Economy of Israel

| Economy of Israel | |

|---|---|

| |

| Rank | 49th (PPP) / 39th (nominal) |

| Currency | Israeli new shekel (NIS; ₪) |

| Fiscal year | Calendar year |

| Trade organisations | BIS, CLS, EBRD, IADB, ICC, ISO, ITUC, OECD, UN, WCO, WFTU, WTO. |

| Statistics | |

| GDP |

$274.504 billion (PPP 2013)[1] $272.737 billion (nominal 2013)[1] |

| GDP growth | 4.8% (2011 est.; 81st) |

| GDP per capita |

$34,875(PPP; 2013 est.) $34,651 (nominal; 2013 est.)[1] |

| GDP by sector | agriculture: 2.5%, industry: 31.2%, services: 64.7% (2011 est.) |

| Inflation (CPI) | 3.2% (2011 est.; 59th) |

| Population below poverty line | 22.5% (2012)[2] |

| Gini coefficient | 39.2 (2008; 69th) |

| Labour force | 3.227 million (2011 est.; 100th) |

| Labour force by occupation | agriculture: 2%, industry: 16%, services: 82% (September 2008) |

| Unemployment | 5.6% (2011 est.; 56th)[3] |

| Main industries | high-technology products (including aviation, communications, telecommunications equipment, computer hardware and software, computer-aided design and manufacturing, medical electronics, fiber optics), pharmaceuticals, potash and phosphates, metals products, chemical products, plastics, diamond cutting, petroleum refining, textiles.[4] |

| Ease of doing business rank | 38th (2013)[5] |

| External | |

| Exports | $62.5 billion FOB (2011 est.; 54th) |

| Export goods | high technology products, telecommunications equipment, military equipment, pharmaceuticals, mechanical machinery and machinery based equipment, cut diamonds and jewelry, agricultural products and foodstuffs, chemicals, textiles and apparel.[6] |

| Main export partners |

|

| Imports | $70.62 billion FOB (2011 est.; 47th) |

| Import goods | raw materials, military and defense equipment, aircraft parts, motor vehicles, consumer electronics, investment goods, mechanical machinery and related parts, rough diamonds, petroleum, fuels, grain and wheat, consumer goods.[6] |

| Main import partners |

|

| FDI stock | $82.82 billion (2011 est.; 43rd) |

| Gross external debt | $112 billion (31 December 2011 est.; 40th) |

| Public finances | |

| Public debt | 69.6% of GDP (2013 est.; 28th) |

| Budget deficit | −3% of GDP (2011 est.; 105th) |

| Revenues | $68.29 billion (2011 est.) |

| Expenses | $75.65 billion (2011 est.) |

| Credit rating | |

| Foreign reserves | $78.93 billion (31 December 2011 est.; 26th) |

|

Main data source: CIA World Fact Book | |

The economy of Israel is a market economy.[12] As of 2012, Israel ranks 16th among 187 nations on the UN's Human Development Index, which places it in the category of "Very Highly Developed".

The major industrial sectors include high-technology products, metal products, electronic and biomedical equipment, agricultural products, processed foods, chemicals, and transport equipment; the Israeli diamond industry is one of the world's centers for diamond cutting and polishing. Relatively poor in natural resources, Israel depends on imports of petroleum, raw materials, wheat, motor vehicles, uncut diamonds and production inputs, though the country's nearly total reliance on energy imports may change with recent discoveries of large natural gas reserves off its coast.[13][14] Israel is active in software, telecommunication and semiconductors development.[15] The high concentration of high-tech industries in Israel, which are backed by a strong venture capital industry, gave it the nickname "Silicon Wadi", which is considered second in importance only to its Californian counterpart.[16][17][18] Numerous Israeli companies have been acquired by global corporations for its reliable and quality corporate personnel.[19] The country was the destination for Berkshire Hathaway's first investment outside the United States when it purchased ISCAR Metalworking, and the first research and development centers outside the United States for companies including Intel, Microsoft, and Apple.[19][20][21] American business magnates and investors Bill Gates, Warren Buffett, and Donald Trump have each praised Israel's economy and each entrepreneur has invested heavily in numerous Israeli industries that range include real estate, high technology, and manufacturing beyond their traditional business activities and investments back in the United States.[22][23][24][25][26][27][28] Israel is also a major tourist destination, with 3.5 million foreign tourists visiting in 2012.

In September 2010, Israel was invited to join the OECD.[29] Israel has also signed free trade agreements with the European Union, the United States, the European Free Trade Association, Turkey, Mexico, Canada, Jordan, Egypt, and on 18 December 2007, became the first non-Latin-American country to sign a free trade agreement with the Mercosur trade bloc.[30][31]

History

The first survey of the Dead Sea in 1911, by the Russian Jewish engineer Moshe Novomeysky, led to the establishment of Palestine Potash Ltd. in 1930, later renamed the Dead Sea Works.[32] In 1923, Pinhas Rutenberg was granted an exclusive concession for the production and distribution of electric power. He founded the Palestine Electric Company, later the Israel Electric Corporation.[33] Between 1920 and 1924, some of the countries largest factories were established, including the Shemen Oil Company, the Societe des Grand Moulins, the Palestine Silicate Company and the Palestine Salt Company.[34] In 1937, there were 86 spinning and weaving factories in the country, employing a workforce of 1,500. Capital and technical expertise were supplied by Jewish professionals from Europe. The Ata textile plant in Kiryat Ata, which went on to become an icon of the Israeli textile industry, was established in 1934.[35] The industry underwent rapid development during World War II, when supplies from Europe were cut off while local manufacturers were commissioned for army needs. By 1943, the number of factories had grown to 250, with a workforce of 5,630, and output increased tenfold.[36]

From 1924, trade fairs were held in Tel Aviv. The Orient Fair was inaugurated in 1932.[37]

After independence

After statehood, Israel faced a deep economic crisis. As well as having to recover from the devastating effects of the 1948 Arab-Israeli War, it also had to absorb hundreds of thousands of Jewish refugees from Europe and the Arab world. Israel was financially overwhelmed and faced a deep economic crisis, which led to a policy of austerity from 1949 to 1959. Unemployment was high, and foreign currency reserves were scarce.[38]

In 1952, Israel and West Germany signed an agreement stipulating that West Germany was to pay Israel for the persecution of Jews during the Holocaust, and compensate for Jewish property stolen by the Nazis. Over the next 14 years, West Germany paid Israel 3 billion marks. The reparations became a decisive part of Israel's income, comprising as high as 87.5% of Israel's income in 1956.[38] In 1950, the Israeli government launched Israel Bonds for American and Canadian Jews to buy. In 1951, the final results of the bonds program exceeded $52 million. Additionally, many American Jews made private donations to Israel, which in 1956 were thought to amount to $100 million a year. In 1957, bond sales amounted to 35% of Israel's special development budget.[39] Later in the century Israel became significantly reliant on economic aid from the United States,[40] a country which also became Israel's most important source of political support internationally.

