Petrobras

|

|

| Type | Semi-Public (BM&F Bovespa:PETR3, PETR4 NYSE: PBR, PBRA BMAD: XPBR, XPBRA MERVAL: APBR) |

|---|---|

| Industry | Oil and Gasoline |

| Founded | (1953) |

| Headquarters | Rio de Janeiro, Brazil |

| Key people | José Sergio Gabrielli de Azevedo (CEO) |

| Products | Petroleum and derived products BR service stations Lubrax motor oil |

| Revenue | |

| Net income | |

| Owner(s) | Brazilian Government (50.01%) |

| Employees | 74,240[1] |

| Subsidiaries | BR Distribuidora, Petroquisa, Transpetro, Petrobras Energía, Braskem, among others.[2] |

| Website | www.petrobras.com |

Petrobras (BM&F Bovespa:PETR3, PETR4 / NYSE: PBR, PBRA / BMAD: XPBR, XPBRA / BCBA: APBR) (pronounced [pe.tɾo.ˈbɾas] in Brazilian Portuguese), short for Petróleo Brasileiro S.A., is a semi-public[3] Brazilian multinational energy company headquartered in Rio de Janeiro.

Petrobras is the world's fourth largest energy company[4] and the largest company in Latin America by market capitalization and revenue, and the largest company headquartered in the Southern Hemisphere.[5][6][7] The company was founded in 1953, mainly due to the efforts of then Brazilian President Getúlio Vargas. While the company ceased to be Brazil's legal monopolist in the oil industry in 1997, it remains a significant oil producer, with output of more than 2 million barrels of oil equivalent per day, as well as a major distributor of oil products.

The company also owns oil refineries and oil tankers. Petrobras is a world leader in development of advanced technology from deep-water and ultra-deep water oil production.

Contents |

Overview

Petrobras controls significant oil and energy assets in 18 countries in Africa, North America, South America, Europe and Asia. These holdings as well as properties in Brazil give it total assets of $133.5 billion (2008).

Petrobras is Latin America's largest company, thanks to 2008 sales of $118.3 billion, according to a ranking from Latin Business Chronicle over Latin America's Top 500 Companies.

The Brazilian government owns 55.7% of Petrobras' common shares with voting rights,[8]. The privately held shares are traded on BM&F Bovespa, where they are part of the Ibovespa index.

Petrobras began the processing of oil shale in 1953 by developing Petrosix technology for extracting oil from oil shale. The pilot plant started in 1982 and the commercial production started in 1992. At present, the company operates two retorts, the largest of which processes 260 tonnes/hour of oil shale.

Petrobras operated the world's largest oil platform - the Petrobras 36 Oil Platform - until an explosion on 15 March 2001 led to its sinking on 20 March 2001. In 2007, Petrobras inaugurated the Petrobras 52 Oil Platform, replacing the 36. The 52 is the biggest Brazilian oil platform and third in the world[9].

Petrobras is also recognized as the largest sponsor of arts, culture, and environmental protection in Brazil. Among the environmental initiatives, Petrobras is the main supporter of whale conservation and research through the Brazilian Right Whale Project [10] and the Instituto Baleia Jubarte (Brazilian Humpback Whale Institute).[11] Petrobras has been a sponsor of the Williams Formula-1 team. The company employs the H-Bio process to produce biodiesel.[12]

According to Fortune 500 Petrobras is the 34th largest company in the world.[13]

History

Petrobras was created in 1953 during the government of Brazilian president Getúlio Vargas, with popular support under the motto "The Petroleum is Ours!". The company's creation provoked the wrath of Brazil's elite, who reacted fervently against the institution and Vargas himself.

Petrobras commenced its activities with the collection it inherited from the old National Oil Council (Conselho Nacional do Petróleo, CNP), which, however, preserved its inspection function for the sector.

