable price" to the tree assumes that there already exists a market in timber or in forests that tells us what the tree would normally be worth.[38]

Expanded form of value

In the expanded value-form, the equation process between quantities of different commodities is simply continued serially, so that their values relative to each other are established, and they can all be expressed in some or other commodity-equivalent. The expanded value-form expression really represents only an extension of the simple value form, where products alternate as relative and equivalent forms in order to be equated to each other.

Marx argues that, as such, the expanded value-form is practically inadequate, because to express what any commodity is worth might now require the calculation of a whole "chain" of comparisons, i.e.

X amount of commodity A is worth Y commodity B, is worth Z commodity C ... etc.

What this means is, that if A is normally traded for B, and B is normally traded for C, then to find out how much A is worth in terms of C, we first have to convert the amounts into B (and maybe many more intermediate steps). This is obviously inefficient if many goods are traded at the same time.

General form of value

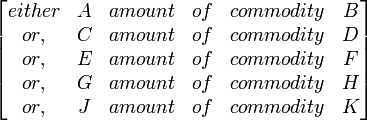

The practical solution in trade is therefore the emergence of a general value-form, in which the values of all kinds of bundles of commodities can be expressed in amounts of one standard commodity (or just a few standards) which function as a general equivalent. The general equivalent has itself no relative form of value in common with other commodities; instead its value is expressed only in a myriad of other commodities.

=

=

In ancient civilizations where considerable market trade occurred, there were usually a few types of goods that could function as a general standard of value. This standard served for value comparisons; it did not necessarily mean that goods were actually traded for the standard commodity.[39] This rather cumbersome problem is solved with the introduction of money—the owner of a product can sell it for money, and buy another product he wants with money, without worrying anymore about whether the thing offered in exchange for his own product is indeed the product that he wants himself. Now, the only limit to trade is the development of the market.

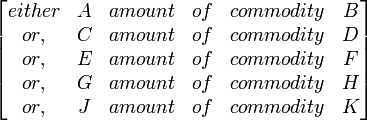

Money-form of value

Just because quantities of goods can be expressed in amounts of a general equivalent, which acts as a referent, this does not mean that they can necessarily all be traded for that equivalent. The general equivalent may only be a sort of yardstick used to compare what goods are worth. Hence, the general equivalent form in practice gives way to the money-commodity, which is a universal equivalent, meaning that (provided people are willing to trade) it possesses the characteristic of direct and universal exchangeability in precisely measured quantities.

=

=

But for most of the history of human civilization, money was not actually universally used, partly because the prevailing systems of property rights and cultural custom did not allow many goods to be sold for money, and partly because many products were distributed and traded without using money. Also, several different "currencies" were often used side by side. Marx himself believed that nomadic peoples were the first to develop the money-form of value (in the sense of a universal equivalent in trade) because all their possessions were mobile, and because they were regularly in contact with different communities, which encouraged the exchange of products.[40] When money is generally used in trade, money becomes the general expression of the value-form of goods being traded; usually this is associated with the emergence of a state authority issuing legal currency. At that point the value-form appears to have acquired a fully independent, separate existence from any particular traded object (behind this autonomy, however, is the power of state authorities or private agencies to enforce financial claims).

According to Marx's theory of money,[41] the money-form of value (whether bullion, coinage, paper or money of account) fulfills a number of social functions at the same time:

- It is a universal equivalent, which can in principle exchange for any product offered for sale.

- It is a means of exchange, facilitating the circulation of commodities.

- It provides a standard measure of value; a means of accounting for value; and it is the measuring unit of prices.

- It is a universally accepted means of payment for goods & services rendered, and for debt obligations.

- It is a means to store value owned, accumulate value, or form hoards of wealth.

Once the money-commodity (e.g., gold, silver, bronze) is securely established as a stable medium of exchange, symbolic money-tokens (e.g., bank notes and debt claims) issued by the state, trading houses or corporations can in principle substitute for the "real thing" on a regular basis. At first, these "paper claims" (legal tender) are by law convertible on demand into quantities of gold, silver etc., and they circulate alongside precious metals. But gradually currencies come into use that are not so convertible, i.e., "fiduciary money" or fiat money which relies on social trust that people will honor their transactional obligations. These kinds of fiduciary money rely not on the value of money-tokens themselves (as in commodity money), but on the ability to enforce financial claims and contracts, principally by means of the power and laws of the state, but also by other institutional methods. Eventually, as Marx anticipated in 1844, precious metals play very little role anymore in the monetary system.[42]

Alongside fiat money, credit money also develops. Credit money, although expressed in currency units, does not consist of money tokens. It consists rather of financial claims, including of all kinds of debt certificates (promissory notes) which entitle the holder to future income under contractually specified conditions. These claims can themselves be traded for profit. Credit arrangements existed already in the ancient world,[43] but there was no very large-scale trade in debt obligations. In the modern world, the majority of money no longer consists of money tokens, but of credit money. Marx was quite aware of the role of credit money, but did not analyze it in depth. His concern was only with how the credit system directly impacted on the capitalist production process.

