ING Group

|

|

| Type | Naamloze vennootschap (Euronext: INGA, NYSE: ING) |

|---|---|

| Industry | Financial services |

| Founded | 1991 |

| Headquarters | Amsterdam, Netherlands |

| Area served | Worldwide |

| Key people | Jan Hommen (CEO), Patrick Flynn (CFO), Peter Elverding (Chairman of the supervisory board) |

| Products | Retail, direct, private, investment and commercial banking, insurance and asset management |

| Revenue | €48.19 billion (2009)[1] |

| Profit | |

| Total assets | €1.164 trillion (2009)[1] |

| Total equity | €39.778 billion (2009)[1] |

| Employees | 107,000 (FTE, 2009)[1] |

| Website | www.ing.com |

ING Group (NYSE: ING, Euronext: INGA) is a financial institution of Dutch origin offering banking, insurance and asset management services. ING is an abbreviation of Internationale Nederlanden Groep (English: International Netherlands Group).

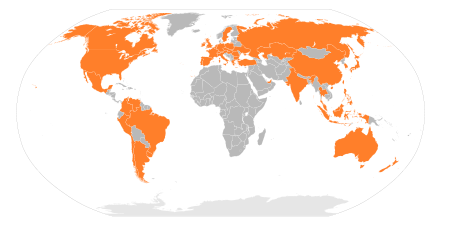

As of 2009, ING Group serves 85 million private, corporate and institutional clients in over 40 countries, with a workforce of over 100,000 people. It owns ING Direct, a virtual bank, as well as retail banking, insurance, investment management, and investment banking operations. Its services operate in countries including Australia, Canada, France, India, Italy, New Zealand, Spain, Poland, UK, and the US. In 2009 it was the largest banking/financial company in the world by revenue[2].

Contents |

International operations

ING has offices in:

- Argentina

- Australia

- Austria

- Belarus

- Belgium

- Brazil

- Bulgaria

- Canada

- Chile

- China

- Colombia

- Czech Republic

- France

- Germany

- Greece

- Hong Kong

- Hungary

- India

- Indonesia

- Italy

- Japan

- Malaysia

- Mexico

- The Netherlands

- New Zealand

- Luxembourg

- Peru

- Philippines

- Poland

- Romania

- Russia

- Singapore

- Slovakia

- South Korea

- Spain

- Taiwan

- Turkey

- Thailand

- Ukraine

- United Arab Emirates

- United Kingdom

- United States of America

Headquarters

ING's headquarters, ING House, is located in the business district of Zuidas in Amsterdam. It was designed by Roberto Meyer and Jeroen van Schooten and was officially opened on 16 September 2002 by Prince Willem-Alexander of the Netherlands. The light-infused building features a 250 seat auditorium, foyer, restaurant, and library, and is also home to an art collection.

History

- 1991: The newly formed company, first called Internationale Nederlanden Groep, later ING Group, was created from the merger of Nationale-Nederlanden and NMB Postbank Group.

- 1991: Nationale-Nederlanden changes to ING Nationale-Nederlanden

- 1991: ING financial group entered the Czech market

- 1994: ING opened first ING Bank in Romania

- 1995: ING acquired investment bank and investment management firm Barings after its collapse (in the process, it also obtained the original sales document of the Louisiana Purchase)

- 1997: ING acquired insurer Equitable of Iowa Companies

- 1997: ING opened ING Direct Canada www.ingdirect.ca

- 1998: ING acquired Banque Bruxelles Lambert (BBL) of Belgium

- 1999: ING acquired BHF-Bank of Germany, opened ING Direct Spain

- 2000: ING acquired US insurers ReliaStar, Aetna Financial Services and Aetna International

- 2000: ING opened ING Direct USA

- 2001: ING acquired Bank Śląski of Poland, and insurer Seguros Comercial America of Mexico

- 2002: ING acquired DiBa bank of Germany

- 2003: ING opened ING Direct UK

- 2004: ING Insurance Company of Canada acquired Allianz Canada

- 2004: ING sold BHF-Bank of Germany to Sal. Oppenheim

- 2005: ING ordered to pay $1.5 million by the NASD for permitting improper market timing in ING funds.[3]