The proceeds from these sources was invested in industrial and agricultural development projects, which allowed Israel to become economically self-sufficient. Among the projects made possible by the aid was the Hadera power plant, the Dead Sea Works, the National Water Carrier, port development in Haifa, Ashdod, and Eilat, desalination plants, and national infrastructure projects.

After statehood, priority was given to establishing industries in areas slated for development, among them Lachish, Ashkelon, the Negev and Galilee. The expansion of Israel's textile industry was a consequence of the development of cotton growing as a profitable agricultural branch. By the late 1960s, textiles were one of the largest industrial branches in Israel, second only to the foodstuff industry. Textiles constituted about 12% of industrial exports, becoming the second-largest export branch after polished diamonds.[36] In the 1990s, cheap East Asian labor decreased the profitability of the sector. Much of the work was subcontracted to 400 Israeli Arab sewing shops. As these closed down, Israeli firms, among them Delta, Polgat, Argeman and Kitan, began doing their sewing work in Jordan and Egypt, usually under the QIZ arrangement. In the early 2000s, Israeli companies had 30 plants in Jordan. Israeli exports reached $370 million a year, supplying such retailers and designers as Marks & Spencer, The Gap, Victoria's Secret, Wal-Mart, Sears, Ralph Lauren, Calvin Klein, and Donna Karan.[36]

In its first two decades of existence, Israel's strong commitment to development led to economic growth rates that exceeded 10% annually. Average living standards steadily rose, with the expenditure of an average wage-earner’s family rising in real terms by 97.% between 1950 and 1963.[41] The years after the 1973 Yom Kippur War were a lost decade economically, as growth stalled, inflation soared and government expenditures rose significantly. Also worthy of mention is the 1983 Bank stock crisis. By 1984, the economic situation became almost catastrophic with inflation reaching an annual rate close to 450% and projected to reach over 1000% by the end of the following year. However, the successful economic stabilization plan implemented in 1985[42] and the subsequent introduction of market-oriented structural reforms[43][44] reinvigorated the economy and paved the way for its rapid growth in the 1990s and became a model for other countries facing similar economic crises.[45]

Two developments have helped to transform Israel's economy since the beginning of the 1990s. The first is waves of Jewish immigration, predominantly from the countries of the former USSR, that has brought over one million new citizens to Israel. These new immigrants, many of them highly educated, now constitute some 16% of Israel's 7.5 million population. The second development benefiting the Israeli economy is the peace process begun at the Madrid conference of October 1991, which led to the signing of accords and later to a peace treaty between Israel and Jordan (1994).

Despite the Second Intifada, which cost Israel billions of dollars in economic terms,[46] Israel managed to open up new markets to Israeli exporters farther afield, such as in the rapidly growing countries of East Asia.

In the past few years there has been an unprecedented inflow of foreign investment in Israel, as companies that formerly shunned the Israeli market now see its potential contribution to their global strategies. In 2006, foreign investment in Israel totaled $13 billion, according to the Manufacturers Association of Israel.[47] The Financial Times said that 'bombs drop, yet Israel's economy grows'.[48] Moreover, while Israel's total gross external debt is US$95 billion, or approximately 41.6% of GDP, since 2001 it has become a net lender nation in terms of net external debt (the total value of assets vs. liabilities in debt instruments owed abroad), which as of June 2012 stood at a significant surplus of US$60 billion.[49] The country also maintains a current account surplus in an amount equivalent to about 3% of its gross domestic product in 2010.

The Israeli economy withstood the late-2000s recession, registering positive GDP growth in 2009 and ending the decade with an unemployment rate lower than that of many western countries.[50] There are several reasons behind this economic resilience, for example, the fact, as stated above, that the country is a net lender rather than a borrower nation and the government and the Bank of Israel's generally conservative macro-economic policies. Two policies in particular can be cited, one is the refusal of the government to succumb to pressure by the banks to appropriate large sums of public money to aid them early in the crisis, thus limiting their risky behavior. The second is the implementation of the recommendations of the Bach'ar commission in the early to mid-2000s which recommended decoupling the banks' depository and investment banking activities, contrary to the then-opposite trend, particularly in the United States, of easing such restrictions which had the effect of encouraging more risk-taking in the financial systems of those countries.[51]

OECD membership

In May 2007, Israel was invited to open accession discussions with the OECD.[52] In May 2010, the OECD voted unanimously to invite Israel to join, despite Palestinian objections.[53] It became a full member on 7 September 2010.[29][54] The OECD praised Israel's scientific and technological progress and described it as having "produced outstanding outcomes on a world scale."[53]

Challenges

The Israeli economy faces many challenges, some are short term and some are long term challenges. On the short term its inability to duplicate its success in the telecommunication industry into other growing industries hampers its economic outlooks. Its inability to foster large multinational companies in the last decade also calls into question its ability to employ large numbers of people in advanced industries.[55] On the long term, Israel is facing challenges of high dependency of the growing number of Ultra-Orthodox Jews who have a low level of official labor force participation amongst men, and this situation could lead to a materially lower employment-to-population ratio and a higher dependency ratio in the future.[56] The governor of the Bank of Israel, Stanley Fischer, stated that the growing poverty amongst the Ultra-Orthodox is hurting the Israeli economy.[57] According to the data published by Ian Fursman, 60% of the poor households in Israel are of the Haredi Jews and the Israeli Arabs. Both groups together represent 25–28% of the Israeli population.

Sectors

Agriculture

2.8% of the country's GDP is derived from agriculture. Of a total labor force of 2.7 million, 2.6% are employed in agricultural production while 6.3% in services for agriculture.[58] While Israel imports substantial quantities of grain (approximately 80% of local consumption), it is largely self-sufficient in other agricultural products and food stuffs. For centuries, farmers of the region have grown varieties of citrus fruits, such as grapefruit, oranges and lemons. Citrus fruits are still Israel's major agricultural export. In addition, Israel is one of the world's leading greenhouse-food-exporting countries. The country exports more than $1.3 billion worth of agricultural products every year, including farm produce as well as $1.2 billion worth of agricultural inputs and technology.[59]

Financial sector

Israel has over 100 active funds operating throughout the country with $10 billion under management. In 2004, international foreign funds from various nations around the world committed over 50% of the total dollars invested exemplifying the country's strong and sound reputation as an internationally sought after foreign investment by many countries.[60] Israel's venture capital sector has rapidly developed from the early 1990s, and has about 70 active venture capital funds (VC), of which 14 international VCs have Israeli offices. Israel's thriving venture-capital and business-incubator industry played an important role in the booming high-tech sector.[61] In 2008, venture capital investment in Israel, rose 19 percent to $1.9 billion.[62]

