Expected utility hypothesis

In economics, game theory, and decision theory the expected utility hypothesis refers to a hypothesis concerning people's preferences with regard to choices that have uncertain outcomes (gambles). This hypothesis states that if certain axioms are satisfied, the subjective value associated with a gamble by an individual is the statistical expectation of that individual's valuations of the outcomes of that gamble. This hypothesis has proved useful to explain some popular choices that seem to contradict the expected value criterion (which takes into account only the sizes of the payouts and the probabilities of occurrence), such as occur in the contexts of gambling and insurance. Daniel Bernoulli initiated this hypothesis in 1738. Until the mid twentieth century, the standard term for the expected utility was the moral expectation, contrasted with "mathematical expectation" for the expected value.[1]

The von Neumann–Morgenstern utility theorem provides necessary and sufficient "rationality" axioms under which the expected utility hypothesis holds.[2]

Expected value and choice under risk

In the presence of risky outcomes, a decision maker could use the expected value criterion as a rule of choice: higher expected value investments are simply the preferred ones. For example, suppose there is a gamble in which the probability of getting a $100 payment is 1 in 80 and the alternative, and far more likely, outcome, is getting nothing. Then the expected value of this gamble is $1.25. Given the choice between this gamble and a guaranteed payment of $1, by this simple expected value theory people would choose the $100-or-nothing gamble. However, under expected utility theory, some people would be risk averse enough to prefer the sure thing, even though it has a lower expected value, while other less risk averse people would still choose the riskier, higher-mean gamble.

Bernoulli's formulation

Nicolas Bernoulli described the St. Petersburg paradox (involving infinite expected values) in 1713, prompting two Swiss mathematicians to develop expected utility theory as a solution. The theory can also more accurately describe more realistic scenarios (where expected values are finite) than expected value alone.

In 1728, Gabriel Cramer, in a letter to Nicolas Bernoulli, wrote, "the mathematicians estimate money in proportion to its quantity, and men of good sense in proportion to the usage that they may make of it."[3]

In 1738, Nicolas' cousin Daniel Bernoulli, published the canonical 18th Century description of this solution in Specimen theoriae novae de mensura sortis or Exposition of a New Theory on the Measurement of Risk.[4]

Daniel Bernoulli proposed that a mathematical function should be used to correct the expected value depending on probability. This provides a way to account for risk aversion, where the risk premium is higher for low-probability events than the difference between the payout level of a particular outcome and its expected value.

Bernoulli's paper was the first formalization of marginal utility, which has broad application in economics in addition to expected utility theory. He used this concept to formalize the idea that the same amount of additional money was less useful to an already-wealthy person than it would be to a poor person.

Infinite expected value — St. Petersburg paradox

The St. Petersburg paradox (named after the journal in which Bernoulli's paper was published) arises when there is no upper bound on the potential rewards from very low probability events. Because some probability distribution functions have an infinite expected value, an expected-wealth maximizing person would pay an infinite amount to take this gamble. In real life, people do not do this.

Bernoulli proposed a solution to this paradox in his paper: the utility function used in real life means that the expected utility of the gamble is finite, even if its expected value is infinite. (Thus he hypothesized diminishing marginal utility of increasingly larger amounts of money.) It has also been resolved differently by other economists by proposing that very low probability events are neglected, by taking into account the finite resources of the participants, or by noting that one simply cannot buy that which is not sold (and that sellers would not produce a lottery whose expected loss to them were unacceptable).

Von Neumann–Morgenstern formulation

The von Neumann-Morgenstern axioms

There are four axioms[5] of the expected utility theory that define a rational decision maker. They are completeness, transitivity, independence and continuity.

Completeness assumes that an individual has well defined preferences and can always decide between any two alternatives.

- Axiom (Completeness): For every A and B either

or

or  .

.

This means that the individual either prefers A to B, or is indifferent between A and B, or prefers B to A.

Transitivity assumes that, as an individual decides according to the completeness axiom, the individual also decides consistently.

- Axiom (Transitivity): For every A, B and C with

and

and  we must have

we must have  .

.

Independence also pertains to well-defined preferences and assumes that two gambles mixed with a third one maintain the same preference order as when the two are presented independently of the third one. The independence axiom is the most controversial one.

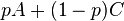

- Axiom (Independence): Let A, B, and C be three lotteries with

, and let

, and let ![t\in (0,1]](/2014-wikipedia_en_all_02_2014/I/media/e/3/2/9/e32985d77fc3dabef5b39119f03eab0e.png) ; then

; then  .

