Standard deviation

In probability theory and statistics, the standard deviation of a statistical population, a data set, or a probability distribution is the square root of its variance. Standard deviation is a widely used measure of the variability or dispersion, being algebraically more tractable though practically less robust than the expected deviation or average absolute deviation.

It shows how much variation there is from the "average" (mean, or expected/budgeted value). A low standard deviation indicates that the data points tend to be very close to the mean, whereas high standard deviation indicates that the data is spread out over a large range of values.

For example, the average height for adult men in the United States is about 70 inches (178 cm), with a standard deviation of around 3 in (8 cm). This means that most men (about 68 percent, assuming a normal distribution) have a height within 3 in (8 cm) of the mean (67–73 in/170–185 cm), one standard deviation. Whereas almost all men (about 95%) have a height within 6 in (15 cm) of the mean (64–76 in/163–193 cm), 2 standard deviations. If the standard deviation were zero, then all men would be exactly 70 in (178 cm) high. If the standard deviation were 20 in (51 cm), then men would have much more variable heights, with a typical range of about 50–90 in (127–229 cm). Three standard deviations account for 99.7% of the sample population being studied, assuming the distribution is normal (bell-shaped).

In addition to expressing the variability of a population, standard deviation is commonly used to measure confidence in statistical conclusions. For example, the margin of error in polling data is determined by calculating the expected standard deviation in the results if the same poll were to be conducted multiple times. The reported margin of error is typically about twice the standard deviation–the radius of a 95% confidence interval. In science, researchers commonly report the standard deviation of experimental data, and only effects that fall far outside the range of standard deviation are considered statistically significant—normal random error or variation in the measurements is in this way distinguished from causal variation. Standard deviation is also important in finance, where the standard deviation on the rate of return on an investment is a measure of the volatility of the investment.

The term standard deviation was first used[1] in writing by Karl Pearson[2] in 1894, following his use of it in lectures. This was as a replacement for earlier alternative names for the same idea: for example, Gauss used mean error.[3] A useful property of standard deviation is that, unlike variance, it is expressed in the same units as the data. Note, however, that for measurements with percentage as unit, the standard deviation will have percentage points as unit.

When only a sample of data from a population is available, the population standard deviation can be estimated by a modified quantity called the sample standard deviation, explained below.

Basic example

Consider a population consisting of the following eight values:

The eight data points have a mean (or average) value of 5:

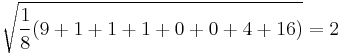

To calculate the population standard deviation, first compute the difference of each data point from the mean, and square the result:

Next divide the sum of these values by the number of values and take the square root to give the standard deviation:

Therefore, the above has a population standard deviation of 2.

The above assumes a complete population. If the 8 values are obtained by random sampling from some parent population, then computing the sample standard deviation would use a denominator of 7 instead of 8. See the section Estimation below for an explanation.

Definition of population values

Let X be a random variable with mean value μ:

Here the operator E denotes the average or expected value of X. Then the standard deviation of X is the quantity

That is, the standard deviation σ (sigma) is the square root of the average value of (X − μ)2.

The standard deviation of a (univariate) probability distribution is the same as that of a random variable having that distribution. Not all random variables have a standard deviation, since these expected values need not exist. For example, the standard deviation of a random variable which follows a Cauchy distribution is undefined because its expected value μ is undefined.

Discrete random variable

In the case where X takes random values from a finite data set  , with each value having the same probability, the standard deviation is

, with each value having the same probability, the standard deviation is

or, using summation notation,

Continuous random variable

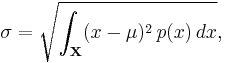

The standard deviation of a continuous real-valued random variable X with probability density function p(x) is

where

and where the integrals are definite integrals taken for x ranging over the sample space of X.

In the case of a parametric family of distributions, the standard deviation can be expressed in terms of the parameters. For example, in the case of the log-normal distribution with parameters μ and σ2, the standard deviation is [(exp(σ2) − 1)exp(2μ + σ2)]1/2.