Between 1991 and 2000, Israel's annual venture-capital outlays, nearly all private, rose nearly 60-fold, from $58 million to $3.3 billion; companies launched by Israeli venture funds rose from 100 to 800; and Israel's information-technology revenues rose from $1.6 billion to $12.5 billion. By 1999, Israel ranked second only to the United States in invested private-equity capital as a share of GDP. Israel led the world in the share of its growth attributable to high-tech ventures: 70 percent."[63]

Israel's thriving venture capital industry has played an important role in the booming high-tech sector, the financial crisis of 2007-2010 also affected the availability of venture capital locally. In 2009, there were 63 mergers and acquisitions in the Israeli market worth a total of $2.54 billion; 7% below 2008 levels ($2.74 billion), when 82 Israeli companies were merged or acquired, and 33% lower than 2007 proceeds ($3.79 billion) when 87 Israeli companies were merged or acquired.[64] Numerous Israeli high tech companies have been acquired by global corporations for its reliable and quality corporate personnel.[19] In addition to venture capital funds, many of the worlds leading investment banks, pension funds, and insurance companies have a strong presence in Israel to financially back Israeli high-tech firms and benefit from its burgeoning high tech sector. These companies include Goldman Sachs, Bear Stearns, Deutsche Bank, JP Morgan, Credit Swiss First Boston, Merrill Lynch, CalPERS, Ontario Teachers Pension Plan, and AIG.[65]

Israel also has a small but fast growing hedge fund industry. Within the last five years between 2007 to 2012, the number of active hedge funds have doubled to 60 while the total asset values that the funds control have quadrupled since 2006. Israel based hedge funds have registered an increase of 162% since 2006 and currently manage a total of $2 billion (NIS 8 billion) as well as employing about 300 people.[66][67][68][69][70] The ever growing hedge fund industry in Israel is also attracting a myriad of investors from around the world, particularly from the United States.[71]

Technology sector

Science and technology in Israel is one of the country's most highly developed and industrialized sectors. The percentage of Israelis engaged in scientific and technological inquiry, and the amount spent on research and development (R&D) in relation to gross domestic product (GDP), is amongst the highest in the world.[72] Israel ranks fourth in the world in scientific activity, as measured by the number of scientific publications per million citizens. Israel's percentage of the total number of scientific articles published worldwide is almost 10 times higher than its percentage of the world's population.[73] Despite its small population relative to other industrialized nations around the world, Israel has the highest number of scientists, technicians, and engineers per capita in the world with 140 scientists, technicians, and engineers per 10,000 employees. In comparison, the same is 85 per 10,000 in the United States and 83 per 10,000 in Japan.[74][75][76]

Israeli scientists have contributed to the advancement of the natural sciences, agricultural sciences, computer sciences, electronics, genetics, medicine, optics, solar energy and various fields of engineering. Israel is home to major players in the high-tech industry and has one of the world's technologically most literate populations.[77] In 1998, Tel Aviv was named by Newsweek as one of the ten technologically most influential cities in the world.[78] In 2012, the city was also named one of the best places for high-tech startup companies, placed second behind its California counterpart.[79][80] In 2013, Tel Aviv repeated the feat where the American newspaper, Boston Globe ranked Tel Aviv as the second best city for business start-ups, after Silicon Valley[81] Israel also remains of the largest centers in the world for technology start-up enterprises. 200 start-ups are created annually and more than 2500 start-up companies are operating throughout the country.[16][82]

Energy

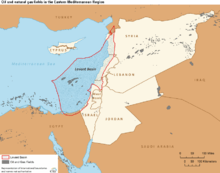

Historically, Israel relied on external imports for meeting most of its energy needs, spending an amount equivalent to over 5% of its GDP per year in 2009 on imports of energy products.[83] The transportation sector relies mainly on gasoline and diesel fuel, while the majority of electricity production is generated using imported coal. The country possesses negligible reserves of crude oil but does have abundant domestic natural gas resources which were discovered in large quantities starting in 2009, after many decades of previously unsuccessful exploration.[13][84][85][86][87]

Natural gas

Until the early 2000s, natural gas use in Israel was minimal. In the late 1990s, the government of Israel decided to encourage the usage of natural gas because of environmental, cost, and resource diversification reasons. At the time however, there were no domestic sources of natural gas and the expectation was that gas would be supplied from overseas in the form of LNG and by a future pipeline from Egypt (which eventually became the Arish–Ashkelon pipeline). Plans were made for the Israel Electric Corporation to construct several gas-driven power plants, for erecting a national gas distribution grid, and for an LNG import terminal. Soon thereafter, gas began to be located within Israeli territory, first in modest amounts and a decade later in very large quantities located in deep water off the Israeli coastline. This has greatly intensified the utilization of natural gas within the Israeli economy, especially in the electrical generation and industrial sectors, with consumption growing from an annual average of 350 million cubic feet between 2000 and 2002 to 129 billion cubic feet in 2010.[84]

| 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2014* | 2016* | 2018* | 2020* | 2022* | 2024* | 2026* | 2028* | 2030* |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1.2 | 1.6 | 2.3 | 2.7 | 3.7 | 4.2 | 5.2 | 8.1 | 9.5 | 10.1 | 11.1 | 11.7 | 13 | 14.3 | 15.3 | 16.8 |

| Figures are in Billion Cubic Meters (BCM) per year. *Estimated. | |||||||||||||||

Gas discoveries

In 2000, a modest discovery was made when a 33-billion-cubic-metre (BCM), or 1,200-billion-cubic-foot, natural-gas field was located offshore Ashkelon, with commercial production starting in 2004. As of 2014 however, this field is nearly depleted—earlier than expected due to increased pumping to partially compensate for the loss of imported Egyptian gas in the wake of unrest associated with the fall of the Mubarak regime in 2011. In 2009, a significant gas find named Tamar, with proven reserves of 223 BCM or 7.9×1012 cu ft (307 BCM total proven + probable) was located in deep water approximately 90 km (60 mi) west of Haifa, as well as a smaller 15 BCM (530×109 cu ft) field situated nearer the coastline.[89][90][91][92] Furthermore, results of 3D seismic surveys and test drilling conducted since 2010 have confirmed that an estimated 535 BCM (18.9×1012 cu ft) natural-gas deposit exists in a large underwater geological formation nearby the large gas field already discovered in 2009.[93][94][95] As of early 2014, Israel has verified gas finds of 35 trillion cubic feet.[96]

