Value added tax

| Public finance |

|---|

|

| Taxation |

| Income tax · Payroll tax CGT · Stamp duty · LVT Sales tax · VAT · Flat tax Tax, tariff and trade Tax haven |

| Tax incidence |

| Tax rate · Proportional tax Progressive tax · Regressive tax Tax advantage |

|

Taxation by country

Tax rates around the world |

| Economic policy |

| Monetary policy Central bank • Money supply Gold standard |

| Fiscal policy Spending • Deficit • Debt |

| Policy-mix |

| Trade policy Tariff • Trade agreement |

| Finance |

| Financial market Financial market participants Corporate · Personal Public · Regulation |

| Banking |

| Fractional-reserve · Full-reserve Free banking · Islamic banking |

| • project |

Value added tax (VAT), or goods and services tax (GST), is a consumption tax levied on value added. In contrast to sales tax, VAT is neutral with respect to the number of passages that there are between the producer and the final consumer; where sales tax is levied on total value at each stage, the result is a cascade (downstream taxes levied on upstream taxes).

By definition, exports are consumed abroad and are usually not subject to VAT; VAT charged under such circumstances is usually refundable. This avoids downward pressure on exports and ultimately export derived revenue.

A VAT is an indirect tax, in that the tax is collected from someone who does not bear the entire cost of the tax.

VAT was invented by a French economist in 1954 as taxe sur la valeur ajoutée (TVA). Maurice Lauré, joint director of the French tax authority, the Direction générale des impôts, was first to introduce VAT with effect from 10 April 1954 for large businesses, and it was extended over time to all business sectors. In France, it is the most important source of state finance, accounting for approximately 45% of state revenues.

Personal end-consumers of products and services cannot recover VAT on purchases, but businesses are able to recover VAT on the materials and services that they buy to make further supplies or services directly or indirectly sold to end-users. In this way, the total tax levied at each stage in the economic chain of supply is a constant fraction of the value added by a business to its products, and most of the cost of collecting the tax is borne by business, rather than by the state. VAT was invented because very high sales taxes and tariffs encourage cheating and smuggling. It has been criticized on the grounds that (like other consumption taxes) it is a regressive tax.

Contents |

Comparison with a sales tax

Value added taxation avoids the cascade effect of sales tax by only taxing the value added at each stage of production. Value added taxation has been gaining favour over traditional sales taxes worldwide. In principle, value added taxes apply to all commercial activities involving the production and distribution of goods and the provision of services. VAT is assessed and collected on the value added to goods in each business transaction. Under this concept the government is paid tax on the gross margin of each transaction.

In many developing countries such as India, sales tax/VAT are a key revenue source as high unemployment and low per capita income render other income sources inadequate. However there is strong opposition to this by many sub-national governments as it leads to an overall reduction in the revenue they collect as well as a loss of some autonomy.

Sales taxes are normally only charged on final sales to consumers: because of reimbursement, VAT has the same overall economic effect on final prices. The main difference is the extra accounting required by those in the middle of the supply chain; this disadvantage of VAT is balanced by application of the same tax to each member of the production chain regardless of its position in it and the position of its customers, reducing the effort required to check and certify their status. When the VAT system has few, if any exemptions such as with GST in New Zealand, payment of VAT is even simpler.

A general economic idea is that if sales taxes exceed 10%, people start engaging in widespread tax evading activity (like buying over the Internet, pretending to be a business, buying at wholesale, buying products through an employer etc.) On the other hand, total VAT rates can rise above 10% without widespread evasion because of the novel collection mechanism. However because of its particular mechanism of collection, VAT becomes quite easily the target of specific frauds like carousel fraud which can be very expensive in terms of loss of tax incomes for states.

Collection mechanism

The standard way to implement a VAT is to say a business owes some percentage on the price of the product minus all taxes previously paid on the good. If VAT rates were 10%, an orange juice maker would pay 10% of the $5 per gallon price ($0.50) minus taxes previously paid by the orange farmer (maybe $0.20). In this example, the orange juice maker would have a $0.30 tax liability. Each business has a strong incentive for its suppliers to pay their taxes, allowing VAT rates to be higher with less tax evasion than a retail sales tax.

Example

Consider the manufacture and sale of any item, which in this case we will call a widget.

Without any sales tax

- A widget manufacturer spends $1 on raw materials and uses them to make a widget.

- The widget is sold wholesale to a widget retailer for $1.20, leaving a profit of $0.20.

- The widget retailer then sells the widget to a widget consumer for $1.50, making a profit of $0.30.

With a North American (Canadian provincial and U.S. state) sales tax

With a 10% sales tax:

- The manufacturer pays $1.00 for the raw materials, certifying it is not a final consumer.

- The manufacturer charges the retailer $1.20, checking that the retailer is not a consumer, leaving the same profit of $0.20.

- The retailer charges the consumer $1.65 ($1.50 + $1.50x10%) and pays the government $0.15, leaving the same profit of $0.30.

