United States dollar

| United States dollar | |||||

|

|||||

| ISO 4217 Code | USD | ||||

|---|---|---|---|---|---|

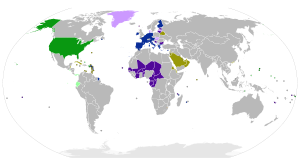

| Official user(s) | |||||

| Unofficial user(s) |

10 countries and territories

|

||||

| Inflation | 2.7% (United States only) | ||||

| Source | The World Factbook, 2007 est. | ||||

| Pegged by |

22 currencies

|

||||

| Subunit | |||||

| 1/10 | Dime | ||||

| 1/100 | Cent | ||||

| 1/1000 | Mill | ||||

| Symbol | $ or US$ | ||||

| Cent | ¢ or c | ||||

| Mill | ₥ | ||||

| Nickname | Buck, green, and greenback. Also, Washingtons, Jeffersons, Lincolns, Benjamins, and Hamiltons are used based on denomination;[1] also peso in Puerto Rico, and piastre in Cajun Louisiana. | ||||

| Coins | |||||

| Freq. used | 1¢, 5¢, 10¢, 25¢ | ||||

| Rarely used | 50¢, $1 | ||||

| Banknotes | |||||

| Freq. used | $1, $5, $10, $20, | ||||

| Rarely used | $2, $50, $100 | ||||

| Central bank | Federal Reserve Bank | ||||

| Website | www.federalreserve.gov | ||||

| Printer | Bureau of Engraving and Printing | ||||

| Website | www.moneyfactory.gov | ||||

| Mint | United States Mint | ||||

| Website | www.usmint.gov | ||||

The United States dollar (sign: $; code: USD) is the unit of currency of the United States. The U.S. dollar is normally abbreviated as the dollar sign, $, or as USD or US$ to distinguish it from other dollar-denominated currencies and from others that use the $ symbol. It is divided into 100 cents.

Taken over by the Congress of the Confederation of the United States on July 6, 1785,[2] the U.S. dollar is the currency most used in international transactions.[3] Several countries use the U.S. dollar as their official currency, and in many others it is the de facto currency.[4]

Contents |

Overview

The U.S. dollar uses the decimal system, consisting of 100 equal cents (symbol ¢). In another division, there are 1,000 mills or ten dimes to a dollar, or 4 quarters to a dollar; additionally, the term eagle was used in the Coinage Act of 1792 for the denomination of ten dollars, and subsequently was used in naming gold coins. In the second half of the 19th century there were occasional discussions of creating a $50 gold coin, which was referred to as a "Half Union," thus implying a denomination of 1 Union = $100. However, only cents are in everyday use as divisions of the dollar; "dime" is used solely as the name of the coin with the value of 10¢, while "eagle" and "mill" are largely unknown to the general public, though mills are sometimes used in matters of tax levies and gasoline prices. When currently issued in circulating form, denominations equal to or less than a dollar are emitted as U.S. coins while denominations equal to or greater than a dollar are emitted as Federal Reserve notes (with the exception of gold, silver and platinum coins valued up to $100 as legal tender, but worth far more as bullion). (Both one-dollar coins and notes are produced today, although the note form is significantly more common.) In the past, paper money was occasionally issued in denominations less than a dollar (fractional currency) and gold coins were issued for circulation up to the value of $20 (known as the "double eagle", discontinued in the 1930s).

U.S. coins are produced by the United States Mint. U.S. dollar banknotes are printed by the Bureau of Engraving and Printing, and, since 1914, have been issued by the Federal Reserve. The "large-sized notes" issued before 1928 measured 7.42 inches (188 mm) by 3.125 inches (79.4 mm); small-sized notes, introduced that year, measure 6.14 inches (156 mm) by 2.61 inches (66 mm) by 0.0043 inches (0.11 mm).

Etymology

The name Thaler (from German thal, or nowadays usually Tal, "valley", cognate with "dale" in English) came from the German coin Guldengroschen ("great guilder", being of silver but equal in value to a gold guilder), minted from the silver from a rich mine at Joachimsthal (St. Joachim's Valley, now Jáchymov) in Bohemia (then part of the Holy Roman Empire, now part of the Czech Republic).

For further history of the name, see dollar.

Nicknames

The colloquialism buck (much like the British term "quid") is often used to refer to dollars of various nations, including the U.S. dollar. This term, dating to the 18th century, may have originated with the colonial fur trade. Greenback is another nickname originally applied specifically to the 19th century Demand Note dollars created by Abraham Lincoln to finance the costs of the Civil War for the North. The original note was printed in black and green on the back side. It is still used to refer to the U.S. dollar (but not to the dollars of other countries).