Estimation

One can find the standard deviation of an entire population in cases (such as standardized testing) where every member of a population is sampled. In cases where that cannot be done, the standard deviation σ is estimated by examining a random sample taken from the population. Some estimators are given below:

With standard deviation of the sample

An estimator for σ sometimes used is the standard deviation of the sample, denoted by sN and defined as follows:

This estimator has a uniformly smaller mean squared error than the sample standard deviation (see below), and is the maximum-likelihood estimate when the population is normally distributed. But this estimator, when applied to a small or moderately sized sample, tends to be too low: it is a biased estimator.

The standard deviation of the sample is the same as the population standard deviation of a discrete random variable that can assume precisely the values from the data set, where the probability for each value is proportional to its multiplicity in the data set.

With sample standard deviation

The most common estimator for σ used is an adjusted version, the sample standard deviation, denoted by s and defined as follows:

where  are the observed values of the sample items and

are the observed values of the sample items and  is the mean value of these observations. This correction (the use of N − 1 instead of N) is known as Bessel's correction. The reason for this correction is that s2 is an unbiased estimator for the variance σ2 of the underlying population, if that variance exists and the sample values are drawn independently with replacement. However, s is not an unbiased estimator for the standard deviation σ; it tends to underestimate the population standard deviation.

is the mean value of these observations. This correction (the use of N − 1 instead of N) is known as Bessel's correction. The reason for this correction is that s2 is an unbiased estimator for the variance σ2 of the underlying population, if that variance exists and the sample values are drawn independently with replacement. However, s is not an unbiased estimator for the standard deviation σ; it tends to underestimate the population standard deviation.

The term standard deviation of the sample is used for the uncorrected estimator (using N) whilst the term sample standard deviation is used for the corrected estimator (using N − 1). The denominator N − 1 is the number of degrees of freedom in the vector of residuals,  .

.

Other estimators

Although an unbiased estimator for σ is known when the random variable is normally distributed, the formula is complicated and amounts to a minor correction. Moreover, unbiasedness (in this sense of the word) is not always desirable.

Identities and mathematical properties

The standard deviation is invariant to changes in location, and scales directly with the scale of the random variable. Thus, for a constant c and random variables X and Y:

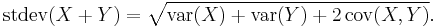

The standard deviation of the sum of two random variables can be related to their individual standard deviations and the covariance between them:

where  and

and  stand for variance and covariance, respectively.

stand for variance and covariance, respectively.

The calculation of the sum of squared deviations can be related to moments calculated directly from the data. In general, we have

For a finite population with equal probabilities on all points, we have

Thus, the standard deviation is equal to the square root of (the average of the squares less the square of the average). See computational formula for the variance for a proof of this fact, and for an analogous result for the sample standard deviation.

Interpretation and application

A large standard deviation indicates that the data points are far from the mean and a small standard deviation indicates that they are clustered closely around the mean.

For example, each of the three populations {0, 0, 14, 14}, {0, 6, 8, 14} and {6, 6, 8, 8} has a mean of 7. Their standard deviations are 7, 5, and 1, respectively. The third population has a much smaller standard deviation than the other two because its values are all close to 7. In a loose sense, the standard deviation tells us how far from the mean the data points tend to be. It will have the same units as the data points themselves. If, for instance, the data set {0, 6, 8, 14} represents the ages of a population of four siblings in years, the standard deviation is 5 years.

As another example, the population {1000, 1006, 1008, 1014} may represent the distances traveled by four athletes, measured in meters. It has a mean of 1007 meters, and a standard deviation of 5 meters.

Standard deviation may serve as a measure of uncertainty. In physical science, for example, the reported standard deviation of a group of repeated measurements should give the precision of those measurements. When deciding whether measurements agree with a theoretical prediction the standard deviation of those measurements is of crucial importance: if the mean of the measurements is too far away from the prediction (with the distance measured in standard deviations), then the theory being tested probably needs to be revised. This makes sense since they fall outside the range of values that could reasonably be expected to occur if the prediction were correct and the standard deviation appropriately quantified. See prediction interval.

Application examples

The practical value of understanding the standard deviation of a set of values is in appreciating how much variation there is from the "average" (mean).

