Unemployment

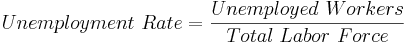

Unemployment occurs when a person is available to work and currently seeking work, but the person is without work.[1] The prevalence of unemployment is usually measured using the unemployment rate, which is defined as the percentage of those in the labor force who are unemployed. The unemployment rate is also used in economic studies and economic indexes such as the United States' Conference Board's Index of Leading Indicators as a measure of the state of the macroeconomics.

There are a variety of different causes of unemployment, and disagreement on which causes are most important. Different schools of economic thought suggest different policies to address unemployment. Monetarists for example, believe that controlling inflation to facilitate growth and investment is more important, and will lead to increased employment in the long run. Keynesians on the other hand emphasize the smoothing out of business cycles by manipulating aggregate demand. There is also disagreement on how exactly to measure unemployment. For example, the conservative government, when in power in the United Kingdom, changed the way in which employment was measured several times. Each time, the figure reduced (Social Trends). Different countries experience different levels of unemployment; the USA currently experiences lower unemployment levels than the European Union,[2][3] and it also changes over time (e.g. the Great depression) throughout economic cycles.

Contents |

Types

According to economist Edmond Malinvaud, the type of unemployment that occurs depends on the situation at the goods market, rather than that they belong to opposing economic theories.[4] If the market for goods is a buyers' market (i.e.: sales are restricted by demand), Keynesian unemployment may ensue while a limiting production capacity is more consistent with classical unemployment.

A common typology of unemployment is the following:

Frictional unemployment

Frictional unemployment occurs when a worker moves from one job to another. While he searches for a job he is experiencing frictional unemployment. This applies for fresh graduates looking for employment as well. This is a productive part of the economy, increasing both the worker's long term welfare and economic efficiency. It is a result of imperfect information in the labour market, because if job seekers knew that they would be employed for a particular job vacancy, almost no time would be lost in getting a new job, eliminating this form of unemployment.

Classical unemployment

Classical or real-wage unemployment occurs when real wages for a job are set above the market-clearing level. This is often ascribed to government intervention, as with the minimum wage, or labour unions. Some, such as Murray Rothbard,[5] suggest that even social taboos can prevent wages from falling to the market clearing level.

Structural unemployment

Structural unemployment is caused by a mismatch between jobs offered by employers and potential workers. This may pertain to geographical location, skills, and many other factors.

If such a mismatch exists, frictional unemployment is likely to be more significant as well. Seasonal unemployment occurs when an occupation is not in demand at certain seasons.

Cyclical or Keynesian unemployment

Cyclical or Keynesian unemployment, also known as demand deficient unemployment, occurs when there is not enough aggregate demand in the economy. This is caused by a business cycle recession, and wages not falling to meet the equilibrium rate.

Causes

There is considerable debate among economists as to the causes of unemployment. Keynesian economics emphasizes unemployment resulting from insufficient effective demand for goods and services in the economy (cyclical unemployment). Others point to structural problems, inefficiencies, inherent in labour markets (structural unemployment). Classical or neoclassical economics tends to reject these explanations, and focuses more on rigidities imposed on the labor market from the outside, such as minimum wage laws, taxes, and other regulations that may discourage the hiring of workers (classical unemployment). Yet others see unemployment as largely due to voluntary choices by the unemployed (frictional unemployment).

Though there have been several definitions of voluntary and involuntary unemployment in the economics literature, a simple distinction is often applied. Voluntary unemployment is attributed to the individual's decisions, whereas involuntary unemployment exists because of the socio-economic environment (including the market structure, government intervention, and the level of aggregate demand) in which individuals operate. In these terms, much or most of frictional unemployment is voluntary, since it reflects individual search behavior. On the other hand, cyclical unemployment, structural unemployment, and classical unemployment, are largely involuntary in nature. However, the existence of structural unemployment may reflect choices made by the unemployed in the past, while classical unemployment may result from the legislative and economic choices made by labor unions and/or political parties. So in practice, the distinction between voluntary and involuntary unemployment is hard to draw. The clearest cases of involuntary unemployment are those where there are fewer job vacancies than unemployed workers even when wages are allowed to adjust, so that even if all vacancies were to be filled, there would be unemployed workers. This is the case of cyclical unemployment, for which macroeconomic forces lead to microeconomic unemployment. See also: unemployment types

Open unemployment is generally associated with capitalist economies. In this view, unemployment is not an aberration of capitalism, indicating any sort of systemic malfunction. Rather, unemployment is a necessary structural feature of capitalism, intended to discipline the workforce. If unemployment is too low, workers make wage demands that either cuts into profits to an extent that jeopardize future investment, or are passed on to consumers, thus generating inflationary instability. David Schweickart suggests, "Capitalism cannot be a full-employment economy, except in the very short term. For unemployment is the "invisible hand" -- carrying a stick -- that keeps the workforce in line."[6].

