Duration gap

Contents |

Definition

The difference between the duration of assets and liabilities held by a financial entity.

Overview

The duration gap is a financial and accounting term and is typically used by banks, pension funds, or other financial institutions to measure their risk due to changes in the interest rate. This is one of the mismatches that can occur and are known as asset liability mismatches.

Another way to define Duration Gap is: it is the difference in the sensitivity of interest-yielding assets and the sensitivity of liabilities (of the organization ) to a change in market interest rates (yields).

The duration gap measures how well matched are the timings of cash inflows (from assets) and cash outflows (from liabilities).

When the duration of assets is larger than the duration of liabilities, the duration gap is positive. In this situation, if interest rates rise, assets will lose more value than liabilities, thus reducing the value of the firm's equity. If interest rates fall, assets will gain more value than liabilities, thus increasing the value of the firm's equity.

Conversely, when the duration of assets is less than the duration of liabilities, the duration gap is negative. If interest rates rise, liabilities will lose more value than assets, thus increasing the value of the firm's equity. If interest rates fall, liabilities will gain more value than assets, thus reducing the value of the firm's equity.

By duration matching, that is creating a zero duration gap, the firm becomes immunized against interest rate risk. Duration has a double-facet view. It can be beneficial or harmful depending on where interest rates are headed.

Some of the limitations of duration gap management include the following:

- the difficulty in finding assets and liabilities of the same duration

- some assets and liabilities may have patterns of cash flows that are not well defined

- customer prepayments may distort the expected cash flows in duration

- customer defaults may distort the expected cash flows in duration

- convexity can cause problems.

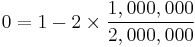

When the duration gap is zero, the firm is immunized only if the size of the liabilities equals the size of the assets. In this example with a two-year loan of one million and a one-year asset of two millions, the firm is still exposed to refinancing risk after one year when the remaining year of the two-year loan has to be financed.

Torque analogy

The duration gap calculation resemble a mechanical torque calculation but with moment arm and force replaced with average duration and total value respectively. It's like the children's seesaw lever with assets on the left part of the plank and liabilities on the right part. When the plank is balancing horizontally the time-value torque is zero meaning that the maturity of assets and liabilities are matched.

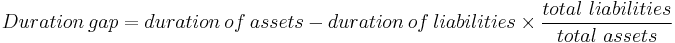

To be able to compare firms and banks of different size the equation has to be normalized by dividing everything by total assets giving the formula for the duration gap.

See also

- List of finance topics

- Bond convexity

- The duration difference is also shown by sorting into maturity buckes as in the table How the example bank manages its liquidity