Climate

As a simple example, consider the average daily maximum temperatures for two cities, one inland and one on the coast. It is helpful to understand that the range of daily maximum temperatures for cities near the coast is smaller than for cities inland. Thus, while these two cities may each have the same average maximum temperature, the standard deviation of the daily maximum temperature for the coastal city will be less than that of the inland city as, on any particular day, the actual maximum temperature is more likely to be farther from the average maximum temperature for the inland city than for the coastal one.

Sports

Another way of seeing it is to consider sports teams. In any set of categories, there will be teams that rate highly at some things and poorly at others. Chances are, the teams that lead in the standings will not show such disparity, but will perform well in most categories. The lower the standard deviation of their ratings in each category, the more balanced and consistent they will tend to be. Whereas, teams with a higher standard deviation will be more unpredictable. For example, a team that is consistently bad in most categories will have a low standard deviation. A team that is consistently good in most categories will also have a low standard deviation. However, a team with a high standard deviation might be the type of team that scores a lot (strong offense) but also concedes a lot (weak defense), or, vice versa, that might have a poor offense but compensates by being difficult to score on.

Trying to predict which teams, on any given day, will win, may include looking at the standard deviations of the various team "stats" ratings, in which anomalies can match strengths vs. weaknesses to attempt to understand what factors may prevail as stronger indicators of eventual scoring outcomes.

In racing, a driver is timed on successive laps. A driver with a low standard deviation of lap times is more consistent than a driver with a higher standard deviation. This information can be used to help understand where opportunities might be found to reduce lap times.

Finance

In finance, standard deviation is a representation of the risk associated with a given security (stocks, bonds, property, etc.), or the risk of a portfolio of securities (actively managed mutual funds, index mutual funds, or ETFs). Risk is an important factor in determining how to efficiently manage a portfolio of investments because it determines the variation in returns on the asset and/or portfolio and gives investors a mathematical basis for investment decisions (known as mean-variance optimization). The overall concept of risk is that as it increases, the expected return on the asset will increase as a result of the risk premium earned – in other words, investors should expect a higher return on an investment when said investment carries a higher level of risk, or uncertainty of that return. When evaluating investments, investors should estimate both the expected return and the uncertainty of future returns. Standard deviation provides a quantified estimate of the uncertainty of future returns.

For example, let's assume an investor had to choose between two stocks. Stock A over the last 20 years had an average return of 10%, with a standard deviation of 20 percentage points (pp) and Stock B, over the same period, had average returns of 12%, but a higher standard deviation of 30 pp. On the basis of risk and return, an investor may decide that Stock A is the safer choice, because Stock B's additional 2% points of return is not worth the additional 10 pp standard deviation (greater risk or uncertainty of the expected return). Stock B is likely to fall short of the initial investment (but also to exceed the initial investment) more often than Stock A under the same circumstances, and is estimated to return only 2% more on average. In this example, Stock A is expected to earn about 10%, plus or minus 20 pp (a range of 30% to -10%), about two-thirds of the future year returns. When considering more extreme possible returns or outcomes in future, an investor should expect results of up to 10% plus or minus 60 pp, or a range from 70% to (−)50%, which includes outcomes for three standard deviations from the average return (about 99.7% of probable returns).

Calculating the average return (or arithmetic mean) of a security over a given period will generate an expected return on the asset. For each period, subtracting the expected return from the actual return results in the variance. Square the variance in each period to find the effect of the result on the overall risk of the asset. The larger the variance in a period, the greater risk the security carries. Taking the average of the squared variances results in the measurement of overall units of risk associated with the asset. Finding the square root of this variance will result in the standard deviation of the investment tool in question.

Population standard deviation is used to set the width of Bollinger Bands, a widely adopted technical analysis tool. For example, the upper Bollinger Band is given as:  The most commonly used value for n is 2; there is about 5% chance of going outside, assuming the normal distribution is right.

The most commonly used value for n is 2; there is about 5% chance of going outside, assuming the normal distribution is right.