The Tamar field began commercial production on 30 March 2013 after four years of extensive development works.[97] The supply of gas from Tamar is expected to provide a boost to the Israeli economy, which has suffered losses of approximately NIS15 billion since 2011 resulting from the disruption of gas supplies from neighboring Egypt (and which are not expected to resume due to Egypt's decision to indefinitely suspend its gas supply agreement to Israel).[98] As a result Israel, as well as its other neighbor Jordan, which also suffered from disruption of gas deliveries from Egypt, had to resort to importing significantly more expensive and polluting liquid heavy fuels as substitute sources of energy. While Egyptian gas supplies to Jordan were partially restored in 2013,[99] supplies from Tamar, and in the future from the Leviathan field, are expected to satisfy all Israeli domestic natural gas needs for decades to come.[84] Moreover, due to the erratic supply of gas from Egypt, Jordan has reportedly been considering signing an agreement to import gas from Israel. While less desirable to the kingdom from a political standpoint, such an agreement represents the most expedient and least costly option for Jordan to compensate for its loss of Egyptian gas.[100][101] The energy shortages in Egypt which led it to curtail its exports of natural gas mean that Egypt too may someday obtain natural gas from Israel, though so far Egypt has rejected such deals on political grounds, despite the fact that procuring gas from Israel would be significantly cheaper than from other sources of imported natural gas.[102]

The large gas discoveries so far have confirmed that the Levant basin of the Eastern Mediterranean contains significant quantities of natural gas and, potentially, crude oil. Consequently, additional exploration for oil and gas off Israel's coastline is continuing.[86][103] A source close to Prime Minister Benjamin Netanyahu has valued Israel's natural gas reserves at $130 billion,[104] while in 2012 BusinessWeek estimated the reserves' value at $240 billion.[105] The businesses involved in exploration aim to export a share of future production, but others argue that it would be preferable, on geopolitical grounds, to use the gas within the country instead of other energy sources.[106] In early 2012 the Israeli cabinet announced plans to set up a sovereign wealth fund that would allocate part of the royalties from energy exploration to education, defense and overseas investments.[107]

| Field[108] | Discovered | Production | Estimated size |

|---|---|---|---|

| Noa North | 1999[109] | 2012 | 50 billion cubic feet |

| Mari-B | 2000 | 2004 | 1 trillion cubic feet |

| Tamar | 2009 | 2013 | 10.8 trillion cubic feet[92] |

| Dalit | 2009 | Not in production | 700 billion cubic feet |

| Leviathan | 2010 | Not in production | 19 trillion cubic feet |

| Dolphin | 2011 | Not in production | 81.3 billion cubic feet[110] |

| Tanin | 2012 | Not in production | 1.2–1.3 trillion cubic feet |

| Karish | 2013 | Not in production | 2.3–3.6 trillion cubic feet |

Electricity

The Israel Electric Corporation (IEC), a state-owned enterprise, produces nearly all of the electricity generated in Israel. The IEC has an aggregate installed generating capacity of 11,690 MW, virtually all of it produced from fossil fuels. The company sold 52,037 GWh of electricity in 2010. The IEC is in the midst of adding several thousand megawatts of generating capacity due to increased demand and a low operating reserve, though a debate is currently raging with respect to how much should be generated from new coal-fired versus gas-fired plants, a determination complicated by the fact that some of the company's capital investment decisions predate the recent discoveries of significant reserves of natural gas offshore. In addition, in order to encourage competition in the electricity market, the government of Israel is currently (mid-2010) considering proposals from four private companies to generate up to 3,640 MW of electricity in 11 new sites, most of which would be gas-fired combined cycle power stations.

While the country possesses sufficient generation and transmission capacity to meet all domestic electricity needs, a chronic problem faced by Israel's electricity market is a persistently low operating reserve, which is mostly the result of Israel being an "electricity island". Most countries have the capability of relying on power drawn from producers in adjacent countries in the event of a power shortage. Israel's grid however, is unconnected to those of neighboring countries. This is mostly due to political reasons but also to the considerably less-developed nature of the power systems of Jordan and Egypt, whose per-capita electric generation is one quarter to one fifth that of Israel's. Nevertheless, unlike in the countries surrounding it, rolling blackouts in Israel are rare, even at periods of extreme demand. However, to help alleviate the low reserve situation and to enable the potential of electricity exports when surplus electricity is available, Israel and Cyprus are considering implementing the proposed EuroAsia Interconnector project. This consists of laying a 2000MW HVDC undersea power cable between them and between Cyprus and Greece, thus connecting Israel to the greater European power grid.[111]

| Coal | Fuel oil | Natural gas | Diesel | |

|---|---|---|---|---|

| Installed capacity by plant type | 39.7% | 3.4% | 39.8% | 18.9% |

| Total annual generation by fuel source | 61.0% | 0.9% | 36.6% | 1.5% |

Solar power

Solar power in Israel and the Israeli solar energy industry has a history that dates to the founding of the country. In the 1950s, Levi Yissar developed a solar water heater to help assuage an energy shortage in the new country.[112] By 1967 around one in twenty households heated their water with the sun and 50,000 solar heaters had been sold.[112] With the 1970s oil crisis, Harry Zvi Tabor, the father of Israel's solar industry, developed the prototype solar water heater that is now used in over 90% of Israeli homes.[113] Israeli engineers are on the cutting edge of solar energy technology,[114] and its solar companies work on projects around the world.[115]

Industrial sector

Israel has a well-developed chemical industry with many of its products aimed at the export market. Most of the chemical plants are located in Ramat Hovav, the Haifa Bay area and near the Dead Sea. Israel Chemicals is one of largest fertilizer and chemical companies in Israel and its subsidiary, the Dead Sea Works in Sdom is the world's fourth largest producer and supplier of potash products.[116] The company also produces other products such as magnesium chloride, industrial salts, de-icers, bath salts, table salt, and raw materials for the cosmetic industry.[116] One of the country's largest employers is Israel Aerospace Industries which produces mainly aviation and defense products. Another large employer is Teva Pharmaceutical Industries, one of the world's largest pharmaceutical companies, currently employing 40,000 people as of 2011. It specializes in generic and proprietary pharmaceuticals and active pharmaceutical ingredients. It is the largest generic drug manufacturer in the world and one of the 15 largest pharmaceutical companies worldwide.[117][118]

Diamond industry

Israel is one of the world's three major centers for polished diamonds, alongside Belgium and India. Israel's net polished diamond exports slid 22.8 percent in 2012 as polished diamond exports fell to $5.56 billion from $7.2 billion in 2011. Net exports of rough diamonds dropped 20.1 percent to $2.8 billion and net exports of polished diamonds slipped 24.9 percent to $4.3 billion, while net rough diamond imports dropped 12.9 percent to $3.8 billion. Net exports and imports have dropped to due to the ongoing Global financial crisis, particularly within the Eurzone and the United States. The United States is the largest market accounting for 36% of overall export market for polished diamonds while Hong Kong remains at second with 28 percent and Belgium at 8 percent coming in third.[119][120][121][122]