.

Continuity assumes that when there are three lotteries (A, B and C) and the individual prefers A to B and B to C, then there should be a possible combination of A and C in which the individual is then indifferent between this mix and the lottery B.

- Axiom (Continuity): Let A, B and C be lotteries with

; then there exists a probability p such that B is equally good as

; then there exists a probability p such that B is equally good as  .

.

If all these axioms are satisfied, then the individual is said to be rational and the preferences can be represented by a utility function, i.e. one can assign numbers (utilities) to each outcome of the lottery such that choosing the best lottery according to the preference  amounts to choosing the lottery with the highest expected utility. This result is called the von Neumann—Morgenstern utility representation theorem.

amounts to choosing the lottery with the highest expected utility. This result is called the von Neumann—Morgenstern utility representation theorem.

In other words: if an individual always chooses his/her most preferred alternative available, then the individual will choose one gamble over another if and only if there is a utility function such that the expected utility of one exceeds that of the other. The expected utility of any gamble may be expressed as a linear combination of the utilities of the outcomes,with the weights being the respective probabilities. Utility functions are also normally continuous functions. Such utility functions are also referred to as von Neumann–Morgenstern (vNM) utility functions. This is a central theme of the expected utility hypothesis in which an individual chooses not the highest expected value, but rather the highest expected utility. The expected utility maximizing individual makes decisions rationally based on the axioms of the theory.

The von Neumann–Morgenstern formulation is important in the application of set theory to economics because it was developed shortly after the Hicks-Allen "ordinal revolution" of the 1930s, and it revived the idea of cardinal utility in economic theory.[citation needed] Note, however, that while in this context the utility function is cardinal, in that implied behavior would be altered by a non-linear monotonic transformation of utility, the expected utility function is ordinal because any monotonic increasing transformation of it gives the same behavior.

Risk aversion

The expected utility theory implies that rational individuals act as though they were maximizing expected utility, and takes into account that individuals may be risk averse, meaning that the individual would refuse a fair gamble (a fair gamble has an expected value of zero). Risk aversion implies that their utility functions are concave and show diminishing marginal wealth utility. The risk attitude is directly related to the curvature of the utility function: risk neutral individuals have linear utility functions, while risk seeking individuals have convex utility functions and risk averse individuals have concave utility functions. The degree of risk aversion can be measured by the curvature of the utility function.

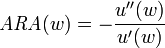

Since the risk attitudes are unchanged under affine transformations of u, the first derivative u' is not an adequate measure of the risk aversion of a utility function. Instead, it needs to be normalized. This leads to the definition of the Arrow–Pratt[6][7] measure of absolute risk aversion:

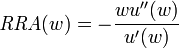

The Arrow–Pratt measure of relative risk aversion is:

Special classes of utility functions are the CRRA (constant relative risk aversion) functions, where RRA(w) is constant, and the CARA (constant absolute risk aversion) functions, where ARA(w) is constant. They are often used in economics for simplification.

A decision that maximizes expected utility also maximizes the probability of the decision's consequences being preferable to some uncertain threshold (Castagnoli and LiCalzi,1996; Bordley and LiCalzi,2000;Bordley and Kirkwood, ). In the absence of uncertainty about the threshold, expected utility maximization simplifies to maximizing the probability of achieving some fixed target. If the uncertainty is uniformly distributed, then expected utility maximization becomes expected value maximization. Intermediate cases lead to increasing risk-aversion above some fixed threshold and increasing risk-seeking below a fixed threshold.

Examples of von Neumann-Morgenstern utility functions

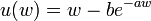

The utility function  was originally suggested by Bernoulli (see above). It has relative risk aversion constant and equal to one, and is still sometimes assumed in economic analyses. The utility function

was originally suggested by Bernoulli (see above). It has relative risk aversion constant and equal to one, and is still sometimes assumed in economic analyses. The utility function  exhibits constant absolute risk aversion, and for this reason is often avoided, although it has the advantage of offering substantial mathematical tractability when asset returns are normally distributed. Note that, as per the affine transformation property alluded to above, the utility function

exhibits constant absolute risk aversion, and for this reason is often avoided, although it has the advantage of offering substantial mathematical tractability when asset returns are normally distributed. Note that, as per the affine transformation property alluded to above, the utility function  gives exactly the same preferences orderings as does

gives exactly the same preferences orderings as does  ; thus it is irrelevant that the values of

; thus it is irrelevant that the values of  and its expected value are always negative: what matters for preference ordering is which of two gambles gives the higher expected utility, not the numerical values of those expected utilities.

and its expected value are always negative: what matters for preference ordering is which of two gambles gives the higher expected utility, not the numerical values of those expected utilities.

