Tariff

|

|

Policies

Government revenue

Tax revenue · Non-tax revenue Law · Tax bracket Exemption · Credit · Deduction Tax shift · Tax cut · Tax holiday Tax advantage · Tax incentive Tax reform · Tax harmonization Tax competition · Double taxation Tax, tariff and trade |

|

Price effect · Excess burden

Tax incidence Laffer curve · Optimal tax |

|

Collection

Revenue service · Revenue stamp

Tax assessment · Taxable income Tax lien · Tax refund · Tax shield Tax residence · Tax preparation Tax investigation · Tax resistance Tax avoidance and evasion Tax shelter · Tax haven Private tax collection · Tax farming Smuggling · Black market |

|

Distribution

|

|

Types

Direct · Indirect · Ad valorem · In rem

Capital gains · Consumption Dividend · Excise · Georgist Gift · Gross receipts · Income Inheritance (estate) · Land value Payroll · Pigovian · Property Sales · Sin · Stamp · Turnover Value-added (VAT) Corporate profit · Excess profits Windfall profits |

|

International and trade

Custom · Duty

Tariff (Import · Export) · Tariff war Free trade · Free trade zone Trade pact · Tax equalization Tax treaty |

|

By country

Tax rates around the world

Tax revenues as %GDP Albania · Australia · Britain · Canada China · France · Germany India · New Zealand United States |

A tariff (from the Arabic تعريفة, transliterated taʿrīfah, "notification"; derived from the verb ʿarrafa, "to announce, inform") is a tax levied on imports or exports.

Contents |

History

Tariffs are usually associated with protectionism, the economic policy of restraining trade between nations. For political reasons, tariffs are usually imposed on imported goods, although they may also be imposed on exported goods.

In the past, tariffs formed a much larger part of government revenue than they do today.

When shipments of goods arrive at a border crossing or port, customs officers inspect the contents and charge a tax according to the tariff formula. Since the goods cannot continue on their way until the duty is paid, it is the easiest duty to collect, and the cost of collection is small. Traders seeking to evade tariffs are known as smugglers.

Types

There are various types of tariffs:

- An ad valorem tariff is a set percentage of the value of the good that is being imported. Sometimes these are problematic, as when the international price of a good falls, so does the tariff, and domestic industries become more vulnerable to competition. Conversely, when the price of a good rises on the international market so does the tariff, but a country is often less interested in protection when the price is high.

They also face the problem of inappropriate transfer pricing where a company declares a value for goods being traded which differs from the market price, aimed at reducing overall taxes due.

- A SPECIFIC tariff, is a tariff of a specific amount of money that does not vary with the price of the good. These tariffs are vulnerable to changes in the market or inflation unless updated periodically.

- A REVENUE tariff is a set of rates designed primarily to raise money for the government. A tariff on coffee imports imposed by countries where coffee cannot be grown, for example raises a steady flow of revenue.

- A PROHIBITIVE tariff is one so high that nearly no one imports any of that item.

- A PROTECTIVE tariff is intended to artificially inflate prices of imports and protect domestic industries from foreign competition (see also effective rate of protection,) especially from competitors whose host nations allow them to operate under conditions that are illegal in the protected nation, or who subsidize their exports.

- An environmental tariff, similar to a 'protective' tariff, is also known as a 'green' tariff or 'eco-tariff', and is placed on products being imported from, and also being sent to countries with substandard environmental pollution controls.

- A RETALIATORY tariff is one placed against a country who already charges tariffs against the country charging the retaliatory tariff (e.g. If the United States were to charge tariffs on Chinese goods, China would probably charge a tariff on American goods, also). These are usually used in an attempt to get other tariffs rescinded.

Tariffs, in the 20th century, are set by a Tariff Commission based on terms of reference obtained from the government or local authority and suo motu studies of industry structure.

Tax, tariff and trade rules in modern times are usually set together because of their common impact on industrial policy, investment policy, and agricultural policy. A trade bloc is a group of allied countries agreeing to minimize or eliminate tariffs and other barriers against trade with each other, and possibly to impose protective tariffs on imports from outside the bloc. A customs union has a common external tariff, and, according to an agreed formula, the participating countries share the revenues from tariffs on goods entering the customs union.

If a country's major industries lose to foreign competition, the loss of jobs and tax revenue can severely impair parts of that country's economy and increase poverty. If a nation's standard of living or industrial regulations are too great, it is impossible for domestic industries to survive unprotected trade with inferior nations without compromising them; this compromise consists of a global race to the bottom. Protective tariffs have historically been used as a measure against this possibility. However, protective tariffs have disadvantages as well. The most notable is that they prevent the price of the good subject to the tariff from undercutting local competition, disadvantaging consumers of that good or manufacturers who use that good to produce something else: for example a tariff on food can increase poverty, while a tariff on steel can make automobile manufacture less competitive. They can also backfire if countries whose trade is disadvantaged by the tariff impose tariffs of their own, resulting in a trade war and, according to free trade theorists, disadvantaging both sides.(Murad)

Economic analysis

Neoclassical economic theories hold that tariffs are a harmful interference with the individual freedom and the laws of the free market. They believe that it is unfair toward consumers and generally disadvantageous for a country to artificially maintain an industry made inefficient by local demands, and that it is better to allow a collapse to take place. Opposition to all tariffs is part of the free trade principle; the World Trade Organization aims to reduce tariffs and to avoid countries discriminating between differing countries when applying tariffs.