The oil exploration and production operations, as well as the remaining activities connected to the oil, natural gas, and derivative sector, except for wholesale distribution and retail via service stations, were a monopoly Petrobras held from 1954 to 1997. During this period, Petrobras became the leader in derivative marketing in Brazil, and, thanks to the company’s performance, it was awarded the Offshore Technology Conference (OTC) in 1992, one which it was granted again in 2001.[14]

After 40 years of exploration, production, refining and transportation of Brazil's oil, Petrobras started to compete with other foreign and domestic companies in 1997. The Brazilian government created the Petroleum’s National Agency (Agência Nacional do Petróleo, ANP), responsible for the regulation and supervision of petroleum sector activities, and the National Council of Energy Policies, a public agency responsible for the development of public energy policy.

In 2003, commemorating its 50 years, Petrobras doubled its daily production of oil and natural gas, surpassing the mark of 2 million barrels.

On 21 April 2006, Brazilian president Luiz Inácio Lula da Silva started production on the P-50 oil platform, in the Albacora East Field at Campos Basin, which enabled Brazil to achieve self-sufficiency in oil[15].

Many attempts were made to privatize the company, especially under the country's dictatorship from 1964 to 1985.

Chronology

- 1953: The company is created by president Getúlio Vargas.

- 1954-1961: The company faced opposition by the government.

- 1961: A report released by the government reveals pessimistic news about oil prospects in the country's terrains.

- 1973: The company's short period of growth was met by the first oil crisis. The crisis affected the country as a whole, as the "Brazilian miracle", fast growth in the national economy, came to a halt. The company itself almost faced bankruptcy.

- 1974: Petrobras discovered a huge oil field in Bacia de Campos, which oil reserves raise the company's finances, "resurrecting" its operations nationwide.

- 1975: The company signed "risk contracts" of partnership with private oil companies to intensify the search for new oil fields and to consolidate its influences in the country.

- 1979: Petrobras was affected by second oil crisis, but the effect was not as strong as it had been in the crisis of 1973.

- 1997: The government approved Law N. 9.478, essentially breaking the company's monopoly in Brazil and allowing competitors to develop the country's oil fields. Petrobras also reached the mark of producing one million barrels per day. The company executed agreements with other Latin American governments and began operations outside of Brazilian domains.

- 2000: The company reached the world record of oil exploration in deep waters, at 1,877 meters below sea level.

- 2001: An accident occurred at the P-36 Platform, which was the world's biggest oil platform. The platform, owing to technical failures, sank on 20 May with about 1500 tons of oil.

- 2003: The company acquired Argentina's largest oil company Perez Companc Energía (PECOM Energía S.A.), and its operational bases in Bolivia, Peru and Paraguay.

- 2006: Petrobras achieved Brazilian self-sufficiency in oil.

- 2007: The company recorded its highest earnings ever, with more than US$13 billion of profit. The company announced the discovery of the giant gas field "Jupiter", in Santos. Value of the company's shares increased by about 106%, from February to December.

- 2008: The company discovered what could be the world's third largest oil field. The actual reserves are yet to be verified, however.

Bolivian controversy

On May 2006, Bolivia's president Evo Morales announced the nationalization of all gas and oil fields in the country. Evo Morales ordered the occupation of all fields by the Bolivian Army. Petrobras was heavily affected by the nationalization. At the time, the company's Bolivian subsidiary had great importance in the country's economy[16]:

- Petrobras represented 24% of the Bolivian industrial taxes, 18% of the country's GDP and 20% of the foreign investments.

- The company operated in 46% of the oil reserves in Bolivia and was responsible for 75% of the country's gas exports to Brazil.

- The company invested, between 1994 and 2005, US$1.5 billion in the Bolivian economy.

