Harrod–Domar model

The Harrod–Domar model is used in development economics to explain an economy's growth rate in terms of the level of saving and productivity of capital. It suggests that there is no natural reason for an economy to have balanced growth. The model was developed independently by Sir Roy F. Harrod in 1939 and Evsey Domar in 1946. The Harrod–Domar model was the precursor to the exogenous growth model.

Contents |

Mathematical formalism

Let Y represent output, which equals income, and let K equal capital. S is total saving, s is the savings rate, and I is investment. δ stands for the rate of depreciation of the capital stock (delta). The Harrod–Domar model makes the following a priori assumptions:

|

1: Output is a function of capital stock |

|

2: The marginal product of capital is constant; the production function exhibits constant returns to scale. This implies capital's marginal and average products are equal. |

|

3: Capital is necessary for output. |

|

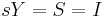

4: The product of the savings rate and output equals saving, which equals investment |

|

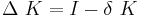

5: The change in the capital stock equals investment less the depreciation of the capital stock |

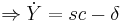

Derivation of output growth rate:

An alternative (and, perhaps, simpler) derivation is as follows, with dots (for example,  ) denoting percentage growth rates.

) denoting percentage growth rates.

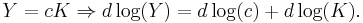

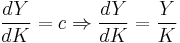

First, assumptions (1)–(3) imply that output and capital are linearly related (for readers with an economics background, this proportionality implies a capital-elasticity of output equal to unity). These assumptions thus generate equal growth rates between the two variables. That is,

Since the marginal product of capital, c, is a constant, we have

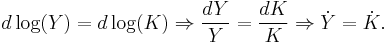

Next, with assumptions (4) and (5), we can find capital's growth rate as,

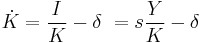

In summation, the savings rate times the marginal product of capital minus the depreciation rate equals the output growth rate. Increasing the savings rate, increasing the marginal product of capital, or decreasing the depreciation rate will increase the growth rate of output; these are the means to achieve growth in the Harrod–Domar model.

Although the Harrod–Domar model was initially created to help analyse the business cycle, it was later adapted to explain economic growth. Its implications were that growth depends on the quantity of labour and capital; more investment leads to capital accumulation, which generates economic growth. The model also had implications for less economically developed countries; labour is in plentiful supply in these countries but physical capital is not, slowing economic progress. LEDCs do not have sufficient average incomes to enable high rates of saving, and therefore accumulation of the capital stock through investment is low.

The model implies that economic growth depends on policies to increase investment, by increasing saving, and using that investment more efficiently through technological advances.

The model concludes that an economy does not find full employment and stable growth rates naturally, similar to the Keynesian beliefs.

Criticisms of the model

The main criticism of the model is the level of assumption, one being that there is no reason for growth to be sufficient to maintain full employment; this is based on the belief that the relative price of labour and capital is fixed, and that they are used in equal proportions. The model explains economic boom and bust by the assumption that investors are only influenced by output (known as the accelerator principle); this is now widely believed to be false.

In terms of development, critics claim that the model sees economic growth and development as the same; in reality, economic growth is only a subset of development. Another criticism is that the model implies poor countries should borrow to finance investment in capital to trigger economic growth; however, history has shown that this often causes repayment problems later.

The endogenity of savings: Perhaps the most important parameter in the Harrod–Domar model is the rate of savings. Can it be treated as a parameter that can be manipulated easily by policy? That depends on how much control the policy maker has over the economy. In fact, there are several reasons to believe that the rate of savings may itself be influenced by the overall level of per capita income in the society , not to mention the distribution of that income among the population.

See also

- Solow growth model (neo-classical growth model)

- Economic growth

- Mahalanobis model

- Endogenous growth theory

Reference

Roy F. Harrod, ‘An Essay in Dynamic Theory’ (1939) 49 Economic Journal 14–33

![\begin{align}

& c= \frac{dY}{dK}=\frac{Y(t%2B1) - Y(t)}{K(t) %2B sY(t) - \delta\ K(t) - K(t)} \\[8pt]

& c= \frac{Y(t%2B1) - Y(t)}{sY(t) - \delta\ \frac{dK}{dY} Y(t)} \\[8pt]

& c(sY(t) - \delta\ \frac{dK}{dY} Y(t))=Y(t%2B1) - Y(t) \\[8pt]

& cY(t)\left(s - \delta\ \frac{dK}{dY}\right) = Y(t%2B1) - Y(t) \\[8pt]

& cs - c \delta\ \frac{dK}{dY}=\frac{Y(t%2B1) - Y(t)}{Y(t)} \\[8pt]

& s \frac{dY}{dK} - \delta\ \frac{dY}{dK} \frac{dK}{dY}=\frac{Y(t%2B1) - Y(t)}{Y(t)} \\[8pt]

& s c - \delta\ = \frac{ \Delta Y}{Y}

\end{align}](/2012-wikipedia_en_all_nopic_01_2012/I/abfc9c650424cfbb41d30b7bb159f043.png)