So the consumer has paid 10% ($0.15) extra, compared to the no taxation scheme, and the government has collected this amount in taxation. The retailers have not lost anything directly to the tax, and retailers have the extra paperwork to do so that they correctly pass on to the government the sales tax they collect. Suppliers and manufacturers have the administrative burden of supplying correct certifications, and checking that their customers (retailers) aren't consumers.

With a value added tax

With a 10% VAT:

- The manufacturer pays $1.10 ($1 + $1x10%) for the raw materials, and the seller of the raw materials pays the government $0.10.

- The manufacturer charges the retailer $1.32 ($1.20 + $1.20x10%) and pays the Government $0.02 ($0.12 minus $0.10), leaving the same profit of $0.20.

- The retailer charges the consumer $1.65 ($1.50 + $1.50x10%) and pays the government $0.03 ($0.15 minus $0.12), leaving the profit of $0.30 (1.65-1.32-.03).

So the consumer has paid 10% ($0.15) extra, compared to the no taxation scheme, and the government has collected this amount in taxation. The businesses have not lost anything directly to the tax. They do not need to request certifications from purchasers who are not end users, but they do have the extra accounting to do so that they correctly pass on to the government the difference between what they collect in VAT (output VAT, an 11th of their income) and what they spend in VAT (input VAT, an 11th of their expenditure).

Note that in each case the VAT paid is equal to 10% of the profit, or 'value added'.

The advantage of the VAT system over the sales tax system is that businesses cannot hide consumption (such as wasted materials) by certifying it is not a consumer.

Limitations to example and VAT

In the above example, we assumed that the same number of widgets were made and sold both before and after the introduction of the tax. This is not true in real life.

The fundamentals of supply and demand suggest that any tax raises the cost of transaction for someone, whether it is the seller or purchaser. In raising the cost, either the demand curve shifts leftward, or the supply curve shifts upward. The two are functionally equivalent. Consequently, the quantity of a good purchased, and/or the price for which it is sold, decrease.

This shift in supply and demand is not incorporated into the above example, for simplicity and because these effects are different for every type of good. The above example assumes the tax is non-distortionary.

A VAT, like most taxes, distorts what would have happened without it. Because the price for someone rises, the quantity of goods traded decreases. Correspondingly, some people are worse off by more than the government is made better off by tax income . That is, more is lost due to supply and demand shifts than is gained in tax. This is known as a deadweight loss. The income lost by the economy is greater than the government's income; the tax is inefficient. The entire amount of the government's income (the tax revenue) may not be a deadweight drag, if the tax revenue is used for productive spending or has positive externalities - in other words, governments may do more than simply consume the tax income. While distortions occur, consumption taxes like VAT are often considered superior because they distort incentives to invest, save and work less than most other types of taxation - in other words, a VAT discourages consumption rather than production.

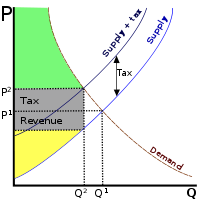

A Supply-Demand Analysis of a Taxed Market

In the above diagram,

Deadweight loss: the area of the triangle formed by the tax income box, the original supply curve, and the demand curve

Government's tax income: the grey rectangle that says "tax"

Total consumer surplus after the shift: the green area

Total producer surplus after the shift: the yellow area

Criticisms

The "value added tax" has been criticized as the burden of it relies on personal end-consumers of products and is therefore a regressive tax (the poor pay more, in comparison, than the rich). However, this calculation is derived when the tax paid is divided not by the tax base (the amount spent) but by income, which is argued to create an arbitrary relationship. The tax rate itself is proportional with higher income people paying more tax but at the same rate as they consume more. If a value added tax is to be related to income, then the unspent income can be treated as deferred (spending savings at a later point in time), at which time it is taxed creating a proportional tax using an income base. Such taxes can have a progressive effect on the effective tax rate of consumption by using exemptions, rebates, or credits.

Revenues from a value added tax are frequently lower than expected because they are difficult and costly to administer and collect. In many countries, however, where collection of personal income taxes and corporate profit taxes has been historically weak, VAT collection has been more successful than other types of taxes. VAT has become more important in many jurisdictions as tariff levels have fallen worldwide due to trade liberalization, as VAT has essentially replaced lost tariff revenues. Whether the costs and distortions of value added taxes are lower than the economic inefficiencies and enforcement issues (e.g. smuggling) from high import tariffs is debated, but theory suggests value added taxes are far more efficient.

Certain industries (small-scale services, for example) tend to have more VAT avoidance, particularly where cash transactions predominate, and VAT may be criticized for encouraging this. From the perspective of government, however, VAT may be preferable because it captures at least some of the value-added. For example, a carpenter may offer to provide services for cash (i.e. without a receipt, and without VAT) to a homeowner, who usually cannot claim input VAT back. The homeowner will hence bear lower costs and the carpenter may be able to avoid other taxes (profit or payroll taxes). The government, however, may still receive VAT for various other inputs (lumber, paint, gasoline, tools, etc) sold to the carpenter, who would be unable to reclaim the VAT on these inputs. While the total tax receipts may be lower compared to full compliance, it may not be lower than under other feasible taxation systems.

