Debt ratio

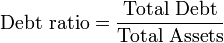

Debt Ratio is a financial ratio that indicates the percentage of a company's assets that are provided via debt. It is the ratio of total debt (the sum of current liabilities and long-term liabilities) and total assets (the sum of current assets, fixed assets, and other assets such as 'goodwill').

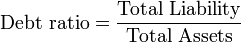

or alternatively:

For example, a company with $2 million in total assets and $500,000 in total liabilities would have a debt ratio of 25%.

The higher the ratio, the greater risk will be associated with the firm's operation. In addition, high debt to assets ratio may indicate low borrowing capacity of a firm, which in turn will lower the firm's financial flexibility. Like all financial ratios, a company's debt ratio should be compared with their industry average or other competing firms.

Total liabilities divided by total assets. The debt/asset ratio shows the proportion of a company's assets which are financed through debt