The nationalization strained the relationship between Petrobras and the Bolivian government. On October 28, 2006, after a long negotiation, Petrobras and Bolivia signed an agreement, whereby the company would take 18% of the profits, and the Bolivian government would take the remainder.[17]

Business[18]

Petrobras' most important assets are petroleum reserves in Brazil. Its oil field in the Campos Basin accounts more than 80% of the Brazilian oil production. The company also works on developing the "green energy", including biodiesel fuel. Petrobras recently opened its business to the ethanol fuel, facing great competition against the North American ethanol. However, investment in biofuels will represent only 1% of the company's profit between 2008 and 2012.[19]

Petrobras is involved in the following areas of business:

- Domestic sales: Domestic sales represent the majority of the company's profit and includes the extraction and distribution of oil, natural gas, electricity and petrochemical products;

- Export: The main exports are not of oil extraction itself, but are related to mechanic technologies. However, it is planned to the company exports oil in large quantities when it begins to explore the Jupiter and the Tupi fields (see "List of recent oil field discoveries");

- Foreign exchange gains: The company imports natural gas from other South American countries, mostly from Bolivia. According to the Brazilian group National Petroleum Agency, Petrobras owns Brazil's largest and most important gas pipe network, having a near monopoly of the natural gas marketed in the country.

Petrobras works extensively with foreign acquisitions too, buying and controlling the most important energy companies in South America and exploring huge deep-water fields of West Africa and the Gulf of Mexico. Petrobras is known for its technology in deep-water exploration. The Tupi field, which could be the world's third largest oil field (although data is still unverified), is a deep-water discovery, located in the pre-salt layer.

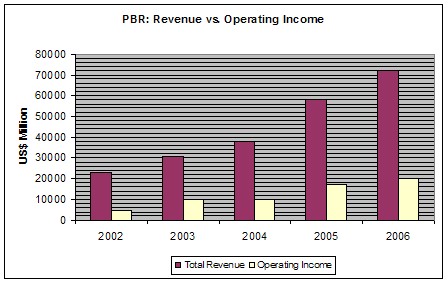

The company began to increase profits from 2002, with the government's heavy investments. In the first quarter of 2008, Petrobras reached the market value of US$295.6 billion, surpassing Microsoft (US$274 billion) and becoming America's third largest company, ahead of giant oil companies such as BP and Chevron-Texaco, and only behind of ExxonMobil and General Electric. Petrobras' market value is also bigger than Industrial and Commercial Bank of China (US$289.3 billion), making it the sixth biggest company by market value in the world.

Competition

Comparison with world-wide companies

| Company | Reserves (MM boe) | Current Years of Production | Oil & Gas Production (1000s boe/d) 2006 | Oil & Gas Production Growth (%) 2006 |

| Petrobras | 11,458 | 14.2 | 2,287 | 4.5 |

| BP | 17,368 | 10.4 | 3,926 | -1.9 |

| ChevronTexaco | 11,020 | 10.9 | 2,667 | 6.1 |

| ExxonMobil | 21,518 | 11.3 | 4,238 | 3.8 |

| Royal Dutch Shell | 11,108 | 6.7 | 3,474 | -1.0 |

Growth

- Rising prices: the company profited from rising oil prices in 2007-2008.

- Increasing demand: oil demand has increased drastically in the emergent countries, for which Petrobras exports its technologies. The BRIC countries' (Brazil itself, Russia, India and China) growth explains this huge demand. The Brazilian self-sufficiency in Petroleum (as of May 2006) allowed the company to export small quantities of oil.

- Political issues: despite of being nearly half privately owned, the majority of shares belong to the Brazilian government, which gives it control of the company's finances and operations. The recent growth of the company is explained by political stability. Since 1997 the Brazilian oil market was opened to foreign investments, but Petrobras continues to be the largest oil company in the country, enjoying a near monopoly.