Grand, sometimes shortened to simply G, is a common term for the amount of $1,000. The suffix k (from "kilo-") is also commonly used to denote this amount (such as "$10k" to mean $10,000). Banknotes' nicknames are usually the same as their values (such as five, twenty, etc.) The $5 bill has been referred to as a "fin" or a "fiver" or a "five-spot;" the $10 bill as a "sawbuck," a "ten-spot," or a "Hamilton"; the $20 bill as a "double sawbuck," a "twomp," a "twenty-banger," or a "Jackson"; the $1 bill is sometimes called a "single," the $2 bill a "deuce" or a "Tom," and the $100 bill is nicknamed the hunsky, a "Benjamin," "Benjie," or "Frank" (after Benjamin Franklin, who is pictured on the note), C-note (C being the Roman numeral for 100), Century Note, or "bill" ("two bills" being $200, etc.). The dollar has also been referred to as a "bone" or "bones" (i.e. twenty bones is equal to $20) or a "bean" for slang on the East Coast (primarily in New York). Occasionally these will be referred to as "dead presidents," although neither Hamilton ($10) nor Franklin ($100) was President. $100 notes are occasionally referred to as 'large' in banking ("twenty large" being $2,000, etc.). The newer designs are sometimes referred to as "Bigface" bills.

In Panama, the translation of buck is palo (lit. stick); a nickname for the balboa. For example: "Esto vale 20 palos" ("This is worth 20 bucks"). In Puerto Rico (as well as by Puerto Ricans living in the continental U.S.), the dollar may be referred to as a peso. In French-speaking areas of Louisiana, the dollar is referred to as a piastre which is pronounced "pee-as", and cents by the French holdhover of sous, pronounced "soo." In Mexico, prices in dollars are referred in some places to as "en americano" ("in american"): one would ask "¿Cuánto cuesta en americano?" ("How much does it cost 'in american'?") and would receive the U.S. dollar price in the Spanish language. (In Mexico, peso is used primarily for the Mexican peso.) In Peru, a nickname for the U.S. dollar is coco, which is a pet name for Jorge (George in Spanish), an alleged reference to the portrait of George Washington on the $1 note.

Dollar sign

The symbol $, usually written before the numerical amount, is used for the U.S. dollar (as well as for many other currencies). The sign's ultimate origins are not certain, though it is widely accepted that it comes from the symbol for the New Spanish peso which in turn comes from the Spanish Coat of arms. This takes the form of two vertical bars and a swinging cloth band in the shape of an "S".

History

- See also: History of the United States dollar

The first dollar coins issued by the United States Mint were of the same size and composition as the Spanish dollar and even after the American Revolutionary War the Spanish and U.S. silver dollars circulated side by side in the United States. The coinage of various English colonies also circulated. The lion dollar was popular in the Dutch New Netherland Colony (New York), but the lion dollar also circulated throughout the English colonies during the seventeenth and early eighteenth centuries. Examples circulating in the colonies were usually worn so that the design was not fully distinguishable, thus they were sometimes referred to as "dog dollars".[5]

The U.S. dollar was originally created and defined by the Coinage Act of 1792. It specified a "dollar" to be between 371 and 416 grains (27.0 g) of silver (depending on purity) and an 'eagle" to be between 247 and 270 grains (17 g) of gold (again depending on purity). It set the value of an eagle at 10 dollars, and the dollar at 1/10th eagle. It called for 90% silver alloy coins in denominations of 1, 1/2, 1/4, 1/10, and 1/20; it called for 90% gold alloy coins in denominations of 1, 1/2, 1/4, and 1/10.

The value of gold or silver contained in the dollar was then converted into relative value in the economy for the buying and selling of goods. This allowed the value of things to remain fairly constant over time, except for the influx and outflux of gold and silver in the nation's economy.

For articles on the currencies of the colonies and states, see Connecticut pound, Delaware pound, Georgia pound, Maryland pound, Massachusetts pound, New Hampshire pound, New Jersey pound, New York pound, North Carolina pound, Pennsylvania pound, Rhode Island pound, South Carolina pound and Virginia pound.

Continental currency

- See also: Continental currency

In 1775, the United States and the individual states began issuing "Continental Currency" denominated in Spanish dollars and (for the issues of the states) the £sd currencies of the states. The dollar was valued relative to the states' currencies at the following rates:

| State | Value of Dollar in State Currency |

|---|---|

| Georgia | 5 Shillings |

| Connecticut, Massachusetts, New Hampshire, Rhode Island, Virginia | 6 Shillings |

| Delaware, Maryland, New Jersey, Pennsylvania | 7½ Shillings |

| New York, North Carolina | 8 Shillings |

| South Carolina | 32½ Shillings |

The continental currency suffered from printing press inflation and was replaced by the silver dollar at the rate of 1 silver dollar = 1000 continental dollars.

