IS/LM model

The IS/LM model (Investment Saving/Liquidity preference Money supply) is a macroeconomic tool that demonstrates the relationship between interest rates and real output in the goods and services market and the money market. The intersection of the IS and LM curves is the "General Equilibrium" where there is simultaneous equilibrium in both markets.[1]

Contents |

History

The IS/LM model was born at the Econometric Conference held in Oxford during September, 1936. Roy Harrod, John R. Hicks, and James Meade all presented papers describing mathematical models attempting to summarize John Maynard Keynes' General Theory of Employment, Interest, and Money. Hicks, who had seen a draft of Harrod's paper, invented the IS/LM model (originally using LL, not LM). He later presented it in "Mr. Keynes and the Classics: A Suggested Interpretation".[2]

Hicks later agreed that the model missed important points from the Keynesian theory, criticizing it as having very limited use beyond "a classroom gadget", and criticizing equilibrium methods generally: "When one turns to questions of policy, looking towards the future instead of the past, the use of equilibrium methods is still more suspect."[3] The first problem was that it presents the real and monetary sectors as separate, something Keynes attempted to transcend. In addition, an equilibrium model ignores uncertainty – and that liquidity preference only makes sense in the presence of uncertainty "For there is no sense in liquidity, unless expectations are uncertain."[4] A shift in the IS or LM curve will cause change in expectations, causing the other curve to shift. Most modern macroeconomists see the IS/LM model as being at best a first approximation for understanding the real world.

Although disputed in some circles and accepted to be imperfect, the model is widely used and seen as useful in gaining an understanding of macroeconomic theory. It is used in most university macroeconomics textbooks. [5]

Formulation

The model is presented as a graph of two intersecting lines in the first quadrant.

The horizontal axis represents national income or real gross domestic product and is labelled Y. The vertical axis represents the real interest rate, i. Since this is a non-dynamic model, there is a fixed relationship between the nominal interest rate and the real interest rate (the former equals the latter plus the expected inflation rate which is exogenous in the short run); therefore variables such as money demand which actually depend on the nominal interest rate can equivalently be expressed as depending on the real interest rate.

The point where these schedules intersect represents a short-run equilibrium in the real and monetary sectors (though not necessarily in other sectors, such as labor markets): both the product market and the money market are in equilibrium. This equilibrium yields a unique combination of the interest rate and real GDP.

IS curve

For the IS curve, the independent variable is the interest rate and the dependent variable is the level of income (even though the interest rate is plotted vertically). The IS curve is drawn as downward-sloping with the interest rate (i) on the vertical axis and GDP (gross domestic product: Y) on the horizontal axis. The initials IS stand for "Investment and Saving equilibrium" but since 1937 have been used to represent the locus of all equilibria where total spending (consumer spending + planned private investment + government purchases + net exports) equals an economy's total output (equivalent to real income, Y, or GDP). To keep the link with the historical meaning, the IS curve can be said to represent the equilibria where total private investment equals total saving, where the latter equals consumer saving plus government saving (the budget surplus) plus foreign saving (the trade surplus). In equilibrium, all spending is desired or planned; there is no unplanned inventory accumulation.[6] The level of real GDP (Y) is determined along this line for each interest rate.

Thus the IS curve is a locus of points of equilibrium in the "real" (non-financial) economy. Given expectations about returns on fixed investment, every level of the real interest rate (i) will generate a certain level of planned fixed investment and other interest-sensitive spending: lower interest rates encourage higher fixed investment and the like. Income is at the equilibrium level for a given interest rate when the saving that consumers and other economic participants choose to do out of this income equals investment (or, equivalently, when "leakages" from the circular flow equal "injections"). The multiplier effect of an increase in fixed investment resulting from a lower interest rate raises real GDP. This explains the downward slope of the IS curve. In summary, this line represents the causation from falling interest rates to rising planned fixed investment (etc.) to rising national income and output.