Oil reserves

At the 20th National Forum, it was revealed that Petrobras, with 11.7 billion barrels of oil, has the fourth biggest oil reserves among petrochemical companies with publicly traded shares. The figure does not include the recent discoveries in the mega-fields of Tupi, Jupiter, Carioca and Bem-te-vi.[20]

Profitability

From May 1997 to June 2006, the company's value in the Ibovespa increased about 1200%, reaching a record profit in 2006, with approximately R$25.9 billion becoming the most profitable public company in Latin America of 2006. The discovery of large reserves in Santos increased its stock price by about 19% in one day. Petrobras, is considered the most reliable Blue Chip of the Bovespa Stock Exchange. While the North American Crisis of 2007 decreased the value of the stocks of a great majority of stock markets in the world, Petrobras helped hold the Bovespa's activities steady, making it one of the least affected stock exchanges in the world by the crisis.

Investment grade

On 30 April 2008, Brazil received an "investment grade" rating from Standard & Poor's, given to countries with stable and consistent growing economy. According to Standard & Poor's, Brazil jumped from a BB+ grade to a BBB-, the minimum level any country needs to reach to receive the grade. Petrobras played a big part in the country's growth, and the high rating would be useful in attracting foreign investments.

Investors criticized the company for increasing gasoline prices in Brazil, despite record oil production. The company is having problems adapting its business to the ethanol market.

Devaluation

After a great advance on its stock shares (reaching R$52.30 in Ibovespa) in May 2008, Petrobras faced a great devaluation in the following month, with its shares decreasing to R$43.90 on 19 June 2008[21]. The most probable explanation for the great fall was the lack of information about the mega-fields recently discovered by the company. The great instability in Wall Street's markets also had great weight in those terrible results.[22]

Petrobras' fall also led to bad results on the entire BM&F Bovespa, as Petrobras and Vale accounts for more than 25% of BM&F Bovespa's trade value[23], the devaluation of those companies' shares led it to lose more than 6,000 points in just 25 days.

However, with the continuous decrease of oil prices, Petrobras' stock shares fell to R$33,00 on 14 August 2008. Its market cap presented the biggest loss of value in the Americas, with US$93 billion (13 August 2008).

Milestones

.jpg)

- On 19 December 2005, Petrobras announced a contract with the Japanese Nippon Alcohol Hanbai to launch a joint-venture. The project named Brazil-Japan Ethanol would import ethanol from Brazil, in a bid to develop an ethanol market in Japan.

- On 21 April 2006, while on board the Petrobras P-50 oil rig, a floating production storage and offloading vessel, President Luiz Inácio Lula da Silva announced Brazil's self-sufficiency in petroleum,.

- In November 2007, Petrobras announced a discovery of a major new oil field off the coast of Rio de Janeiro. The Tupi oil field in the Santos Basin had an estimated reserve of 5 billion to 8 billion barrels. The figure would put Tupi as the world's largest oil reserve since the discovery of Kashagan in Kazakhstan in 2000. The country's reserves would increase by 62 per cent, and Tupi's reserve would be on par with Norway’s 8.5 billion barrels of proven oil reserves .[24]

- The Financial Times listed Petrobras as one of the world's 50 largest companies in 2007.[25]

- On January 21, 2008, Petrobras announced the discovery of Jupiter, a huge oil field which could equal the Tupi oil field. It is located 37 km (23 mi) from Tupi, 5,100 m (16,730 ft) below the Atlantic Ocean, 290 km (180 mi) from Rio de Janeiro.[26]

- On April 14, 2008, a second massive oil field was announced in the same region as the Tupi oil field with reserves estimated at 33 billion barrels of oil.[27]

- On May 21, 2008, Petrobras announced the discovery of a third megafield, located on the coast of the State of São Paulo.