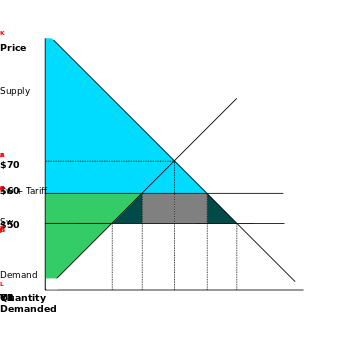

In the following graph we see the effect that an import tariff has on the domestic economy. In a closed economy without trade we would see equilibrium at the intersection of the demand and supply curves (point B), yielding prices of $70 and an output of Y*. In this case the consumer surplus would be equal to the area inside points A, B and K, while producer surplus is given as the area A, B and L. When incorporating free international trade into the model we introduce a new supply curve denoted as SW. This curve makes the assumption that the international supply of the good or service is perfectly elastic and that the world can produce at a near infinite quantity at the given price. Obviously, in real world conditions this is somewhat unrealistic, but making such assumptions is unlikely to have a material impact on the outcome of the model. In this case the international price of the good is $50 ($20 less than the domestic equilibrium price).

The model above is only completely accurate in the extreme case where none of the consumers belong to the producers group and the cost of the product is a fraction of their wages. If instead, we take the opposite extreme, and assume all consumers come from the producers' group, and also assume their only purchasing power comes from the wages earned in production and the product costs their whole wage, then the graph looks radically different. Without tariffs, only those producers/consumers able to produce the product at the world price will have the money to purchase it at that price. The small FGL triangle will be matched by an equally small mirror image triangle of consumers still able to buy. With tariffs, a larger CDL triangle and its mirror will survive.

Note also, that with or without tariffs, there is no incentive to buy the imported goods over the domestic, as the price of each is the same. Only by altering available purchasing power through debt, selling off assets, or new wages from new forms of domestic production, will the imported goods be purchased. Or, of course, if its price were only a fraction of wages.

In the real world, as more imports replace domestic goods, they consume a larger fraction of available domestic wages, moving the graph towards this view of the model. If new forms of production are not found in time, the nation will go bankrupt, and internal political pressures will lead to debt default, extreme tariffs, or worse.

Establishing tariffs slows down this process, allowing more time for new forms of production to be developed, but also buttresses industries which may never regain competitive prices.

Political analysis

The tariff has been used as a political tool to establish an independent nation; for example, the United States Tariff Act of 1789, signed specifically on July 4, was called the "Second Declaration of Independence" by newspapers because it was intended to be the economic means to achieve the political goal of a sovereign and independent United States.[1]

In modern times, the political impact of tariffs has been seen in a positive and negative sense. The 2002 United States steel tariff imposed a 30% tariff on a variety of imported steel products for a period of three years. American steel producers supported the tariff[2], but the move was criticised by the Cato Institute[3].

Tariffs can occasionally emerge as a political issue prior to an election. In the leadup to the 2007 Australian Federal election, the Australian Labor Party announced it would undertake a review of Australian car tariffs if elected[4]. The Liberal Party made a similar commitment, while independent candidate Nick Xenophon announced his intention to introduce tariff-based legislation as "a matter of urgency".[5]

United States

See also

- Effective rate of protection

- Embargo

- Environmental tariff

- Excise duty

- General Agreement on Tariffs and Trade (GATT)

- Import quota

- List of international trade topics

- List of tariffs

- Swiss Formula

- Telecommunications tariff

- Trade barrier

References

- ↑ Thomas Jefferson - under George Washington by America's History

- ↑ BW Online | March 8, 2002 | Behind the Steel-Tariff Curtain

- ↑ Trade Briefing Paper no. 14. Steel Trap: How Subsidies and Protectionism Weaken the U.S. Steel Industry | Cato's Center for Trade Policy Studies

- ↑ http://www.theaustralian.news.com.au/story/0,25197,22729573-5013871,00.html

- ↑ Candidate wants car tariff cuts halted - Breaking News - National - Breaking News

Further reading

- Salvatore, Dominick (2005), Introduction to International Economics (First ed.), Hoboken, NJ: Wiley, ISBN 0471202266.

- Taussig, F. W. (1911), "Tariff", Encyclopedia Britannica, 26 (11th ed.), pp. 422–427, http://www.econlib.org/library/Taussig/tsgEnc1.html.

- Free Markets And Tariffs, http://www.americanprotectionist.com/Archives/FreeMarkets.html.

External links

For a details on the Current Rates of Import & Export Duties please refer to the following website

|

||||||||||||||||||||

|

||||||||