The class of constant relative risk aversion utility functions contains three categories. Bernoulli's utility function

has relative risk aversion equal to unity. The functions

for  have relative risk aversion equal to

have relative risk aversion equal to  . And the functions

. And the functions

for  also have relative risk aversion equal to

also have relative risk aversion equal to  .

.

See also the discussion of utility functions having hyperbolic absolute risk aversion (HARA).

Measuring risk in the expected utility context

Often people refer to "risk" in the sense of a potentially quantifiable entity. In the context of mean-variance analysis, variance is used as a risk measure for portfolio return; however, this is only valid if returns are normally distributed or otherwise jointly elliptically distributed.[8][9][10] However, D. E. Bell[11] proposed a measure of risk which follows naturally from a certain class of von Neumann-Morgenstern utility functions. Let utility of wealth be given by  for individual-specific positive parameters a and b. Then expected utility is given by

for individual-specific positive parameters a and b. Then expected utility is given by

Thus the risk measure is  , which differs between two individuals if they have different values of the parameter

, which differs between two individuals if they have different values of the parameter  , allowing different people to disagree about the degree of risk associated with any given portfolio.

, allowing different people to disagree about the degree of risk associated with any given portfolio.

Criticism

Expected utility theory is criticized by behavioral decision science. It argues that, whilst Bernoulli's paper was concise and brilliant, the theory is not perfect. For example, in 2000 behavioral economist Matthew Rabin proved mathematically that the utility of wealth cannot explain loss aversion and attempts to so use it will fail. Bernoulli's theory on the utility of wealth assumed that if two people have the same wealth all other things being equal the people should be equally happy. However, where two people have US$1m but one has just prior to that had US$2m but lost US$1m whereas the other had US$500 and had just gained US$999,500 they will not be equally happy. Bernoulli's theory thus lacked a reference point. Nevertheless it remained a dominant theory for over 250 years. Kahneman and Tversky in 1979 presented their prospect theory which showed empirically, among other things, how preferences of individuals are inconsistent among same choices, depending on how those choices are presented.[12]

Like any mathematical model, expected utility theory is an abstraction and simplification of reality. The mathematical correctness of expected utility theory and the salience of its primitive concepts do not guarantee that expected utility theory is a reliable guide to human behavior or optimal practice.

The mathematical clarity of expected utility theory has helped scientists design experiments to test its adequacy, and to distinguish systematic departures from its predictions. This has led to the field of behavioral finance, which has produced deviations from expected utility theory to account for the empirical facts.

Conservatism in updating beliefs

It is well established that humans find logic hard, mathematics harder, and probability even more challenging[citation needed]. Psychologists have discovered systematic violations of probability calculations and behavior by humans.[citation needed] Consider, for example, the Monty Hall problem.

In updating probability distributions using evidence, a standard method uses conditional probability, namely the rule of Bayes. An experiment on belief revision has suggested that humans change their beliefs faster when using Bayesian methods than when using informal judgment.[13]

Irrational deviations

Behavioral finance has produced several generalized expected utility theories to account for instances where people's choice deviate from those predicted by expected utility theory. These deviations are described as "irrational" because they can depend on the way the problem is presented, not on the actual costs,rewards, or probabilities involved.

Particular theories include prospect theory, rank-dependent expected utility and cumulative prospect theory and SP/A theory.[14]

Preference reversals over uncertain outcomes

Starting with studies such as Lichtenstein & Slovic (1971), it was discovered that subjects sometimes exhibit signs of preference reversals with regard to their certainty equivalents of different lotteries. Specifically, when eliciting certainty equivalents, subjects tend to value "p bets" (lotteries with a high chance of winning a low prize) lower than "$ bets" (lotteries with a small chance of winning a large prize). When subjects are asked which lotteries they prefer in direct comparison, however, they frequently prefer the "p bets" over "$ bets."[15] Many studies have examined this "preference reversal," from both an experimental (e.g., Plott & Grether, 1979)[16] and theoretical (e.g., Holt, 1986)[17] standpoint, indicating that this behavior can be brought into accordance with neoclassical economic theory under specific assumptions.