Defense industry

Israel is one of the world's major exporters of military equipment, accounting for 10% of the world total in 2007. Three Israeli companies were listed on the 2010 Stockholm International Peace Research Institute index of the world's top 100 arms-producing and military service companies: Elbit Systems, Israel Aerospace Industries and RAFAEL.[123][124] The Defense industry in Israel is a strategically important sector and a large employer within the country. It is also a major player in the global arms market and is the 11th largest arms exporter in the world as of 2012.[125] Total arms transfer agreements topped 12.9 billion between 2004 to 2011.[126] There are over 150 active defense companies based in the country with combined revenues of more than 3.5 billion USD annually.[127] Israeli defense equipment exports have reached 7 billion U.S. dollars in 2012, making it a 20 percent increase from the amount of defense-related exports in 2011. Much of the exports are sold to the United States and Europe. Other major regions that purchase Israeli defense equipment include Southeast Asia and Latin America.[128][129][130] India is also major country for Israeli arms exports and has remained Israel's largest arms market in the world.[131][132] Israel is considered to be the leading UAV exporter in the world.[133] According to the Stockholm International Peace Research Institute, Israeli defense companies were behind 41% of all drones exported in 2001-2011.[134]

Tourism

Tourism is one of Israel's major sources of income and economic growth engine in the country, attracting 3.5 million foreign tourists in 2012, representing a 4 percent increase since 2011 making it an all-time high.[135] Israel offers a plethora of historical and religious sites, beach resorts, archaeological tourism, heritage tourism and ecotourism. Israel has the highest number of museums per capita in the world.[136] The most popular paid site is Masada.[137]

External trade

For 2006, Israeli exports grew by 11%, to just over $29 billion; the hi-tech sector accounted for $14 billion, a 20% increase from the previous year.[47]

The United States is Israel's largest trading partner, and Israel is the United States' 26th-largest trading partner;[138] two-way trade totaled some $24.5 billion in 2010, up from $12.7 billion in 1997. The principal U.S. exports to Israel include computers, integrated circuits, aircraft parts and other defense equipment, wheat, and automobiles. Israel's chief exports to the U.S. include cut diamonds, jewelry, integrated circuits, printing machinery, and telecommunications equipment. The two countries signed a free trade agreement (FTA) in 1985 that progressively eliminated tariffs on most goods traded between the two countries over the following ten years. An agricultural trade accord was signed in November 1996, which addressed the remaining goods not covered in the FTA. Some non-tariff barriers and tariffs on goods remain, however. Israel also has trade and cooperation agreements in place with the European Union and Canada, and is seeking to conclude such agreements with a number of other countries, including Turkey, Jordan and several countries in Eastern Europe.

In regional terms, the European Union is the top destination for Israeli exports. In the four-month period between October 2011 and January 2012, Israel exported goods totalling $5 billion to the EU – amounting to 35% of Israel's overall exports. During the same period, Israeli exports to the Far East came to $3.1 billion.[139]

Until 1995, Israel's trade with the Arab world was minimal due to the Arab League boycott, which was begun against the Jewish community of Palestine in 1945. Arab nations not only refused to have direct trade with Israel (the primary boycott), but they also refused to do business with any corporation that operated in Israel (secondary boycott), or any corporation that did business with a corporation that did business with Israel (tertiary boycott).

In 2013, commercial trade between Israel and the Palestinian territories were valued at US$ 20 billion annually.[140]

In 2012, ten companies were responsible for 47.7% of Israel's exports. These companies were Intel, Elbit Systems, Oil Refineries Ltd, Teva Pharmaceuticals, Iscar, Israel Chemicals, Makhteshim Agan, Paz Oil Company, Israel Aerospace Industries and the Indigo division of Hewlett-Packard. The Bank of Israel and Israel's Export Institute have warned that the country is too dependent on a small number of exporters.[141]

Rankings

As of 2012, Israel ranks 26th in Global Competitiveness Report by World Economic Forum, and 16th among 187 world nations on the UN's Human Development Index, which places it in the category of "Very Highly Developed". Israel's economy also ranks 17th among the world's most economically developed nations, according to IMD's World Competitiveness Yearbook rankings. The Israeli economy was ranked as the world's most durable economy in the face of crises, and was also ranked first in the rate research and development center investments.[142] The Bank of Israel was ranked first among central banks for its efficient functioning, up from the 8th place in 2009. Israel was ranked first also in its supply of skilled manpower.[142] Israeli companies, particularly in the high-tech area, have enjoyed considerable success raising money on Wall Street and other world financial markets: as of 2010 Israel ranked second among foreign countries in the number of its companies listed on U.S. stock exchanges.[143]

Having moved away from the socialist economic model since the mid-1980s and early 1990s, Israel has made dramatic moves toward the free-market paradigm. As of 2012, Israel's economic freedom score is 67.8, making its economy the 48th freest in the 2012 Index of Economic Freedom. Israel's economic competitiveness is helped by strong protection of property rights, relatively low corruption levels, and high openness to global trade and investment. Income and corporate tax rates remain relatively high.[144] As of 2011, Israel ranks 36th out of 182 countries in Transparency International's Corruption Perceptions Index. Bribery and other forms of corruption are illegal in Israel, which is a signatory to the OECD Bribery Convention since 2008.[144]

Indicators

Average wages in 2007 hovered around $133 per day.[145]

| Annual data 2011 | |

|---|---|

| Population (m) – 7.6 | Population growth – 1.5% |

| GDP per head (US$; PPP) – $31,400 | Real GDP growth – 4.7% |

| Percent of unemployed persons (2011) – 5.6% | Inflation – 3.5% |

| Exchange rate (av) NIS:US$ – 3.9 | Current-account balance (% of GDP) – 0.1% |

See also

References

- ↑ 1.0 1.1 1.2 "Report for Selected Countries and Subjects". International Monetary Fund. October 2013. Retrieved October 2013.

- ↑ "Israel: a divided society". Israel: High voter turnout results in setback for Netanyahu. 23 January 2013. Retrieved 23 January 2013.

- ↑ "Israel". International Monetary Fund. Retrieved March 20, 2013.

- ↑ "Israel: Trade Statistics". Global Edge. Retrieved March 18, 2013.

- ↑ "Doing Business in Israel 2013". World Bank. Retrieved 22 October 2012.