- 2005: ING acquired a 19.9% stake in Bank of Beijing; which was later diluted to 16.07% after the company listed in Shanghai

- 2006: ING opened ING Life Bulgaria, a branch of ING Life Hungary

- 2007: ING acquired the domestic asset management operations of ABN AMRO Asset Management in Taiwan

- 2007: ING acquired Oyak bank of Turkey

- 2007: ING launched its first variable annuities product for the European market in Spain

- 2007: ING acquired US web-based stock brokerage firm ShareBuilder

- 2007: ING acquired Landmark Asset Management Company of South Korea

- 2007: ING acquired a 30% stake in TMB Bank, Thailand

- 2007: ING acquired NetBank when NetBank was closed by the US Office of Thrift Supervision

- 2007: Ernst and Young became registered independent auditors of ING Group

- 2008: ING sold ING Seguros in Mexico

- 2008: ING acquired CitiStreet in the USA

- 2008: ING launched retail banking in Ukraine

- 2008: ING acquired the voluntary pension fund Oyak Emeklilik in Turkey

- 2008: ING sold its life insurance business in Taiwan

- 2008: ING Group, in a move to increase its Tier-One capital ratio, accepts a €10 billion capital injection from the Dutch government.

- 2009: ING closed retail banking in Ukraine

- 2009: In order to save €1.4 billion, ING announced that they would be cutting about 7,000 employees from their payroll. The CEO, Michel Tilmant, also resigned.[4]

- 2009: ING Group sold all of its ownership stake in ING Canada (Property & Casualty Insurer operating in Canada).[5][6]

- 2009: ING Group’s Restructuring Plan announced, stating that ING needs to divest ING Direct USA by the end of 2013.[7][8]

- 2009: ING announces that it will move towards a separation of its banking and insurance operations.[7][8]

- 2009: ING secures €7.5bn rights issue and repays €5bn to the Dutch State.

Transactions with the Dutch State

Capital injection

On Sunday October 19, 2008, in a move to increase its core Tier 1 capital ratio to above 8%, ING Group accepted a capital injection plan by the Dutch Government. The plan will supply €10 billion (US$13.5 billion) into the operation, in exchange for securities, and veto rights on major operations and investments. Wouter Bos, the Dutch finance minister at the time, said that this was done as a means of fortifying the bank as the bank is in a sound financial state, to weather the financial crisis. Management said that the capital injection shall have no dilutive impact to existing shareholders. As part of the 'loan' agreement, two government advisers have been appointed to the supervisory board.

Repayment of Dutch state

On 21 Dec 2009, ING announced that it has completed its planned repurchase of EUR 5 billion of the Core Tier 1 securities issued in November 2008 to the Dutch State and its EUR 7.5 billion rights issue.

Divisions

Retail Banking

ING offers retail banking services in the Netherlands, Belgium, Luxembourg, Poland, Romania, Turkey, India, Thailand and China. Private Banking is offered in the Netherlands, Belgium, Luxembourg, Switzerland and various countries in Asia and Central Europe. Mid Corporate Clients in the home markets (the Netherlands, Belgium, Poland and Romania) are also part of Retail Banking.

In its home market, the Netherlands, ING is the largest retail bank by market share, holding 40% of current account deposits [2], followed by Rabobank (30%), ABN AMRO (20%), and others (10%).

Outside of the Benelux, ING's focus is on Central and Eastern Europe, and Asia. In India, ING has a 44% stake in ING Vysya Bank and is the single largest shareholder. In China, ING has a 16.7% stake in Bank of Beijing, the largest city commercial bank in China. In Thailand, ING has a 30% stake in TMB Bank, a universal banking platform with a nationwide network.

ING Direct

ING Direct is ING Group's marketing name for a branchless direct bank with operations in Australia, Austria (branded ING-DiBa), Canada, France, Germany (branded ING-DiBa), Italy, Spain, the United Kingdom and the United States. It offers services over the Internet, phone, ATM or by mail, and focuses on simple, high-interest savings accounts.

