Retail Price Index

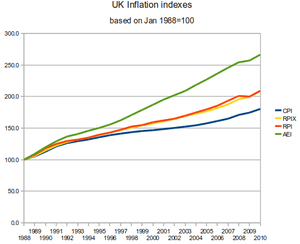

In the United Kingdom, the Retail Prices Index or Retail Price Index[1] (RPI) is a measure of inflation published monthly by the Office for National Statistics. It measures the change in the cost of a basket of retail goods and services.

History

RPI was first calculated for June 1947.[2] It was once the principal official measure of inflation. It has been superseded in that regard by the Consumer Price Index (CPI)[3][4]

The RPI is still used by the government as a base for various purposes, such as the amounts payable on index-linked securities including index-linked gilts, and social housing rent increases.[5] Many employers also use it as a starting point in wage negotiation.[6] It is no longer used by the government as the basis for the indexation of the pensions of its former employees. The UK state pension (at 2012) is indexed by the higher of RPI, CPI or 2.5%. [7]

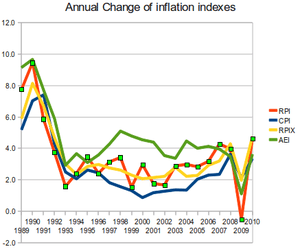

The highest annual average inflation since the introduction of the RPI came in 1975, when inflation touched 25% for that year. Indeed, the reading for June 1975 showed an increase in retail prices on an annual basis of 26.9% from a year earlier. By 1978 it had fallen to less than 10%, but rose again towards 20% over the following two years before the monetarist economic policies of the Conservative government led by Margaret Thatcher (elected in 1979) brought inflation down. By 1982, it had fallen below 10% and a year later was down to 4%, remaining low for several years until approaching double figures again by 1990. Aided by a recession in the early 1990s, increased interest rates brought inflation down again to an even lower level.[8]

In March 2009, the change in RPI measured over a 12-month period turned negative, indicating an overall annual reduction in prices, for the first time since 1960.[6] The change in RPI in the 12 months ending in April 2009, at -1.2%, was the lowest since records began in 1948.[9]

Housing associations lobbied the government to allow them to freeze rents at current levels rather than reduce them in line with the RPI, but the Treasury concluded that rents should follow RPI down as far as -2%, leading to savings in housing benefit.[5]

In February 2011, the RPI jumped to 5.1%[10] putting pressure on the Bank of England to raise interest rates despite disappointing projected GDP growth of only 1.6% in 2011.[10] The September 2011 figure of 5.6%, the highest for twenty years, was described by the Daily Telegraph as "shockingly bad".[11]

Calculation

The United Kingdom RPI is constructed as follows:

- A base year or starting point is chosen. This becomes the standard against which price changes are measured.

- A list of items bought by an average family is drawn up. This is facilitated by the Living Costs and Food Survey.

- A set of weights are calculated, showing the relative importance of the items in the average family budget - the greater the share of the average household bill, the greater the weight.

- The price of each item is multiplied by the weight given to the item, so that the contribution of the item's price is in proportion to its importance.

- The price of each item must be found in both the base year and the year of comparison (or month).

This enables the percentage change to be calculated over the desired time period.

In practice the comparison is made over shorter periods, and the weights are frequently reassessed. Detailed information is published on the Office for National Statistics website.

The following items are not included in the CPI: Council tax, mortgage interest payments, house depreciation, buildings insurance, ground rent, solar PV feed in tariffs and other house purchase cost such as estate agents' and conveyancing fees.[12]

CPI is usually lower, though this is due more to the differences in the calculation formulas for the indices than to the differences in coverage. The UK Government announced in the June 2010 budget that CPI would be used in place of RPI for uprating of some benefits with effect from April 2011.[13]

Regarding State Pensions the UK Government confirmed in their autumn statement in 2011 that these would go up by the greater of the CPI, the RPI, or 2.5%. [7]

The variability of the change in RPI is shown in the graph on the right. This was one of the arguments used in favour of changing to RPIX.

Variations

Variations on the RPI include the RPIX, which removes the cost of mortgage interest payments, and the RPIY, which excludes indirect taxes (VAT) and local authority taxes as well as mortgage interest payments.

See also

- Consumer price index (general concept)

- Price index (more detailed statistical explanation)

References

- ↑ Finance Bill — Rates of duty, etc.: reference to Retail Price Index — 18 July 2000

- ↑ "History of and differences between the Consumer Prices Index and Retail Prices Index". Office for National Statistics. 2011. Retrieved 2011-10-10.

- ↑ National Statistics Online. 2008-10-14. Retrieved 2008-10-22

- ↑ "Consumer inflation falls to 4.5%". BBC News. 2008-11-18. Retrieved 2008-11-29. "The Consumer Prices Index (CPI) measure dropped to 4.5% from 5.2% in September. ... Retail Prices Index (RPI)... fell from 5% to 4.2%"

- ↑ 5.0 5.1 Landlords lose rent cuts battle, Inside Housing, 10 July 2009

- ↑ 6.0 6.1 Inflation measure turns negative , BBC News, 21 April 2009

- ↑ 7.0 7.1 "Autumn Statement 2011 - pension increases". 12 August 2012.

- ↑ "Thatcher years in graphics". BBC News. 2005-11-18.

- ↑ Threat of deflation as retail price index falls to lowest-ever level, The Times, 20 May 2009

- ↑ 10.0 10.1 "Output, prices and jobs". The Economist. 2011-03-24.

- ↑ "Inflation is disastrous for our economic future". Daily Telegraph (London). 18 October 2011. Retrieved 20 October 2011.

- ↑ Consumer Price Indices, A brief guide, Office for National Statistics, retrieved 2011-04-24

- ↑ "Budget June 2010 - benefits and tax credits". DirectGov. UK Government. 3 May 2011. Retrieved 25 October 2011.

External links

- Consumer Price Indices: A brief guide, Office for National Statistics, August 2011

- Retail Prices Index topic page at ONS website

- Historic inflation calculator: how the value of money has changed since 1900 (ThisisMoney.co.UK, DMG Media)