- ↑ 6.0 6.1 "Israel: Trade Statistics". Global Edge. Retrieved March 18, 2013.

- ↑ "Exports Partners of Israel". CIA World Factbook. 2012. Retrieved 2013-07-22.

- ↑ "İmports Partners of Israel". CIA World Factbook. 2012. Retrieved 2013-07-22.

- ↑ "Sovereigns rating list". Standard & Poor's. Retrieved 26 May 2011.

- ↑ 10.0 10.1 10.2 Rogers, Simon; Sedghi, Ami (15 April 2011). "How Fitch, Moody's and S&P rate each country's credit rating". The Guardian (UK). Retrieved 31 May 2011.

- ↑ Filut, Adrian (17 October 2012). "S&P reiterates Israel's A+ rating despite failure to agree budget". IL: Globes. Retrieved 21 October 2012.

- ↑ "Economy of Israel" in CIA 2011 World Factbook, web:CIA-IS.

- ↑ 13.0 13.1 Buck, Tobias (31 August 2012). "Field of dreams: Israel’s natural gas". Financial Times Magazine. Retrieved 2 September 2012.

- ↑ "What a gas!". The Economist. 11 November 2010.

- ↑ http://www.iaesi.org.il/_Uploads/dbsAttachedFiles/HongKongbusinessdelegation.pdf

- ↑ 16.0 16.1 "The Intellectual Capital of the State of Israel". State of Israel Ministry of Industry, Trade, and Labor. November 2007. p. 27. Retrieved March 18, 2013.

- ↑ "Israel's technology cluster". The Economist. 19 March 2008. Retrieved 17 October 2012.

- ↑ Dolmadjian, Katia (28 June 2011). "Israeli innovators build new 'Silicon Valley'". Agence France-Presse. Retrieved 17 October 2012.

- ↑ 19.0 19.1 19.2 "FUNDING THE FUTURE: Advancing STEM in Israeli Education". STEM Israel. December 4, 2012. Retrieved March 18, 2013.

- ↑ Shelach, Shmulik (14 December 2011). "Apple to set up Israel development center". Globes. Retrieved 10 February 2013.

- ↑ Shelach, Shmulik (10 February 2013). "Apple opens Ra'anana development center". Globes. Retrieved 10 February 2013.

- ↑ "Donald Trump Plans World-Class Golf Course in Israel". Algemeiner. May 17, 2013. Retrieved 9 August 2013.

- ↑ Allison Kaplan Sommer (Dec 2, 2002). "Microsoft's Bill Gates: Israel is a vital resource for us". Israel 21. Retrieved 9 August 2013.

- ↑ Maya Shwayder (January 15, 2013). "Donald Trump, Big In Israel, Endorses Prime Minister Benjamin Netanyahu". IB Times. Retrieved 9 August 2013.

- ↑ "Bill Gates pledges new investment in Israel". Wis TV. October 26, 2005. Retrieved 9 August 2013.

- ↑ "Donald Trump to U.S. – "You’re fired!"". Wise Money Israel. June 21, 2013. Retrieved 9 August 2013.

- ↑ David Lev (5/2/2013). "Buffett: Israel a Top Place for Ideas, Investments". Israel National News. Retrieved 9 August 2013.

- ↑ "Israeli Business Investments". Israeli Business Investment.com. Retrieved 9 August 2013.

- ↑ 29.0 29.1 "Israel's accession to the OECD". Organisation for Economic Co-operation and Development. Retrieved 15 October 2012.

- ↑ Israel's Free Trade Area Agreements, IL: Tamas, retrieved 8 September 2011.

- ↑ "Israel signs free trade agreement with Mercosur". Israel Ministry of Foreign Affairs. 19 December 2007. Retrieved 15 October 2012.

- ↑ The political economy of Israel: From ideology to stagnation, Yakir Plessner, p.72. Google Books. Retrieved on 8 September 2011.

- ↑ "The Seventh Dominion?". Time magazine. 4 March 1929. Retrieved 24 May 2007.

- ↑ The Roots of Separatism in Palestine: British Economic Policy, 1920-1929, ed. Barbara Jean Smith

- ↑ Tsur, Doron. (12 October 2010) "When the guns fell silent", Haaretz. Retrieved on 8 September 2011.

- ↑ 36.0 36.1 36.2 "Textiles", Jewish Virtual Library. Retrieved on 8 September 2011.

- ↑ "City of Work and Prosperity": The Levant Fair

- ↑ 38.0 38.1 "הויכוח סביב הסכם השילומים" (in Hebrew). Retrieved 15 October 2012.

- ↑ "ORGANIZATIONS: Dollars for Israel". Time. 21 January 1957.

- ↑ Mark, Clyde (12 July 2004). annual report "Israel: US Foreign Assistance". Congressional Research Service. Retrieved 19 July 2012.

- ↑ The Challenge Of Israel by Misha Louvish

- ↑ Eleventh Knesset. Knesset.gov.il. Retrieved on 8 September 2011.

- ↑ Generating a Sharp Disinflation: Israel 1985 Michael Bruno, National Bureau of Economic Research

- ↑ Israel's Economy: 1986–2008, Rafi Melnick and Yosef Mealem

- ↑ Fischer, Stanley (1987). "The Israeli Stabilization Program, 1985-86". The American Economic Review (American Economic Association) 77 (2): 275–278. JSTOR 1805463.

- ↑ De Boer, Paul; Missaglia, Marco (September 2007). "Economic consequences of intifada: a sequel". Econometric Institute Report. Erasmus University Rotterdam. Retrieved 15 October 2012.

- ↑ 47.0 47.1 "Israeli Growth", Dateline World Jewry, September 2007

- ↑ / Middle East / Arab-Israel conflict – Israeli economy shrugs off political turmoil. Financial Times (7 May 2007). Retrieved on 8 September 2011.

- ↑ "Israel's International Investment Position (IIP), June 2012". Bank of Israel. 19 September 2012. Retrieved 15 October 2012.

- ↑ Bassok, Moti (1 January 2010). "GDP, jobs figures end 2009 on a high". Haaretz. Retrieved 17 October 2012.

- ↑ Rolnik, Guy (31 December 2009). "כך ביזבזנו עוד משבר ענק" [How another Giant Crisis was Wasted]. TheMarker (in Hebrew). Retrieved 17 October 2012.

- ↑ "Israel invited to join the OECD". Retrieved 21 May 2007.

- ↑ 53.0 53.1 OECD members vote unanimously to invite Israel to join. BBC News (10 May 2010). Retrieved on 8 September 2011.

- ↑ "Members and partners". Organisation for Economic Co-operation and Development. Retrieved 15 October 2012.

- ↑ "What's Next for the Startup Nation?". Retrieved 15 October 2012.