Classical economists dispute this, arguing that when there is too high a supply of labour, providing unions and Government have no prevented wage changes, the wage rate should fall, returning the economy to its long run efficient position at full employment.

Libertarian thinkers like F.A. Hayek claimed that unemployment increases the more the government intervenes into the economy to try to improve the rights of those with jobs. For example, he asserted that minimum wages raise the cost of labour to above the market equilibrium, resulting in people who wish to work at the going rate but cannot as the wages are higher than their worth to business; unemployment.[7][8] They believed that laws restricting layoffs made businesses less likely to hire in the first place leaving many young people unemployed and unable to find work.[8]

This school (the Austrian School) argued that the results of both actions lead to less productivity and are claimed to incur a higher cost on society as a whole. The results lead to not just higher unemployment but may increase poverty. The narrative continued by saying that the welfare state then responds with various benefits that are paid for by the middle and upper class which reduces their ability to consume and reduces the incentive to work hard and innovate for all sections of society, as the poor have income without working and the rich see their reward for work reduced.[9] Economists like Ludwig Von Mises, Milton Friedman, Friedrich Von Hayek not only believe that the welfare of society decreases with this kind of intervention[10] but that these economic policies are not sustainable.

One of the explanations behind (structural unemployment) and a warning that this kind of unemployment could be permanent in modern society, came from economist and philosopher André Gorz.The microchip revolution and the explosion in computer science and robotising of work even in less developed industrialized countries is the main reason.

He therefore argues that the idea of `working less so everyone can work and that an basic income for all must be the solution,and he explains: "The connection between more and better has been broken; our needs for many products and services are already more than adequately met, and many of our as-yet- unsatisfied needs will be met not by producing more, but by producing differently, producing other things, or even producing less. This is especially true as regards our needs for air, water, space, silence, beauty, time and human contact...

"From the point where it takes only 1,000 hours per year or 20,000 to 30,000 hours per lifetime to create an amount of wealth equal to or greater than the amount we create at the present time in 1,600 hours per year or 40,000 to 50,000 hours in a working life, we must all be able to obtain a real income equal to or higher than our current salaries in exchange for a greatly reduced quantity of work...

"Neither is it true any longer that the more each individual works, the better off everyone will be. The present crisis has stimulated technological change of an unprecedented scale and speed: `the microchip revolution'. The object and indeed the effect of this revolution has been to make rapidly increasing savings in labour, in the industrial, administrative and service sectors. Increasing production is secured in these sectors by decreasing amounts of labour. As a result, the social process of production no longer needs everyone to work in it on a full-time basis. The work ethic ceases to be viable in such a situation and workbased society is thrown into crisis," André Gorz, Critique of Economic Reason,Gallié, 1989.

Okun's Law

Okun's law states that for every 2% GDP falls relative to potential GDP, unemployment rises 1% (of the total workforce). When the economy operates at productive capacity, it will experience the Natural rate of unemployment. [11]

U= ^u-h[100(y/yn)-100]

Solutions

Societies try a number of different measures to get as many people as possible into work. However, attempts to reduce the level of unemployment beyond the Natural rate of unemployment generally fail, resulting only in less output and more inflation.

Phillips Curve

It used to be largely believed that unemployment could be solved using the Phillips curve. This involves increasing inflation to reduce unemployment by fooling workers into accepting jobs at a lower rate than they would otherwise have done, due to the declining value of money.[12] However, since the work of Milton Friedman, it is widely accepted that the Phillips curve is vertical in the long run: you cannot achieve a lowering of the unemployment rate in the long run, and attempts to do so will only cause inflation.

Demand side

Normal markets reach equilibrium, where supply equals demand; everyone who wants to sell at the market price can. Those who do not want to sell at this price do not; in the labour market this is classical unemployment. Increases in the demand for labour will move the economy along the demand curve, increasing wages and employment. The demand for labour in an economy is derived from the demand for goods and services. As such, if the demand for goods and services in the economy increases, the demand for labour will increase, increasing employment and wages.

Monetary policy and fiscal policy can both be used to increase short-term growth in the economy, increasing the demand for labour and decreasing unemployment.

