Sortino ratio

The Sortino ratio measures the risk-adjusted return of an investment asset, portfolio or strategy. It is a modification of the Sharpe ratio but penalizes only those returns falling below a user-specified target, or required rate of return, while the Sharpe ratio penalizes both upside and downside volatility equally. The ratio is calculated as:

,

,

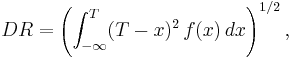

where R is the asset or portfolio realized return; T is the target or required rate of return for the investment strategy under consideration, (T was originally known as the minimum acceptable return, or MAR); DR is the target semideviation = square root of the target semivariance (TSV). TSV is the return distribution's lower-partial moment of degree 2 (LPM2).

where  is often taken to be the risk free interest rate and

is often taken to be the risk free interest rate and  is the pdf of the returns. This can be thought of as the root mean squared underperformance, where the underperformance is the amount by which a return is below target (and returns above target are treated as underperformance of 0).

is the pdf of the returns. This can be thought of as the root mean squared underperformance, where the underperformance is the amount by which a return is below target (and returns above target are treated as underperformance of 0).

Thus, the ratio is the actual rate of return in excess of the investor's target rate of return, per unit of downside risk; or, overperformance divided by root-mean-square underperformance. The ratio was created by Brian M. Rom[1] in 1986 as an element of Investment Technologies'[2] Post-Modern Portfolio theory portfolio optimization software.

See also

- Modern Portfolio Theory

- Modigliani Risk-Adjusted Performance

- Post-modern portfolio theory

- Sharpe ratio

- Upside potential ratio

- V2 ratio