Silver and gold standards

From 1792, when the Mint Act was passed, the dollar was pegged to silver and gold at 371.25 grains of silver, 24.75 grains (1.604 g) of gold (15:1 ratio). 1834 saw a shift in the gold standard to 23.2 grains (1.50 g), followed by a slight adjustment to 23.22 grains (1.505 g) in 1837 (16:1 ratio).

In 1862, paper money was issued without the backing of precious metals, due to the Civil War. Silver and gold coins continued to be issued and in 1878 the link between paper money and coins was reinstated. This disconnect from gold and silver backing also occurred during the War of 1812. The use of paper money not backed by precious metals had occurred under the Articles of Confederation from 1777 to 1788 when paper money became referred to as "not worth a continental". This was a primary reason for the "No state shall... make any thing but gold and silver coin a tender in payment of debts" clause in article 1, section 10 of the United States Constitution.

In 1900, the bimetallic standard was abandoned and the dollar was defined as 23.22 grains (1.505 g) of gold, equivalent to setting the price of 1 troy ounce of gold at $20.67. Silver coins continued to be issued for circulation until 1964, when all silver was removed from dimes and quarters, and the half dollar was reduced to 40% silver. Silver half dollars were last issued for circulation in 1969.

Gold coins were confiscated in 1933 and the gold standard was changed to 13.71 grains (0.888 g), equivalent to setting the price of 1 troy ounce of gold at $35. This standard persisted until 1968. Between 1968 and 1975, a variety of pegs to gold were put in place. The price was at $42.22 per ounce before January 1, 1975 saw the U.S. dollar freely float on currency markets.

According to the Bureau of Printing and Engraving, the largest note it ever printed was the $100,000 Gold Certificate, Series 1934. These notes were printed from December 18, 1934 through January 9, 1935, and were issued by the Treasurer of the United States to Federal Reserve Banks only against an equal amount of gold bullion held by the Treasury. These notes were used for transactions between Federal Reserve Banks and were not circulated among the general public.

Coins

Official United States coins have been produced every day from 1792 to the present. In normal circulation today, there are coins of the denominations 1¢ ([one] cent, also referred to as a penny), 5¢ (nickel), 10¢ (dime), 25¢ (quarter dollar officially, or simply quarter in common usage), 50¢ (half dollar officially, sometimes referred to as a fifty-cent piece), and $1 (dollar officially, but frequently referred to as a dollar coin).

Dollar coins

Dollar coins have not been very popular in the United States.[6] Silver dollars were minted intermittently from 1794 through 1935; a copper-nickel dollar of the same large size, featuring President Dwight D. Eisenhower, was minted from 1971 through 1978. Gold dollars were also minted in the 1800s. The Susan B. Anthony dollar coin was introduced in 1979; these proved to be unpopular because they were often mistaken for quarters, due to their nearly-equal size, their milled edge, and their similar color. Minting of these dollars for circulation was suspended in 1980 (collectors' pieces were struck in 1981), but, as with all past U.S. coins, they remain legal tender. As the number of Anthony dollars held by the Federal Reserve and dispensed primarily to make change in postal and transit vending machines had been virtually exhausted, additional Anthony dollars were struck in 1999. In 2000, a new $1 coin featuring Sacagawea was introduced, which corrected some of the mistakes of the Anthony dollar by having a smooth edge and a gold color, without requiring changes to vending machines that accept the Anthony dollar. However, this new coin has failed to achieve the popularity of the still-existing $1 bill and is rarely used in daily transactions. The failure to simultaneously withdraw the dollar bill and weak publicity efforts have been cited by coin proponents as primary reasons for the failure of the dollar coin to gain popular support. There are indications that the dollar coin's failure was also due to the reluctance of armored transport companies to make the necessary adjustments to handle the new coins, and the government's reluctance to mandate it.[7] The result of the armored carriers' unwillingness to handle the new coins was that they virtually never reached merchants in quantities sufficient to be given out as change on a routine basis, or for retail clerks to become used to handling them.

In February 2007, the US Mint, under the Presidential $1 Coin Act of 2005,[8] introduced a new $1 US Presidential dollar coin. Based on the success of the "50 State Quarters" series, the new coin features a rotating portrait of deceased presidents in order of their inaugurations, starting with George Washington, on the obverse side. The reverse side features the Statue of Liberty. To allow for larger, more detailed portraits, the traditional inscriptions of "E Pluribus Unum," "In God We Trust," the year of minting or issuance, and the mint mark will be inscribed on the edge of the coin instead of the face. This feature, similar to the edge inscriptions seen on the British £1 coin, is not usually associated with US coin designs. The inscription "Liberty" has been eliminated, with the Statue of Liberty serving as a sufficient replacement. In addition, due to the nature of US coins, this will be the first time there will be circulating US coins of different denominations with the same President featured on the obverse (heads) side. (Lincoln/penny, Jefferson/nickel, Franklin D. Roosevelt/dime, Washington/quarter and Kennedy/half dollar.) Another unusual fact about the new $1 coin is Grover Cleveland will have two coins with his portrait issued due to the fact he was the only US President to be elected to two non-consecutive terms.[9]