- On May 19, 2009, Petrobras finalized a $10 billion loan from China in return for a ten years long supply of oil (150,000 barrels a day the first year, 200,000 barrels a day the nine others) [28]

List of recent oil field discoveries

From 2002-2005, Petrobras doubled its success rate at drilling new wells.[29]

| Date | Basin | Field | API gravity |

| April 18, 2006 | Espirito Santo | Golfinho | 38[30] |

| July 11, 2006 | Santos | Tupi | 30[31] |

| March 2, 2007 | Campos | Caxareu | 30[32] |

| June 8, 2007 | Espirito Santo | Pirambu | 29[33] |

| September 5, 2007 | Santos | Tupi | 27[34] |

| September 10, 2007 | Campos | Xerelete | 17[35] |

| September 20, 2007 | Santos | Tupi Sul | 28[36] |

| December 21, 2007 | Santos | Caramba | 27[37] |

| January 21, 2008 | Santos | Jupiter | Huge Gas field[38] |

| May 21, 2008 | Santos | Bem-Te-Vi | 36[39] |

| May 29, 2008 | Santos | Tiro | 36[40] |

| June 12, 2008 | Santos | Guará | 28[41] |

| July 14, 2008 | Espirito Santo | Golfinho | 27[42] |

| August 20, 2008 | Campos | Aruanã | 28[43] |

| September 26, 2008 | Santos | Sidon | 36[44] |

| November 21, 2008 | Espirito Santo | Jubarte | 30[45] |

| November 25, 2008 | Jequitinhonha | BM-J-3 | ?[46] |

| January 26, 2009 | Santos | Piracucá | ?[47] |

| April 08, 2009 | Santos | Corcovado-1 | ?[48] |

| November 16, 2009 | Campos | Marimbá | 29[49] |

Mega-fields

The company's most important discoveries started at the end of 2007, when the first mega-field, named Tupi, was found at a depth of 5,000 meters below the sea level, the first discovery of the company in the pre-salt layer. The second discovery was announced on January 21, 2008: the new mega-field was named Jupiter and had the same size as Tupi.[50]. The company revealed no more information about the field, forcing many investors to regard those facts as an "industrial secret".

On May 21, 2008, the company announced the discovery of a third oil megafield[51], located 250 km distant from the state of São Paulo, at a depth between 6000 and 6300 meters below sea level. The discovery was made by a consortium formed by Petrobras (66% of participation), Shell (20%) and Galp Energia (14%). The field's oil reserves had an API gravity between 25 and 28.

In June 2009, Petrobras signed a three year $180 million contract with the American Dril-Quip for the supply of deep-sea drilling systems to be used in Brazilian offshore wells [52]

Criticisms

According to the Brazilian economy website InfoMoney.com, North American stock companies are considering the oil mega-field discoveries suspicious. On May 24, 2008, the company's shares fell 4% because of the scarce information given by Petrobras about the fields.[53] (Portuguese)

An article written by Roberto Altenhofen Pires Pereira for InfoMoney.com said (translated from Portuguese):

(...) Everyone knows that the potential of the fields is huge, but that stills being only a "potential". No concrete information about the fields' capacity has been released at any time. These are only expectations, which still face a great technological challenge to the exploration of so deep deposits, which may even make this exploration unfeasible.

Reputation

By the end of 2003, Petrobras subscribed to the United Nations Global Compact, a voluntary agreement which encompasses a set of principles regarding human rights, working conditions and the environment.

The company's growth since 2006 has made Petrobras the most profitable company in the Brazilian economy, and gave it great importance worldwide, being recognized as the eighth biggest oil exploring company in the world.[55]

Since 2006 Petrobras has been listed in the Dow Jones Sustainability Index, an important reference index for environmentally and socially responsible investors.

On February 25, 2008, the Spanish consultancy firm Management and Excellence acknowledged Petrobras as the world's most sustainable oil company.[56]

The civil society named Transparency International, which fights against global corruption, published a list on April 28, 2008 containing the names of 42 companies with high transparency levels, in which Petrobras was included.[57]

In May 2008, World Trademark Review magazine awarded[58] the Petrobras trademark team with an Industry Award for Latin American Team of the Year, a category in which Petrobras competed with Coca-Cola, Pepsico, and Procter and Gamble. [59]

Global operations

Petrobras global operations extends over 27 countries (including Brazil). Those operations are more related to diplomatic trades than oil exploration, although the company has important fields in India, Turkey, Angola and Nigeria. The most important countries for commercial agreements are Japan, United Kingdom and China. The complete map can be seen in Petrobras official link Petrobras Worldwide.