- ↑ OECD Economic Outlook: Israel

- ↑ BoI chief: Haredi unemployment is hurting Israel's economy

- ↑ Agriculture in Israel – Facts and Figures 2008 – Israeli ministry of Agriculture Presentation. Moag.gov.il. Retrieved on 8 September 2011.

- ↑ "Israeli Agro-Technology". Jewish Virtual Library. Retrieved March 27, 2013.

- ↑ "Economic Overviews". Israel Trade Commission. Retrieved March 18, 2013.

- ↑ Venture Capital in Israel. Investinisrael.gov.il (21 June 2010). Retrieved on 8 September 2011.

- ↑ International venture funding rose 5 percent in 2008. VentureBeat (18 February 2009). Retrieved on 8 September 2011.

- ↑ Gilder, George. "Silicon Israel – How market capitalism saved the Jewish state". City Journal - Summer 2009 19 (3). Retrieved 11 November 2009.

- ↑ Venture Capital in Israel

- ↑ Yoram Ettinger. "Investing in Israel". The New York Times. Retrieved March 18, 2013.

- ↑ Israel belatedly joins the global hedge fund boom - Israel News | Haaretz Daily Newspaper

- ↑ Israel Stakes Claim As Future Hedge Fund Center | FINalternatives

- ↑ Israeli hedge fund industry enjoys massive growth

- ↑ Hedge Funds Review - Audio: israel's hedge fund industry shows promise

- ↑ Tzur Management - Israel Hedge Fund Survey | Tzur Management

- ↑ How Israeli hedge funds can exploit their US potential - Globes

- ↑ Invest In Israel. Where Breakthroughs Happen

- ↑ Ilani, Ofri (17 November 2009). "Israel ranks fourth in the world in scientific activity, study finds". Haaretz. Retrieved 17 October 2012.

- ↑ http://sun.inc.hse.ru/sites/default/files/Shteinbuk.pdf

- ↑ Israel_cover+text.qxd

- ↑ Investing in Israel

- ↑ "Israel profile - Media". BBC News. British Broadcasting Corporation. Retrieved 14 October 2012.

- ↑ "Tel Aviv One of The World’s Top High-Tech Centers". Jewish Virtual Library. American-Israeli Cooperative Enterprise. Retrieved 14 October 2012.

- ↑ After Silicon Valley, Tel Aviv Ranks Best for Tech Startups: Study - Bloomberg

- ↑ Tel Aviv named top startup center | ISRAEL21c

- ↑

- ↑ "Israel Association of Electronics & Software Industries Overview 2011". Israel Association of Electronics and Software Industries. Retrieved March 18, 2013.

- ↑ Asa-El, Amotz (27 January 2009). "Gas discovery tempers Israeli recession blues". MarketWatch. Retrieved 17 October 2012.

- ↑ 84.0 84.1 84.2 "Oil and natural gas in the Eastern Mediterranean region (summer 2013 report)". U.S. Energy Information Administration. 15 August 2013. Retrieved 23 August 2013.

- ↑ Levinson, Charles; Chazan, Guy (30 December 2010). "Big Gas Find Sparks a Frenzy in Israel". The Wall Street Journal. Retrieved 1 January 2011.

- ↑ 86.0 86.1 Bar-Eli, Avi (26 April 2011). "400 Drills in 60 Years: Is there Oil in Israel?". TheMarker (in Hebrew). Retrieved 27 April 2011.

- ↑ Udasin, Sharon (3 July 2012). "New Natural Gas Wealth Means Historic Change for Israel". National Geographic News (part of "The Great Energy Challenge" series). Retrieved 25 August 2012.

- ↑ "Delivery System". Israel Natural Gas Lines, Ltd. Retrieved 24 March 2012.

- ↑ "Delek Group Subsidiaries Announce Preliminary Results of 3D Seismic Survey & Updates on Tamar & Mari-B Fields" (Press release). Delek Group. 3 June 2010. Retrieved 3 June 2010.

- ↑ Bar-Eli, Avi (12 August 2009). "Tamar offshore field promises even more gas than expected". Haaretz. Retrieved 17 October 2012.

- ↑ Scheer, Steven (3 June 2010). "Noble increases Tamar gas reserve estimate 15 pct". Reuters. Retrieved 17 October 2012.

- ↑ 92.0 92.1 "Tamar Reserves Update". Isramco Negev 2, LP. 1 February 2014. p. 2. Retrieved 2 February 2014.

- ↑ "Noble Energy Announces Successful Leviathan Appraisal Results and Increases Resource Size" (Press release). Noble Energy. 19 December 2011. Retrieved 28 December 2011.

- ↑ "Significant Discovery Announced at Leviathan-1" (Press release). Delek Group. 29 December 2010. Retrieved 30 December 2010.

- ↑ Barkat, Amiram; Koren, Hillel (1 May 2013). "Leviathan gas reserves raised again". Globes. Retrieved 1 May 2013.

- ↑ http://www.economist.com/news/middle-east-and-africa/21595039-obstacles-still-block-flow-oil-and-gas-eastern-mediterranean-too Israel’s and Palestine’s gas and oil: Too optimistic?

- ↑ Solomon, Shoshanna; Ackerman, Gwen (30 March 2013). "Israel Begins Gas Production at Tamar Field in Boost to Economy". Bloomberg. Retrieved 30 March 2013.

- ↑ Barkat, Amiram (30 March 2013). "עצמאות אנרגטית: החלה הזרמת הגז הטבעי ממאגר "תמר"; צפוי להגיע לישראל תוך 24 שעות" [Energy Independence: Gas from Tamar Execpted to Arrive in 24 Hours]. Globes (in Hebrew). Retrieved 30 March 2013.

- ↑ "Egyptian gas supply to Jordan stabilises at below contract rate". Al-Ahram. 3 June 2013. Retrieved 16 June 2013.

- ↑ "Energy-poor Jordan faces explosive electricity hikes". UPI. 11 July 2013. Retrieved 12 July 2013.

- ↑ Said, Summer (29 January 2014). "BP’s Risha Exit Means Slim Pickings for Jordan’s Energy Needs". The Wall Street Journal. Retrieved 5 February 2014.

- ↑ "Egypt says not interested in Israeli gas as plans LNG imports". Reuters. 23 October 2013. Retrieved 16 November 2013.

- ↑ Zeno, Lior (10 May 2011). "Two Weeks' Postponement in Pelagic's Drilling License Approval". TheMarker. Retrieved 21 May 2011.

- ↑ Barkat, Amiram (19 February 2012). "'Israel's gas reserves worth $130b'". Globes. Retrieved 20 February 2012.