Uncertain probabilities

If one is using the frequentist notion of probability, where probabilities are considered to be facts, then applying expected value and expected utility to decision-making requires knowing the probability of various outcomes. However, this is unknown in practice: one is operating under uncertainty (in economics, one talks of Knightian uncertainty). Thus one must make assumptions, but then the expected value of various decisions is very sensitive to the assumptions. This is particularly a problem when the expectation is dominated by rare extreme events, as in a long-tailed distribution.

Alternative decision techniques are robust to uncertainty of probability of outcomes, either not depending on probabilities of outcomes and only requiring scenario analysis (as in minimax or minimax regret), or being less sensitive to assumptions.

Bayesian approaches to probability treat it as a degree of belief, and thus deny the existence of Knightian uncertainty and uncertain probabilities.

See also

- Allais paradox

- Ambiguity aversion

- Bayesian probability

- Behavioral economics

- Decision theory

- Generalized expected utility

- Indifference price

- Loss function

- Lottery (probability)

- Marginal utility

- Prospect theory

- Rank-dependent expected utility

- Risk aversion

- Risk in psychology

- Subjective expected utility

- Two-moment decision models

References

- ↑ "Moral expectation", under Jeff Miller, Earliest Known Uses of Some of the Words of Mathematics (M), accessed 2011-03-24. The term "utility" was first introduced mathematically in this connection by Jevons in 1871; previously the term "moral value" was used.

- ↑ Journals and Publications :: The New School for Social Research (NSSR)

- ↑ http://www.cs.xu.edu/math/Sources/Montmort/stpetersburg.pdf#search=%22Nicolas%20Bernoulli%22

- ↑ Bernoulli, Daniel; Originally published in 1738; translated by Dr. Louise Sommer. (January 1954). "Exposition of a New Theory on the Measurement of Risk". Econometrica (The Econometric Society) 22 (1): 22–36. doi:10.2307/1909829. JSTOR 1909829. Retrieved 2006-05-30.

- ↑ Neumann, John von, and Morgenstern, Oskar, Theory of Games and Economic Behavior, Princeton, NJ, Princeton University Press, 1944, second ed. 1947, third ed. 1953.

- ↑ Arrow, K.J.,1965, "The theory of risk aversion," in Aspects of the Theory of Risk Bearing, by Yrjo Jahnssonin Saatio, Helsinki. Reprinted in: Essays in the Theory of Risk Bearing, Markham Publ. Co., Chicago, 1971, 90-109.

- ↑ Pratt, J. W. (January–April 1964). "Risk aversion in the small and in the large". Econometrica 32 (1/2): 122–136. doi:10.2307/1913738. JSTOR 1913738.

- ↑ Borch, K. (January 1969). "A note on uncertainty and indifference curves". Review of Economic Studies 36 (1): 1–4. doi:10.2307/2296336. JSTOR 2296336.

- ↑ Chamberlain, G. (1983). "A characterization of the distributions that imply mean-variance utility functions". Journal of Economic Theory 29 (1): 185–201. doi:10.1016/0022-0531(83)90129-1.

- ↑ Owen, J., Rabinovitch, R. (1983). "On the class of elliptical distributions and their applications to the theory of portfolio choice". Journal of Finance 38 (3): 745–752. doi:10.2307/2328079. JSTOR 2328079.

- ↑ Bell, D.E. (December 1988). "One-switch utility functions and a measure of risk". Management Science 34 (12): 1416–24. doi:10.1287/mnsc.34.12.1416.

- ↑ Daniel Kahneman; Amos Tversky (1979). Prospect Theory: An Analysis of Decision under Risk. Econometrica, Vol. 47, No. 2., pp. 263-292.

- ↑ Subjects changed their beliefs faster by conditioning on evidence (Bayes's theorem) than by using informal reasoning, according to a classic study by the psychologist Ward Edwards: Edwards, Ward (1968). "Conservatism in Human Information Processing". In Kleinmuntz, B. Formal Representation of Human Judgment. Wiley.

Edwards, Ward (1982). "Conservatism in Human Information Processing (excerpted)". In Daniel Kahneman, Paul Slovic and Amos Tversky. Judgment under uncertainty: Heuristics and biases. Cambridge University Press.