ING Direct Canada

ING Direct Canada was founded in 1997. As of 2009 ING DIRECT Canada has over 1.6 million clients, employs over 900 people and has over $27 billion in assets. ING Direct Canada has four 'Save Your Money Cafés' in the major cities of Toronto, Montréal, Calgary and Vancouver.[9]

Its products include Savings accounts, Tax-Free Savings Accounts (TFSAs), Mortgages, Retirement Savings Plans (RSPs), Guaranteed Investments (GICs), Mutual Funds, and Business Accounts.

ING Direct Canada is a member of the Canadian Bankers Association (CBA) and registered member with the Canada Deposit Insurance Corporation (CDIC), a federal agency insuring deposits at all of Canada's chartered banks. ING Direct Canada operates as Banking Institution #614, Transit #00152.[10]

ING Direct United States

ING Direct was founded in 2000, with its headquarters in Wilmington, Delaware. ING Direct is a member of the Federal Deposit Insurance Corporation (FDIC).

In September 2007, ING Direct acquired 104,000 customers and FDIC insured assets from a failed virtual bank NetBank.[11] Two months later, ING Direct acquired online stock broker Sharebuilder.[12]

Orange Savings Account

Its product range includes Savings, checking, IRA, and CDs accounts

The Orange Savings Account is an online savings product offered by ING Direct. ING Direct allows users two possible methods to deposit money into an Orange Savings account: electronic transfer from a checking account at another institution, and direct deposit. Customers can link up to three external checking accounts for electronic deposits and withdrawals.

Individual Retirement (IRA) Savings Account

Traditional and Roth IRA accounts are offered. Both are near paperless products. Accounts can be opened online, in addition to supporting contributions and distributions without forms. Only bank to bank custodial transfers and conversions require paperwork. Rates follow the rates of the OSA. Customers may also open IRA CDs that are tied to their IRA savings account.

Electric Orange Checking

Electric Orange is ING Direct's interest-bearing paperless checking account. The account has no minimum balance or direct deposit requirements, no monthly maintenance fees, and pays tiered interest rate according to account balance.

Access to the account is available through a MasterCard debit card (withdrawals at Allpoint ATMs are free), "Electric Checks" which are electronic transfers to other people who don't need to be ING Direct account holders, free Bill Pay, and direct debit. Unlike a traditional checking account, Electric Orange account does not allow access via paper checks written by the account holder, although customers can request ING Direct to print and mail a check on the account holder's behalf. Checks mailed by ING Direct are debited from the account at the moment of the request and regardless whether the check is ever cashed. Deposit options include Automated Clearing House (ACH) transfers from a linked account at another bank, direct deposit, transfer from Orange Savings accounts as well as mailing in paper checks. Foreign transactions are subject to a 3% fee.

Unlike the Orange Savings Account, enrollment in ING Direct's "e1st" program is mandatory for Electronic Orange customers, and the account holder of an Electronic Orange account must agree to receive information about all their ING Direct accounts electronically through the Internet. Customers that do not have an Electric Orange account may still opt to have paper statements mailed to them. Also, unlike the Orange Savings Account, the Electric Orange account offers overdraft protection, this is however, mandatory, if you do not have the necessary credit, you will be not be allowed to open an Electric Orange account.

Orange Certificate of Deposit

Another popular savings method that ING Direct offers is a certificate of deposit, or CD. ING Direct offers a number of options for their CDs, with the time starting out at a minimum of six months, and the longest being 60 months. These products are also offered within IRA savings accounts.

ING Direct Cafes

In March 2001, ING Direct opened cafés in 6 cities: Chicago, IL, Philadelphia, PA, Los Angeles, CA, New York City, NY, St. Cloud, MN, and Wilmington, DE, each serving Peet's Coffee. New cafes were opened in Chicago, IL (Summer 2007), St. Cloud, MN (2008), and Waikiki, Honolulu, Hawai'i (November 2008).[13]

Inside the cafés, ING DIRECT has internet terminals that let their account-holders check the status of their ING Direct accounts and surf the Internet free of charge. The cafés often feature seminars on financial topics such as money management, handling one's retirement, mortgages, and credit management.

Services

ING Direct (USA) offers a range of products including Checking accounts, Savings accounts, Business accounts, Mutual funds, and Mortgages.