Geometric interpretation

To gain some geometric insights, we will start with a population of three values, x1, x2, x3. This defines a point P = (x1, x2, x3) in R3. Consider the line L = {(r, r, r) : r in R}. This is the "main diagonal" going through the origin. If our three given values were all equal, then the standard deviation would be zero and P would lie on L. So it is not unreasonable to assume that the standard deviation is related to the distance of P to L. And that is indeed the case. To move orthogonally from L to the point P, one begins at the point:

whose coordinates are the mean of the values we started out with. A little algebra shows that the distance between P and M (which is the same as the orthogonal distance between P and the line L) is equal to the standard deviation of the vector x1, x2, x3, divided by the square root of the number of dimensions of the vector.

Chebyshev's inequality

An observation is rarely more than a few standard deviations away from the mean. Chebyshev's inequality ensures, for all distributions for which the standard deviation is defined, the within a number of standard deviations is at least that as follows. The following table gives some exemplar values of the minimum population within a number of standard deviations.

| Min. population | Distance from mean |

|---|---|

| 50% | √2 |

| 75% | 2 |

| 89% | 3 |

| 94% | 4 |

| 96% | 5 |

| 97% | 6 |

[4] [4] |

|

Rules for normally distributed data

The central limit theorem says that the distribution of a sum of many independent, identically distributed random variables tends towards the famous bell-shaped normal distribution with a probability density function of:

where  is the arithmetic mean of the sample. The standard deviation therefore is simply a scaling variable that adjusts how broad the curve will be, though also appears in the normalizing constant to keep the distribution normalized for different widths.

is the arithmetic mean of the sample. The standard deviation therefore is simply a scaling variable that adjusts how broad the curve will be, though also appears in the normalizing constant to keep the distribution normalized for different widths.

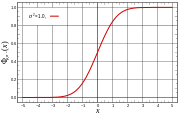

If a data distribution is approximately normal then the proportion of data values within z standard deviations of the mean is defined by  , where

, where  is the error function. If a data distribution is approximately normal then about 68% of the data values are within 1 standard deviation of the mean (mathematically, μ ± σ, where μ is the arithmetic mean), about 95% are within two standard deviations (μ ± 2σ), and about 99.7% lie within 3 standard deviations (μ ± 3σ). This is known as the 68-95-99.7 rule, or the empirical rule.

is the error function. If a data distribution is approximately normal then about 68% of the data values are within 1 standard deviation of the mean (mathematically, μ ± σ, where μ is the arithmetic mean), about 95% are within two standard deviations (μ ± 2σ), and about 99.7% lie within 3 standard deviations (μ ± 3σ). This is known as the 68-95-99.7 rule, or the empirical rule.

For various values of z, the percentage of values expected to lie in and outside the symmetric confidence interval, CI = (−zσ, zσ), are as follows:

| zσ | Percentage within CI | Percentage outside CI | Ratio outside CI |

|---|---|---|---|

| 1σ | 68.2689492% | 31.7310508% | 1 / 3.1514871 |

| 1.645σ | 90% | 10% | 1 / 10 |

| 1.960σ | 95% | 5% | 1 / 20 |

| 2σ | 95.4499736% | 4.5500264% | 1 / 21.977894 |

| 2.576σ | 99% | 1% | 1 / 100 |

| 3σ | 99.7300204% | 0.2699796% | 1 / 370.398 |

| 3.2906σ | 99.9% | 0.1% | 1 / 1000 |

| 4σ | 99.993666% | 0.006334% | 1 / 15,788 |

| 5σ | 99.9999426697% | 0.0000573303% | 1 / 1,744,278 |

| 6σ | 99.9999998027% | 0.0000001973% | 1 / 506,800,000 |

| 7σ | 99.9999999997440% | 0.0000000002560% | 1 / 390,600,000,000 |

Relationship between standard deviation and mean

The mean and the standard deviation of a set of data are usually reported together. In a certain sense, the standard deviation is a "natural" measure of statistical dispersion if the center of the data is measured about the mean. This is because the standard deviation from the mean is smaller than from any other point. The precise statement is the following: suppose x1, ..., xn are real numbers and define the function:

Using calculus or by completing the square, it is possible to show that σ(r) has a unique minimum at the mean:

The coefficient of variation of a sample is the ratio of the standard deviation to the mean. It is a dimensionless number that can be used to compare the amount of variance between populations with means that are close together. The reason is that if you compare populations with same standard deviations but different means then coefficient of variation will be bigger for the population with the smaller mean. Thus in comparing variability of data, coefficient of variation should be used with care and better replaced with another method.

