First Citizens BancShares

| Type | Public |

|---|---|

| Traded as | NASDAQ: FCNCA |

| Industry | Finance, Investments, and Insurance |

| Founded | 1898 |

| Headquarters | Raleigh, North Carolina, United States |

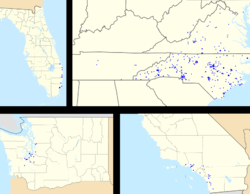

| Area served | First Citizens Bank - California, Colorado, District of Columbia, Florida, Maryland, North Carolina, Tennessee, Virginia, Washington, West Virginia Ironstone Bank - Arizona, California, Colorado, Florida, Georgia, Kansas, Missouri, New Mexico, Oklahoma, Oregon, Texas, Washington |

| Key people | Frank B. Holding Jr. (CEO) (Chairman of the Board) |

| Products | Commercial banking, Investment banking |

| Net income | US$ 27.75 million (2009) |

| Total assets | US$ 21 billion (as of 09/30/2010) |

| Employees | ~5,000 |

| Website | www.firstcitizens.com |

First Citizens Bancshares, Incorporated (First Citizens Bancshares) is a bank holding company based in Raleigh, North Carolina. that operates two subsidiaries, First Citizens Bank and IronStone Bank. In aggregate, First Citizens operates in 17 states in the United States, concentrated in the Southeastern United States, Southern California, and Washington.

First Citizens is the 46th largest bank holding company in the United States with $21 billion in assets.[1] The company employs approximately 4,400 employees.[2]

First Citizens Bank serves clients in more than 200 locales in North Carolina, Virginia, West Virginia, Tennessee, Maryland, Florida, Colorado, California, Washington and Washington, DC. First Citizens has 435 branches. IronStone Bank, a division of the company, has 58 branches[3] in Arizona, California, Colorado, Georgia, Florida, Kansas, Missouri, New Mexico, Oklahoma, Oregon, Texas, and Washington.

In 1998, First Citizens Bank made an agreement with First Citizens Bank of South Carolina, also owned by the Frank Holding family, allowing customers of either bank to conduct transactions with the other institution.[4]

On Dec 22, 2003, Citizens Bancshares restated its previously announced 2003 third quarter earnings, following a determination by its independent auditors to chang its accounting treatment of one third quarter transaction related to shares of the Company's common stock donated to it by an unrelated third party.[5]

On October 8, 2010, First Citizens filed a merger application with federal regulators, the Office of the Comptroller of the Currency and the Federal Reserve Bank of Richmond, and respective state banking departments in IronStone's footprint. IronStone Bank will continue to operate under its trade name.[6] The change became official January 7, 2011.[3]

First Citizens Bank entered into an agreement with the Federal Deposit Insurance Corp. (FDIC) to purchase substantially all the assets and assume the majority of the liabilities of United Western Bank, Denver, Colorado on January 21, 2011.[7] Months later First Citizens took over the failed Colorado Capital Bank of Castle Rock, Colorado in a similar deal. It was the sixth FDIC-related agreement since July 2009.[8] First Citizens now has 14 branches in Colorado, 3 of them IronStone.[9]

On December 10, 2013, 1st Financial Corp. shareholders approved a merger with First Citizens. As of September 30, 2013, Hendersonville, North Carolina-based 1st Financial had 12 branches in Western North Carolina, $675 million in assets and $660 million in deposits. In spring 2014, accounts of Mountain 1st Bank & Trust are to change to First Citizens.[10]

Timeline

First Citizens Bank, first known as the Bank of Smithfield, opened on March 1, 1898.[11]

- 1898 - established as the First-Citizens Bank & Trust Company[12]

- 1971 - acquired The Haynes Bank of Cliffside, North Carolina[12]

- 1974 - acquired The Bank of Coleridge in Ramseur, North Carolina and The Bank of Commerce in Charlotte, North Carolina[12]

- 1979 - acquired Bank of Conway in Conway, North Carolina[12]

- 1981 - acquired Commercial & Farmers Bank of Rural Hall, North Carolina and Commercial & Savings Bank of Boonville, North Carolina[12][13][14]

- 1983 - acquired Peoples Bank of North Carolina in Madison, North Carolina[12]

- 1985 - acquired First State Bank of Winterville, North Carolina, Farmers Bank of Pilot Mountain, North Carolina, and Farmers Bank of Sunbury in Sunbury, North Carolina[12]

- 1990 - acquired Heritage Federal Savings and Loan Association of Monroe, North Carolina and North Carolina Savings and Loan Association, FA of Charlotte, North Carolina[12]

- 1991 - acquired Mutual Savings and Loan Association of Charlotte, North Carolina and First Federal Savings Bank of Hendersonville, North Carolina[12]

