Share (finance)

| Securities | |

|

|

|

Securities |

|

|

Markets |

|

|

Bonds by coupon |

|

|

Bonds by issuer |

|

|

Equities (stocks) |

|

|

Investment funds |

|

|

Structured finance Tranche Credit-linked note |

|

|

Derivatives |

|

In financial markets, a share is a unit of account for various financial instruments including stocks (ordinary or preferential), and investments in limited partnerships, and REITs. The common feature of all these is equity participation (limited in the case of preference shares).

The term stocks in the plural is often used as a synonym for shares.[1] Traditionalist demands that the plural stocks be used only when referring to stock of more than one company are rarely heard nowadays.

Contents |

Valuation

Shares are valued according to various principles in different markets, but a basic premise is that a share is worth the price at which a transaction would be likely to occur were the shares to be sold. The liquidity of markets is a major consideration as to whether a share is able to be sold at any given time. An actual sale transaction of shares between buyer and seller is usually considered to provide the best prima-facie market indicator as to the 'true value' of shares at that particular moment.

Tax treatment

Tax treatment of dividends varies between territories. For instance, in India, dividends are tax free in the hands of the shareholder, but the company paying the dividend has to pay dividend distribution tax at 12.5%. There is also the concept of a deemed dividend, which is not tax free. Further, Indian tax laws include provisions to stop dividend stripping.

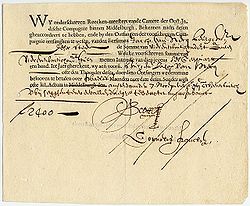

Investors were given share certificates as evidence of their ownership of shares but certificates are not always issued nowadays. Instead, the ownership may be recorded electronically by a system such as CREST.

See also

- Mutual organization

References

cnnmoney.com [1]