The ultimate universal equivalent according to Marx is "world money", i.e., financial instruments that are accepted and usable for trading purposes everywhere, such as bullion.[44] In the world market, the value of commodities is expressed by a universal standard, so that their "independent value-form" appears to traders as "universal money".[45] Nowadays the US dollar,[46] the Euro, and the Japanese Yen are widely used as "world currencies" providing a near-universal standard and measure of value. They are used as a means of exchange worldwide, and consequently most governments have significant reserves or claims to these currencies.

In summary

It is important to note that Marx's four steps in the development of the value-form are mainly an analytical or logical progression, which may not always conform to the actual historical processes by which objects begin to acquire a relatively stable value and are traded as commodities.[47] Three reasons are:

- Various different methods of trade (including counter-trade) may always exist and persist side by side. Thus, simpler and more developed expressions of value may be used in trade at the same time, or combined (for example, in order to fix a rate of exchange, traders may have to reckon how much of commodity B can be acquired, if commodity A is traded).

- Market and non-market methods of allocating resources may combine, in rather unique ways. The act of sale, for example, may not only give the owner of a good possession of it, but also grant or deny access to other goods. The actual distinction between selling and barter may not be so easy to draw, and all kinds of "deals" can be done in which the trade of one thing has consequences for the possession of other things.

- Objects that previously had no socially accepted value at all, may acquire it in a situation where money is already used, simply by imputing or attaching a money-price to them. In this way, objects can acquire the value-form "all at once"—they are suddenly integrated in an already existing market (The only prerequisite is that somebody owns the trading rights for those objects).

It is just that, typically, what the socially accepted value of a wholly new kind of object will be, requires the practical "test" of a regular trading process, assuming a regular supply by producers and a regular demand for it, which establishes a trading "norm" consistent with production costs. A new object that wasn't traded previously may be traded far above or below its real value, until the supply and demand for it stabilizes, and its exchange-value fluctuates only within relatively narrow margins (in official economics, this process is acknowledged as a form of price discovery).[48]

Implications

To summarize, the development of the value-form through the growth of trading processes involves a continuous dual equalization & relativization process:

- the worth of products and assets relative to each other is established with increasingly precise equations, creating a structure of relative values;

- the comparative labour efforts required to make the products are also valued in an increasingly standardized way at the same time. For almost any particular type of labour, it can then be specified, fairly accurately, how much money it would take, on average, to procure it.

Six main effects of this are:

- The process of market-expansion, involving the circulation of more and more goods, services and money, leads to the development of the value-form of products, which includes and transforms more and more aspects of human life, until almost everything is structured by the value-form;

- That it increasingly seems as though economic value ("what things are worth") is a natural, intrinsic characteristic of products and assets (just like the characteristics that make them useful) rather than a social effect created by labour-cooperation;

- what any particular kind of labour is worth, becomes largely determined by the value of the tradeable product of the labour, and labour becomes organized according to the value it produces.

- The development of markets leads to the capitalization of money, products and services: the trade of money for goods and goods for money leads directly to the use of the trading process purely to "make money" from it (a practice known in classical Greece as "chrematistics").

- Labour power that creates no commodity value or does not have the potential to do so, has no value for commercial purposes, and is therefore usually not highly valued economically, except insofar as it reduces costs that would otherwise be incurred.

- The diffusion of value relations eradicates traditional social relations and corrodes all social relations not compatible with commerce; the valuation that becomes of prime importance is what something will trade for. The end result is the emergence of the circuit M-C...P...C'-M', which indicates that production has become a means for the process of making money (that is, Money [=M] buys commodities [=C] which are transformed through production [=P] into new commodities [=C'], and, upon sale, result in more money [=M'] than existed at the start).

Generalized commodity production

Capital existed in the form of trading capital already thousands of years before capitalist factories emerged in the towns; its owners (whether rentiers, merchants or state functionaries) often functioned as intermediaries between commodity producers. They facilitated exchange, for a price. Marx defines the capitalist mode of production as "generalized commodity production", meaning that most goods and services are produced primarily for commercial purposes, for profitable market sale.[49] This has the consequence, that both the input and the output of production become tradeable objects with prices, and that the whole of production is reorganized according to commercial principles. Whereas originally commercial trade occurred episodically at the boundaries of different communities, Marx argues,[50] eventually commerce engulfs and reshapes the whole production process of those communities.