Phillips, L.D.; Edwards, W.; Edwards, Ward (October 2008). "Chapter 6: Conservatism in a simple probability inference task (Journal of Experimental Psychology (1966) 72: 346-354)". In Jie W. Weiss and David J. Weiss. A Science of Decision Making:The Legacy of Ward Edwards. Oxford University Press. p. 536. ISBN 978-0-19-532298-9. - ↑ Acting Under Uncertainty: Multidisciplinary Conceptions by George M. von Furstenberg. Springer, 1990. ISBN 0-7923-9063-6, ISBN 978-0-7923-9063-3. 485 pages.

- ↑ Lichtenstein, S.; P. Slovic (1971). "Reversals of preference between bids and choices in gambling decisions". Journal of Experimental Psychology 89 (1): 46–55. ISSN 0096-3445.

- ↑ Grether, David M.; Plott, Charles R. (1979). "Economic Theory of Choice and the Preference Reversal Phenomenon". American Economic Review 69 (4): 623–638. JSTOR 1808708.

- ↑ Holt, Charles (1986). "Preference Reversals and the Independence Axiom". American Economic Review 76 (3): 508–515. JSTOR 1813367.

- Charles Sanders Peirce and Joseph Jastrow (1885). "On Small Differences in Sensation". Memoirs of the National Academy of Sciences 3: 73–83. http://psychclassics.yorku.ca/Peirce/small-diffs.htm

- Ramsey, Frank Plumpton; “Truth and Probability” (PDF), Chapter VII in The Foundations of Mathematics and other Logical Essays (1931).

- de Finetti, Bruno. "Probabilism: A Critical Essay on the Theory of Probability and on the Value of Science," (translation of 1931 article) in Erkenntnis, volume 31, September 1989.

- de Finetti, Bruno. 1937, “La Prévision: ses lois logiques, ses sources subjectives,” Annales de l'Institut Henri Poincaré,

- de Finetti, Bruno. "Foresight: its Logical Laws, Its Subjective Sources," (translation of the 1937 article in French) in H. E. Kyburg and H. E. Smokler (eds), Studies in Subjective Probability, New York: Wiley, 1964.

- de Finetti, Bruno. Theory of Probability, (translation by AFM Smith of 1970 book) 2 volumes, New York: Wiley, 1974-5.

- Donald Davidson, Patrick Suppes and Sidney Siegel (1957). Decision-Making: An Experimental Approach. Stanford University Press.

- Pfanzagl, J (1967). "Subjective Probability Derived from the Morgenstern-von Neumann Utility Theory". In Martin Shubik. Essays in Mathematical Economics In Honor of Oskar Morgenstern. Princeton University Press. pp. 237–251.

- Pfanzagl, J. in cooperation with V. Baumann and H. Huber (1968). "Events, Utility and Subjective Probability". Theory of Measurement. Wiley. pp. 195–220.

- Morgenstern, Oskar (1976). "Some Reflections on Utility". In Andrew Schotter. Selected Economic Writings of Oskar Morgenstern. New York University Press. pp. 65–70. ISBN 0-8147-7771-6.

Further reading

- Schoemaker PJH (1982). "The Expected Utility Model: Its Variants, Purposes, Evidence and Limitations". Journal of Economic Literature 20: 529–563.

- Anand P. (1993). Foundations of Rational Choice Under Risk. Oxford: Oxford University Press. ISBN 0-19-823303-5.

- Arrow K.J. (1963). "Uncertainty and the Welfare Economics of Medical Care". American Economic Review 53: 941–73.

- Scott Plous (1993) "The psychology of judgment and decision making", Chapter 7 (specifically) and 8,9,10, (to show paradoxes to the theory).

![{\begin{aligned}\operatorname {E}[u(w)]&=\operatorname {E}[w]-b\operatorname {E}[e^{{-aw}}]\\&=\operatorname {E}[w]-b\operatorname {E}[e^{{-a\operatorname {E}[w]-a(w-\operatorname {E}[w])}}]\\&=\operatorname {E}[w]-be^{{-a\operatorname {E}[w]}}\operatorname {E}[e^{{-a(w-\operatorname {E}[w])}}]\\&={\text{Expected wealth}}-b\cdot e^{{-a\cdot {\text{Expected wealth}}}}\cdot {\text{Risk}}.\end{aligned}}](/2014-wikipedia_en_all_02_2014/I/media/4/e/b/a/4eba8217a9ebbf7e6f60636ddf747c53.png)