Because exports are generally zero-rated (and VAT refunded or offset against other taxes), this is often where VAT fraud occurs. In Europe, the main source of problems is called carousel fraud. Large quantities of valuable goods (often microchips or mobile phones) are transported from one member state to the other. During these transactions, some companies owe VAT, others acquire a right to reclaim VAT. The first companies, called 'missing traders' go bankrupt without paying. The second group of companies can 'pump' money straight out of the national treasuries. This kind of fraud originated in the 1970s in the Benelux-countries. Today, the British treasury is a large victim.[1] There are also similar fraud possibilities inside a country. To avoid this, in some countries like Sweden, the major owner of a limited company is personally responsible for taxes. This is circumvented by having an unemployed person without assets as the formal owner.

VAT systems

European Union

The European Union Value Added Tax ("EU VAT") is a value added tax encompassing member states in the European Union Value Added Tax Area. Joining in this is compulsory for member states of the European Union.

As a consumption tax, the EU VAT taxes the consumption of goods and services in the EU VAT area. The EU VAT's key issue asks where the supply and consumption occurs thereby determining which member state will collect the VAT and what VAT rate will be charged.

Different rates of VAT apply in different EU member states. The minimum standard rate of VAT throughout the EU is 15%, although reduced rates of VAT, as low as 0%, are applied in various states on various sorts of supply (for example, newspapers and certain magazines in Belgium). The maximum rate in the EU is 25%.

VAT that is charged by a business and paid by its customers is known as "output VAT" (that is, VAT on its output supplies). VAT that is paid by a business to other businesses on the supplies that it receives is known as "input VAT" (that is, VAT on its input supplies). A business is generally able to recover input VAT to the extent that the input VAT is attributable to (that is, used to make) its taxable outputs. Input VAT is recovered by setting it against the output VAT for which the business is required to account to the government, or, if there is an excess, by claiming a repayment from the government.

The Sixth VAT Directive requires certain goods and services to be exempt from VAT (for example, postal services, medical care, lending, insurance, betting), and certain other goods and services to be exempt from VAT but subject to the ability of an EU member state to opt to charge VAT on those supplies (such as land and certain financial services). Input VAT that is attributable to exempt supplies is not recoverable, although a business can increase its prices so the customer effectively bears the cost of the 'sticking' VAT (the effective rate will be lower than the headline rate and depend on the balance between previously taxed input and labour at the exempt stage).

- See also: Taxation in the United Kingdom#Value added tax

The Nordic countries

MOMS (Danish: merværdiafgift, formerly meromsætningsafgift), Norwegian: merverdiavgift (bokmål) or meirverdiavgift (nynorsk) (abbreviated MVA), Swedish: mervärdesskatt (earlier mervärdesomsättningsskatt)), Icelandic: virðisaukaskattur (abbreviated VSK) or Finnish: arvonlisävero (abbreviated ALV) are the Nordic terms for VAT. Like other countries' sales and VAT taxes, it is a regressive indirect tax.

In Denmark, VAT is only applied at one level, and is not split into two levels as in other countries (e.g. Germany), where VAT is split into VAT for foodstuffs and VAT for nonfood. The current percentage in Denmark is 25%. That makes Denmark one of the countries with the highest value added tax, alongside Norway and Sweden. A number of services are not taxable, for instance public transportation of private persons, health care services, publishing newspapers, rent of premises (the lessor can, though, voluntarily register as VAT payer, except for residential premises), travel agency operations.

In Finland , the standard rate of VAT is 22%. In addition, two reduced rates are in use: 17%, which is applied on food and animal feed, and 8%, which is applied on passenger transportation services, cinema performances, physical exercise services, books, pharmaceuticals, entrance fees to commercial cultural and entertainment events and facilities. Supplies of some goods and services are exempt under the conditions defined in the Finnish VAT Act: hospital and medical care; social welfare services; educational, financial and insurance services; lotteries and money games; transactions concerning bank notes and coins used as legal tender; real property including building land; certain transactions carried out by blind persons and interpretation services for deaf persons. The seller of these tax-exempt services or goods is not subject to VAT and does not pay tax on sales. He therefore may not deduct VAT included in the purchase prices of his inputs.

In Iceland, VAT is split into two levels: 24.5% for most goods and services but 7% for certain goods and services. The 7% level is applied for hotel and guesthouse stays, licence fees for radio stations (namely RÚV), newspapers and magazines, books; hot water, electricity and oil for heating houses, food for human consumption (but not alcoholic beverages), access to toll roads and music.

In Norway, VAT is split into three levels: 25% is the general VAT, 14% (formerly 13%, up on January 1, 2007) for foods and restaurant take-out (food eaten in a restaurant has 25%), 8% for person transport, movie tickets, and hotel stays. Books and newspapers are free of VAT, while magazines and periodicals with a less than 80% subscription rate are taxed. Svalbard has no VAT because of a clause in the Svalbard Treaty. Cultural events are excluded from VAT.