Supply side

However, the labour market is not efficient: it doesn't clear. Minimum wages and union activity keep wages from falling, which means too many people want to sell their labour at the going price but cannot. Supply-side policies can solve this by making the labour market more flexible. These include removing the minimum wage and reducing the power of unions, which act as a labour cartel. Other supply side policies include education to make workers more attractive to employers.

Supply side reforms also increase long-term growth. This increased supply of goods and services requires more workers, increasing employment. It is argued that supply side policies, which include cutting taxes on businesses and reducing regulation, create jobs and reduce unemployment.

One structural solution to unemployment proposed was a graduated retail tax, or "jobs levy", to firms where labor is more expensive than capital. This method will shift tax burden to capital intensive firms and away from labor intensive firms. In theory this will make firms shift operations to a more politically desired balance between labor intensive and capital intensive production. The excess tax revenue from the jobs levy would finance labor intensive public projects.[13] However, by raising the value of labour artificially above capital, this would discourage capital investment, the source of economic growth. With less growth, long-run employment would fall.

Costs of unemployment

Individual

Unemployed individuals are unable to earn money to meet financial obligations. Failure to pay mortgage payments or to pay rent may lead to homelessness through foreclosure or eviction. Unemployment increases susceptibility to malnutrition, illness, mental stress, and loss of self-esteem, leading to depression. According to a study published in Social Indicator Research, even those who tend to be optimistic find it difficult to look on the bright side of things when unemployed. Using interviews and data from German participants aged 16 to 94 – including individuals coping with the stresses of real life and not just a volunteering student population – the researchers determined that even optimists struggled with being unemployed.[14]

Dr. M. Brenner conducted a study in 1979 on the "Influence of the Social Environment on Psychology." Brenner found that for every 10% increase in the number of unemployed there is a 1.2% in total mortality, a 1.7% increase in cardiovascular disease, 1.3% more cirrhosis cases, 1.7% more suicides, 0.4% more arrests, and 0.8% more assaults reported to the police.[15] A more recent study by Christopher Ruhm[16] on the effect of recessions on health found that several measures of health actually improve during recessions. As for the impact of an economic downturn on crime, during the Great Depression the crime rate did not decrease. Because unemployment insurance in the U.S. typically does not replace 50% of the income one received on the job (and one cannot receive it forever), the unemployed often end up tapping welfare programs such as Food Stamps or accumulating debt. Higher government transfer payments in the form of welfare and food stamps decrease spending on productive economic goods, decreasing GDP.

Some hold that many of the low-income jobs are not really a better option than unemployment with a welfare state (with its unemployment insurance benefits). But since it is difficult or impossible to get unemployment insurance benefits without having worked in the past, these jobs and unemployment are more complementary than they are substitutes. (These jobs are often held short-term, either by students or by those trying to gain experience; turnover in most low-paying jobs is high) Unemployment insurance keeps an available supply of workers for the low-paying jobs, while the employers' choice of management techniques (low wages and benefits, few chances for advancement) is made with the existence of unemployment insurance in mind. This combination promotes the existence of one kind of unemployment, frictional unemployment.

Another cost for the unemployed is that the combination of unemployment, lack of financial resources, and social responsibilities may push unemployed workers to take jobs that do not fit their skills or allow them to use their talents. Unemployment can cause underemployment.

The fear of job loss can spur psychological anxiety.

Society

An economy with high unemployment is not using all of the resources, i.e. labour, available to it. Since it is operating below its production possibility frontier, it could have higher output if all the workforce were usefully employed. However, there is a trade off between economic efficiency and unemployment: if the frictionally unemployed accepted the first job they were offered, they would be likely to be operating at below their skill level, reducing the economy's efficiency.[12]

It is estimated that, during the Great Depression, unemployment due to sticky wages cost the US economy about $4 trillion. This is many times larger than losses due to monopolies, cartels and tariffs.

During a long period of unemployment, workers can lose their skills, causing a loss of human capital. Being unemployed can also reduce the life expectancy of workers by about 7 years [17]

High unemployment can encourage xenophobia and protectionism as workers fear that foreigners are stealing their jobs. Efforts to preserve existing jobs of domestic and native workers include legal barriers against "outsiders" who want jobs, obstacles to immigration, and/or tariffs and similar trade barriers against foreign competitors.

Finally, a rising unemployment rate concentrates the oligopsony power of employers by increasing competition amongst workers for scarce employment opportunities..