In turn, this means what whether or not a product will be produced, and how it will be produced, depends not simply on whether it is physically possible to produce it or on whether people need it, but on its financial cost of production, whether a sufficient amount can be sold, and whether its production yields sufficient profit income. That is why Marx regarded the individual commodity, which simultaneously represents value and use-value as the "cell" (or the "cell-form") in the "body" of capitalism. The seller primarily wants money for his product and is not really concerned with its consumption or use (other than from the point of view of making sales); the buyer wants to use or consume the product, and money is the means to acquire it. Thus the seller does not aim directly to satisfy the need of the buyer, nor does the buyer aim to enrich the seller. Rather, the buyer and the seller are the means for each other to acquire money or goods. As a corollary, production becomes less and less a creative activity to satisfy human needs, but simply a means to make money or acquire access to goods and services.[51] As against that, products obviously could not be sold unless people need them, and unless that need is practically acknowledged. The social effect is that the motives for trading may be hidden to some or other extent, or appear somewhat differently from what they really are (in this sense, Marx uses the concept of "character masks").

Reification

The concept of the value-form as an aspect of the commodity form is intended to show how, with the development of commodity trade, anything with a utility for people (a use-value) can be transformed into a quantity of abstract value, objectively expressible as a sum of money; but, also, how this transformation changes the organization of labour to maximize its value-creating capacity, how it changes social interactions and the very way people are aware of their interactions.

However, the quantification of objects and the manipulation of quantities ineluctably leads to distortions (reifications) of their qualitative properties. For the sake of obtaining a measure of magnitude, it is frequently assumed that objects are quantifiable, but in the process of quantification, various qualitative aspects are conveniently ignored or abstracted away from. Obviously the expression of everything in money prices is not the only valuation that can, or should, be made.

Essentially, Marx argues that if the values of things are to express social relations, then, in trading activity, people necessarily have to "act" symbolically in a way that inverts the relations among objects and subjects, whether they are aware of that or not. They have to treat a relationship as if it is a thing in its own right. In an advertisement, a financial institution might for example say "with us, your money works for you", but money does not "work", people do. A relationship gets treated as a thing, and a relationship between people is expressed as a relationship between things.

In Postmodernist culture, this inversion is acknowledged, but an explicit attempt is made to recognize the social relationship involved and its meaning for Self and Other; the idea is that, in so doing, an otherwise impersonal, estranged or superficial trading contact can be "humanized". The question remains how one can know that this attempt is authentic and what its real motivation is.

Marketisation

The total implications of the development of the value-form are much more farreaching than can be described in this article, since (1) the processes by which the things people use are transformed into objects of trade (often called commodification, commercialization or marketization) and (2) the social effects of these processes, are both extremely diverse. A very large literature exists about the growth of business relationships in all sorts of areas. For capitalism to exist, markets must grow, but market growth requires changes in the way people relate socially, and changes in property rights. This is often a problem-fraught and conflict-ridden process, as Marx describes in his story about primitive accumulation.

Value-form and price-form

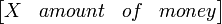

In his story, Marx defines "value" simply as the ratio of a physical quantity of product to a quantity of average labour-time, which is equal to a quantity of gold-money (in other words, a scalar):

- X quantity of product = Y quantity of average labour hours = Z quantity of gold-money

He admits early on, that the assumption of gold-money is a theoretical simplification,[52] since the buying power of money units can vary due to causes that have nothing to do with the production system (within certain limits, X, Y and Z can vary independently of each other); but he thought it was useful to reveal the structure of economic relationships involved in the capitalist mode of production, as a prologue to analyzing the motion of the system as a whole; and, he believed that variations in the buying power of money did not alter that structure at all, insofar as the working population was forced to produce in order to survive, and in so doing entered into societal relations of production independent of their will; the basic system of property rights remained the same, irrespective of whether products and labour were traded for a higher or a lower price.

As any banker or speculator knows, however, the expression of the value of something as a quantity of money-units is by no means the "final and ultimate expression of value".[53]

- At the simplest level, the reason is that different "monies" (currencies) may be used side by side in the trading process, meaning that "what something is worth" may require expressing one currency in another currency and that one currency is traded against another, where currency exchange rates fluctuate all the time. Thus, money itself can take many different forms.