Early releases of the Washington coin included error coins shipped primarily from the Philadelphia mint to Florida and Tennessee banks. Highly sought after by collectors, and trading for as much as $850 each within a week of discovery, the error coins were identified by the absence of the edge impressions "E PLURIBUS UNUM IN GOD WE TRUST 2007 P". The mint of origin is generally accepted to be mostly Philadelphia, although identifying the source mint is impossible without opening a mint pack also containing marked units. Edge lettering is minted in both orientations with respect to "heads", some amateur collectors were initially duped into buying "upside down lettering error" coins.[10] Some cynics also erroneously point out that the Federal Reserve makes more profit from dollar bills than dollar coins because they wear out in a few years, whereas coins are more permanent. The fallacy of this argument arises because new notes printed to replace worn out notes which have been withdrawn from circulation bring in no net revenue to the government to offset the costs of printing new notes and destroying the old ones. As most vending machines are incapable of making change in banknotes, they commonly accept only $1 bills, though a few will give change in dollar coins.

Other denominations

The United States has minted other coin denominations at various times from 1792 to 1935: half-cent, 2-cent, 3-cent, 20-cent, $2.50 (Quarter Eagle), $3.00, $5.00 (Half Eagle), $10.00 (Eagle), $20.00 (Double Eagle) and $50.00 (Half Union). Technically, all these coins are still legal tender at face value, though they are far more valuable today for their numismatic value, and for gold and silver coins, their precious metal value. In addition, an experimental $4.00 (Stella) coin was also minted, but never placed into circulation and is properly considered to be a pattern rather than an actual coin denomination. 1 dollar gold pieces were also made, and are the smallest American coin ever to be made. Half dimes preceded the nickel 5 cent piece for about the first half of the 19th century.The $50 coin mentioned was only produced in 1915 for the Panama-Pacific International Exposition (1915) celebrating the opening of the Panama Canal. Only 1,128 were made, 645 of which were octagonal; this remains the only US coin that was not round as well as the largest and heaviest US coin ever. (The Susan B. Anthony dollar was round in shape; only the frame of the images on either side was decagonal.[11])

From 1934 to present the only denominations produced for circulation have been the familiar penny, nickel, dime, quarter, half dollar and dollar. The nickel is the only coin still in use today that is essentially unchanged (except in its design) from its original version. Every year since 1866, the nickel has been 75% copper and 25% nickel, except for 4 years during World War II when nickel was needed for the war.

Collectors' coins

Since 1982 the United States Mint has also produced many different denominations and designs specifically for collectors and speculators. There are silver, gold and platinum bullion coins, called "American Eagles," all of which are legal tender though their use in everyday transactions is non-existent. The reason for this is that they are not intended for use in transactions and thus the face value of the coins is much lower than the worth of the precious metals in them. The American Silver Eagle bullion coin is issued only in the $1 (1 troy ounce) denomination and has been minted yearly starting in 1986. The American Gold Eagle bullion coin denominations (with gold content), minted since 1986, are: $5 (1/10 troy oz), $10 (1/4 troy oz), $25 (1/2 troy oz), and $50 (1 troy oz). The American Platinum Eagle bullion coin denominations (with platinum content), minted since 1997, are: $10 (1/10 troy oz), $25 (1/4 troy oz), $50 (1/2 troy oz), and $100 (1 troy oz). The silver coin is 99.9% silver, the gold coins are 91.67% gold (22 karat), and the platinum coins are 99.95% platinum. These coins are not available from the Mint for individuals but must be purchased from authorized dealers. In 2006 The Mint began direct sales to individuals of uncirculated bullion coins with a special finish, and bearing a "W" mintmark. The Mint also produces high quality "proof" coins intended for collectors in the same denominations and bullion content which are available to individuals.

Mint marks

Most U.S. coins bear a mint mark as part of the design, usually found on the front of the coin near the date although in the past it was more commonly found on the reverse. The Philadelphia Mint issues coins bearing a letter P (or no mark at all), while the Denver Mint uses a letter D. The San Francisco Mint uses an S, though no coins have been released from that mint for general circulation since 1980. It does, however, continue to strike proof coins for collectors. The West Point Mint uses a W, though this is rarely seen as the West Point mint only makes high denomination coins (with face values over $1.00) which are not meant for everyday use. A CC mark, for the Carson City Mint, was used for a short time in the mid-nineteenth century, but the mint at that location was only a temporary establishment. The New Orleans Mint used a mint mark O. It operated from the 1830s until the American Civil War, and again from 1879-1909. The letter D was also used for coinage of the Dahlonega Mint from 1837 to 1861, and C was used for the Charlotte Mint during the same timespan. The latter two mints struck gold coins only.