Historical unemployment

Preliterate communities treat their members as parts of an extended family and thus do not allow unemployment. In precapitalist societies such as European feudalism, the serfs were never "unemployed" because they had direct access to the land, and the needed tools, and could thus work to produce crops. Just as on the American frontier during the nineteenth century, there were day laborers and subsistence farmers on poor land, whose position in society was somewhat analogous to the unemployed of today. But they were not truly unemployed, since they could find work and support themselves on the land.

Under both ancient and modern systems of slave-labor, slave-owners never let their property be unemployed for long. (If anything, they would sell the unneeded laborer.) Planned economies such as the old Soviet Union or today's Cuba typically provide occupation for everyone, using substantial overstaffing if necessary. (This is called "hidden unemployment," which is sometimes seen as a kind of underemployment, definition 3.) Workers' cooperatives—such as those producing plywood in the U.S. Pacific Northwest—do not let their members become unemployed unless the co-op itself goes bankrupt.

Measurement

Though many people care about the number of unemployed, economists typically focus on the unemployment rate. This corrects for the normal increase in the number of people employed due to increases in population and increases in the labor force relative to the population. The unemployment rate is expressed as a percentage, and is calculated as follows:

As defined by the International Labour Organization, "unemployed workers" are those who are currently not working but are willing and able to work for pay, currently available to work, and have actively searched for work.[18]

Since not all unemployment may be "open" and counted by government agencies, official statistics on unemployment may not be accurate.

The ILO describes 4 different methods to calculate the unemployment rate:[19]

- Labour Force Sample Surveys are the most preferred method of unemployment rate calculation since they give the most comprehensive results and enables calculation of unemployment by different group categories such as race and gender. This method is the most internationally comparable.

- Official Estimates are determined by a combination of information from one or more of the other three methods. The use of this method has been declining in favor of Labour Surveys.

- Social Insurance Statistics such as unemployment benefits, are computed base on the number of persons insured representing the total labour force and the number of persons who are insured that are collecting benefits. This method has been heavily criticized due to the expiration of benefits before the person finds work.

- Employment Office Statistics are the least effective being that they only include a monthly tally of unemployed persons who enter employment offices. This method also includes unemployed who are not unemployed per the ILO definition.

European Union (Eurostat)

Eurostat, the statistical office of the European Union, defines unemployed as those persons age 15 to 74 who are not working, have looked for work in the last four weeks, and ready to start work within two weeks, which conform to ILO standards. Both the actual count and rate of employment are reported. Statistical data is available by member state, EU12, EU15, EU25, EU27, EA11, and EA13. Eurostat also includes a long-term unemployment rate. This is defined as part of the unemployed who have been unemployed for an excess of 1 year.[20]

Three methods of data collection are used in the European Union. The European Union Labour Force Survey (EU-LFS) collects data on all member states each quarter. For monthly calculations, national surveys or national registers from employment offices are used in conjunction with quarterly EU-LFS data. Monthly unemployment rates are interpolated from monthly data from member states to provide "harmonized data."[21]

At this time Germany's unemployment data is collected separately from the (EU-LFS).

United States Bureau of Labor Statistics

The Bureau of Labor Statistics measures employment and unemployment (of those over 15 years of age) using two different labor force surveys[22] conducted by the United States Census Bureau (within the United States Department of Commerce) and/or the Bureau of Labor Statistics (within the United States Department of Labor) that gather employment statistics monthly. The Current Population Survey (CPS), or "Household Survey", conducts a survey based on a sample of 60,000 households. This Survey measures the unemployment rate based on the ILO definition.[23]The data is also used to calculate 5 other unemployment rates as a percentage of the labor force based on different definitions noted as U1 through U6:[24]

- U1: Percentage of labor force unemployed 15 weeks or longer.

- U2: Percentage of labor force who lost jobs or completed temporary work.

- U3: Official unemployment rate per ILO definition.

- U4: U3 + "discouraged workers", or those who have stopped looking for work because current economic conditions make them believe that no work is available for them.

- U5: U4 + other "marginally attached workers", or those who "would like" and are able to work, but have not looked for work recently.

- U6: U5 + Part time workers who want to work full time, but can not due to economic reasons.

Note: "Marginally attached workers" are added to the total labor force for unemployment rate calculation for U4, U5, and U6.