Petrobras is a member of the following international associations:

- ARPEL (Asociación Regional de Empresas de Petroleo y Gas Natural en Latinoamérica y el Caribe)

- IPIECA (International Petroleum Industry Environmental Conservation Association)

- OGP (International Association of Oil and Gas Producers)

- WBCSD (World Business Council for Sustainable Development)

Offices

|

Petrobras in popular culture

- Petrobras sponsored Flamengo, one of the most popular Brazilian football teams.

- Brazilian films and TV shows sponsored by Petrobras often included shots of the company's operations.

- In the Speed Racer live-action movie, one of the cars featured is the "Green Energy", a biodiesel fueled racing car sponsored by Petrobras.

- Petrobras sponsored River Plate in Argentina.

- Petrobras has been a secondary sponsor for the AT&T WilliamsF1 Team from 1998 to 2008.

See also

- History of Brazil (1945-1964)

- Ethanol fuel in Brazil

- Petrobras 36 Oil Platform

- Petrosix

- Transpetro

- Tupi oil field

- Eletrobrás

- Walter K. Link

References

- ↑ About us,

- ↑ Petrobras Group

- ↑ Petrobras - Investor Relations

- ↑ "Brazil's Petrobras Overtakes Shell to Become World's 4th Largest Energy Co". http://www.brazzilmag.com/component/content/article/81-january-2010/11769-brazils-petrobras-overtakes-shell-to-become-worlds-4th-largest-energy-co-.html.

- ↑ Latin Business Chronicle

- ↑ http://notibiz.notiemail.com/noticias.asp?leng=en&id=2037 Notibiz

- ↑ Hora do Povo(Portuguese)

- ↑ Source: 09-July-2006 - Petrobras Investor Relation Site

- ↑ Lula inaugura a maior plataforma de petróleo do Brasil

- ↑ Brazilian Right Whale Project

- ↑ Instituto Baleia Jubarte

- ↑ Petrobras.com

- ↑ http://money.cnn.com/magazines/fortune/global500/2009/full_list/

- ↑ OTC Distinguished Achievement Awards for Companies, Organizations, and Institutions

- ↑ Petrobras sets oil production record

- ↑ Saiba o tamanho da Petrobras na economia da Bolívia, e a importância da Bolívia para a Petrobras - 02/05/2006 - EFE - Economia

- ↑ Folha Online - Dinheiro - Acordo com Bolívia garante rentabilidade para Petrobras, diz Silas - 29/10/2006

- ↑ http://www2.petrobras.com.br/ri/spic/bco_arq/2778_form_20f_2005_port_16ago_alt8dez06.pdf

- ↑ Microsoft PowerPoint - Petrobras and Biofuels - May 2007.ppt

- ↑ Petrobras.com

- ↑ [1]

- ↑ InfoMoney: Petrobras: perda de suporte pode levar ações preferenciais aos R$ 43,00

- ↑ InfoMoney: JPMorgan Chase rebaixa recomendação do Brasil para underweight

- ↑ "Petróleo mostra que 'Deus pode mesmo ser brasileiro'". BBC Brasil. 2007-11-16. http://oglobo.globo.com/economia/mat/2007/11/16/327191975.asp. Retrieved 2008-05-26.

- ↑ "Global 500 2007 accounts" (pdf). Financial Times. 2007-07-29. http://media.ft.com/cms/ac6bbb8c-2baf-11dc-b498-000b5df10621,dwp_uuid=95d63dfa-257b-11dc-b338-000b5df10621.pdf. Retrieved 2008-05-26.

- ↑ Duffy, G (2008-01-22). "'Huge' oil field found off Brazil". BBC News. http://news.bbc.co.uk/2/hi/americas/7201744.stm. Retrieved 2008-05-26.