In Sweden, VAT is split into three levels: 25% for most goods and services including restaurants bills, 12% for foods (incl. bring home from restaurants) and hotel stays (but breakfast at 25%) and 6% for printed matter, cultural services, and transport of private persons. Some services are not taxable for example education of children and adults if public utility, and health and dental care, but education is taxable at 25% in case of courses for adults at a private school. Dance events (for the guests) have 25%, concerts and stage shows have 6%, and some types of cultural events have 0%.

MOMS replaced OMS (Danish "omsætningsafgift", Swedish "omsättningsskatt") in 1967, which was a tax applied exclusively for retailers.

| Year | Tax level | OMS/MOMS |

| 1962 | 9% | OMS |

| 1967 | 10% | MOMS |

| 1968 | 12.5% | MOMS |

| 1970 | 15% | MOMS |

| 1977 | 18% | MOMS |

| 1978 | 20.25% | MOMS |

| 1980 | 22% | MOMS |

| 1992 | 25% | MOMS |

India

In India, VAT replaced sales tax on 1 April 2005. Of the 28 Indian states, eight did not introduce VAT. Haryana had already adopted it on 1 April 2004. The "empowered committee" of the basic framework for uniform VAT laws in the states. Due to the federal nature of the Indian constitution, the states do have the power to set their own VAT rate. Chanchal Kumar Sharma (2005:929) asserts: " political compulsions have led the government to propose an imperfect model of VAT" 'Indian VAT system is imperfect' to the extent it 'goes against the basic premise of VAT'. India seems to have an 'essenceless VAT' because the very reasons for which VAT receives academic support have been disregarded by the VAT-Indian Style, namely: removal of the distortions in movement of goods across states;Uniformity in tax structure (Sharma, 2005: 929). Chanchal Kumar Sharma ( 2005:929) clearly states, " Local or state level taxes like octroi, entry tax, lease tax, workers contract tax, entertainment tax and luxury tax are not integrated into the new regime which goes against the basic premise of VAT which is to have uniformity in the tax structure. The fact that no tax credit will be allowed for inter-state trade seriously undermines the basic benefit of enforcing a vat system, namely the removal of the distortions in movementof goods across the states".

" Even the most essential prerequisite for success of VAT ie elimination of [Central sales tax (CST)] has been deferred. CST is levied on basis of origin and collected by the exporting state; the consumers of the importing state bear its incidence. CST creates tax barriers to integrate the Indian market and leads to cascading impact on cost of production. Further, the denial of input tax credit on inter-state sales and inter state transfers would affect free flow of goods." (Sharma,2005:922)

The greatest challenge in India, asserts Sharma(2005) is to design a sales tax system that will provide autonomy to subnational levels to fix tax rate, without compromising efficiency or creating enforcement problems.

The Andhra Pradesh experience

In the Indian state of Andhra Pradesh, the Andhra Pradesh Value Added Tax Act, 2005 came into force on 1 April 2005 and contains six schedules. Schedule I contains goods generally exempted from tax. Schedule II deals with zero rated transactions like exports and Schedule III contains goods taxable at 1%, namely jewellery made from bullion and precious stones. Goods taxable at 4% are listed under Schedule IV. The majority of foodgrains and goods of national importance, like iron and steel, are listed under this head. Schedule V deals with Standard Rate Goods, taxable at 12.5%. All goods that are not listed elsewhere in the Act fall under this head. The VI Schedule contains goods taxed at special rates, such as some liquor and petroleum products.

The Act prescribes threshold limits for VAT registration - dealers with a taxable turnover of over Rs.40.00 lacs, in a tax period of 12 months, are mandatorily registered as VAT dealers. Dealers with a taxable turnover, in a tax period of 12 months, between Rs.5.00 to 40.00 lacs are registered as Turnover Tax (TOT) dealers. While the former category of dealers are eligible for input tax credit, the latter category of dealers are not. A VAT dealer pays tax at the rate specifed in the Schedules. The sales of a TOT dealer are all taxable at 1%. A VAT dealer has to file a monthly return disclosing purchases and sales. A TOT dealer has to file a quarterly return disclosing only sale turnovers. While a VAT dealer can buy goods for business from anywhere in the country, a TOT dealer is barred from buying outside the State of A.P.

The Act appears to be the most liberal VAT law in India. It has simplified the registration procedures and provides for across the board input tax credit (with a few exceptions) for business transactions. A unique feature of registration in Andhra Pradesh is the facility of voluntary VAT registration and input tax credit for start-ups.

The Act also provides for transitional relief (TR) for goods on hand as of 1 April 2005. However, these goods ought to have been purchased from registered dealers between 1 April 2005 to 31 March 2006. This is a bold step compared to the 3 months TR provided by several developed countries.

The Act not only provides for tax refunds for exporters (refund of tax paid on inputs used in the manufacture of goods exported), it also provides for refund of tax in cases where the inputs are taxed at 12.5% and outputs are taxed at 4%.