The Current Employment Statistics survey (CES), or "Payroll Survey", conducts a survey based on a sample of 160,000 businesses and government agencies that represent 400,000 individual employers.[25] This survey measures only nonagricultural, nonsupervisory employment; thus, it does not calculate an unemployment rate, and it differs from the ILO unemployment rate definition. These two sources have different classification criteria, and usually produce differing results. Additional data is also available from the government, such as the unemployment insurance weekly claims report available from the Office of Workforce Security, within the U.S. Department of Labor Employment & Training Administration.[26]

These statistics are for the U.S. economy as a whole, hiding variations among groups. For January 2008 in the U.S. the unemployment rates were 4.4% for adult men, 4.2% for adult women, 4.4% for Caucasians, 6.3% for Hispanics or Latinos (all races), 9.2% for African Americans, 3.2% for Asian Americans, and 18.0% for teenagers.[25]

These percentages represent the usual rough ranking of these different groups' unemployment rates. The absolute numbers change over time and with the business cycle. The Bureau of Labor Statistics provides up-to-date numbers via a pdf linked here. The BLS also provides a readable concise current Employment Situation Summary, updated monthly.[27]

Limitations of the unemployment definition

The unemployment rate may be different from the impact of the economy on people. The unemployment figures indicate how many are not working for pay but seeking employment for pay. It is only indirectly connected with the number of people who are actually not working at all or working without pay. Therefore, critics believe that current methods of measuring unemployment are inaccurate in terms of the impact of unemployment on people as these methods do not take into account the 1.5% of the available working population incarcerated in U.S. prisons (who may or may not be working while incarcerated), those who have lost their jobs and have become discouraged over time from actively looking for work, those who are self-employed or wish to become self-employed, such as tradesmen or building contractors or IT consultants, those who have retired before the official retirement age but would still like to work (involuntary early retirees), those on disability pensions who, while not possessing full health, still wish to work in occupations suitable for their medical conditions, those who work for payment for as little as one hour per week but would like to work full-time. These people are "involuntary part-time" workers, those who are underemployed, e.g., a computer programmer who is working in a retail store until he can find a permanent job, involuntary stay-at-home mothers who would prefer to work, and graduate and Professional school students who were unable to find worthwhile jobs after they graduated with their Bachelor's degrees.

On the other hand, the measures of employment and unemployment may be "too high". In some countries, the availability of unemployment benefits can inflate statistics since they give an incentive to register as unemployed. People who do not really seek work may choose to declare themselves unemployed so as to get benefits; people with undeclared paid occupations may try to get unemployment benefits in addition to the money they earn from their work. Conversely, the absence of any tangible benefit for registering as unemployed discourages people from registering.

However, in countries such as the United States, Canada, Mexico, Australia, Japan and the European Union, unemployment is measured using a sample survey (akin to a Gallup poll). According to the BLS, a number of Eastern European nations have instituted labor force surveys as well. The sample survey has its own problems because the total number of workers in the economy is calculated based on a sample rather than a census.

It is possible to be neither employed nor unemployed by ILO definitions, i.e., to be outside of the "labor force." These are people who have no job and are not looking for one. Many of these are going to school or are retired. Family responsibilities keep others out of the labor force. Still others have a physical or mental disability which prevents them from participating in labor force activities.

Typically, employment and the labor force include only work done for monetary gain. Hence, a homemaker is neither part of the labor force nor unemployed. Nor are full-time students nor prisoners considered to be part of the labor force or unemployment. The latter can be important. In 1999, economists Lawrence F. Katz and Alan B. Krueger estimated that increased incarceration lowered measured unemployment in the United States by 0.17% between 1985 and the late 1990s. In particular, as of 2005, roughly 0.7% of the US population is incarcerated (1.5% of the available working population).

Children, the elderly, and some individuals with disabilities are typically not counted as part of the labor force in and are correspondingly not included in the unemployment statistics. However, some elderly and many disabled individuals are active in the labor market.

In the early stages of an economic boom, unemployment often rises. This is because people join the labor market (give up studying, start a job hunt, etc.) because of the improving job market, but until they have actually found a position they are counted as unemployed. Similarly, during a recession, the increase in the unemployment rate is moderated by people leaving the labor force or being otherwise discounted from the labor force, such as with the self-employed.

For the fourth quarter of 2004, according to OECD, (source Employment Outlook 2005 ISBN 92-64-01045-9), normalized unemployment for men aged 25 to 54 was 4.6% in the USA and 7.4% in France. At the same time and for the same population the employment rate (number of workers divided by population) was 86.3% in the U.S. and 86.7% in France.

This example shows that the unemployment rate is 60% higher in France than in the USA, yet more people in this demographic are working in France than in the USA, which is counterintuitive if it is expected that the unemployment rate reflects the health of the labor market.[28] [29].