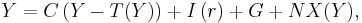

The IS curve is defined by the equation

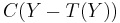

where Y represents income,  represents consumer spending as an increasing function of disposable income (income, Y, minus taxes, T(Y), which themselves depend positively on income),

represents consumer spending as an increasing function of disposable income (income, Y, minus taxes, T(Y), which themselves depend positively on income),  represents investment as a decreasing function of the real interest rate, G represents government spending, and NX(Y) represents net exports (exports minus imports) as a decreasing function of income (decreasing because imports are an increasing function of income). In this equation, the level of G (government spending) is presumed to be exogenous, meaning that it is taken as a given.

represents investment as a decreasing function of the real interest rate, G represents government spending, and NX(Y) represents net exports (exports minus imports) as a decreasing function of income (decreasing because imports are an increasing function of income). In this equation, the level of G (government spending) is presumed to be exogenous, meaning that it is taken as a given.

LM curve

For the LM curve, the independent variable is income and the dependent variable is the interest rate. The LM curve shows the combinations of interest rates and levels of real income for which the money market is in equilibrium. It is an upward-sloping curve representing the role of finance and money. The initials LM stand for "Liquidity preference and Money supply equilibrium". As such, the LM function is the set of equilibrium points between the liquidity preference or Demand for Money function and the money supply function (as determined by banks and central banks).

Each point on the LM curve reflects a particular equilibrium situation in the money market equilibrium diagram, based on a particular level of income. In the money market equilibrium diagram, the liquidity preference function is simply the willingness to hold cash balances instead of securities. For this function, the nominal interest rate (on the vertical axis) is plotted against the quantity of cash balances (or liquidity), on the horizontal. The liquidity preference function is downward sloping. Two basic elements determine the quantity of cash balances demanded (liquidity preference) and therefore the position and slope of the function:

- 1) Transactions demand for money: this includes both (a) the willingness to hold cash for everyday transactions and (b) a precautionary measure (money demand in case of emergencies). Transactions demand is positively related to real GDP (represented by Y,and also referred to as income). This is simply explained - as GDP increases, so does spending and therefore transactions. As GDP is considered exogenous to the liquidity preference function, changes in GDP shift the curve. For example, an increase in GDP will, ceteris paribus, move the entire liquidity preference function rightward in response to the GDP increase.

- 2) Speculative demand for money: this is the willingness to hold cash instead of securities as an asset for investment purposes. Speculative demand is inversely related to the interest rate. As the interest rate rises, the opportunity cost of holding cash increases - the incentive will be to move into securities.

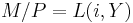

The money supply function for this situation is plotted on the same graph as the liquidity preference function. The money supply is determined by the central bank decisions and willingness of commercial banks to loan money. Though the money supply is related indirectly to interest rates in the very short run, the money supply in effect is perfectly inelastic with respect to nominal interest rates (assuming the central bank chooses to control the money supply rather than focusing directly on the interest rate). Thus the money supply function is represented as a vertical line - money supply is a constant, independent of the interest rate, GDP, and other factors. Mathematically, the LM curve is defined by the equation  , where the supply of money is represented as the real amount M/P (as opposed to the nominal amount M), with P representing the price level, and L being the real demand for money, which is some function of the interest rate i and the level Y of real income. The LM curve shows the combinations of interest rates and levels of real income for which money supply equals money demand—that is, for which the money market is in equilibrium.

, where the supply of money is represented as the real amount M/P (as opposed to the nominal amount M), with P representing the price level, and L being the real demand for money, which is some function of the interest rate i and the level Y of real income. The LM curve shows the combinations of interest rates and levels of real income for which money supply equals money demand—that is, for which the money market is in equilibrium.

For a given level of income, the intersection point between the liquidity preference and money supply functions implies a single point on the LM curve: specifically, the point giving the level of the interest rate which equilibrates the money market at the given level of income. Recalling that for the LM curve, the interest rate is plotted against real GDP (whereas the liquidity preference and money supply functions plot interest rates against the quantity of cash balances), an increase in GDP shifts the liquidity preference function rightward and hence raises the interest rate. Thus the LM function is positively sloped.