- In more sophisticated trade, moreover, what is traded is not money itself, but rather claims to money ("financial claims" and counter-claims, for example debt obligations, borrowing facilities or stocks that provide the holder with an income).

- And in even more sophisticated trade, what is traded is the insurance of financial claims against the risk of possible monetary loss. In turn, money can be made just from the knowledge about the probability that a financial trend or risk will occur or not occur.

Eventually financial trade becomes so complex, that what a financial asset is worth is often no longer expressible in any exact quantity of money (a "cash value") without all sorts of qualifications, and that its worth becomes entirely conditional on its expected earnings potential.[54]

In Capital Volume 3, which he drafted before Volume I, Marx shows he was well aware of this. He distinguished not only between "real capital" (physical, tangible capital assets) and "money capital", but also noted the existences of "fictitious capital" and "pseudo-commodities" that have exclusively symbolic value (which, however, can be converted into real product value through trade). Marx believed that a failure to theorize the value-form correctly led to "the strangest and most contradictory ideas about money," which "emerges sharply... in [the theory of] banking, where the commonplace definitions of money no longer hold water".[55]

The price-form

Consistent with this, Marx explicitly introduced a distinction between the value-form and the price-form early on in Capital, Volume I. Simply put, the price-form is a mediator of trade that is separate and distinct from the value-form.[56] Prices express exchange-value in units of money.[57] A price is a "sign" that conveys information about either a possible or a realized transaction (or both at the same time). The information may be true or false; it may refer to observables or unobservables; it may be estimated, assumed or probable. However, because prices are also numbers, it is easy to treat them as manipulable "things" in their own right, in abstraction from their appropriate context. The price resulting from a calculation may be regarded as symbolizing (representing) one transaction, or many transactions at once, but the validity of this "price abstraction" all depends on whether the computational procedure is accepted.

According to Marx, the price-form is not a "further development" of the value-form,[58] for three reasons:

- As Marx notes, prices may be attached to almost anything at all ("the price of owning, using or borrowing something"), and therefore need not express product-values at all. Prices do not necessarily have anything to do with the production of tangible wealth, although they might facilitate claims to it.

- Insofar as the price of a commodity does express its value accurately, this does not necessarily mean that it will actually trade at this price; products can trade at prices above or below what the goods are really worth, or fail to be traded at any price.

- Although as a rule there will be a strong positive correlation between product-prices and product-values, they may change completely independently of each other for all kinds of reasons. When things are bought or sold, they may be over-valued or under-valued due to all kinds of circumstances.

In Marx's theory, not just anything has a value in the economic sense, even if things can be priced. Only the products of human labour have the property of value, and their "value" is the total current labour cost implicated in making them, on average. Value relationships among physical products and assets—as proportions of current labour effort involved in making them—exist according to Marx quite independently from price information, and prices can oscillate in all sorts of ways around economic values, or indeed quite independently of them. However, the expression of product-value by prices in money-units in most cases does not diverge very greatly from the actual value; if there was a very big difference, people would not be able to sell them, or they would not buy them.

If prices for products rise, hours worked may rise, and if prices fall, hours worked may fall (sometimes the reverse may also occur, to the extent that extra hours are worked, to compensate for lower income resulting from lower prices, or if more sales occur because prices are lowered). In that sense, it is certainly true that product-prices and product-values mutually influence each other. It is just that, according to Marx, product-values are not determined by the labor-efforts of any particular enterprise, but by the combined result of all of them.

Real prices and ideal prices

In discussing the form of prices in various draft manuscripts and in Das Kapital, Marx drew an essential distinction between actual prices charged and paid, i.e., prices that express how much money really changed hands, and various "ideal prices" (imaginary or notional prices).[59] Because prices are symbols or indicators in more or less the same way as traffic lights are, they can symbolize something that really exists (e.g., hard cash) but they can also symbolize something that doesn't exist, or symbolize other symbols. That can make the forms of prices highly variegated, flexible and complex to understand, but also potentially very deceptive, disguising the real relationships involved. Modern economics is largely a "price science" (a science of "price behaviour"), in which economists attempt to analyze, explain and predict the relationships between different kinds of prices—using the laws of supply and demand as a guiding principle. This however was not Marx's primary concern; he focused rather on the structure and dynamics of the capitalist system as a whole. His concern was with the overall results that market activity would lead to in human society.

In what Marx called "vulgar economics", the complexity of the concept of prices is ignored however, because, Marx claimed, the vulgar economists assumed that:

- all prices belong to the same object class (they are qualitatively the same, and differ only quantitatively, irrespective of the type of transaction with which they are associated, or the valuation principles used).