Banknotes

The United States dollar is unique in the way that there have been more than 10 types of banknotes, such as Federal Reserve Bank Note, gold certificate, and United States Note. The Federal Reserve Note is the only type that remains in circulation since the 1970s.

The largest denominations of currency currently printed or minted by the United States are the $100 bill and the $100 one troy ounce Platinum Eagle.

Currently printed denominations are $1, $2, $5, $10, $20, $50, and $100. Notes above the $100 denomination ceased being printed in 1946 and were officially withdrawn from circulation in 1969. These notes were used primarily in inter-bank transactions or by organized crime; it was the latter usage that prompted President Richard Nixon to issue an executive order in 1969 halting their use. With the advent of electronic banking, they became less necessary. Notes in denominations of $500, $1,000, $5,000, $10,000, and $100,000 were all produced at one time; see large denomination bills in U.S. currency for details.

The design of the notes has been accused of being unfriendly to the visually-impaired. A U.S. District Judge ruled on November 28, 2006 that the American bills gave an undue burden to the blind and denied them "meaningful access" to the U.S. currency system. The judge has ordered the Treasury Department to begin working on a redesign within 30 days.[12]

Value

Consumer Price Index

Time-relative value

The following table shows the equivalent amount of goods, in a particular year, that could be purchased with $1.[13]

| Year | Equivalent buying power | Year | Equivalent buying power | Year | Equivalent buying power |

|---|---|---|---|---|---|

| 1774 | $10.53 | 1860 | $10.22 | 1950 | $3.42 |

| 1780 | $6.20 | 1870 | $6.51 | 1960 | $2.78 |

| 1790 | $9.30 | 1880 | $8.31 | 1970 | $2.12 |

| 1800 | $6.77 | 1890 | $9.34 | 1980 | $1.00 |

| 1810 | $6.91 | 1900 | $10.12 | 1990 | $0.63 |

| 1820 | $7.25 | 1910 | $8.94 | 2000 | $0.48 |

| 1830 | $9.21 | 1920 | $4.11 | 2007 | $0.40 |

| 1840 | $9.83 | 1930 | $4.93 | 2008 | $0.38 |

| 1850 | $10.88 | 1940 | $5.87 |

International use

The dollar is also used as the standard unit of currency in international markets for commodities such as gold and petroleum (the latter sometimes called petrocurrency). Some non-U.S. companies dealing in globalized markets, such as Airbus, list their prices in dollars.

At the present time, the U.S. dollar remains the world's foremost reserve currency. In addition to holdings by central banks and other institutions there are many private holdings which are believed to be mostly in $100 denominations. The majority of U.S. notes are actually held outside the United States. All holdings of US dollar bank deposits held by non-residents of the US are known as eurodollars (not to be confused with the euro) regardless of the location of the bank holding the deposit (which may be inside or outside the U.S.) Economist Paul Samuelson and others maintain that the overseas demand for dollars allows the United States to maintain persistent trade deficits without causing the value of the currency to depreciate and the flow of trade to readjust. Milton Friedman at his death believed this to be the case but, more recently, Paul Samuelson has said he now believes that at some stage in the future these pressures will precipitate a run against the U.S. dollar with serious global financial consequences.[15]

