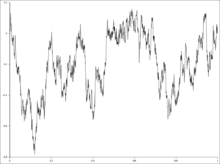

Brownian bridge

A Brownian bridge is a continuous-time stochastic process B(t) whose probability distribution is the conditional probability distribution of a Wiener process W(t) (a mathematical model of Brownian motion) given the condition that B(1) = 0. More precisely:

The expected value of the bridge is zero, with variance t(1 − t), implying that the most uncertainty is in the middle of the bridge, with zero uncertainty at the nodes. The covariance of B(s) and B(t) is s(1 − t) if s < t. The increments in a Brownian bridge are not independent.

Relation to other stochastic processes

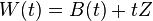

If W(t) is a standard Wiener process (i.e., for t ≥ 0, W(t) is normally distributed with expected value 0 and variance t, and the increments are stationary and independent), then

is a Brownian bridge for t ∈ [0, 1].

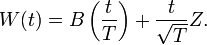

Conversely, if B(t) is a Brownian bridge and Z is a standard normal random variable, then the process

is a Wiener process for t ∈ [0, 1]. More generally, a Wiener process W(t) for t ∈ [0, T] can be decomposed into

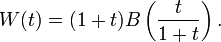

Another representation of the Brownian bridge based on the Brownian motion is, for t ∈ [0, 1]

Conversely, for t ∈ [0, ∞]

The Brownian bridge may also be represented as a Fourier series with stochastic coefficients, as

where  are independent identically distributed standard normal random variables (see the Karhunen–Loève theorem).

are independent identically distributed standard normal random variables (see the Karhunen–Loève theorem).

A Brownian bridge is the result of Donsker's theorem in the area of empirical processes. It is also used in the Kolmogorov–Smirnov test in the area of statistical inference.

Intuitive remarks

A standard Wiener process satisfies W(0) = 0 and is therefore "tied down" to the origin, but other points are not restricted. In a Brownian bridge process on the other hand, not only is B(0) = 0 but we also require that B(1) = 0, that is the process is "tied down" at t = 1 as well. Just as a literal bridge is supported by pylons at both ends, a Brownian Bridge is required to satisfy conditions at both ends of the interval [0,1]. (In a slight generalization, one sometimes requires B(t1) = a and B(t2) = b where t1, t2, a and b are known constants.)

Suppose we have generated a number of points W(0), W(1), W(2), W(3), etc. of a Wiener process path by computer simulation. It is now desired to fill in additional points in the interval [0,1], that is to interpolate between the already generated points W(0) and W(1). The solution is to use a Brownian bridge that is required to go through the values W(0) and W(1).

General case

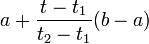

For the general case when B(t1) = a and B(t2) = b, the distribution of B at time t ∈ (t1, t2) is normal, with mean

and the covariance between B(s) and B(t), with s<t is

References

- Glasserman, Paul (2004). Monte Carlo Methods in Financial Engineering. New York: Springer-Verlag. ISBN 0-387-00451-3.

- Revuz, Daniel; Yor, Marc (1999). Continuous Martingales and Brownian Motion (2nd ed.). New York: Springer-Verlag. ISBN 3-540-57622-3.

![B_{t}:=(W_{t}|W_{1}=0),\;t\in [0,1]](/2014-wikipedia_en_all_02_2014/I/media/7/9/1/c/791c8ea76157cd10fd3c8b2cafbea915.png)