- for theoretical purposes, there is no substantive difference between price idealizations and prices which are actually charged.

- "price" is just another word for "value", i.e., value and price are identical expressions, since the value relationship simply expresses a relationship between a quantity of money and a quantity of use-values.

- prices are always exact, in the same way that numbers are exact (disregarding price estimation, valuation changes and accounting error).

- price information is always objective (i.e., it is never influenced by how people regard that information).

- people always have equal access to information about prices, in which case swindles are merely an aberration from the normal functioning of markets (rather than an integral feature of them, which requires continual policing).

- the price for any particular type of good is always determined everywhere in exactly the same way, according to the same economic laws, regardless of the given social set-up.

In his critique of political economy, Marx denied that any of these assumptions were scientifically true (see further real prices and ideal prices). He distinguished carefully between the values, exchange values, market values, market prices and prices of production of commodities. However he did not analyze all the different forms that prices can take (for example, market-driven prices, administered prices, accounting prices, negotiated and fixed prices, estimated prices, nominal prices, or inflation-adjusted prices) focusing mainly on the value proportions he thought to be central to the functioning of the capitalist mode of production as a social system. The effect of this omission was that debates about the relevance of Marx's value theory became confused, and that Marxists repeated the same ideas Marx himself had rejected as "vulgar economics". In other words, they accepted a vulgar concept of price.[60]

Fluctuating price signals serve to adjust product-values and labour efforts to each other, in an approximate way; prices are mediators in this sense. But that which mediates should not be confused with what is mediated. Thus, if the observable price-relationships are simply taken at face value, they might at best create a distorted picture, and at worst a totally false picture of the economic activity to which they refer. At the surface, prices might quantitatively express an economic relationship in the simplest way, but in the process they might abstract away from other features of the economic relationship that are also very essential to know. Indeed, that is another important reason why Marx's analysis of economic value largely disregards the intricacies of price fluctuations; it seeks to discover the real economic movement behind the price fluctuations.

Scientific criticism

There are five main lines of scholarly criticism of Marx's idea of the value-form.

Obscurantism

The criticism most often heard from the critics of Marx, such as Karl Popper, Friedrich von Hayek, Ian Steedman and Francis Wheen is that, even if Marx himself meant well, Marx's value-form idea is simply an esoteric obscurantism, "dialectical hocus pocus", "sophistry" or "mumbo jumbo". Francis Wheen refers to "a shaggy-dog story, a picaresque journey through the realms of higher nonsense."[61] This type of criticism was already being made while Marx was still alive, as Marx himself reports in a postface to the second German edition of Das Kapital in 1873.[62]

Marx's argument does not really make coherent scientific sense, it is argued by his critics – quite possibly because Marx tried to do too much at once. That is, at one and the same time, one finds Marx

- trying to respond to the classical discourses of the political economists in an erudite way;

- poking fun at, and setting traps for what he regarded as pedantic, pseudo-profound German professors prattling about "dialectics";

- trying to tell an entertaining story using metaphors that would really sell;

- trying to make a substantive, serious argument about the historical origin and essential nature of economic value.

The result, some critics feel, is a series of devastating ambivalences and ambiguities, which cover up all kinds of illogical moves—moves that, they claim, are fatal to Marx's argument.

Often, Marxists have replied to this type of criticism by restating Marx's arguments in clearer language, or by showing that Marx's theory of economic value at the very least fares no worse than the subjective theory of value (the theory of the util as the measuring unit of utility). Even so, when he published his very clear restatement Karl Marx's Theory of History: A Defence,[63] the Marxist philosopher Gerald Cohen explicitly dissociated himself from Marx's value theory. Cohen argued that it is possible to have an historical materialism without a labour theory of value, because the one does not logically entail the other as well. This interpretation contrasts with Lenin's opinion—repeated by Johann Witt-Hansen[64]—that with the appearance of Das Kapital, "the materialist conception of history is no longer a hypothesis, but a scientifically proven proposition".[65]

The substance of value

Whereas many economists and philosophers have been inspired by Marx's analysis of the value-form, they have usually rejected the thrust of Marx's argument, namely that the substance of product-value is the expenditure of human labor effort in general, i.e., abstract labour.

Marx insists that:

It is not money that renders the commodities commensurable. Quite the contrary. Because all commodities, as values, are objectified human labour, and therefore in themselves commensurable, their values can be communally measured in one and the same specific commodity, and this commodity can be converted into the common measure of their values, that is into money. Money as a measure of value is the necessary form of appearance of the measure of value immanent in commodities, namely labour-time.[66]

Marx's argument is that the exchangeability of commodities with recognition of their value is based on the common factor that all of them are products of social labour (co-operative human labour producing things for others).[67] Critics however argue that Marx's argument is simply not logically compelling. They suggest Marx's observations fail to provide any logically decisive proof that human labour is the substance of economic value.

