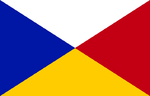

P&O Nedlloyd

| |

| Industry | Shipping |

|---|---|

| Fate | Taken over by Maersk Line |

| Founded | 1997 |

| Defunct | 2006 |

| Headquarters | Rotterdam, Netherlands |

| Area served | Worldwide |

| Services | Container transportation |

| Website | www.ponl.com |

P&O Nedlloyd Container Line Limited was an Anglo-Dutch worldwide ocean-going container shipping line, with dual headquarters in London and Rotterdam. The company was formed in 1997 by the merger of the container-shipping interests of Dutch transportation company Royal Nedlloyd (Nedlloyd Line) and the British maritime shipping giant P&O Group (P&O Containers).

In 2004, Royal Nedlloyd bought the remaining shares from P&O and the company was listed as Royal P&O Nedlloyd on the Dutch stock exchange. Royal P&O Nedlloyd was acquired by the Danish A.P. Moller-Maersk Group (Maersk) in 2005 and was combined with their existing container shipping business Maersk-Sealand to form Maersk Line. As Sealand was the USA based historic innovator of container shipping, Maersk Line subsequently embodies the Dutch, British as well as Danish and American merchant marine legacy.

History

The company, P&O Nedlloyd, a 50/50 joint venture was formed in December 1996; when P&O Containers Limited (formerly OCL'), a British shipping giant merged its container-shipping interests with the Dutch container transportation company, Royal Nedlloyd Lines. P&O Nedlloyd was the largest partner in the Grand Alliance, which also included shippings concerns such as OOCL, Hapag Lloyd and NYK Lines.

Expanding in 1998, the line purchased Blue Star Line's container business. The company also acquired the container business of Harrison Line (based in the UK). Further expansion came with the buyout of Farrell Lines (US-based) in 2000.

In 2001, after three years of negotiations, an attempt to make P&O Nedlloyd failed. With Philip Green at the helm Anglo-Dutch boardroom balancing got a different rational and in April 2004 Royal Nedlloyd purchased the 25% shares of P&O Nedlloyd from P&O and exchange the remain 25% shares holds by P&O with 25% shares of the newly formed listed company, makes Royal Nedlloyd is the major shares holder.[1]

The company was listed on the Euronext Amsterdam as Royal P&O Nedlloyd NV. By the end of 2005 Royal P&O Nedlloyd was efficiently operating its worldwide business according to standardised global processes and a single IT application called 'FOCUS', which included all commercial, operational as well as financial activities.

In May 2005 Maersk announced plans to purchase P&O Nedlloyd[2] for 2.3 billion euros.[3] At the time of the acquisition, P&O Nedlloyd had 6% of the global industry market share, and Maersk-Sealand had 12%. The combined company would be about 18% of world market share. Maersk completed the buyout of the company on 13 August 2005, Royal P&O Nedlloyd shares terminated trading on 5 September. In February 2006, the new combined entity adopted the name "Mærsk Line"

At the time the company was folded into A.P. Moller, it owned and chartered a fleet of over 160 vessels. Its container fleet, consisting of owned and leased vessels, had a capacity of 635,000 twenty-foot equivalent units (TEU). Royal P&O Nedlloyd N.V. had 13,000 employees in 146 countries..

In the three years following the acquisition, there has been an exodus of the majority of P&O Nedlloyd's customers from Maersk Line, as well as a decrease in the customer-satisfaction at the combined company's liner operations.[4] By the end of 2006, Maersk global market share had fallen from 18.2% to 16.8%, at the same time, the next two largest carriers increased their market share, MSC went from 8.6% to 9.5% and CMA CGM from 5.6% to 6.5%.[5][6][7] In January 2008, Maersk Line announced drastic reorganisational measures.[8]

Three years after the take over of P&O Nedlloyd the Maersk Line corporate streamline strategy, based on the Lean Six Sigma process excellence principles, is following the best practices of the P&O Nedlloyd legacy, which at the time of its take over already had a system of globally standardised business processes and one single IT application to support this.

Heritage

Items of P&O Nedlloyd and its predecessors historical heritage are displayed at both the Maritime Museum in Rotterdam and the National Maritime Museum in London.

Gallery

-

P&O Nedlloyd 9'6 container in a Freightliner well wagon at Banbury station in 2001.

-

P&O Nedlloyd Unity in Suez Canal.

-

P&O Nedlloyd Vera Cruz outbound Santos/Brazil in 2000.

-

P&O Nedlloyd Tasman in 2000.

-

P&O Nedlloyd Barentz.

References

- ↑ MacAlister, Terry (2004-02-03). "P&O casts off container unit". The Guardian (London). Retrieved 2010-03-21.

- ↑ MacAlister, Terry (2005-05-113). "Maersk and Nedlloyd in bid talks". The Guardian (London). Retrieved 2010-03-21.

- ↑ Notes of the P&O Nedlloyd shareholder meeting 27 July 2005

- ↑ Wright, Robert. "CMA CGM chief looks forward to smooth sailing" - Financial Times - July 1, 2007

- ↑ Urquhart, Donald. "Maersk Line's market share declines in 2006" - The Business Times - Marshall Cavendish - 29 January 07

- ↑ "Liner Shipping Report" - AXS-Alphaliner - January 2007 - (Adobe Acrobat *.PDF document)

- ↑ Kennedy, Frank. "Shipowners order new vessels worth record $105.5b in 2006" - Gulf News - 12/02/2007

- ↑ Interview with CEO December 2007

External links

| Wikimedia Commons has media related to P&O Nedlloyd. |

- Official website

- PONLHeritage Website

- SCARA (OCL/P&OCL/PONL) staff association

- P&O Nedlloyd Videos

- Maersk Line Website

| ||||||||||||||||||||||