Dollar versus euro

| Year | Highest ↑ | Lowest ↓ | ||||

|---|---|---|---|---|---|---|

| Date | Rate | Date | Rate | |||

| 1999 | 03 Dec | €0.9985 | 05 Jan | €0.8482 | ||

| 2000 | 26 Oct | €1.2118 | 06 Jan | €0.9626 | ||

| 2001 | 06 Jul | €1.1927 | 05 Jan | €1.0477 | ||

| 2002 | 28 Jan | €1.1658 | 31 Dec | €0.9536 | ||

| 2003 | 08 Jan | €0.9637 | 31 Dec | €0.7918 | ||

| 2004 | 14 May | €0.8473 | 28 Dec | €0.7335 | ||

| 2005 | 15 Nov | €0.8571 | 03 Jan | €0.7404 | ||

| 2006 | 02 Jan | €0.8456 | 05 Dec | €0.7501 | ||

| 2007 | 12 Jan | €0.7756 | 27 Nov | €0.6723 | ||

| 2008 | 27 Oct | €0.8026 | 15 Jul | €0.6254 | ||

| Source: Euro exchange rates in USD, ECB | ||||||

Not long after the introduction of the euro (€ ; ISO 4217 code EUR) as a cash currency in 2002, the dollar began to depreciate steadily in value. As U.S. trade and budget deficits continued to increase, the euro started rising in value. By December 2004, the dollar had fallen to new lows against all major currencies; the euro rose above $1.36/€ (under €0.74/$) for the first time, in contrast to previous lows in early 2003 (€0.87/$). In the first quarter of 2004 the U.S. dollar, with the advantage of Federal Reserve's policy of raising the interest rates, regained some standing against all major currencies, climbing from €0.78/$ to €0.84/$. However, all gains were lost in the second half of 2004, and the dollar stood at €0.74/$ at the end of 2004. Since 2002, the only year in which the dollar actually recovered against the euro was 2005. Although some analysts previewed the dollar dropping as far as $1.60/€ (€0.63/$), it finished 2005 with an increase against the euro, climbing to €0.83/$. An interest rate reduction by the Federal Reserve on September 18, 2007, raised the euro's value significantly and caused the dollar to fall below €0.70 one month later, to new record lows.[16] Economists like Alan Greenspan suggest that another reason for the continued fall of the dollar is its decreasing role as the world's reserve currency. Jim Rogers declared that he thinks the dollar's value will fall even further, especially against the Chinese yuan. Chinese officials signaled plans to diversify the nation's $1.43 trillion reserve in response to a falling U.S. currency which also set the dollar under pressure.[17][18] However, the demise of the dollar may be premature; a sharp turnaround has occurred in recent months with the global financial crisis, with the dollar and Japanese yen soaring against most world currencies.

The dollar as the major international reserve currency

The dollar is the most important international reserve currency, followed by the euro. The euro inherited this status from the German mark, and since its introduction, has increased its standing considerably, mostly at the expense of the dollar. Despite the dollar's recent losses to the euro, it is still by far the major international reserve currency, with an accumulation more than double that of the euro.

In August 2007, two scholars affiliated with the government of the People's Republic of China threatened to sell its substantial reserves in American dollars in response to American legislative discussion of trade sanctions designed to revalue the Chinese yuan.[19] The Chinese government denied that selling dollar-denominated assets would be an official policy in the foreseeable future.

Former Federal Reserve Chairman Alan Greenspan said in September 2007 that the euro could replace the U.S. dollar as the world's primary reserve currency. It is "absolutely conceivable that the euro will replace the dollar as reserve currency, or will be traded as an equally important reserve currency."[20]

| '95 | '96 | '97 | '98 | '99 | '00 | '01 | '02 | '03 | '04 | '05 | '06 | '07 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| US dollar | 59.0% | 62.1% | 65.2% | 69.3% | 70.9% | 70.5% | 70.7% | 66.5% | 65.8% | 65.9% | 66.4% | 65.7% | 63.9% |

| Euro | 17.9% | 18.8% | 19.8% | 24.2% | 25.3% | 24.9% | 24.3% | 25.2% | 26.5% | ||||

| German mark | 15.8% | 14.7% | 14.5% | 13.8% | |||||||||

| Pound sterling | 2.1% | 2.7% | 2.6% | 2.7% | 2.9% | 2.8% | 2.7% | 2.9% | 2.6% | 3.3% | 3.6% | 4.2% | 4.7% |

| Japanese yen | 6.8% | 6.7% | 5.8% | 6.2% | 6.4% | 6.3% | 5.2% | 4.5% | 4.1% | 3.9% | 3.7% | 3.2% | 2.9% |

| French franc | 2.4% | 1.8% | 1.4% | 1.6% | |||||||||

| Swiss franc | 0.3% | 0.2% | 0.4% | 0.3% | 0.2% | 0.3% | 0.3% | 0.4% | 0.2% | 0.2% | 0.1% | 0.2% | 0.2% |

| Other | 13.6% | 11.7% | 10.2% | 6.1% | 1.6% | 1.4% | 1.2% | 1.4% | 1.9% | 1.8% | 1.9% | 1.5% | 1.8% |

| Sources: 1995-1999, 2006-2007 IMF: Currency Composition of Official Foreign Exchange ReservesPDF (80 KB) Sources: 1999-2005, ECB: The Accumulation of Foreign ReservesPDF (816 KB) |

|||||||||||||

U.S. Dollar Index

The U.S. Dollar Index (USDX) is the creation of the New York Board of Trade (NYBOT). It was established in 1973 for tracking the value of the USD against a basket of currencies, which, at that time, represented the largest trading partners of the United States. It began with 17 currencies from 17 nations, but the launch of the euro subsumed 12 of these into just one, so the USDX tracks only six currencies today.

| Currency units per U.S. dollar | |

|---|---|

| Weighting | |

| Euro | 57.6% |

| Japanese yen | 13.6% |

| Pound sterling | 11.9% |

| Canadian dollar | 9.1% |

| Swedish krona | 4.2% |

| Swiss franc | 3.6% |

| Source: NYBOT, " US Dollar Index", pg.3 (PDF) | |

The Index is described by the NYBOT as "a trade weighted geometric average".[21] The baseline of 100.00 on the USDX was set at its launch in March 1973. This event marks the watershed between the fixed-rate system of the Bretton Woods regime and the floating-rate system of the Smithsonian regime. Since then, the USDX has climbed as high as the 160s and drifted as low as the 70s.