- 1993 - acquired Caldwell Savings Bank of Lenoir, North Carolina, Surety Federal Savings and Loan Association, FA of Morganton, North Carolina, and Pioneer Savings Bank of Rocky Mount, North Carolina[12]

- 1994 - acquired The Bank of Bladenboro in Bladenboro, North Carolina, Edgecomb Homestead Savings Bank of Tarboro, North Carolina, and First Republic Savings Bank FSB of Roanoke Rapids, North Carolina[12]

- 1995 - acquired First Investors Savings Bank of Whiteville, North Carolina and State Bank of Fayetteville, North Carolina[12]

- 1996 - acquired First-Citizens Bank & Trust Company of Lawrenceville, Virginia, Peoples Savings Bank of Wilmington, North Carolina, and Summit Savings Bank of Sanford, North Carolina[12]

- 1997 - acquired First Savings Bank of Rockingham County in Reidsville, North Carolina[12]

- 1998 - acquired First Citizens Bank & Trust Company of White Sulphur Springs, West Virginia[12]

- 2003 - acquired Avery County Bank of Newland, North Carolina[12]

- 2009 - U.S. Bank National Association, a subsidiary bank of U.S. Bancorp, entered into a definitive agreement to purchase the bond trustee business of First Citizens Bank, a subsidiary of First Citizens BancShares.

- 2009 - acquired Temecula Valley Bank[15] of Temecula, California and Venture Bank[16] of Lacey, Washington

- 2010 - acquired First Regional Bank of Los Angeles, California[12] and Sun American Bank of Boca Raton, Florida[12]

- 2011 - changed IronStone Bank to division from subsidiary[3]

- 2011 - acquired United Western Bank of Denver, Colorado[7]

- 2011 - acquired Colorado Capital Bank of Castle Rock, Colorado[8]

- 2013 - announced merger with 1st Financial Corp. of Hendersonville, North Carolina

Subsidiaries

| Name | Asset size |

|---|---|

| First-Citizens Bank & Trust Company | $18.2 billion[2] |

| Ironstone Bank | $2.8 billion[2] |

References

- ↑ "Top 50 bank holding companies". Federal Financial Institutions Examination Council. 2010-09-30. Retrieved 2010-09-30.

- ↑ 2.0 2.1 2.2 "Associated Banc-Corp". Holding Companies. iBanknet.com. 2010-09-30. Retrieved 2010-09-30.

- ↑ 3.0 3.1 3.2 Ranii, David (2011-01-07). "First Citizens completes in-house merger". News & Observer. Retrieved 2011-01-07.

- ↑ "Briefly," The News & Observer, July 23, 1998, p. D2.

- ↑ "Citizens Bancshares Corporation Announces Revised Third Quarter Earnings".

- ↑ Weisbecker, Lee (2010-10-08). "First Citizens looks to merge with IronStone Bank". Charlotte Business Journal. Retrieved 2011-01-24.

- ↑ 7.0 7.1 "First Citizens Bank Purchases Certain Assets, Assumes Certain Liabilities Of United Western Bank". 2011-01-21. Retrieved 2011-01-24.

- ↑ 8.0 8.1 "Lighting company CFO finalist for honor". Salisbury Post. 2011-01-21. Retrieved 2011-01-24.

- ↑ "First Citizens Bank Purchases Certain Assets, Assumes Certain Liabilities of Colorado Capital Bank". Yahoo Finance. 2011-07-08. Retrieved 2011-07-21.

- ↑ "Mountain 1st-First Citizens merger OK'd". Asheville Citizen-Times. 2013-12-10. Retrieved 2013-12-18.

- ↑ "A Century of Expertise". Retrieved 2011-01-24.

- ↑ 12.0 12.1 12.2 12.3 12.4 12.5 12.6 12.7 12.8 12.9 12.10 12.11 12.12 12.13 12.14 12.15 12.16 12.17 "Bank Holding Company Detail". FDIC Institution Directory. Federal Deposit Insurance Corporation. 2006-12-31. Retrieved 2007-04-15.

- ↑ "First Citizens Bank Purchases Certain Assets, Assumes Certain Liabilities of Sun American Bank". 2010-03-05. Retrieved 2011-01-24.

- ↑ "First Citizens Bank Purchases Certain Assets, Assumes Certain Liabilities of First Regional Bank". 2010-01-29. Retrieved 2011-01-24.

- ↑ "First Citizens Bank Acquires Temecula Valley Bank". 2009-07-17. Retrieved 2011-01-24.

- ↑ "First Citizens Bank Acquires Venture Bank of Washington". 2009-09-11. Retrieved 2011-01-24.