Often we want some information about the accuracy of the mean we obtained. We can obtain this by determining the standard deviation of the sampled mean. The standard deviation of the mean is related to the standard deviation of the distribution by:

where N is the number of observation in the sample used to estimate the mean. This can easily be proven with:

hence

Resulting in:

Worked example

The standard deviation of a discrete random variable is the root-mean-square (RMS) deviation of its values from the mean.

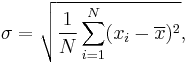

If the random variable X takes on N values  (which are real numbers) with equal probability, then its standard deviation σ can be calculated as follows:

(which are real numbers) with equal probability, then its standard deviation σ can be calculated as follows:

- Find the mean,

, of the values.

, of the values. - For each value

calculate its deviation

calculate its deviation  from the mean.

from the mean. - Calculate the squares of these deviations.

- Find the mean of the squared deviations. This quantity is the variance σ2.

- Take the square root of the variance.

This calculation is described by the following formula:

where  is the arithmetic mean of the values xi, defined as:

is the arithmetic mean of the values xi, defined as:

If not all values have equal probability, but the probability of value xi equals pi, the standard deviation can be computed by:

where

Suppose we wished to find the standard deviation of the distribution placing probabilities 1⁄4, 1⁄2, and 1⁄4 on the points in the sample space 3, 7, and 19.

Step 1: find the probability-weighted mean

Step 2: find the deviation of each value in the sample space from the mean,

Step 3: square each of the deviations, which amplifies large deviations and makes negative values positive,

Step 4: find the probability-weighted mean of the squared deviations,

Step 5: take the positive square root of the quotient (converting squared units back to regular units),

So, the standard deviation of the set is 6. This example also shows that, in general, the standard deviation is different from the mean absolute deviation (which is 5 in this example).

Rapid calculation methods

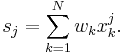

The following two formulas can represent a running (continuous) standard deviation. A set of three power sums s0, s1, s2 are each computed over a set of N values of x, denoted as xk.

Note that s0 raises x to the zero power, and since x0 is always 1, s0 evaluates to N.

Given the results of these three running summations, the values s0, s1, s2 can be used at any time to compute the current value of the running standard deviation. This definition for sj can represent the two different phases (summation computation sj, and  calculation).

calculation).

Similarly for sample standard deviation,

In a computer implementation, as the three sj sums become large, we need to consider round-off error, arithmetic overflow, and arithmetic underflow. The method below calculates the running sums method with reduced rounding errors:

where A is the mean value.

Sample variance:

Standard variance:

Weighted calculation

When the values xi are weighted with unequal weights wi, the power sums s0, s1, s2 are each computed as:

And the standard deviation equations remain unchanged. Note that s0 is now the sum of the weights and not the number of samples N.

The incremental method with reduced rounding errors can also be applied, with some additional complexity.

A running sum of weights must be computed:

and places where 1/i is used above must be replaced by wi/Wi:

In the final division,

and

where n is the total number of elements, and n' is the number of elements with non-zero weights. The above formulas become equal to the simpler formulas given above if weights are taken as equal to 1.

Combining standard deviations

Population-based statistics

The populations of sets, which may overlap, can be calculated simply as follows:

Standard deviations of non-overlapping,  , sub-populations can be aggregated as follows if the size (actual or relative to one another) and means of each are known:

, sub-populations can be aggregated as follows if the size (actual or relative to one another) and means of each are known:

For example, suppose it is known that the average American man has a mean height of 70 inches with a standard deviation of 3 inches and that the average American woman has a mean height of 65 inches with a standard deviation of 2 inches. The mean and standard deviation in inches for American adults could be calculated as:

For the more general M non-overlapping data sets X1 through XM:

where

If the size (actual or relative to one another), mean, and standard deviation of two overlapping populations are known for the populations as well as their intersection, then the standard deviation of the overall population can still be calculated as follows:

If two or more sets of data are being added in a pairwise fashion, the standard deviation can be calculated if the covariance between the each pair of data sets is known.