The VAT Act in Andhra Pradesh is administered by the Commercial Taxes Department (department to collect VAT and other taxes) using a networked software package called VATIS. The personnel were trained prior to the Act coming into force. VATIS is used to process documents and forms received and to generate registration certificates and tax demand notices.

VAT, to be successful, relies on voluntary tax compliance. Since VAT believes in self assessments, dealers are required to maintain proper records, issue tax invoices, file correct tax returns etc. The opposite seems to be happening in India. Businesses are still run on traditional lines. Cash transactions are order of the day. The unorganised sector dominates the market. The hope of higher tax compliance and lesser evasion is still a far cry in Andhra Pradesh. This is reflected in the high percentage of return defaulters (14%), credit returns (35%) and nil returns (20%). That is, roughly 70% of VAT dealers are presently not paying any tax. Filing of credit returns is rampant among FMCG, Consumer Durables, Drugs and Medicines and Fertilizers. The margins are low in this sector (ranging between 2 to 5%). The value addition is not enough to yield revenue as of now. Credits offered by manufacturers compounds the problem. The question is, in a typical purchases and sales scenario, can there be more output tax than input tax? When purchases consistently exceed sales, can output tax exceed input tax? If a VAT dealer can balance his/her purchases and sales, can there be a net tax to the State? Is there a mathematical model or paradigm which can give value added tax and which can reduce the percentage of credit returns? There are no ready answers for these queries. The only remedy seems to be the restriction of input tax to the corresponding purchase value of goods put to sales. In fact a two tier system can be adopted to counter the credit returns - allow full input tax to manufacturers and restrict input tax to the purchase value of goods put to sale to traders. Restricting input tax to 4% in the case of inter state sales and in the case of products taxable at 12.5% seems to be another solution.

Mexico

Impuesto al Valor Agregado (IVA, "value-added tax" in Spanish) is a tax applied in Mexico and other countries of Latin America. In Chile it is also called Impuesto al Valor Agregado and in Peru it is called Impuesto General a las Ventas or IGV.

Prior to the IVA, a similar tax called impuesto a las ventas ("sales tax") had been applied in Mexico. In September, 1966, the first attempt to apply the IVA took place when revenue experts declared that the IVA should be a modern equivalent of the sales tax as it occurred in France. At the convention of the Inter-American Center of Revenue Administrators in April and May, 1967, the Mexican representation declared that the application of a value-added tax would not be possible in Mexico at the time. In November, 1967, other experts declared that although this is one of the most equitable indirect taxes, its application in Mexico could not take place.

In response to these statements, direct sampling of members in the private sector took place as well as field trips to the European countries this tax was applied or it was soon to be applied. In 1969, the first attempt to substitute the mercantile-revenue tax for the value-added tax took place. On December 29, 1978 the Federal government published the official application of the tax beginning on January 1, 1980 in the Official Journal of the Federation (Diario Oficial de la Federación).

New Zealand

Goods and Services Tax (GST) is a Value Added Tax introduced in New Zealand in 1986, which is currently 12.5%. It is notable for exempting few items from the tax.

Australia

Goods and Services Tax (GST) is a Value Added Tax introduced in Australia in 2000 which is collected by the Federal Government but given to the State Governments. The Australian Constitution restricts the ability of individual States to collect excises or sales taxes. Whilst the rate is currently set at 10%, there are many zero-rated items such as fresh food, education and health services, as well exemptions for Government charges and fees.

Canada

Goods and Service Tax (GST) is a Value Added Tax introduced in 1991 at a rate of 7%. The rate is currently 5% and is imposed in addition to provincial sales taxes, except in Alberta, where there is no provincial sales tax; and in New Brunswick, Newfoundland and Nova Scotia, where a Harmonized Sales Tax (5% GST + 8% PST = 13% HST) (combined GST and provincial sales tax) is collected.

United States

In the United States, the state of Michigan used a form of VAT known as the "Single Business Tax" (SBT) as its form of general business taxation. It is the only state in the U.S. to have used a VAT. When it was adopted in 1975, it replaced seven business taxes, including a corporate income tax. On August 9, 2006, the Michigan legislature approved voter-initiated legislation to repeal the Single Business Tax. The repeal became effective January 1, 2008.[2]

Most states have sales taxes charged to the end buyer only. State sales taxes range from 0%-13% and municipalities often add an extra local sales tax.[3] In many stores, the price tags and/or advertised prices do not include the taxes; these will be added at the cash register before the customer pays. In many states, no sales tax is charged for services. This is a key difference between most sales taxes levied throughout the United States and the value added taxes in other countries.