Shifts

One hypothesis is that a government's deficit spending ("fiscal policy") has an effect similar to that of a lower saving rate or increased private fixed investment, increasing the amount of demand for goods at each individual interest rate. An increased deficit by the national government shifts the IS curve to the right. This raises the equilibrium interest rate (from i1 to i2) and national income (from Y1 to Y2), as shown in the graph above. The equilibrium level of national income in the IS-LM diagram is referred to as aggregate demand.

By the above hypothesis, the graph indicates one of the major criticisms of deficit spending as a way to stimulate the economy: rising interest rates lead to crowding out – i.e., discouragement – of private fixed investment, which in turn may hurt long-term growth of the supply side (potential output).

Keynesians respond that deficit spending may actually "crowd in" (encourage) private fixed investment via the accelerator effect, which helps long-term growth. Further, if government deficits are spent on productive public investment (e.g., infrastructure or public health) that directly and eventually raises potential output, although not necessarily as much as the lost private investment might have. The extent of any crowding out depends on the shape of the LM curve. A shift in the IS curve along a relatively flat LM curve can increase output substantially with little change in the interest rate. On the other hand, an upward shift in the IS curve along a vertical LM curve will lead to higher interest rates, but no change in output (this case represents the Treasury View).

Rightward shifts of the IS curve also result from exogenous increases in investment spending (i.e., for reasons other than interest rates or income), in consumer spending, and in export spending by people outside the economy being modelled, as well as by exogenous decreases in spending on imports. Thus these too raise both equilibrium income and the equilibrium interest rate. Of course, changes in these variables in the opposite direction shift the IS curve in the opposite direction.

The IS/LM model also allows for the role of monetary policy. If the money supply is increased, that shifts the LM curve downward, lowering interest rates and raising equilibrium national income. Further, exogenous decreases in liquidity preference, perhaps due to improved transactions technologies, lead to downward shifts of the LM curve and thus increases in income and decreases in interest rates. Changes in these variables in the opposite direction shift the LM curve in the opposite direction.

Incorporation into larger models

By itself, the IS-LM model is used to study the short run when prices are fixed or sticky and no inflation is taken into consideration. But in practice the main role of the model is as a sub-model of larger models (especially the Aggregate Demand-Aggregate Supply model) which allow for a flexible price level. In the aggregate demand-aggregate supply model, each point on the aggregate demand curve is an outcome of the IS-LM model for aggregate demand Y based on a particular price level. Starting from one point on the aggregate demand curve, at a particular price level and a quantity of aggregate demand implied by the IS-LM model for that price level, if one considers a higher potential price level, in the IS-LM model the real money supply M/P will be lower and hence the LM curve will be shifted higher, leading to lower aggregate demand; hence at the higher price level the level of aggregate demand is lower, so the aggregate demand curve is negatively sloped.

See also

References

- ^ Robert J. Gordon, Macroeconomics eleventh edition, 2009

- ^ Hicks, J. R. (1937), "Mr. Keynes and the Classics - A Suggested Interpretation", Econometrica, v. 5 (April): 147-159.

- ^ Hicks, John (1980-1981), "IS-LM: An Explanation", Journal of Post Keynesian Economics, v. 3: 139-155

- ^ (Hicks 1980-1981)

- ^ Mankiw, N. Gregory (May 2006). "The Macroeconomist as Scientist and Engineer". p. 19. http://www.economics.harvard.edu/files/faculty/40_Macroeconomist_as_Scientist.pdf. Retrieved 2011-12-30.

- ^ Fonseca, Gonçalo L., The General Glut Controversy, The New School, http://homepage.newschool.edu/het//essays/classic/glut.htm

External links

- Fonseca, Gonçalo L., et al. The Hicks-Hansen IS-LM Model A fairly in-depth explanation of the model.

- Krugman, Paul. There's something about macro - An explanation of the model and its role in understanding macroeconomics.

- Krugman, Paul. IS-LMentary - A basic explanation of the model and its uses.

- Weerapana, Akila. The IS Curve and the LM Curve (pdf) - Lecture Notes explaining the IS Curve and the LM Curve.

- Wiens, Elmer G. IS-LM Model - An online, interactive IS-LM model of the Canadian economy.