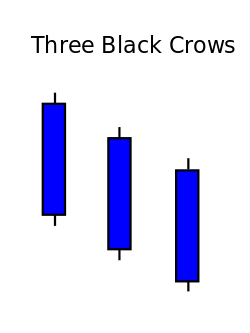

Three Black Crows

From Wikipedia, the free encyclopedia

The three black crows help to confirm that a bull market has ended and market sentiment has turned negative. In Japanese Candlestick Charting Techniques, technical analyst Steve Nison says "The three black crows would likely be useful for longer-term traders."[2]

This candlestick pattern has a counterpart known as the Three white soldiers, whose attributes help identify a bullish reversal or market upswing.

See also

References

- ↑ "Stock market investing 101 - Simplified utilizing candlestick signals". Retrieved 16 June 2010.

- ↑ Nison, Steve (2001). Candlestick Charting Explained (2nd ed.). Paramus, New Jersey: New York Institute of Finance. p. 97. ISBN 0-7352-0181-1.

- Japanese Candlestick Charting Techniques by Steve Nison. Published by New York Institute of Finance. ISBN 0-7352-0181-1

- Candlestick Charting Explained by Gregory L. Morris. Published by McGraw-Hill. ISBN 0-07-146154-X

External links

| ||||||||||||||||||||||||||||||||||||||

This article is issued from Wikipedia. The text is available under the Creative Commons Attribution/Share Alike; additional terms may apply for the media files.