Due to these deficiencies, many labor market economists prefer to look at a range of economic statistics such as labor market participation rate, the percentage of people aged between 15 and 64 who are currently employed or searching for employment, the total number of full-time jobs in an economy, the number of people seeking work as a raw number and not a percentage, and the total number of person-hours worked in a month compared to the total number of person-hours people would like to work. In particular the NBER does not use the unemployment rate but prefer various employment rates to date recessions [30].

Aiding the unemployed

The most developed countries have aids for the unemployed as part of the welfare state. These unemployment benefits include unemployment insurance, welfare, unemployment compensation and subsidies to aid in retraining. The main goal of these programs is to alleviate short-term hardships and, more importantly, to allow workers more time to search for a good job.

In the U.S. the unemployment insurance allowance one receives is based solely on previous income (not time worked, family size, etc.) and usually compensates for one-third of one's previous income. To qualify, one must reside in their respective state for at least a year and, of course, work. The system was established by the Social Security Act of 1935. While 90% of citizens are covered on paper, only 40% could actually receive benefits. In cases of highly seasonal industries the system provides income to workers during the off seasons, thus encouraging them to stay attached to the industry.

In the United States the New Deal made unemployment relief a top governmental priority. The goal of the Works Progress Administration (WPA) was to employ most of the unemployed people on relief until the economy recovered. FERA/WPA director Harry Hopkins testified to Congress in January 1935 why he set the number at 3.5 million, using FERA data. At $1200 per worker per year he asked for and received $4 billion.

"On January 1 there were 20 million persons on relief in the United States. Of these, 8.3 million were children under sixteen years of age; 3.8 million were persons who, though between the ages of sixteen and sixty-five were not working nor seeking work. These included housewives, students in school, and incapacitated persons. Another 750,000 were persons sixty-five years of age or over. Thus, of the total of 20 million persons then receiving relief, 12.85 million were not considered eligible for employment. This left a total of 7.15 million presumably employable persons between the ages of sixteen and sixty-five inclusive. Of these, however, 1.65 million were said to be farm operators or persons who had some non-relief employment, while another 350,000 were, despite the fact that they were already employed or seeking work, considered incapacitated. Deducting this two million from the total of 7.15 million, there remained 5.15 million persons sixteen to sixty-five years of age, unemployed, looking for work, and able to work. Because of the assumption that only one worker per family would be permitted to work under the proposed program, this total of 5.15 million was further reduced by 1.6 million--the estimated number of workers who were members of families which included two or more employable persons. Thus, there remained a net total of 3.55 million workers in as many households for whom jobs were to be provided." [Howard p 562, paraphrasing Hopkins]

The WPA did not quite reach 3.5 million--its maximum was 3.3 million in November 1938. Worker pay was based on three factors: the region of the country, the degree of urbanization and the individual's skill. It varied from $19/month to $94/month. The goal was to pay the local prevailing wage, but to limit a person to 30 hours or less a week of work. About 75% of WPA employment and 75% of WPA expenditures went to public infrastructure, such as highways, airports, parks and libraries.

The WPA had numerous critics who said that political considerations helped decide which states received the most funding. Civil rights leaders often complained that African Americans were proportionally underrepresented. In New Jersey, they argued, "In spite of the fact that Negroes indubitably constitute more than 20% of the State's unemployed, they composed 15.9% of those assigned to W.P.A. jobs during 1937." [Howard 287] Nationwide in late 1937, 15.2% were African American. The NAACP magazine Opportunity hailed the WPA: [February, 1939, p. 34. in Howard 295]

It is to the eternal credit of the administrative officers of the WPA that discrimination on various projects because of race has been kept to a minimum and that in almost every community Negroes have been given a chance to participate in the work program. In the South, as might have been expected, this participation has been limited, and differential wages on the basis of race have been more or less effectively established; but in the northern communities, particularly in the urban centers, the Negro has been afforded his first real opportunity for employment in white-collar occupations

Congress shut down the WPA in late 1943 as World War II created thousands of jobs in the military.

| Year | 1936 | 1937 | 1938 | 1939 | 1940 | 1941 |

|---|---|---|---|---|---|---|

| Workers employed | ||||||

| WPA | 1,995 | 2,227 | 1,932 | 2,911 | 1,971 | 1,638 |

| CCC and NYA | 712 | 801 | 643 | 793 | 877 | 919 |

| Other federal work projects | 554 | 663 | 452 | 488 | 468 | 681 |

| Public assistance cases | ||||||

| Social security programs | 602 | 1,306 | 1,852 | 2,132 | 2,308 | 2,517 |

| General relief | 2,946 | 1,484 | 1,611 | 1,647 | 1,570 | 1,206 |

| Total families helped | 5,886 | 5,660 | 5,474 | 6,751 | 5,860 | 5,167 |

| Unemployed workers (Bur Lab Stat) | 9,030 | 7,700 | 10,390 | 9,480 | 8,120 | 5,560 |

| Coverage (cases/unemployed) | 65% | 74% | 53% | 71% | 72% | 93% |

source: Donald S. Howard, WPA and Federal Relief Policy. 1943 p 34.

