Cointelation

Cointelation is a portmanteau neologism in finance, designed to signify a hybrid method between COINTegration and corrELATION techniques.

Correlation is typically used by financial practitioners, when representing relationships between assets. However, academics have long since questioned this method due to the plethora of issues that plague it related to spurious correlation. Academics often think cointegration is a natural replacement in some of the cases as it is able to represent the physical reality of these assets better. However, despite this general academic consensus, cointegration is not widely used by financial practitioners.[1] So in 2012 Babak Mahdavi Damghani, Daniella Welch, Ciaran O'Malley and Stephen Knights proposed a hybrid method to encourage financial practitioners to begin to utilise cointelation as a superior alternative to both correlation and cointegration. The cointelation relationship can be described by the following set of Stochastic differential equation:

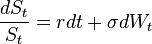

is commonly referred to as the leading stochastic process and

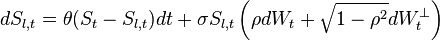

is commonly referred to as the leading stochastic process and  the lagging stochastic process. With this dynamical system, if the correlation of cointelation

the lagging stochastic process. With this dynamical system, if the correlation of cointelation  is set to -1, conditional to the time lapse between returns measurements, then the measured correlation one gets can span the whole correlation range [-1,1].

is set to -1, conditional to the time lapse between returns measurements, then the measured correlation one gets can span the whole correlation range [-1,1].

The particular point of cointelation can be linked to the concept of Inferred Correlation [2] which gives an expectation of the maximum measured correlation of cointelated pairs at timescale not measurable:

![E[\sup \rho _{{t}}]=\rho +(1-\rho )(1-e^{{-\lambda \theta (t-1)}})](/2014-wikipedia_en_all_02_2014/I/media/2/0/b/6/20b6aa5cb4d70fd41905399f03b5324c.png) where

where  and

and  are the parameters from the cointelated SDE.

are the parameters from the cointelated SDE.

See also

- Correlation

- Cointegration

- Stochastic differential equation

References

- ↑ Mahdavi Damghani B., Welch D., O'Malley C., Knights S. (2012). "The Misleading Value of Measured Correlation". Wilmott Magazine.

- ↑ Mahdavi Damghani B. (2013). "The Non-Misleading Value of Inferred Correlation: An Introduction to the Cointelation Model". Wilmott Magazine.