Because of the controversy over the substance of value, the famous Japanese Marxist scholar Kozo Uno argued in his classic Principles of Political Economy that Marx's original argument had to be revised.[68] In the revised version, the theory of the value-form is integrated in the theory of commodity circulation, and does not refer to the substance (content) of value at all. The substance of value as labour then becomes apparent and is theoretically demonstrated only in the analysis of the production of commodities "by means of commodities". Some Western Marxists do not find this Unoist approach very satisfactory however,[69] because of Marx's basic insistence that the formation of product values is an outcome of both the "economy of labour-time" and "the economy of trade" working in tandem.

An additional complication is that, as the accumulation of capital grows, more and more durable assets exist external to the sphere of production. When society becomes wealthier, the total amount of the personally owned properties of individuals (assets owned by households) and public property increases, even if some people own little and others own a lot. Marx was primarily concerned with the value of newly produced commodities, but it is unclear from his theory about the capitalist mode of production what determines the value of a growing stock of durable assets in society, a stock of assets which is neither an input nor an output of current production.

Usefulness

This criticism is basically that all the problems Marx tries to solve with his theory of the forms of value can be solved much better and more plausibly with modern price theory.

In a 1975 paper subtitled "Was Marx's Journey Really Necessary?", the influential Marxian economist Ronald L. Meek argued that Marx's value theory had become redundant because all economic relationships can be described and explained in terms of prices. Indeed, what Marx calls "value" can be regarded simply as a kind of "theoretical price". The conclusion drawn is that value theory really adds nothing to the economic arguments, and is therefore best abandoned.

The Marxist response to this criticism[70] was extremely weak; most Marxists had accepted the conventional price-theories of economics as largely correct and unproblematic,[71] and just kept insisting that value-theory was a necessary "add-on" to make sense of the economy.[72]

From the 1970s, the so-called "value-form theorists" ("value-form school") have emphasized—influenced by Theodor W. Adorno[73] and the rediscovery of the writings of Isaak Illich Rubin[74]—the importance of Marx's value theory as a qualitative critique—a cultural, sociological or philosophical critique of the reifications involved in capitalist commercialism. The value-form school has become very popular especially among Western Marxists who are not economists. Supporters of the "value-form school", especially in Germany and Britain, often regard Marx's theory of the form of value as proof of a radical break from all conventional economics. This implies there is little point in engaging with conventional economics, because conventional economics makes quite incompatible theoretical assumptions. Critics of the value-form school often see this intellectual tradition as an "evasive tactic", which avoids difficult quantitative problems concerning the relationship between economic value and money-prices which still need to be solved.[75]

Value-form theory has also been popular among intellectual supporters of Autonomism[76] and Anarchism,[77] although Antonio Negri thinks the theory is outdated now.[78] Negri's theory is the same as that of the Financial Times journalist John Kay, who believes that "The political and economic environment in which Marx wrote was a brief interlude in economic history."[79] Both writers regard Marx's theory of value as outdated, although they still like to use some of Marx's rhetorics.

The suggestion of some authors (such as Reuten/Williams) is that although Marx's labour theory of value is theoretically wrong as stated, his theory can be modified such that, rather than value being created by co-operative human labour, value and abstract labour can be regarded as effects ("social forms") created by the exchange-process itself.[80] Simply put, the value of goods is nothing more than the money they will exchange for, from which it seems to follow that if there is no money, value does not exist either. This interpretation is often called the "monetary theory of value".[81] Marx himself denied this interpretation when he said explicitly in chapter 2 of Capital, Volume I that "The act of exchange gives to the commodity converted into money, not its value, but its specific value-form".[82] Critics of the Reuten/Williams theory[83] make three main points:

- Reuten and Williams fall victim to precisely the theory Marx's argument intends to demolish. That is, they fall victim to commodity fetishism and therefore they believe that commodities have value because money exists, or because exchange exists.