Ex-Presidential candidate Mike Huckabee has proposed a national sales tax at a rate of 30% (which would replace all federal income tax). This has generated considerable confusion as a 30% addition translates to 23% of the total purchasing price being paid as taxes.[4]. Huckabee's FairTax proposal is pitched, in part, as a means of increasing the competitiveness of domestic goods against those of European producers whose VAT is refunded on exports.[5]

Tax rates

EU States

| Country | Standard rate | Reduced rate | Abbr. | Name |

|---|---|---|---|---|

| 20% | 12% or 10% | USt. | Umsatzsteuer | |

| 21% | 12% or 6% | BTW TVA MWSt |

Belasting over de toegevoegde waarde Taxe sur la Valeur Ajoutée Mehrwertsteuer |

|

| 20% | 0% or 7% | ДДС | Данък върху добавената стойност | |

| 15% | 5% | ΦΠΑ | Φόρος Προστιθέμενης Αξίας | |

| 19% | 9% | DPH | Daň z přidané hodnoty | |

| 25% | none | moms | Merværdiafgift | |

| 18% | 5% | km | käibemaks | |

| 22% | 17% or 8% | ALV Moms |

Arvonlisävero Mervärdesskatt |

|

| 19.6% | 5.5% or 2.1% | TVA | Taxe sur la valeur ajoutée | |

| 19% | 7% | MwSt./USt. | Mehrwertsteuer/Umsatzsteuer | |

| 19% | 9% or 4.5% (reduced by 30% to 13%, 6% and 3% on islands) |

ΦΠΑ | Φόρος Προστιθέμενης Αξίας | |

| 20% | 5% | ÁFA | általános forgalmi adó | |

| 21.5% | 13.5%, 4.8% or 0% | CBL VAT |

Cáin Bhreisluacha (Irish) Value Added Tax (English) |

|

| 20% | 10%, 6%, or 4% | IVA | Imposta sul Valore Aggiunto | |

| 18% | 5% | PVN | Pievienotās vērtības nodoklis | |

| 18% | 9% or 5% | PVM | Pridėtinės vertės mokestis | |

| 15% | 12%, 9%, 6%, or 3% | TVA | Taxe sur la Valeur Ajoutée | |

| 18% | 5% | VAT | Taxxa tal-Valur Miżjud | |

| 19% | 6% or 0% | BTW | Belasting toegevoegde waarde | |

| 22% | 7%, 3% or 0% | PTU/VAT | Podatek od towarów i usług | |

| 20% (as of July 1 2008) | 12% or 5% | IVA | Imposto sobre o Valor Acrescentado | |

| Madeira and Azores | 15% | 8% or 4% | IVA | Imposto sobre o Valor Acrescentado |

| 19% | 9% | TVA | Taxa pe valoarea adăugată | |

| 19% | 10% | DPH | Daň z pridanej hodnoty | |

| 20% | 8.5% | DDV | Davek na dodano vrednost | |

| 16% | 7% or 4% | IVA | Impuesto sobre el valor añadido | |

| Canary Islands | 5% | 0% or 2% | IGIC | Impuesto General Indirecto Canario |

| 25% | 12% or 6% | Moms | Mervärdesskatt | |

| 15% (temporary cut from 17.5%) | 5% or 0% | VAT | Value Added Tax |

Non-EU countries

| Country | Standard rate | Reduced rate | Local name |

|---|---|---|---|

| 20% | 0% | TVSH = Tatimi mbi Vleren e Shtuar | |

| 21% | 10.5% or 0% | IVA = Impuesto al Valor Agregado | |

| 20% | 0% | AAH = Avelatsvats arjheki hark ԱԱՀ = Ավելացված արժեքի հարկ |

|

| 10% | 0% | GST = Goods and Services Tax | |

| 15% | VAT = Value Added Tax | ||

| 17% | none | PDV = porez na dodatu vrijednost | |

| 12% + 25% + 5% | 0% | *IPI - 12% = Imposto sobre produtos industrializados (Tax over industrialized products) - Federal Tax ICMS - 25% = Imposto sobre circulacao e servicos (Tax over commercialization and services) - State Tax ISS - 5% = Imposto sobre servico de qualquer natureza (Tax over any service) - City tax *IPI for imported products is 60% |

|

| 5% | 4.5%2 | GST = Goods and Services Tax, TPS = Taxe sur les produits et services; HST = Harmonized Sales Tax, TVH = Taxe de vente harmonisée | |

| 19% | IVA = Impuesto al Valor Agregado | ||

| 16% | IVA = Impuesto sobre el Valor Agregado | ||

| 17% | 6% or 3% | 增值税 (pinyin:zēng zhí shuì) | |

| 22% | 10% | PDV = Porez na dodanu vrijednost | |

| 16% | 12% or 0% | ITBIS = Impuesto sobre Transferencia de Bienes Industrializados y Servicios | |

| 12% | IVA = Impuesto al Valor Agregado | ||

| 10% | GST = Goods and Sales Tax (الضريبة على القيمة المضافة) | ||

| 13% | IVA = Impuesto al Valor Agregado | ||

| 12.5% | 0% | VAT = Value Added Tax | |

| 18% | 0% | DGhG = Damatebuli Ghirebulebis gdasakhadi დღგ = დამატებული ღირებულების გადასახადი | |