The USDX has not been updated to reflect new trading realities in the global economy, where the bulk of trade has shifted strongly towards new partners like China and Mexico and oil exporting countries while the United States homeland has itself de-industrialized.

Dollarization and fixed exchange rates

Other nations besides the United States use the U.S. dollar as their official currency, a process known as official dollarization. For instance, Panama has been using the dollar alongside the Panamanian balboa as the legal tender since 1904 at a conversion rate of 1:1. Ecuador (2000), El Salvador (2001), and East Timor (2000) all adopted the currency independently. The former members of the U.S.-administered Trust Territory of the Pacific Islands, which included Palau, the Federated States of Micronesia, and the Marshall Islands, chose not to issue their own currency after becoming independent, having all used the U.S. dollar since 1944. Two British dependencies also use the U.S. dollar: the British Virgin Islands (1959) and Turks and Caicos Islands (1973).

Some countries that have adopted the U.S. dollar issue their own coins: See Ecuadorian centavo coins and East Timor centavo coins.

Some other countries link their currency to U.S. dollar at a fixed exchange rate. The local currencies of Bermuda and the Bahamas can be freely exchanged at a 1:1 ratio for USD. Argentina used a fixed 1:1 exchange rate between the Argentine peso and the U.S. dollar from 1991 until 2002. The currencies of Barbados and Belize are similarly convertible at an approximate 2:1 ratio. In Lebanon, one dollar is equal to 1500 Lebanese pound, and is used interchangeably with local currency as de facto legal tender. The exchange rate between the Hong Kong dollar and the United States dollar has also been linked since 1983 at HK$7.8/USD, and pataca of Macau, pegged to Hong Kong dollar at MOP1.03/HKD, indirectly linked to the U.S. dollar at roughly MOP8/USD. Several oil-producing Arab countries on the Persian Gulf, including Saudi Arabia, peg their currencies to the dollar, since the dollar is the currency used in the international oil trade.

The People's Republic of China's renminbi was informally and controversially pegged to the dollar in the mid-1990s at ¥ 8.28/USD. Likewise, Malaysia pegged its ringgit at RM3.8/USD in 1997. On July 21, 2005 both countries removed their pegs and adopted managed floats against a basket of currencies. Kuwait did likewise on May 20, 2007,[22] and Syria did likewise in July 2007.[23]

Belarus, on the other hand, will tie its currency, the Belarusian ruble, with the U.S. dollar in 2008.[24]

In some countries, such as Peru and Uruguay, although USD is not officially regarded as a legal tender, it is commonly accepted. In Mexico's border area and major tourist zones, it is accepted as if it were a second legal currency. Some stores near the US border in Canada also accept the U.S. dollar. In Cambodia, the USD also circulates freely and may be preferred over the Cambodian riel for large purchases.[25][26] After the U.S. invasion of Afghanistan, U.S. dollars are accepted as if it were legal tender. Prices of most big ticket items such as houses and cars are set in U.S. dollars.

Exchange rates

Historical exchange rates

| 1970* | 1980* | 1985* | 1990* | 1993 | 1999 | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Euro | - | - | - | 0.8343 | 0.8551 | 0.9387 | 1.0832 | 1.1171 | 1.0578 | 0.8833 | 0.8040 | 0.8033 | 0.7960 | 0.7293 |

| Japanese yen | 357.6 | 240.45 | 250.35 | 146.25 | 111.08 | 113.73 | 107.80 | 121.57 | 125.22 | 115.94 | 108.15 | 110.11 | 116.31 | 117.76 |

| Pound sterling | 0.4164 | 0.4484[28] | 0.8613[28] | 0.6207 | 0.6660 | 0.6184 | 0.6598 | 0.6946 | 0.6656 | 0.6117 | 0.5456 | 0.5493 | 0.5425 | 0.4995 |

| Renminbi yuan | 2.46 | 1.5 | 2.7957 | 4.7339 | 5.7795 | 8.2781 | 8.2784 | 8.2770 | 8.2771 | 8.2772 | 8.2768 | 8.1936 | 7.9723 | 7.6058 |

| Singapore dollar | - | - | 2.179 | 1.903 | 1.6158 | 1.6951 | 1.7361 | 1.7930 | 1.7908 | 1.7429 | 1.6902 | 1.6738 | 1.5882 | 1.421 |

| Canadian dollar | 1.081 | 1.168 | 1.321 | 1.1605 | 1.2902 | 1.4858 | 1.4855 | 1.5487 | 1.5704 | 1.4008 | 1.3017 | 1.2115 | 1.1340 | 1.0734 |

