G-expectation

In probability theory, the g-expectation is a nonlinear expectation based on a backwards stochastic differential equation (BSDE) originally developed by Shige Peng.[1]

Definition

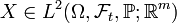

Given a probability space  with

with  is a (d-dimensional) Wiener process (on that space). Given the filtration generated by

is a (d-dimensional) Wiener process (on that space). Given the filtration generated by  , i.e.

, i.e. ![{\mathcal {F}}_{t}=\sigma (W_{s}:s\in [0,t])](/2014-wikipedia_en_all_02_2014/I/media/7/3/9/0/739020a3a84139f8a5fb16a1e131482a.png) , let

, let  be

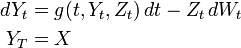

be  measurable. Consider the BSDE given by:

measurable. Consider the BSDE given by:

Then the g-expectation for  is given by

is given by ![{\mathbb {E}}^{g}[X]:=Y_{0}](/2014-wikipedia_en_all_02_2014/I/media/b/0/4/3/b0432efb21f796bf68defe431a96b291.png) . Note that if

. Note that if  is an m-dimensional vector, then

is an m-dimensional vector, then  (for each time

(for each time  ) is an m-dimensional vector and

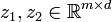

) is an m-dimensional vector and  is an

is an  matrix.

matrix.

In fact the conditional expectation is given by ![{\mathbb {E}}^{g}[X\mid {\mathcal {F}}_{t}]:=Y_{t}](/2014-wikipedia_en_all_02_2014/I/media/7/1/a/5/71a56ca189c4bfb007cce793207110fb.png) and much like the formal definition for conditional expectation it follows that

and much like the formal definition for conditional expectation it follows that ![{\mathbb {E}}^{g}[1_{A}{\mathbb {E}}^{g}[X\mid {\mathcal {F}}_{t}]]={\mathbb {E}}^{g}[1_{A}X]](/2014-wikipedia_en_all_02_2014/I/media/6/b/2/c/6b2c750a5ecae31f5dfa7f562f71edbe.png) for any

for any  (and the

(and the  function is the indicator function).[1]

function is the indicator function).[1]

Existence and uniqueness

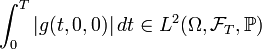

Let ![g:[0,T]\times {\mathbb {R}}^{m}\times {\mathbb {R}}^{{m\times d}}\to {\mathbb {R}}^{m}](/2014-wikipedia_en_all_02_2014/I/media/c/e/3/c/ce3c1c4d7105dc0d4b5787fd1cfba233.png) satisfy:

satisfy:

-

is an

is an  -adapted process for every

-adapted process for every

-

the L2 space (where

the L2 space (where  is a norm in

is a norm in  )

) -

is Lipschitz continuous in

is Lipschitz continuous in  , i.e. for every

, i.e. for every  and

and  it follows that

it follows that  for some constant

for some constant

Then for any random variable  there exists a unique pair of

there exists a unique pair of  -adapted processes

-adapted processes  which satisfy the stochastic differential equation.[2]

which satisfy the stochastic differential equation.[2]

In particular, if  additionally satisfies:

additionally satisfies:

-

is continuous in time (

is continuous in time ( )

) -

for all

for all ![(t,y)\in [0,T]\times {\mathbb {R}}^{m}](/2014-wikipedia_en_all_02_2014/I/media/f/1/5/0/f1507c38a5a5f714d9f7b23a2727ee15.png)

then for the terminal random variable  it follows that the solution processes

it follows that the solution processes  are square integrable. Therefore

are square integrable. Therefore ![{\mathbb {E}}^{g}[X|{\mathcal {F}}_{t}]](/2014-wikipedia_en_all_02_2014/I/media/8/f/1/c/8f1c6deed92c4940e32b2bbd342138d8.png) is square integrable for all times

is square integrable for all times  .[3]

.[3]

See also

- Expected value

- Choquet expectation

- Risk measure – almost any time consistent convex risk measure can be written as

![\rho _{g}(X):={\mathbb {E}}^{g}[-X]](/2014-wikipedia_en_all_02_2014/I/media/8/8/d/e/88de2e920dc78f5cff263b217fa0fba4.png) [4]

[4]

References

- ↑ 1.0 1.1 Philippe Briand; François Coquet; Ying Hu; Jean Mémin; Shige Peng (2000). "A Converse Comparison Theorem for BSDEs and Related Properties of g-Expectation" (pdf). Electronic Communications in Probability 5 (13): 101–117. Retrieved August 2, 2012.

- ↑ Peng, S. (2004). "Nonlinear Expectations, Nonlinear Evaluations and Risk Measures" (pdf). Stochastic Methods in Finance. Lecture Notes in Mathematics 1856. pp. 165–138. doi:10.1007/978-3-540-44644-6_4. ISBN 978-3-540-22953-7. Retrieved August 9, 2012.

- ↑ Chen, Z.; Chen, T.; Davison, M. (2005). "Choquet expectation and Peng's g -expectation". The Annals of Probability 33 (3): 1179. doi:10.1214/009117904000001053.

- ↑ Rosazza Gianin, E. (2006). "Risk measures via g-expectations". Insurance: Mathematics and Economics 39: 19–65. doi:10.1016/j.insmatheco.2006.01.002.