Endogeneity (economics)

In an econometric model, a parameter or variable is said to be endogenous when there is a correlation between the parameter or variable and the error term. Endogeneity can arise as a result of measurement error, autoregression with autocorrelated errors, simultaneity, omitted variables, and sample selection errors. Broadly, a loop of causality between the independent and dependent variables of a model leads to endogeneity.

For example, in a simple supply and demand model, when predicting the quantity demanded in equilibrium, the price is endogenous because producers change their price in response to demand and consumers change their demand in response to price. In this case, the price variable is said to have total endogeneity once the demand and supply curves are known. In contrast, a change in consumer tastes or preferences would be an exogenous change on the demand curve.

Contents |

Exogeneity vs. Endogeneity

In a stochastic model, the notion of the usual exogeneity, sequential exogeneity, strong\strict exogeneity can be defined. Exogeneity is articulated in such a way that a variable or variables is exogenous for parameter  . Even if a variable is exogenous for parameter

. Even if a variable is exogenous for parameter  , it might be endogenous for parameter

, it might be endogenous for parameter  .

.

When the explanatory variables are not stochastic, then they are strong exogenous for all the parameters.

In econometrics the problem of endogeneity occurs when the independent variable is correlated with the error term in a regression model. This implies that the regression coefficient in an Ordinary Least Squares (OLS) regression is biased, however if the correlation is not contemporaneous, then it may still be consistent. There are many methods of overcoming this, including instrumental variable regression and Heckman selection correction.

Static Models

The following are some common sources of endogeneity.

Omitted Variable

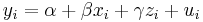

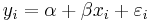

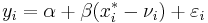

In this case, the endogeneity comes from an uncontrolled confounding variable. A variable is both correlated with an independent variable in the model and with the error term. (Equivalently, the omitted variable both affects the independent variable and separately affects the dependent variable.) Assume that the "true" model to be estimated is,

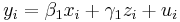

but we omit  (perhaps because we don't have a measure for it) when we run our regression.

(perhaps because we don't have a measure for it) when we run our regression.  will get absorbed by the error term and we will actually estimate,

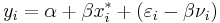

will get absorbed by the error term and we will actually estimate,

(where

(where  )

)

If the correlation of  and

and  is not 0 and

is not 0 and  separately affects

separately affects  (meaning

(meaning  ), then

), then  is correlated with the error term

is correlated with the error term  .

.

Here, x and 1 are not exogenous for alpha and beta since, given x and 1, the distribution of y depends not only on alpha and beta, but also on z and gamma.

Measurement Error

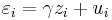

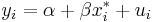

Suppose that we do not get a perfect measure of one of our independent variables. Imagine that instead of observing  we observe

we observe  where

where  is the measurement "noise". When we try to estimate the following univariate regression,

is the measurement "noise". When we try to estimate the following univariate regression,

we actually end up estimating,

(where

(where  )

)

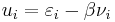

Since both  and

and  depend on

depend on  , they are correlated. Measurement error in the dependent variable, however, does not cause endogeneity (though it does increase the variance of the error term).

, they are correlated. Measurement error in the dependent variable, however, does not cause endogeneity (though it does increase the variance of the error term).

Dynamic Models

The endogeneity problem is particularly relevant in the context of time series analysis of causal processes. It is common for some factors within a causal system to be dependent for their value in period t on the values of other factors in the causal system in period t-1. Suppose that the level of pest infestation is independent of all other factors within a given period, but is influenced by the level of rainfall and fertilizer in the preceding period. In this instance it would be correct to say that infestation is exogenous within the period, but endogenous over time.

Let the model be y=f(x,z)+u, then if the variable x is sequential exogenous for parameter  , and y does not cause x in Granger sense, then the variable x is strong/strict exogenous for the parameter

, and y does not cause x in Granger sense, then the variable x is strong/strict exogenous for the parameter  .

.

Simultaneity

Generally speaking, simultaneity occurs in the dynamic model, but this example is static one.

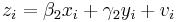

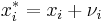

Suppose that two variables are codetermined, with each affecting the other. Suppose that we have two "structural" equations,

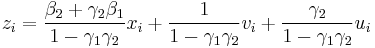

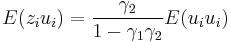

We can show that estimating either equation results in endogeneity. In the case of the first structural equation, we will show that  . First, solving for

. First, solving for  we get (assuming that

we get (assuming that  ),

),

Assuming that  and

and  are uncorrelated with

are uncorrelated with  , we find that,

, we find that,

Therefore, attempts at estimating either structural equation will be hampered by endogeneity.

See also

- Virtuous circle and vicious circle

- Heterogeneity

- Endogenous money

- Endogeneity: An inconvenient truth (Podcast with Prof. John Antonakis)[1]

References

Peter Kennedy. "A Guide to Econometrics". Sixth Edition. (c) 2008. Page 139.