| Mexican peso (old) | - | 22.800 | 206.97 | 2,679.5 | 3.1237 | 9.553 | 9.459 | 9.337 | 9.663 | 10.793 | 11.290 | 10.894 | 10.906 | 10.928 |

| Source: Last 4 years 2005-2002 2003-2000 1996-1999 1993-1996 1990 1970-1992 1970-1985 Canada, China, Mexico

|

||||||||||||||

| From Yahoo! Finance: | AUD CAD CHF EUR GBP HKD JPY MXN CNY |

| From XE.com: | AUD CAD CHF EUR GBP HKD JPY MXN CNY |

| From OANDA.com: | AUD CAD CHF EUR GBP HKD JPY MXN CNY |

See also

- Fears grow about U.S. dollar stability

- Canadian dollar reaches parity with US dollar

- Amero

- Economy of the United States

- Federal Reserve note

- Fiat currency

- Gold as an investment

- North American currency union

- Silver as an investment

References

- ↑ Rate-Exchange.org - US Currency / US Dollar

- ↑ Journals of the Continental Congress --Wednesday, JULY 6, 1785.

- ↑ The Implementation of Monetary Policy - The Federal Reserve in the International Sphere

- ↑ Benjamin J. Cohen, The Future of Money, Princeton University Press, 2006, ISBN 0691116660; cf. "the dollar is the de facto currency in Cambodia", Charles Agar, Frommer's Vietnam, 2006, ISBN 0471798169, p. 17

- ↑ The Lion Dollar: Introduction

- ↑ CNN Money Congress tries again for a dollar coin. Written by Gordon T. Anderson. Published April 25, 2005.

- ↑ http://www.gao.gov/new.items/d02896.pdf

- ↑ Pub. L. No. 109-145, 119 Stat. 2664 (Dec. 22, 2005).

- ↑ The United States Mint Pressroom

- ↑ Godless Dollars

- ↑ Coin Facts reference on Susan B. Anthony dollar coin

- ↑ CNNMoney.com (2006-11-29). "Judge rules paper money unfair to blind". Retrieved on 2008-02-17.

- ↑ "Measuring Worth - Purchasing Power of Money in the United States from 1774 to 2007". Retrieved on 2008-05-24.

- ↑ http://www.measuringworth.com/ppowerus/ Purchasing Power of Money in the United States from 1774 to 2007 from measuringworth.com

- ↑ China, US should adjust approach to economic growth

- ↑ ECB: euro exchange rates USD

- ↑ Jeffrey Frankel. "What's Ahead: Decade of the Dollar, the Euro, or the RMB?". Retrieved on November 7, 2007.

- ↑ Adam S. Posen, "The Rise of the Euro: Currency Is Emerging as Rival to the Dollar," The Ripon Review July 2005

- ↑ "China threatens 'nuclear option' of dollar sales.". Retrieved on September 26, 2007.

- ↑ "Reuters". Euro could replace dollar as top currency - Greenspan. Retrieved on September 17, 2007.

- ↑ NYBOT, "US Dollar Index", pg.2

- ↑ "Kuwait pegs dinar to basket of currencies", Forbes (2007-05-20). Retrieved on 2007-06-06.

- ↑ "Syria to Drop Dollar Peg in July", Reuters (2007-06-04). Retrieved on 2007-09-12.

- ↑ "Belarus to link currency to dollar", Associated Press (2007-08-15). Retrieved on 2007-10-01.

- ↑ Chinese University of Hong Kong. "Historical Exchange Rate Regime of Asian Countries: Cambodia". Retrieved on 2007-02-21.

- ↑ Kurt Schuler. "Tables of Modern Monetary History: Asia". Retrieved on 2007-02-21. "The US dollar also circulates freely"

- ↑ FRB: G.5A Release-- Foreign Exchange Rates, Release Dates

- ↑ 28.0 28.1 1970-1992. 1980 derived from AUD-USD=1.1055 and AUD-GBP=0.4957 at end of Dec 1979: 0.4957/1.1055=0.448394392; 1985 derived from AUD-USD=0.8278 and AUD-GBP=0.7130 at end of Dec 1984: 0.7130/0.8278=0.861319159

External links

- U.S. Bureau of Engraving and Printing

- U.S. Currency and Coin Outstanding and in Circulation

- U.S. Treasury page with images of all current banknotes

- American Currency Exhibit at the San Francisco Federal Reserve Bank

- PaperMoneyGuide - Information for collectors of US Currency

- Relative values of the US dollar, from 1790 to 2006

- Summary of BEP Production Statistics

- The U.S. Treasury's Coins & Currency portal

- Wheres George Currency Tracking Project

Images of U.S. currency and coins

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||