| Year | Unemployment (% labor force) |

|---|---|

| 1933 | 24.9 |

| 1934 | 21.7 |

| 1935 | 20.1 |

| 1936 | 16.9 |

| 1937 | 14.3 |

| 1938 | 19.0 |

| 1939 | 17.2 |

| 1940 | 14.6 |

| 1941 | 9.9 |

| 1942 | 4.7 |

| 1943 | 1.9 |

| 1944 | 1.2 |

| 1945 | 1.9 |

source: Historical Statistics US (1976) series D-86

See also welfare and training.

Involuntary unemployment

Say's law declares that, in time, "markets clear" in an unfettered, unregulated laissez-faire economy: every seller will find a buyer at some strike price, and every buyer will find a seller at some strike price. Sellers and buyers may refuse the strike price but this personal decision is voluntary, which causes the selling or buying to leave the economic model. This theory relies heavily on the absence of government regulation and assumes a developed economy without sabotage where labor strikes, as opposed to strike (mutually agreed upon) prices, are illegal.

Keynes tried to demonstrate in The General Theory of Employment, Interest and Money that Say's law did not work in the real world of the 1930s Depression because of oversaving and private investor timidity, and that in consequence people could be thrown out of work involuntarily without being able to find acceptable new jobs.

This conflict of the neoclassical and Keynesian theories has had strong influence on government policy. The tendency for government is to curtail and eliminate unemployment through increases in benefits and government jobs, and to encourage the job-seeker to both consider new careers and relocation to another city. This tends to broaden the "market" to a national level far beyond that with which most people are comfortable.

Involuntary unemployment does not exist in agrarian societies nor is it formally recognized to exist in underdeveloped but urban societies such as the mega-cities of Africa and of India/Pakistan, given that, in such societies, the suddenly unemployed person must meet his survival needs, by getting a new job quickly at any strike price, entrepreneurship, or joining the invisible economy of the hustler.[31]

From the narrative standpoint, involuntary unemployment is discussed in the stories by Ehrenreich, the narrative sociology of Bourdieu, and novels of social suffering such as John Steinbeck's Of Mice and Men.

Benefits

Unemployment may have advantages as well as disadvantages for the overall economy. Notably, it may help avert runaway inflation, which negatively affects almost everyone in the affected economy and has serious long-term economic costs. However the historic assumption that full local employment must lead directly to local inflation has been attenuated, as recently expanded international trade has shown itself able to continue to supply low-priced goods even as local employment rates rise closer to full employment.

The inflation-fighting benefits to the entire economy arising from a presumed optimum level of unemployment has been studied extensively. Before current levels of world trade were developed, unemployment was demonstrated to reduce inflation, following the Phillips curve, or to decelerate inflation, following the NAIRU/natural rate of unemployment theory.

Beyond the benefits of controlled inflation, frictional unemployment provides employers a larger applicant pool from which to select employees better suited to available jobs. The unemployment needed for this purpose may be very small, however, since it is relatively easy to seek a new job without losing one's current one. And when more jobs are available for fewer workers (lower unemployment), it may allow workers to find the jobs that better fit their tastes, talents, and needs.

As in the Marxian theory of unemployment, special interests may also benefit: some employers may expect that employees with no fear of losing their jobs will not work as hard, or will demand increased wages and benefit. According to this theory, unemployment may promote general labor productivity and profitability by increasing employers' monopsony-like power (and profits).

Optimal unemployment has also been defended as an environmental tool to brake the constantly accelerated growth of the GDP to maintain levels sustainable in the context of resource constraints and environmental impacts. However the tool of denying jobs to willing workers seems a blunt instrument for conserving resources and the environment -- it reduces the consumption of the unemployed across the board, and only in the short-term. Full employment of the unemployed workforce, all focused toward the goal of developing more environmentally efficient methods for production and consumption might provide a more significant and lasting cumulative environmental benefit and reduced resource consumption.[32] If so the future economy and workforce would benefit from the resultant structural increases in the sustainable level of GDP growth.

