Graham number

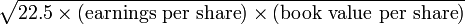

The Graham number or Benjamin Graham number is a figure used in securities investing that measures a stock's so-called fair value.[1] Named after Benjamin Graham, the founder of value investing, the Graham number can be calculated as follows:

The final number is, theoretically, the maximum price that a defensive investor should pay for the given stock. Put another way, a stock priced below the Graham Number would be considered a good value, if it also meets a number of other criteria.

Graham writes[2]:

Current price should not be more than 1½ times the book value last reported. However a multiplier of earnings below 15 could justify a correspondingly higher multiplier of assets. As a rule of thumb we suggest that the product of the multiplier times the ratio of price to book value should not exceed 22.5. (This figure corresponds to 15 times earnings and 1½ times book value. It would admit an issue selling at only 9 times earnings and 2.5 times asset value, etc.)

This number applies only to certain types of stocks in combination with a number of other criteria. The complete Graham selection procedure is much more elaborate. No decision should be made based on this number alone.[3]

Alternative calculation

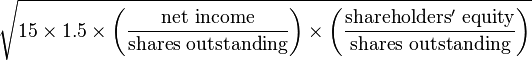

Earnings per share is calculated by dividing net income by shares outstanding. Book value is another way of saying shareholders' equity. Therefore, book value per share is calculated by dividing equity by shares outstanding. Consequently, the formula for the Graham number can also be written as follows:

References

- ↑ Investopedia: Definition of 'Graham Number'

- ↑ Graham, Benjamin; Jason Zweig (2003-07-08) [1949]. "14". The Intelligent Investor. Warren E. Buffett (collaborator) (2003 edition ed.). HarperCollins. p. 349. ISBN 0-06-055566-1.

- ↑ Serenity: Benjamin Graham's Misunderstood Graham-Number.