For the special case where no correlation exists between all pairs of data sets, then the relation reduces to the root-mean-square:

Sample-based statistics

Standard deviations of non-overlapping,  , sub-samples can be aggregated as follows if the actual size and means of each are known:

, sub-samples can be aggregated as follows if the actual size and means of each are known:

For the more general M non-overlapping data sets,  :

:

where:

If the size, mean, and standard deviation of two overlapping samples are known for the samples as well as their intersection, then the standard deviation of the samples can still be calculated. In general:

See also

|

|

References

- ↑ Dodge, Yadolah (2003). The Oxford Dictionary of Statistical Terms. Oxford University Press. ISBN 0-19-920613-9.

- ↑ Pearson, Karl (1894). "On the dissection of asymmetrical frequency curves". Phil. Trans. Roy. Soc. London, Series A 185: 719–810.

- ↑ Miller, Jeff. "Earliest Known Uses of Some of the Words of Mathematics". http://jeff560.tripod.com/mathword.html.

- ↑ Ghahramani, Saeed (2000). Fundamentals of Probability (2nd Edition). Prentice Hall: New Jersey. p. 438.

External links

- A Guide to Understanding & Calculating Standard Deviation

- C++ Source Code (license free) C++ implementation of rapid mean, variance and standard deviation calculation

- Interactive Demonstration and Standard Deviation Calculator

- Standard Deviation – an explanation without maths

- Standard Deviation, an elementary introduction

- Standard Deviation, a simpler explanation for writers and journalists

- Standard Deviation Calculator

- Texas A&M Standard Deviation and Confidence Interval Calculators

- The concept of Standard Deviation is shown in this 8 foot tall Probability Machine (named Sir Francis) comparing stock market returns to the randomness of the beans dropping through the quincunx pattern. from Index Funds Advisors IFA.com

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

![\operatorname{E}[X] = \mu.\,\!](/2010-wikipedia_en_wp1-0.8_orig_2010-12/I/b1f3d67a3f3857cc821f999c00f12af6.png)

![\sigma = \sqrt{\operatorname{E}\left[(X - \mu)^2\right]}.](/2010-wikipedia_en_wp1-0.8_orig_2010-12/I/9276926b3f1d5663490bc3611300d9e4.png)

![\sigma = \sqrt{\frac{1}{N}\left[(x_1-\mu)^2 + (x_2-\mu)^2 + \cdots + (x_N - \mu)^2\right]},](/2010-wikipedia_en_wp1-0.8_orig_2010-12/I/8874f2797725769a1be9fcae598f3c23.png)

![\operatorname{stdev}(X) = \sqrt{E[X-E(X)]^2} = \sqrt{E[X^2] - (E[X])^2}.](/2010-wikipedia_en_wp1-0.8_orig_2010-12/I/d7465426ece5fed4559ab4dd6aaa60ea.png)

![\frac{1}{\sigma\sqrt{2\pi}} \exp\!\left(-\frac{[x-\mu]^2}{2\sigma^2} \right)](/2010-wikipedia_en_wp1-0.8_orig_2010-12/I/b2106d7ec7d831366184d94314b3d764.png)

![\begin{align}

\mu_{X \cup Y} &= \frac{1}{N_{X \cup Y}} \left(N_X \mu _X + N_Y \mu _Y\right)\\

\sigma_{X\cup Y} &= \sqrt{\frac{1}{N_{X \cup Y}} \left(N_X[\sigma_X^2 + \mu_X^2] + N_Y[\sigma_Y^2 + \mu_Y^2]\right) - \mu_{X\cup Y}^2}

\end{align}](/2010-wikipedia_en_wp1-0.8_orig_2010-12/I/113b75302b32a6f783713767fc5557eb.png)