- ↑ "Brazil Finds New Huge Oilfield, Possibly World's Third Largest". Brazzil Mag. 2008-04-14. http://www.brazzilmag.com/content/view/9245/1/. Retrieved 2008-05-26.

- ↑ WJS, May 19, 2009

- ↑ Petrobras 2006 20-f, item 4, p 26 via Wikinvest

- ↑ Petrobras descobre petróleo leve no Espírito Santo

- ↑ Petrobras encontra petróleo em área de novas fronteiras na Bacia de Santos

- ↑ Petrobras Brazil finds light oil in Campos Basin

- ↑ PETROBRAS ACHA ÓLEO LEVE NO PRÉ-SAL DA BACIA DE CAMPOS

- ↑ Petrobras faz nova descoberta de óleo leve na bacia de Santos

- ↑ Petrobras confirma que óleo encontrado em Xerelete é viável comercialmente

- ↑ Petrobras confirma descoberta de petróleo leve na bacia de Santos

- ↑ Petrobras anuncia a descoberta de poço de óleo leve na Bacia de Santos

- ↑ Petrobras descobre grande jazida de gás na bacia de Santos

- ↑ Petrobras anuncia descoberta de óleo leve na bacia de Santos

- ↑ Petrobras anuncia descoberta de óleo leve na bacia de Santos

- ↑ Petrobras anuncia nova descoberta na Bacia de Santos

- ↑ Petrobras anuncia descoberta de petróleo no mar do Espírito Santo

- ↑ Petrobras descobre óleo leve na bacia de Campos

- ↑ Estatal faz segunda descoberta de óleo em Santos

- ↑ Petrobras Hits 1.5-2 Billion Barrels at Pre-Salt Levels

- ↑ Petrobras informa descoberta na bacia do Jequitinhonha

- ↑ Petrobras anuncia descoberta de reserva de gás na bacia de Santos

- ↑ Corcovado-1, Santos Basin, offshore Brazil, encounters hydrocarbons

- ↑ Petrobras anuncia descoberta de óleo leve na Bacia de Campos

- ↑ Press Release: Important Gas and Condensate field discovered in the Pre-Salt layer

- ↑ New Oil Accumulation Discovered in the Santos Basin Pre-Salt Layer

- ↑ Dril-Quip wins $180 million contract Tradingmarkets.com, June 2 2009

- ↑ InfoMoney: Reação às descobertas da Petrobras é posta em xeque, e compromete rumo da ação

- ↑ Roberto Pereira (2008-05-24). "Reaction to Petrobras' Discoveries Undertakes the Share's Future". InfoMoney.com. http://web.infomoney.com.br/templates/news/view.asp?codigo=1129571&path=/investimentos/noticias/. Retrieved 2008-06-01.

- ↑ Portuguese: Petrobras Press release (2007-01-30). "Petrobras é 8ª empresa de petróleo com ações em bolsa". Petrobras. http://www2.petrobras.com.br/portal/frame.asp?pagina=/ri/port/Noticias/Noticias/Index.asp&lang=pt&area=ri. Retrieved 2008-05-26.; "English". http://www2.petrobras.com.br/portal/frame_ri.asp?pagina=/ri/ing/index.asp&lang=en&area=ri.

- ↑ Management And Excellence

- ↑ "Petrobras is a "transparency reference" in the oil sector". 2008-04-29. http://www.agenciapetrobrasdenoticias.com.br/en_materia.asp?id_editoria=8&id_noticia=4824. Retrieved 2008-05-29.

- ↑ WTR Industry Awards 2008

- ↑ Petrobras.com

- ↑ Untitled Document

- Silvestre, B. S., Dalcol, P. R. T. Geographical proximity and innovation: Evidences from the Campos Basin oil & gas industrial agglomeration — Brazil. Technovation (2009), doi:10.1016/j.technovation.2009.01.003

External links

|

|||||

|

|||||

|

|||||

|

|||||