ING Direct UK

ING Direct began operations in the UK in May 2003 and has over 1 million customers. Operations are based in Reading, where the company head office is situated as well as an office based in the city of Cardiff. The bank markets itself as offering good customer service and high interest rates, which are usually higher than its high street competitors, but not always top of comparison tables[14]. The bank has picked up awards for its customer services and mortgage product in 2008 and 2009.[15]

On 8 October 2008 ING purchased the savings accounts of the collapsed Icelandic bank, Kaupthing Singer & Friedlander, the UK Treasury used the Banking (Special Provisions) Act 2008 to transfer the Kaupthing Edge deposit business to ING Direct.[16] Through this, ING Direct took over responsibility for £2.5 billion of deposits of 160,000 UK customers with the Icelandic bank Kaupthing Edge. Some customers were dissatisfied[17] after ING lowered the exceptional high rate the collapsed Kaupthing was previously paying.

ING Directs products in the UK include Savings Accounts, Cash ISAs, Mortgages and Home insurance.

ING Direct Australia

ING Direct Australia was established in 1999 and is headquartered in Sydney, offering banking online and via telephone.

The company's operations are regulated by the Australian Prudential Regulation Authority and the Australian Securities and Investments Commission, Federal Government regulators. ING Direct is a division of ING Bank (Australia).

In October 2008, ING Direct suffered a $749 million outflow of deposit funds. There had been some confusion as to whether or not the Australian Government's guarantee over funds on deposit applied to deposits up to $1 million with ING DIRECT Australia. Once it was confirmed that the Guarantee did apply to ING DIRECT Australia, outflows that had been solely attributed to this situation slowed and deposits returned.

Its products in Australia include Transaction accounts, Savings accounts, Business accounts, Term deposits and Home loans.

Commercial Banking

ING Commercial Banking conducts operations for corporations and other institutions. The primary focus of ING’s Commercial banking business is on the Netherlands, Belgium, Poland and Romania, where it offers a full range of products, from cash management to corporate finance. Elsewhere, it takes a more selective approach to clients and products.

ING's Commercial Banking business was strengthened in 1995, when ING took over Barings Bank. This acquisition increased the brand recognition of ING around the world and strengthened its Commercial Banking presence in the emerging markets. Following the acquisition and up until 2004, ING's investment banking division was called ING Barings, at which point it severed its ties with the Barings name and was combined with ING's other commercial banking operations. However the top floor of ING's London office is still home to the Baring Art Collection,[18] and the Baring Foundation,[19] a charitable foundation.

Commercial Banking is divided into a number of sub-divisions, including Structured Finance, Financial Markets, and Corporate Finance.

Corporate Finance

ING's Corporate Finance department advises businesses on important corporate transactions, including mergers and acquisitions, initial public offerings, secondary offerings, share buy-backs and management buy-outs. The division is headed by former BP executive, David Herbert,[20] and has made recent key hires from other banks including Maurits Duynstee,[21] previously a Managing Director with ABN AMRO, and now head of ING Corporate Finance for Continental Western Europe. The bank has advised on a number of recent high-profile European transactions including satellite navigation manufacturer TomTom in a €359m rights issue, energy supplier Nuon in its €8.5bn sale to Vattenfall, and printer-maker Océ in its €1.3bn merger with Canon. ING was the leading advisor in the Dutch M&A league tables in 2009.[22]

ING Corporate finance also has a strong presence in Russia and Central and Eastern Europe, where the division is headed by Alexander Kabanovsky and Siobhan Walker[23]. In 2009 ING advised Mobile TeleSystems OJSC (MTS), Russias largest mobile operator, in its acquisition of a 51% stake in Comstar UTS for USD 1.27bn[24], and Russia-focused oil producer, Exillon Energy on its USD 100m IPO[25].

Insurance

ING insurance operates throughout America, Asia and Europe.

In 2009 ING announced plans to separate its insurance business from its main banking operations through an IPO. Analysts estimate that the insurance arm is worth up to €16bn[26].

Advertising and sponsorship

ING sponsors a variety of sports, cultural events, and art exhibitions throughout the world.