- ↑ Gismatullin, Edward; Ben-David, Calev (2 August 2012). "Israel Finds $240 Billion Gas Hoard Stranded by Politics: Energy". BusinessWeek. Retrieved 3 August 2012.

- ↑ Trilnick, Itai (8 February 2012). "Don't export gas, think tank urges Israeli leaders". Haaretz. Retrieved 17 October 2012.

- ↑ Shemer, Nadav; Udasin, Sharon (19 February 2012). "Cabinet outlines plan for sovereign wealth fund". Jerusalem Post. Retrieved 20 February 2012.

- ↑ Israel’s Natural Gas Bonanza. Energy Tribune. Retrieved on 8 September 2011.

- ↑ Beckwith, Robin (March 2011). "Israel's Gas Bonanza". Journal of Petroleum Technology: 46. Retrieved 5 February 2012.

- ↑ Yeshayahou, Koby (12 February 2012). "Dolphin gas field estimate cut by 85%". Globes. Retrieved 26 July 2012.

- ↑ "Israel, Cyprus in underwater electricity cable deal". AFP. 4 March 2012. Retrieved 25 March 2012.

- ↑ 112.0 112.1 Petrotyranny by John C. Bacher, David Suzuki, published by Dundurn Press Ltd., 2000; reference is at Page 70 Petrotyranny

- ↑ Sandler, Neal (26 March 2008). "At the Zenith of Solar Energy". Bloomberg Businessweek. Retrieved 17 October 2012.

- ↑ Israel Pushes Solar Energy Technology, Linda Gradstein, National Public Radio, 22 October 2007.

- ↑ Looking to the sun, Tom Parry, Canadian Broadcasting Corporation, 15 August 2007.

- ↑ 116.0 116.1 "Case Study: Dead Sea Works - Sdom, Israel". Water Online. Retrieved 15 October 2012.

- ↑ WebCite query result

- ↑ WebCite query result

- ↑ Jewellery Business - Israel’s 2012 polished diamond exports decline

- ↑ "Diamond Exports". Retrieved January 16, 2013.

- ↑ Israel 2012 diamond exports fall, may rebound if no more crises | Reuters

- ↑ Diamonds.net - Israel's Polished Diamond Exports -22% in 2012

- ↑ Rosenberg, Israel David (27 February 2012). "For arms, Mideast is buyer’s, not a seller’s, market". gantdaily.com (Jerusalem, Israel). The Media Line. Retrieved 6 March 2012.

- ↑ "The SIPRI Top 100 arms-producing and military services companies, 2010". Stockholm International Peace Research Institute. Retrieved 6 March 2012.

- ↑ Top List TIV Tables-SIPRI. Armstrade.sipri.org. Retrieved on 2012-05-09.

- ↑ Israel among top arms exporters and importers - JPost - Defense

- ↑ Thenakedfacts

- ↑ Defense equipment and arms exports from Israel to reach $7 billion in 2012 1101134 - Army Recognition

- ↑ Israel's arms exports increased by 20 percent in 2012 - Israel News | Haaretz Daily Newspaper

- ↑ Israel's arms industry hoping success of Iron Dome will bring it sales - Israel News | Haaretz Daily Newspaper

- ↑ Israel & India: New Allies | Brookings Institution

- ↑ $10 bn business: How Israel became India’s most important partner in arms bazaar - Economic Times

- ↑ Israel builds up its war robot industry. United Press International. April 26, 2013.

- ↑ “Israel – an unmanned air systems (UAS) super power”. Defense Update.

- ↑ breaks record for incoming tourism

- ↑ "Interesting Facts About Israel". Jewish Federations of North America. Retrieved 15 October 2012.

- ↑ "Masada tourists' favorite spot in Israel". Ynetnews. Retrieved 8 April 2009.

- ↑ http://www.ustr.gov/countries-regions/europe-middle-east/middle-east/north-africa/israel

- ↑ Coren, Ora; Bassok, Moti (6 March 2012). "Asia overtakes U.S. as target market for Israeli exports". Haaretz. Retrieved 6 March 2012.

- ↑ Israeli-Palestinian business arbitration center established

- ↑ Cohen, Ora (9 July 2013). "Israel 'dangerously reliant on handful of exports'". Haaretz. Retrieved 9 July 2013.

- ↑ 142.0 142.1 'Israel's economy most durable in face of crises'. Ynet News (20 May 2010). Retrieved on 8 September 2011.

- ↑ U.S. listed Israeli companies. Ishitech.co.il. Retrieved on 8 September 2011.

- ↑ 144.0 144.1 "Israel". The Heritage Foundation. Retrieved 15 October 2012.

- ↑ IMF Report. Imf.org (29 April 2003). Retrieved on 8 September 2011.

Further reading

- Ben-Porath, Yoram ed. The Israeli Economy: Maturing through Crises. Cambridge, MA: Harvard University Press, 1986.

- Chill, Dan. The Arab Boycott of Israel: Economic Aggression and World Reaction. New York: Praeger, 1976.

- Kanovsky, Eliyahu. The Economy of the Israeli Kibbutz. Cambridge, MA: Harvard University Press, 1966.

- Klein, Michael. A Gemara of the Israel Economy. Cambridge, MA: National Bureau of Economic Research, 2005.

- Michaely, Michael. Foreign Trade Regimes and Economic Development: Israel. New York: National Bureau of Economic Research, 1975.

- Ram, Uri (2008). The Globalization of Israel: McWorld in Tel Aviv, Jihad in Jerusalem. New York: Routledge. ISBN 0-415-95304-9.

- Seliktar, Ofira (2000), "The Changing Political Economy of Israel: From Agricultural Pioneers to the “Silicon Valley” of the Middle East", in Freedman, Robert, Israel’s First Fifty Years, Gainesville, FL: University of Florida Press, pp. 197–218.

- Senor, Dan and Singer, Saul, Start-up Nation: The Story of Israel's Economic Miracle, Hachette, New York (2009) ISBN 0-446-54146-X

- Rubner, Alex. The Economy of Israel: A Critical Account of the First Ten Years. New York: Frederick A Praeger, 1960.

- Aharoni, Sara; Aharoni, Meir (2005), Industry & Economy in Israel, Israel books.

- Maman, Daniel and Rosenhek, Zeev. The Israeli Central Bank: Political Economy: Global Logics & Local Actors. Routledge, 2011.

- The Global Political Economy of Israel

External links

| Wikimedia Commons has media related to Economy of Israel. |

- Finance Israel (official website), Israel Ministry of Finance.

- Israel entry at The World Factbook

- Israel and the IMF, International Monetary Fund

- Israel, Organisation for Economic Co-operation and Development.

- Israel Economy, The Heritage Foundation.

- Israel Business and Economy on the Open Directory Project

| |||||||||||

| ||||||||

| |||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||