- Beyond sophisticated neo-Hegelian rhetorics, the Reuten/Williams theory is really not much better than a vulgar accounting theory, according to which "value is created" when goods are sold for more than they were bought for. The objection here is, that value exists not simply because of a trading relationship, but because people actually did some work to produce something of value, and in so doing are socially related also external to the exchange process.[84]

- A "form" isn't a form at all without a content, namely it is "the form of something", the form that a content takes—the point being that a content or substance can take various "forms", necessitating a special study of what those forms are. A "form without a content" would make form and content identical, and the distinction between them redundant. We are then left only with a "sociology of trading processes" studying how people socially interact in trade and how they symbolize that.[85]

Marxian economist John Milios also argues for a "monetary theory of value", where "Money is the necessary form of appearance of value (and of capital) in the sense that prices constitute the only form of appearance of the value of commodities."[86] Critics of this interpretation think that it cannot be correct, for two reasons:

- as Marx so painstakingly showed in his discussion of the development of the value-form, the value of commodities can also be expressed simply and directly in terms of a quantity of other commodities, or one referent commodity. To establish a trading ratio that expresses a value relationship, in principle no money or prices are required at all – that is the whole point. All that is required is the expression that "x quantity of product y is worth p quantity of product q". Milios's argument can be sustained only if, in the trade of one bundle of commodities for another (as in counter-trade), the bundle of commodities traded is itself treated as if it is a "price". But such a "price" is obviously not a quantity of money. The point here is simply that the value-form, in its less developed state, does not require any monetary expression; counter-trade does not necessarily require any monetary referent at all, although in modern times it often does take into account the cash value of a deal.

- Milios conflates the money that actually changes hands with all kinds of possible computable price data for a commodity under various conditions. Effectively, he conflates the value-form with the price-form, and real prices with ideal prices. Milios implies, that only priced goods can have value, but this idea flatly contradicts Marx's theory according to which product-values exist also quite independently from exchange (simply because products represent quantities of labour-effort). If Milios's interpretation is correct, Marx's value theory serves no good purpose—values and prices are hardly distinguishable. In all his economic manuscripts, Marx says that prices are at best the "idealized expression" of the value-form. This view is only logical; after all, prices express the quantity of money for which particular commodities will, or could, change owners. But if the idealization of the value-form as a price is equated with the value-form, the whole value-form idea is itself redundant. It is a bit like saying that the price information about a good is the same as the actual money that changes hands when the good is traded. Most people know very well what the difference is.

In his Social Ontology (2008), "Anglophone Justice Theory, the Gainful Game and the Political Power Play" (2009) and elsewhere, the Australian phenomenologist Michael Eldred radicalizes the reading of 'form' in the value-form to a socio-ontological category. According to Eldred, the phenomenon of exchange-value is substantially one of social power. Hence, money reveals itself to be the quintessential, rudimentary form of reified social power in capitalist society. The further value-forms developed during the course of the capital-analysis, starting with the capital-form and the wage-form of value, through the value-forms of ground-rent, interest, profit of enterprise, to the revenue-form of these income-sources on the surface of economic life, unfold the socio-ontological structure and movement of capitalism as a reified power-play. Eldred argues that such a total ontological structure of capitalist power-play can only come into view, if the whole of Marx's capital-analysis is reconstructed, not just the famous, notoriously difficult first chapter of Marx's Capital.

From a different angle, Jonathan Nitzan and Shimshon Bichler also depict the phenomena of economic value as power relationships.[87] While retaining some of the language of Marx, they however reject Marx's theory of value. The power dimension of value relationships is also prominent in Harry Cleaver's commentary Reading Capital Politically.[88]

This interpretation also has its critics, the main criticism being that by reducing all economic phenomena to a matter of power, the concept of power itself becomes a nebulous idea, which explains "everything and nothing".[89] "Power", like economic value, is by no means a straightforward, simple concept. Power is often circumstantial. It cannot be automatically inferred, from the position taken by participants in market trade, what kind of power they really have. Much may depend simply on popular perceptions and beliefs that they have a certain kind of power. Particularly in economic crises, it is often discovered that those who were thought to have a lot of power, do not really have it (leading to political crises).

There are also anthropologists such as the socialist Lawrence Krader and the anarchist David Graeber who have argued that Marx's value categories should be modified in the light of historical and anthropological research about how human communities value objects.[90] Ever since Werner Sombart and Nikolai Bukharin first argued it,[91] orthodox Marxists have described Marx's theory of value as a purely objective theory of value, as opposed to the subjective theory of the bourgeois economists. However, Krader argued that Marx's theory of value and the theory of utility are compatible, i.e., the one does not exclude the other; and Krader insisted that value has both objective and subjective aspects. Graeber's work is very focused on how value categories shape human lives, and the direct political effects of that.[92]

The Chartalist challenge

An implicit technical and historical criticism of Marx's value-form theory is made by some neo-Keynesian[93] and heterodox Marxian economists[94] as well as anarchists like David Graeber,[95] who are inspired by the chartalist theory of money.[96] These economists interpret Marx's story about how money originates in the exchange process as a theory of commodity money, or the "commodity theory of money". That is, they believe that Marx's theory is more or less the same as the "barter theory of money".