For several years, ING has been the title sponsor of various US Marathons including the New York City Marathon, the Miami Marathon, the Georgia Marathon, the Hartford Marathon, the Philadelphia Distance Run and San Francisco's Bay to Breakers.

ING is a major sponsor of football, sponsoring the Royal Dutch Football Association and the Asian Football Confederation (AFC).[27]

ING was the title sponsor of the Renault Formula One team from the 2007 season to the 2009 season. It was also during this time, the title sponsor of the Australian Grand Prix and Belgian Grand Prix, the Hungarian Grand Prix, and the Turkish Grand Prix. ING ended its sponsorship of Renault in part due to a reduction in advetising spending, and in part due to controversy surrounding the Renault Formula One team.[28]

In art and culture, ING's sponsorships include the Dutch national museum in Amsterdam (the Rijksmuseum), the New York Museum of Modern Art, and also the Royal Concertgebouw Orchestra. ING also owns a number of collections itself, in Belgium, Mexico, the Netherlands, Poland and the United Kingdom.[29]

ING's use of orange in its corporate logo (as well as including Orange in the name of its products) refers to its Dutch origins. ING's Canadian commercials feature Dutch actor Frederik de Groot.[30] In Australia, they feature Scottish comedian Billy Connolly.[31]

See also

- Australian real estate investment trust

- European Financial Services Roundtable

- Inter-Alpha Group of Banks

References

- ↑ 1.0 1.1 1.2 1.3 1.4 "Annual Results 2009". ING. http://www.ing.com/cms/idc_cgi_isapi.dll?IdcService=GET_FILE&dDocName=435379_EN&RevisionSelectionMethod=latestReleased. Retrieved 2010-03-12.

- ↑ Fortune Global 500 Rankings 2009

- ↑ DW-World.de

- ↑ CNN.com

- ↑ ING.com

- ↑ ING.com

- ↑ 7.0 7.1 ING.com

- ↑ 8.0 8.1 Nicholson, Chris V. (October 26, 2009). "ING to Split in Two Amid $11.3 Billion Rights Issue". The New York Times. http://www.nytimes.com/2009/10/27/business/global/27iht-ing.html. Retrieved 2009-10-26.

- ↑ INGdirect.ca

- ↑ [1]

- ↑ INdirect.com

- ↑ ING DIRECT USA (2007-11-19). "ING DIRECT Acquires ShareBuilder". Press release. http://home.ingdirect.com/about/about.asp?s=News_Room&news=News_Releases&years_list=PressReleases2007.xml&id=5. Retrieved 2010-08-12.

- ↑ "ING Direct Cafes Coming". Interest Savings Accounts. http://www.interestsavingsaccounts.net/2009/03/ing-cafes-coming-direct-to-you.html. Retrieved 2009-10-08.

- ↑ "Savers pull £5.4bn from ING Direct". http://www.thisismoney.co.uk/saving-and-banking/article.html?in_article_id=423187&in_page_id=7&expand=true.

- ↑ Top50callcentres.co.uk

- ↑ HM-treasury.gov.uk

- ↑ INGsavers.co.uk

- ↑ BaringArchive.org.uk

- ↑ BaringFoundation.org.uk

- ↑ PBnco.com

- ↑ INGcommercialbanking.com

- ↑ (Dutch) Overfusies.nl

- ↑ ING Press release, Russian hires

- ↑ Bloomberg news, MTS acquisition

- ↑ Dealbook, Exillon IPO

- ↑ http://cachef.ft.com/cms/s/0/aa675a66-ce92-11de-8812-00144feabdc0.html

- ↑ INGafc.com

- ↑ ING press release, end of F1 sponsorship

- ↑ INGartcollection.com

- ↑ Mutually-inclusive blog, ING

- ↑ ING press release, Australian ad campaign

External links

ING Websites

- ING.com ING Group mobile

- ING Commercial Banking

- ING Real Estate

- ING USA (www.ing-usa.com)

- ING Asia (www.ing.asia)

- ING DiBa Austria (www.ing-diba.at)

Other websites

|

|||||

|

|||||||||||||||||

|

|||||

|

|||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||