![\begin{align}

\mu_\text{height} &\approx 0.5(70) + 0.5(65) = \frac{1}{2}(70+65) = 67.5 \\

\sigma_\text{height} &\approx \sqrt{ \frac{1}{2}[(3^2 + 70^2) + (2^2 + 65^2)] - 67.5^2 } \\

&= \sqrt{12.75} \approx 3.5707

\end{align}](/2010-wikipedia_en_wp1-0.8_orig_2010-12/I/fcb57f438c9f8be4767ce8eeac4a98ff.png)

![\begin{align}

\mu_X &= \frac{1}{ \sum_i {N_{X_i}} } \left( \sum_i { N_{X_i}\mu_{X_i} } \right)\\

\sigma_X &= \sqrt{\frac{1}{\sum_i {N_{X_i}}} \left(\sum_i { N_{X_i} [\sigma_{X_i}^2 + \mu_{X_i}^2]}\right) - \mu_X^2 }

\end{align}](/2010-wikipedia_en_wp1-0.8_orig_2010-12/I/e04dcb0ed64474d9330069d2b08ee662.png)

![\begin{align}

\mu_{X \cup Y} &= \frac{1}{N_{X \cup Y}}\left(N_X\mu_X + N_Y\mu_Y - N_{X \cap Y}\mu_{X \cap Y}\right)\\

\sigma_{X \cup Y} &= \sqrt{\frac{1}{N_{X \cup Y}}\left(N_X[\sigma_X^2 + \mu _X^2] + N_Y[\sigma_Y^2 + \mu _Y^2] - N_{X \cap Y}[\sigma_{X \cap Y}^2 + \mu _{X \cap Y}^2]\right) - \mu_{X\cup Y}^2}

\end{align}](/2010-wikipedia_en_wp1-0.8_orig_2010-12/I/dfbfeabd367bd1e8a84bce1baf6d3fd7.png)

![\begin{align}

\mu_{X \cup Y} &= \frac{1}{N_{X \cup Y}}\left(N_X\mu_X + N_Y\mu_Y\right)\\

\sigma_{X \cup Y} &= \sqrt{\frac{1}{N_{X \cup Y} - 1}\left([N_X - 1]\sigma_X^2 + N_X\mu_X^2 + [N_Y - 1]\sigma_Y^2 + N_Y\mu _Y^2 - [N_X + N_Y]\mu_{X \cup Y}^2\right) }

\end{align}](/2010-wikipedia_en_wp1-0.8_orig_2010-12/I/755b6644b38e95d5e77a35786ca73079.png)

![\begin{align}

\mu_X &= \frac{1}{\sum_i { N_{X_i}}} \left(\sum_i { N_{X_i} \mu_{X_i}}\right)\\

\sigma_X &= \sqrt{\frac{1}{\sum_i {N_{X_i} - 1}} \left( \sum_i { \left[(N_{X_i} - 1) \sigma_{X_i}^2 + N_{X_i} \mu_{X_i}^2\right] } - \left[\sum_i {N_{X_i}}\right]\mu_X^2 \right) }

\end{align}](/2010-wikipedia_en_wp1-0.8_orig_2010-12/I/8432914c7d3c1734e55daf3cbbe0365d.png)

![\begin{align}

\mu_{X \cup Y} &= \frac{1}{N_{X \cup Y}}\left(N_X\mu_X + N_Y\mu_Y - N_{X\cap Y}\mu_{X\cap Y}\right)\\

\sigma_{X \cup Y} &= \sqrt{ \frac{1}{N_{X \cup Y} - 1}\left([N_X - 1]\sigma_X^2 + N_X\mu_X^2 + [N_Y - 1]\sigma_Y^2 + N_Y\mu _Y^2 - [N_{X \cap Y}-1]\sigma_{X \cap Y}^2 - N_{X \cap Y}\mu_{X \cap Y}^2 - [N_X + N_Y - N_{X \cap Y}]\mu_{X \cup Y}^2\right) }

\end{align}](/2010-wikipedia_en_wp1-0.8_orig_2010-12/I/8ede35b62d8742795785a911cd7815ef.png)