The "neo-Chartalist" interpretation of money entails, that the commodity theory of money is false;[97] the latter, it is argued, can neither explain the origin of money and credit, nor provide a credible account of monetary phenomena in the modern world.[98] If the Chartalist argument is true, then it cannot also be true that, as Marx argues, money originates as a "special commodity" (a universally exchangeable good) within the exchange process itself. Instead, money is completely "a creature of the state" – it first arises as a unit of account for state debts, credits and taxes, and is then gradually imposed on the whole of the trading process in society.[99] The neo-Chartalist theory is also known as Modern Monetary Theory (MMT) (see Chartalism).

The controversy about this challenge to Marx's idea is far from being resolved at this stage,[100] for five reasons:

- Firstly, there is nowadays no consensus view among Marxists about Marx's theory of money. (1) Some Marxists deny that Marx had any full-fledged theory of money in the modern sense of the word, since he never developed any substantive theory of money circulation and public finance; Marx had deliberately kept his discussion of money and bank capital brief, it is argued, because he aimed only to explain the nature of the capitalist mode of production as simply as possible. (2) Some Marxists like Thomas T. Sekine regard the value-form discussion as a purely theoretical discussion with no bearing on empirical or historical reality; its main purpose is just to show why money necessarily emerges from the exchange of products, not how exactly it originates. (3) Some Marxists, such as Ernest Mandel and John Weeks,[101] have argued that Marx really did have a commodity theory of money, while (4) others argue that (a) such as theory can only be a "special case" of a more general theory of money, or (b) that it is a purely theoretical/analytical assumption, or (c) that it applied only in a certain period in history. (5) Some Marxists think that Marx's theory is substantially the same as the barter theory of money, while others argue it is very different from the barter theory. So, there exists no general agreement about the exact theoretical status of Marx's theory of money.[102]

- Secondly, the analysis of the historical and archaeological evidence about the real origins of money[103] is not simply a matter of "facts", but also a matter of the interpretation of the facts using theoretical frameworks.[104] At what point, exactly, did primitive money come into being?[105] When is money really money?[106] How exactly do we draw the boundary between a "chiefdom" and an "early state"?[107] How economists will interpret the historical record of human exchange processes is influenced by their theory of how markets work in the modern world, and by how they define monetary phenomena.[108] The further one goes back into the past, however, the more fragmentary the scientific evidence about the circulation of goods is, and the more interpretation is involved to understand how it worked. It is easy to project a modern understanding of money into the past, even although money was understood quite differently in the past, or money functioned differently in the past, because people were related and relating in a different way.[109]

- Thirdly, beyond the neo-Keynesian and Marxist theories about money, there is a lot of controversy and disagreement within the discipline of economics as a whole about the theory of money, credit and finance.[110] Representatives of different schools of thought in economics often cannot agree at a very basic scientific level about the causes and effects of monetary phenomena, even if they share the same elementary concepts about the circulation of money.[111] They are therefore likely also to interpret economic developments in quite different ways.

- Fourthly, as a matter of fact, very few Marxian economists have studied monetary economics in any detail, and very few of them have published significant works on the role of money in the economy.[112]

- Fifthly, when economists try to "modernize" Marx's view of money, they strike the problem that in official economics the "macro-theory" of money is very different from the "micro-theory" of money. The way economists think that money functions at the macro-level of society as a whole, differs a lot from the way they say money functions at the level of individuals.[113] They have one story for transactions between individuals, and quite another story for the "big picture". According to Marxist and post-Keynesian critics such as Wynne Godley, Marc Lavoie, Steve Keen, Edward J. Nell and Anwar Shaikh, this creates all kinds of theoretical inconsistencies. To overcome the inconsistencies, post-Keynesian Marxists try to create a so-called "stock-flow consistent model" of monetary transactions. However, it still remains rather unclear how this model can be reconciled with Marx's theory.

The main difficulty for the Chartalist theory is that, for most of recognizably human history, economic exchange took place without using a sovereign currency, and that all kinds of physical goods (such as minerals, cattle, hides, shells and slaves) were used as a kind of money. That is, commodity money existed long before sovereign currency emerged.[114] In addition, large trading houses—such as the Dutch East India Company—sometimes issued their own currency, quite independently of the state. So, the ability of tokens of value to function as money does not necessarily depend on the state at all, even although, in the "modern" epoch, money has mostly taken the form of state-issued currency.

The role of market value in human freedom and progress