| 12% | IVA = Impuesto al Valor Agregado | ||

| 16% | 0% | VAT = Value Added Tax | |

| 3% | VAT = Value Added Tax (مالیات بر ارزش افزوده) | ||

| 24.5% | 7%4 | VSK = Virðisaukaskattur | |

| 12.5% | 4%, 1%, or 0% | VAT = Valued Added Tax | |

| 10% | 5% | PPN = Pajak Pertambahan Nilai | |

| 15.5%7 | Ma'am = מס ערך מוסף | ||

| 5% | Consumption tax = 消費税 | ||

| 10% | VAT = 부가세(附加稅, Bugase) = 부가가치세(附加價値稅, Bugagachise) | ||

| 3% | GST = Goods and Sales Tax | ||

| 16% | GST = Goods and Sales Tax | ||

| 13% | Қосымша салық құны | ||

| 16% | TVSH = Tatimi mbi Vlerën e Shtuar | ||

| 10% | TVA = Taxe sur la valeur ajoutée | ||

| 20% | 5% | TVA = Taxa pe Valoarea Adăugată | |

| 18% | 5% | ДДВ = Данок на Додадена Вредност | |

| 5% | GST = Goods and Services Tax (Government Tax) | ||

| 15% | 0% | IVA = Impuesto al Valor Agregado | |

| 17% | PDV = Porez na dodatu vrijednost | ||

| 12.5% | GST = Goods and Services Tax | ||

| 25% | 14% or 8% | MVA = Merverdiavgift (bokmål)or meirverdiavgift (nynorsk) (informally moms) | |

| 16% | 1% or 0% | GST = General Sales Tax | |

| 5% | ITBMS = Impuesto de Transferencia de Bienes Muebles y Servicios | ||

| 10% | 5% | IVA= Impuesto al Valor Agregado | |

| 19% | IGV = Impuesto General a la Ventas | ||

| 12%10 | RVAT = Reformed Value Added Tax, locally known as Karagdagang Buwis | ||

| 18% | 10% or 0% | НДС = Налог на добавленную стоимость, NDS = Nalog na dobavlennuyu stoimost | |

| 18% | 8% or 0% | PDV = Porez na dodatu vrednost | |

| 7% | GST = Goods and Services Tax | ||

| 14% | 0% | BTW = Belasting op Toegevoegde Waarde, VAT = Valued Added Tax | |

| 15% | |||

| 7.6% | 3.6% or 2.4% | MWST = Mehrwertsteuer, TVA = Taxe sur la valeur ajoutée, IVA = Imposta sul valore aggiunto, TPV = Taglia sin la Plivalur | |

| 7% | VAT = Value Added Tax, ภาษีมูลค่าเพิ่ม | ||

| 15% | |||

| 18% | 8% or 1% | KDV = Katma değer vergisi | |

| 20% | 0% | ПДВ = Податок на додану вартість | |

| 22% | 10% | IVA = Impuesto al Valor Agregado | |

| 10% | 5% or 0% | GTGT = Giá Trị Gia Tăng | |

| 9% | 8% | IVA = Impuesto al Valor Agregado |

Note 1: HST is a combined federal/provincial VAT collected in some provinces. In the rest of Canada, the GST is a 5% federal VAT and if there is a Provincial Sales Tax (PST) it is a separate non-VAT tax.

Note 2: No real "reduced rate", but rebates generally available for new housing effectively reduce the tax to 4.5%.

Note 3: These taxes do not apply in Hong Kong and Macau, which are financially independent as special administrative regions.

Note 4: The reduced rate was 14% until 1 March 2007, when it was lowered to 7%. The reduced rate applies to heating costs, printed matter, restaurant bills, hotel stays, and most food.

Note 5: VAT is not implemented in 2 of India's 28 states.

Note 6: Except Eilat, where VAT is not raised.[7]

Note 7: The VAT in Israel is in the process of being gradually reduced. It was reduced from 18% to 17% on March 2004, to 16.5% on September 2005, and was set to its current rate on July 1, 2006. There are plans to further reduce it in the near future, but they depend on political changes in the Israeli parliament.

Note 8: The introduction of a goods and sales tax of 3% will be introduced on the 6th May 2008 to plug a large budget deficit in the island's government budget.

Note 9: In the 2005 Budget, the government announced that GST would be introduced in January 2007. Many details have not yet been confirmed but it has been stated that essential goods and small businesses would be exempted or zero rated. Rates have not yet been established as of June 2007.

Note 10: The President of the Philippines has the power to raise the tax to 12% after January 1, 2006. The tax was raised to 12% on February 1.

VAT registered

VAT registered means registered for VAT purposes, i.e. entered into an official VAT payers register of a country. Both natural persons and legal entities can be VAT registered. Countries that use VAT have established different thresholds for remuneration derived by natural persons/legal entities during a calendar year (or a different period) by exceeding which the VAT registration is compulsory. Natural persons/legal entities that are VAT registered are obliged to calculate VAT on certain goods/services that they supply and pay VAT into particular state budget. VAT registered persons/entities are entitled to VAT deduction under legislatory regulations of particular country. The introduction of a VAT can reduce the cash economy because businesses that wish to buy and sell with other VAT registered businesses must themselves be VAT registered.