Some critics of the "culture of work" such as anarchist Bob Black see employment as overemphasized culturally in modern countries. Such critics often propose quitting jobs when possible, working less, reassessing the cost of living to this end, creation of jobs which are "fun" as opposed to "work," and creating cultural norms where work is seen as unhealthy. These people advocate an "anti-work" ethic for life.

See also

- Employment gap

- Employment Protection Legislation

- Employment rate

- Labour market

- List of countries by unemployment rate

- List of U.S. states by unemployment rate

- NAIRU

- Poverty

- Underemployment

- Unemployment benefit

- Waithood

- Workfare

- Youth Exclusion

References

- ↑ "International Labour Organization: Resolution concerning statistics of the economically active population, employment, unemployment and underemployment, adopted by the Thirteenth International Conference of Labour Statisticians (October 1982); see page 4; accessed November 26, 2007" (PDF).

- ↑ Cato Daily Dispatch

- ↑ CIA - The World Factbook - Rank Order - Unemployment rate

- ↑ Edmond Malinvaud, "The theory of unemployment reconsidered", Oxford: Basil Blackwell, 1977, ISBN 0631144757

- ↑ America's Great Depression p. 45

- ↑ Schweickart, David (2002). After Capitalism. Rowman & Littlefield Publishers, Inc.. p. 97. ISBN 0-7425-1299-1.

- ↑ F. A. Hayek, The Constitution of Liberty

- ↑ 8.0 8.1 Alain Anderson, Economics. Fourth edition, 2006

- ↑ Keynes for Beginners, Peter Pugh and Chris Garratt, 1993

- ↑ Politics Causes Unemployment - Hans F. Sennholz - Mises Institute

- ↑ Alain Anderson, Economics. Fourth Edition, 2006

- ↑ 12.0 12.1 PThy_Edn_1_Chap_23.rtf

- ↑ Robert Struble, Jr., "Toward a Structural Solution to Unemployment" International Journal of Social Economics 20, no. 11 (1993): 15-26. Also seen in Treatise on Twelve Lights, (2007-08 ed.), chapter 8, "Bolstering Workers: Structuring Full-Employment into Capitalism."

- ↑ Even Optimists Get the Blues When Pink-slipped Newswise, Retrieved on October 27, 2008.

- ↑ Richard Ashley (2007). "Fact sheet on the impact of unemployment" (PDF). Virginia Tech, Department of Economics. Retrieved on 2007-10-11, 2007.

- ↑ Christopher Ruhm, "Are Recessions Good for Your Health?", Quarterly Journal of Economics 2000, 115(2): 617-650

- ↑ Alain Anderson, Economics. Fourth Edition 2006

- ↑ International Labour Organization, Bureau of Statistics,The Thirteenth International Conference of Labour Statisticians, received July 21, 2007

- ↑ International Labour Organization, LABORSTA,[1], retrieved July 22,2007

- ↑ "European Commission, Eurostat". Retrieved on July 23, 2007.

- ↑ "European Commission, Eurostat". Retrieved on July 23, 2007.

- ↑ United States, Bureau of Labor Statistics,[2], retrieved July 23, 2007

- ↑ U.S. Department of Labor, Bureau of Labor Statistics, Current Population Survey overview, retrieved May 25, 2007

- ↑ U.S. Department of Labor, Bureau of Labor Statistics, [3], retrieved August 22, 2007

- ↑ 25.0 25.1 U.S. Department of Labor, Bureau of Labor Statistics, "The Employment Situation: January 2008", January 2008

- ↑ U.S. Department of Labor, Employment & Training Administration, Office of Workforce Security, UI Weekly Claims

- ↑ Employment Situation Summary

- ↑ "Dean Baker, Center for Economic and Policy Research".

- ↑ Raymond Torres, OECD head of Employment Analysis, Le Monde, 30 mai 2007 : unemployment measure is less and less meaningful to measure labour market efficiency.

- ↑ Determination of the December 2007 Peak in Economic Activity, November 28, 2008

- ↑ Bourdieu, Pierre. THE WEIGHT OF THE WORLD: Social Suffering in Contemporary Society.

- ↑ http://treehugger.com/files/2008/02/4_reasons_recession_bad_environment.php Counter-Point: 4 Reasons Why Recession is BAD for the Environment by Michael Graham Richard, Gatineau, Canada on 02. 6.08 Business & Politics

External links

- Economic Policy Institute

- U.S. Unemployment Rate time-series chart of the United States Historical Unemployment Rate

- Current unemployment rates by country

|

|||||||||||||||||||||||