See also

- VAT Identification Number

- List of tax rates around the world

- Jaffa Cake – Its non-VAT status was challenged in a UK court case to determine whether Jaffa Cake was a cake or a biscuit.

- VAT 3

- Value-Added-Tax-free imports from the Channel Islands – low value products can be imported into the EU from the Channel Islands without paying VAT

- Missing Trader Fraud (Carousel VAT Fraud)

- Flat tax

- Goods and Services Tax

- Income tax

- Land value tax

- Progressive tax

- Regressive tax

- Revenue On-Line Service

- Sales tax

- Turnover tax

Notes

- ↑ Carousel fraud 'has cost UK up to £16bn',The Independent, 26 July 2007

- ↑ Single Business Tax - Outline of the Michigan Tax System, Citizens Research Council of Michigan, January 24, 2007

- ↑ State Tax Rates, July 14, 2007

- ↑ Huckabee Whips Up Debate with 'Fair Tax' Plan : NPR

- ↑ Mike Huckabee for President - Issues

- ↑ Ram & McRae's Investors Information Package

- ↑ VAT in Eilat, ECCB

References

- (Icelandic) "Lög nr. 50/1988 um virðisaukaskatt" (1988). Retrieved on 2007-09-05.

- Ahmed, Ehtisham and Nicholas Stern. 1991. The Theory and Practice of Tax Reform in Developing Countries (Cambridge University Press).

- Bird, R. M. and P.-P. Gendron .1998. “Dual VATs and Cross-border Trade: Two Problems, One Solution?” International Tax and Public Finance, 5: 429-42.

- Bird, R.M. and P.-P. Gendron .2000. “CVAT, VIVAT and Dual VAT; Vertical ‘Sharing’ and Interstate Trade,” International Tax and Public Finance, 7: 753-61.

- Keen, M. and S. Smith .2000. “Viva VIVAT!” International Tax and Public Finance, 7: 741-51.

- Keen, M. and S. Smith .1996. "The Future of Value-added Tax in the European Union," Economic Policy, 23: 375-411.

- McLure, C.E. (1993) "The Brazilian Tax Assignment Problem: Ends, Means, and Constraints," in A Reforma Fiscal no Brasil (São Paulo: Fundaçäo Instituto de Pesquisas Econômicas).

- McLure, C. E. 2000. “Implementing Subnational VATs on Internal Trade: The Compensating VAT (CVAT),” International Tax and Public Finance, 7: 723-40.

- Muller, Nichole. 2007. Indisches Recht mit Schwerpunkt auf gewerblichem Rechtsschutz im Rahmen eines Projektgeschäfts in Indien, IBL Review, VOL. 12, Institute of International Business and law, Germany.[1]

- Muller, Nichole. 2007. Indian law with emphasis on commercial legal insurance within the scope of a project business in India. IBL Review, VOL. 12, Institute of International Business and law, Germany.

- MOMS, Politikens Nudansk Leksikon 2002, ISBN 87-604-1578-9

- Andhra Pradesh Value Added Tax Act, 2005, Andhra Pradesh Gazette Extraordinary, 25 March 2005, retrieved on 16 March 2007.

- Serra, J. and J. Afonso. 1999. “Fiscal Federalism Brazilian Style: Some Reflections,” Paper presented to Forum of Federations, Mont Tremblant, Canada, October 1999.

- Sharma, Chanchal kumar 2005. Implementing VAT in India: Implications for Federal Polity. Indian Journal of Political Science, LXVI (4): 915-934. [ISSN: 00019-5510][2]

- Shome, P. and B. Spahn (1996) "Brazil: Fiscal Federalism and Value Added Tax Reform," Working Paper No. 11, National Institute of Public Finance and Policy, New Delhi

- Silvani, C. and P. dos Santos (1996) "Administrative Aspects of Brazil's Consumption Tax Reform," International VAT Monitor, 7: 123-32.

- Tait, A.A. (1988) Value Added Tax: International Practice and Problems (Washington: International Monetary Fund).

External links

- Understanding the China VAT Rebate

- VAT Advisory Services

- VAT Related Services at the Open Directory Project

- VAT in INDIA

- What is VAT?: General overview

- An introduction to VAT

- European VAT rates by service type

- German VAT

- VAT/GST sales tax rates around the world

- Consolidated version of the Sixth VAT Directive (398k pdf)

- HM Revenue & Customs

- UK Consumer Protection Approval Order 2005 (Code of Practice for Traders on Price Indications) defines the rules for VAT marking in the UK.

- UK VAT Threshold Rates

- What is the Single Business Tax? (Michigan Department of Treasury)

- A Guide to the latest VAT news in the UK by PricewaterhouseCoopers

- Consumption Tax Act in JAPAN

- VAT system in Romania